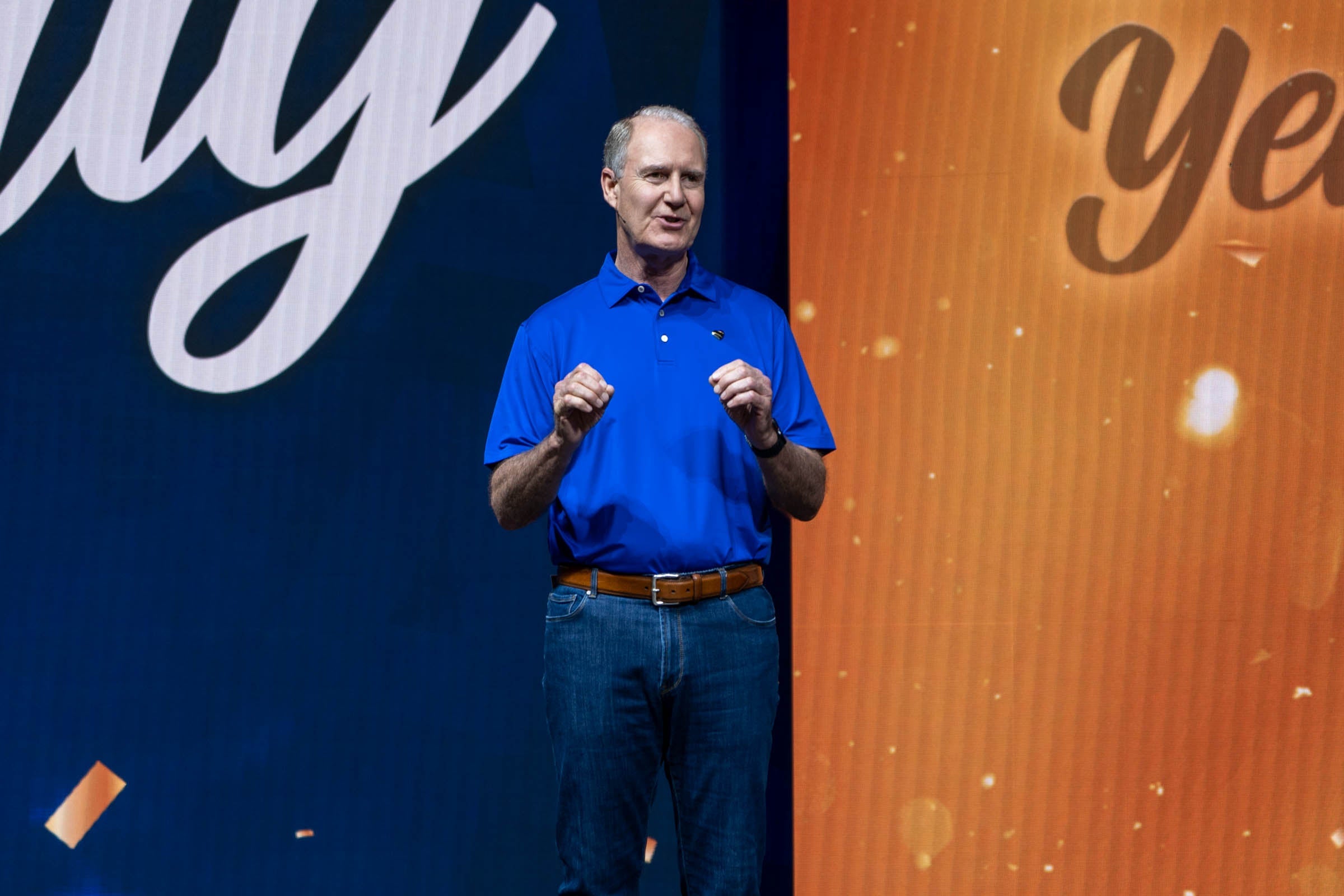

Southwest Airlines CEO Gary Kelly to step down

Southwest Airlines chief Gary Kelly will step down as CEO early next year.

Kelly, 66, will be succeeded by Bob Jordan, currently Southwest's executive vice president of corporate services.

"Bob and I have worked side by side for more than 30 years," Kelly said in a Wednesday statement announcing the transition.

"He is a gifted and experienced executive and well-prepared to take on this important role," Kelly continued. "Working closely with President Tom Nealon and Chief Operating Officer Mike Van de Ven, we will begin developing transition plans in the coming weeks and months. These three top-notch Leaders make for a powerful team to lead us forward."

Jordan, 60, first joined Southwest in 1988.

Kelly began his career at Southwest as a financial controller in 1986, and was appointed chief financial officer three years later, eventually working his way up to CEO in 2004. Kelly replaced James Parker, who succeeded Herb Kelleher, Southwest's legendary co-founder as CEO in 2001.

Under Kelly, Southwest saw transformation and growth, acquiring former rival AirTran Airways, adding dozens of cities to an increasingly wide and dense network map, and flying internationally for the first time in its 50-year history, which the carrier celebrated last week. Also under Kelly's watch, Southwest began flying to Hawaii in March 2019 — adding a destination he said had become a top request of its frequent flyer members.

In more recent years, Kelly also led the airline through some of the biggest crises in the history of commercial aviation.

The nearly two-year Boeing 737 Max grounding, from early-2019 through late-2020, hit Southwest harder than any other airline.

The carrier, which operates a fleet that consists entirely of various variations of Boeing's 737, had 41 Max aircraft unable to fly during the grounding, out of a fleet of 718 aircraft as of the end of 2020. Southwest is the largest Max customer, and was forced to strike scores of flights from its schedule as it worked to adapt around the unexpectedly lengthy grounding.

Kelly also stewarded the airline through the COVID-19 crisis, helping the airline shore up its liquidity and overall finances, avoid furloughing employees, and position itself to take advantage the current resurgence of travel demand, even as air travel came to a near stand-still across the globe earlier in 2020.

"I am most proud, especially after a pandemic, that we have never had a layoff, a furlough," Kelly said at an employee event celebrating the airline's 50th anniversary in Houston last week. "No other airline can say that."

"I'm grateful that I joined Southwest in 1986 when I had the chance. I'm grateful that I'm still a part of this great cause of leading Southwest Airlines. I'm grateful that the worst is behind us," Kelly added at the event. "And of course I am very grateful for my Southwest family."

When asked what he thinks the airline will look like in the next 50 years — and in the post-pandemic era — Kelly grew nostalgic in comments to TPG (TPG was not aware of the planned retirement announcement).

"I wish I was going to be around to see what it looks like, because it'll be different. But as long as we continue to offer great service at a low price and continue to innovate, we'll be good."

More: Southwest unveils new 'freedom' livery, gives workers 50,000 points for 50th anniversary

Among the challenges in the coming years and decades, which Kelly's successors will manage, he sees a few areas of focus, including air pollution, use of new technologies, and, likely, an eventual move away from the 737 platform as the next generation of aircraft are developed.

"Air travel's important. I would say we'll still be laser-focused on air travel," he said. "I think our DNA is to try and be as productive and efficient as we can. I think we'll be a world leader in air travel."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app