British Airways implements no-notice devaluation for American and Alaska award flights

In a major bit of unwelcome news for U.S. travelers, British Airways has increased award prices for many award flights operated by American Airlines and Alaska Airlines, as flagged by AwardWallet. Unfortunately, this comes with no notice, as the new award rates are now showing up through British Airways' search engine.

Here's what you need to know about these changes.

British Airways increases award rates for American and Alaska flights

British Airways Executive Club uses a distance-based award chart when you redeem Avios across its network of partner airlines (though these prices vary slightly depending on the carrier and dates of travel). Before Tuesday, Dec. 12, you could book nonstop American and Alaska-operated flights starting at just 7,500 Avios each way. Unfortunately, that's no longer the case.

Here's a chart with a summary of the new economy award rates, which have already taken effect:

| Distance | Old economy price (before Dec. 12, 2023) | New economy price (as of Dec. 13, 2023) | % change |

|---|---|---|---|

Up to 650 miles | 7,500 Avios | 8,250 Avios | 10% |

651 - 1,151 miles | 9,000 Avios | 11,000 Avios | 22.2% |

1,152 - 2,000 miles | 11,000 Avios | 14,500 Avios | 31.8% |

2,001 - 3,000 miles | 13,000 Avios | 16,000 Avios | 23.1% |

As you can see, these are relatively large increases on a percentage basis.

Sadly, it's an even worse story for first-class award flights on American and Alaska.

| Zone (distance) | Old first-class price (before Dec. 12, 2023) | New first-class price (as of Dec. 13, 2023) | % change |

|---|---|---|---|

Zone 1 (up to 650 miles) | 12,500 Avios | 16,500 Avios | 32% |

Zone 2 (651 - 1,151 miles) | 16,500 Avios | 20,500 Avios | 24.2% |

Zone 3 (1,152 - 2,000 miles) | 22,000 Avios | 29,000 Avios | 32% |

Zone 4 (2,001 - 3,000 miles) | 38,750 Avios | 42,000 Avios | 8.4% |

As noted previously, these rates now appear through the British Airways search engine.

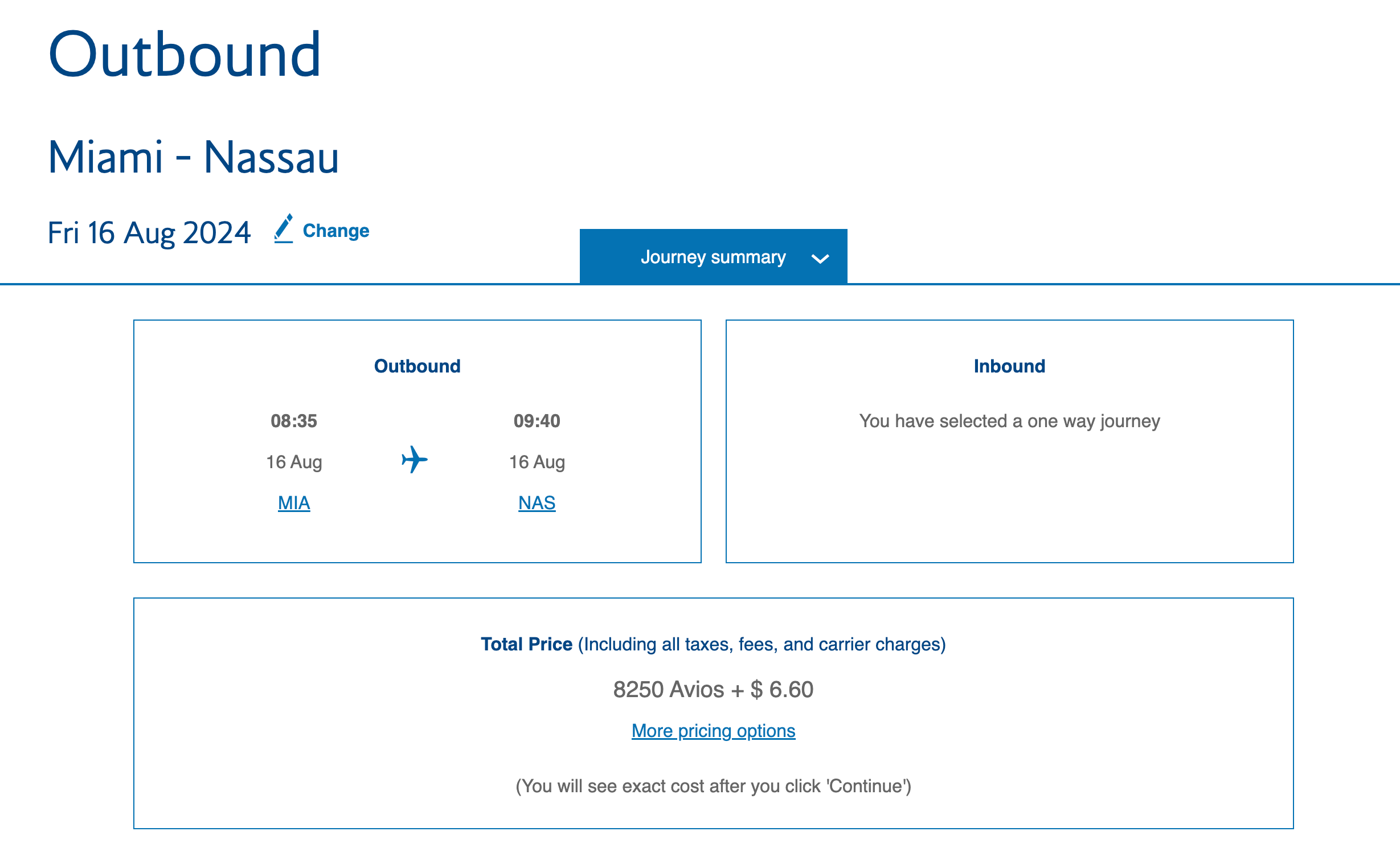

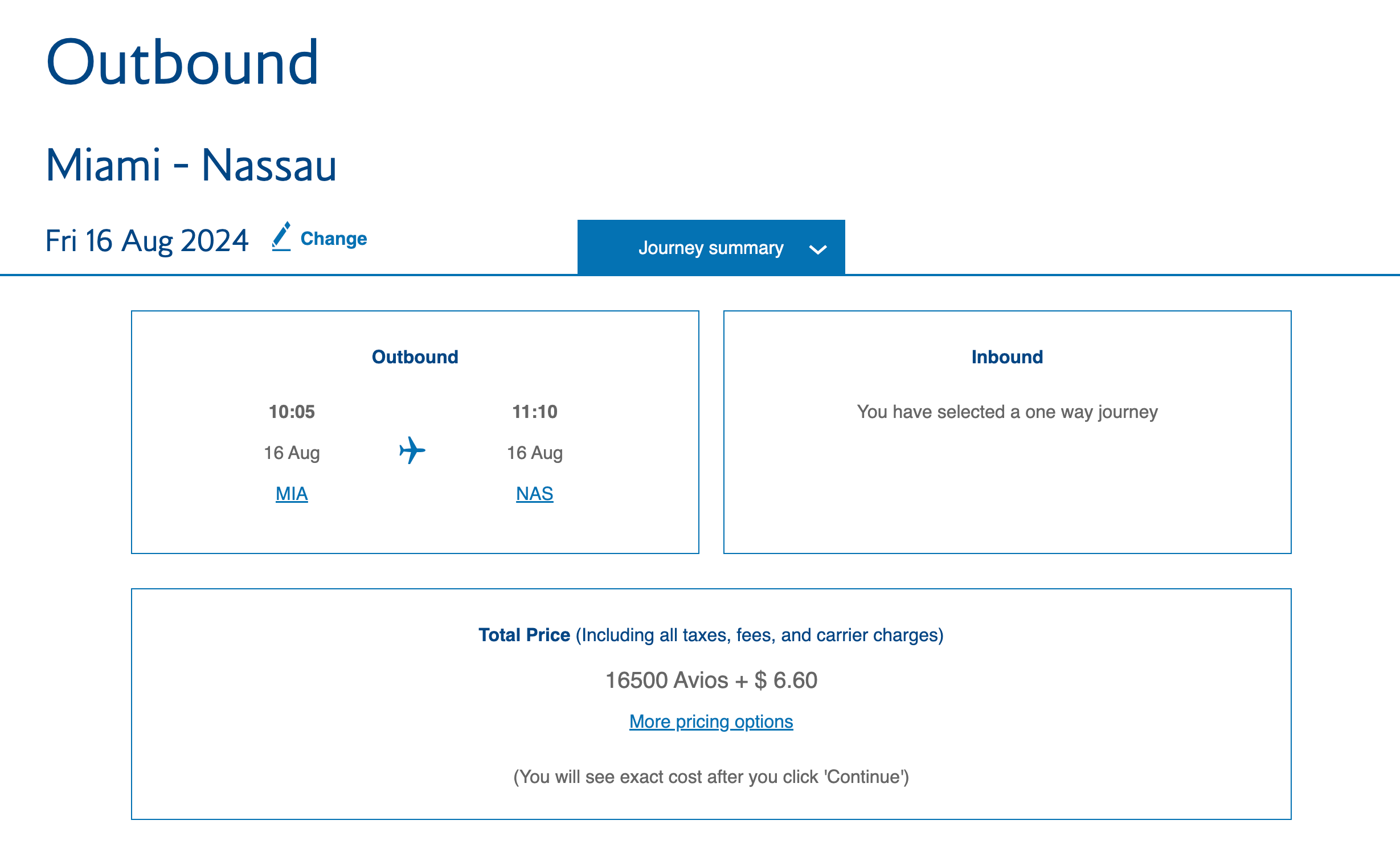

For example, here's a short-haul flight from Miami International Airport (MIA) to Nassau's Lynden Pindling International Airport (NAS) in the Bahamas in both economy and first class.

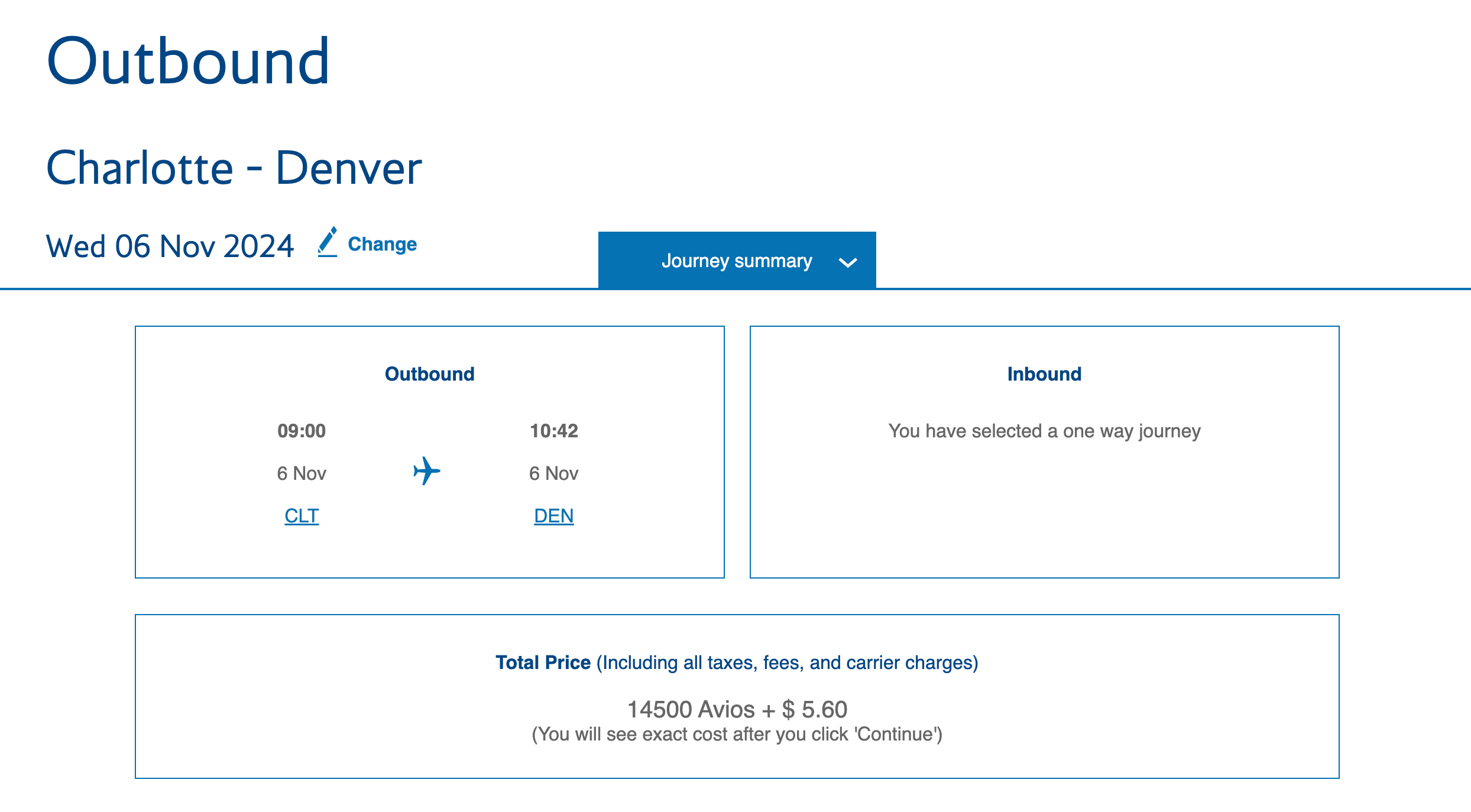

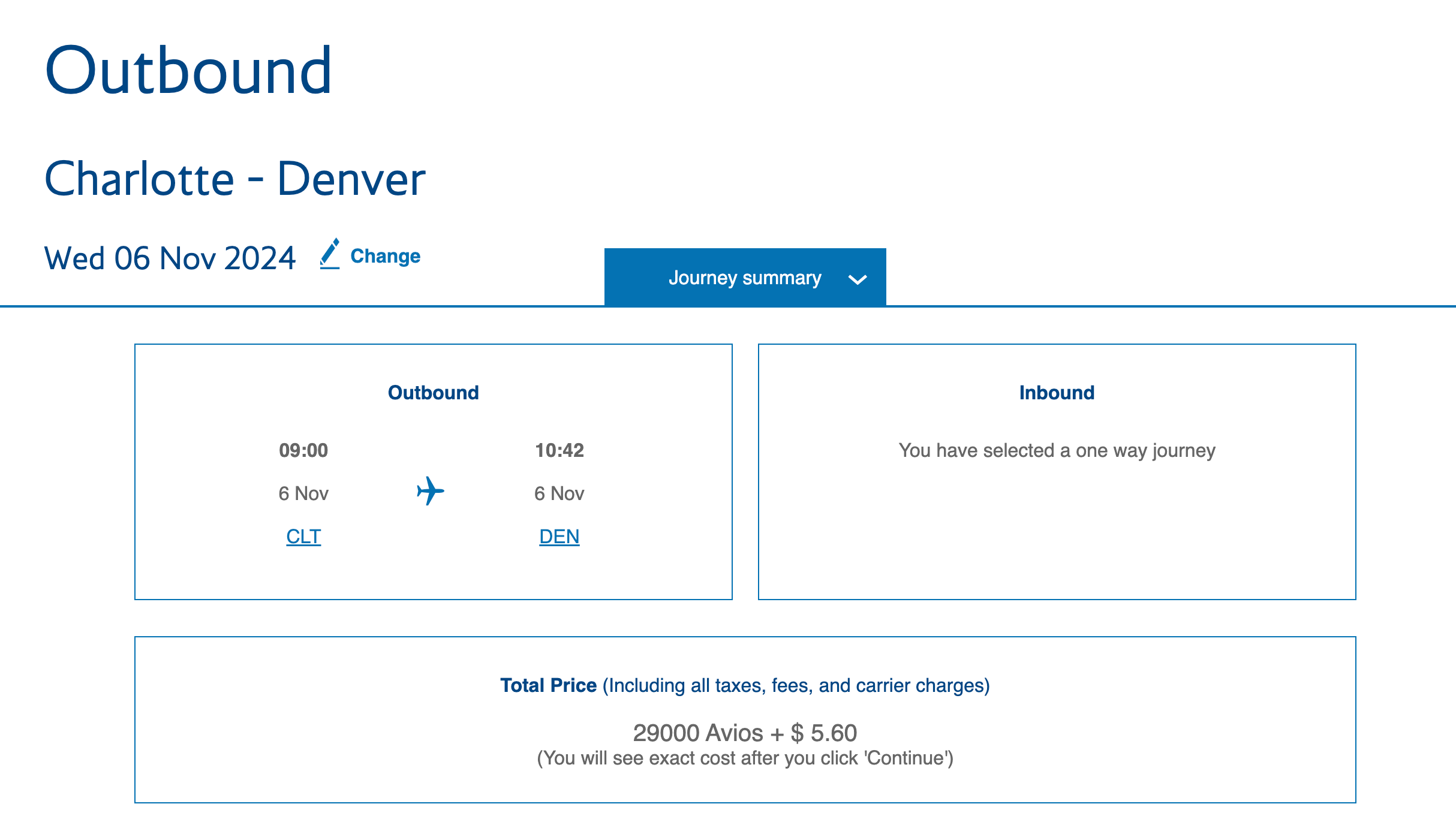

Here's a one-way flight from Charlotte Douglas International Airport (CLT) to Denver International Airport (DEN) in both economy and first class.

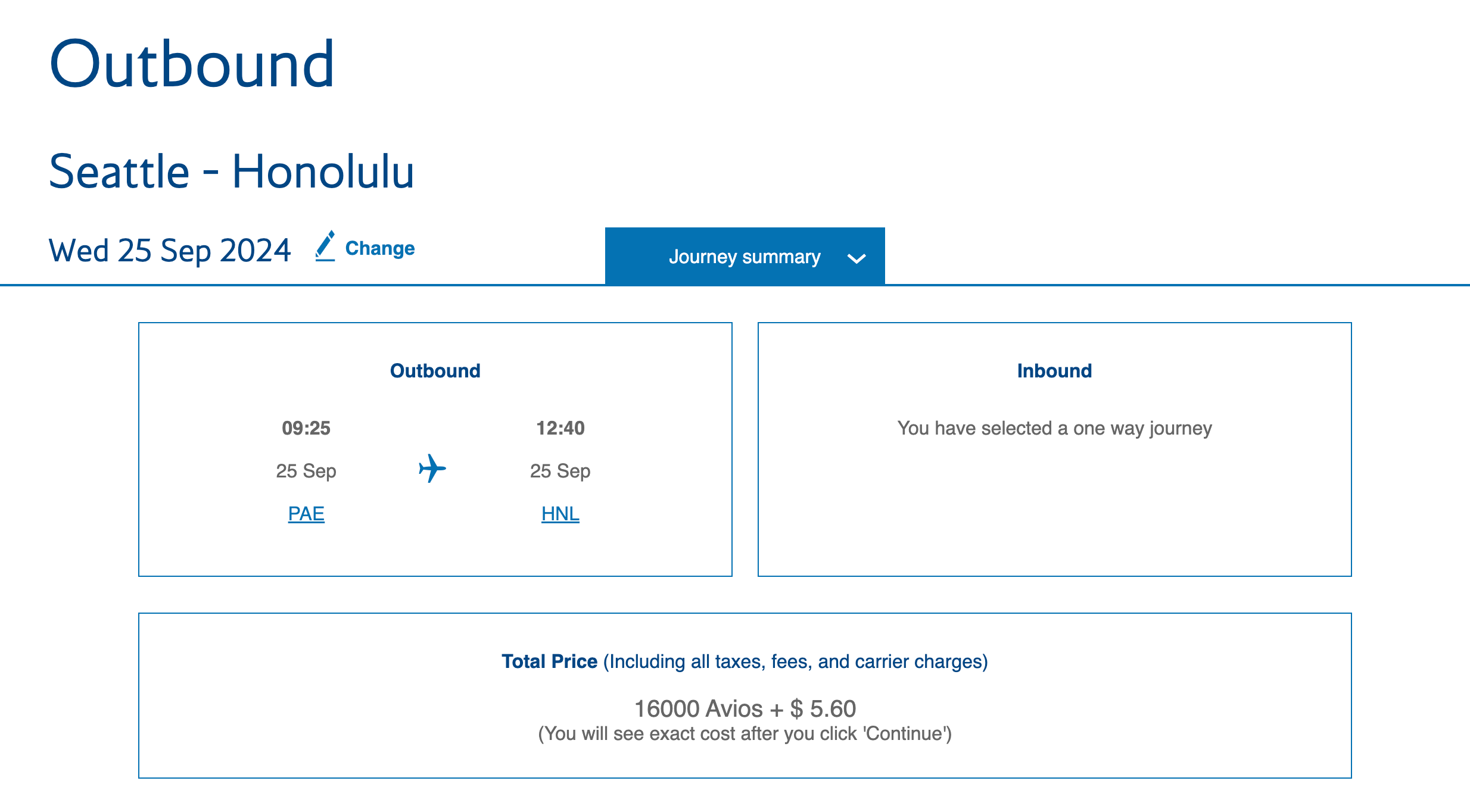

Perhaps the biggest sweet spot affected here is from the West Coast to Hawaii, which previously required just 13,000 Avios each way (or 26,000 Avios round trip). Now, you'll need to pony up 16,000 Avios for a one-way ticket in economy class.

It's worth noting that we're seeing the same increases reflected through Iberia Plus.

Our take on the changes

This is a very frustrating development, as using Avios for American- and Alaska-operated flights was previously a fantastic use of transferable credit card rewards. That's because the British Airways Executive Club partners with most major currencies, including:

In addition, this was implemented with no notice whatsoever, so anyone saving up Avios for a specific redemption has suddenly seen the goalposts moved for their specific trip.

What's interesting is that this comes on the heels of a similar change from another United Kingdom airline, as Virgin Atlantic updated award rates on many Delta-operated itineraries last week — and like BA, Virgin's Flying Club loyalty program also partners with the major credit card programs.

Finally, it's worth noting that British Airways Executive Club has become even more complicated than it was before, as the award rate you'll pay is now all over the place — depending on the carrier, origin or destination, dates of travel and class of service. While some programs are taking steps to simplify complex award pricing, British Airways is going in a different direction.

Bottom line

British Airways has increased the number of Avios you need to book many Alaska- and American-operated award flights, specifically those covering up to 3,000 miles in distance. This means just about all domestic itineraries plus many short- to medium-haul international flights. This comes less than a week after Virgin Atlantic implemented similar pricing changes to many Delta award flights.

That said, it may still make sense to book these awards with Avios, especially if you're short on American AAdvantage or Alaska Mileage Plan miles. We frequently see transfer bonuses from issuers like Amex and Chase to Avios, so these redemptions can still be a great option. They're just not as lucrative as they were before.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app