Is booking Japan Airlines award flights via JetBlue TrueBlue the best new sweet spot?

JetBlue TrueBlue points just got more valuable. Since JetBlue expanded its partnership with Japan Airlines, you can now book JAL flights with TrueBlue points — and there are some fantastic deals out there.

Here's how you can take advantage of our new favorite sweet spot for visiting Japan on points and miles.

How to book Japan Airlines flights using TrueBlue points

You can search award flights on JetBlue's site by checking the "Use TrueBlue Points" box in the search window, or you can use the Best Fare Finder to look for the cheapest dates.

Seats.aero is another handy tool for finding award space. With it, you can narrow your search to TrueBlue redemptions for JAL flights.

Availability is limited, so you'll have a better chance of snagging a great deal if your dates are flexible. Since we've seen the best prices on flights out of major cities on the East and West coasts, you may want to consider booking a positioning flight.

JetBlue has several credit card transfer partners, making it easy to earn enough TrueBlue points for a Japan Airlines redemption. Chase Ultimate Rewards and Citi ThankYou Rewards points both transfer to JetBlue at a 1:1 ratio. American Express Membership Rewards points transfer to JetBlue at a less desirable 250:200 ratio, and Capital One miles transfer at a ratio of 5:3.

If you're looking to earn enough credit card rewards to book a flight to Japan, these cards currently offer valuable welcome bonuses:

- Chase Sapphire Preferred® Card (see rates and fees): Earn 75,000 bonus points after spending $5,000 on purchases in the first three months from account opening.

- Citi Strata Premier® Card (see rates and fees): Earn 60,000 bonus points after spending $4,000 on purchases in the first three months of account opening.

- Chase Sapphire Reserve® (see rates and fees): Earn 125,000 bonus points after spending $6,000 on purchases in the first three months from account opening.

JetBlue also has a handful of cobranded credit cards, all of which offer a welcome bonus to boost your points balance.

Related: How to redeem Chase Ultimate Rewards points for maximum value

Should you book Japan Airlines flights with TrueBlue points?

Since Japan Airlines Mileage Bank miles are extremely difficult to earn, the ability to book JAL flights with TrueBlue points is an exciting development. You can also book JAL award flights through Oneworld partners like American Airlines AAdvantage and Alaska Airlines Mileage Plan, but rates vary.

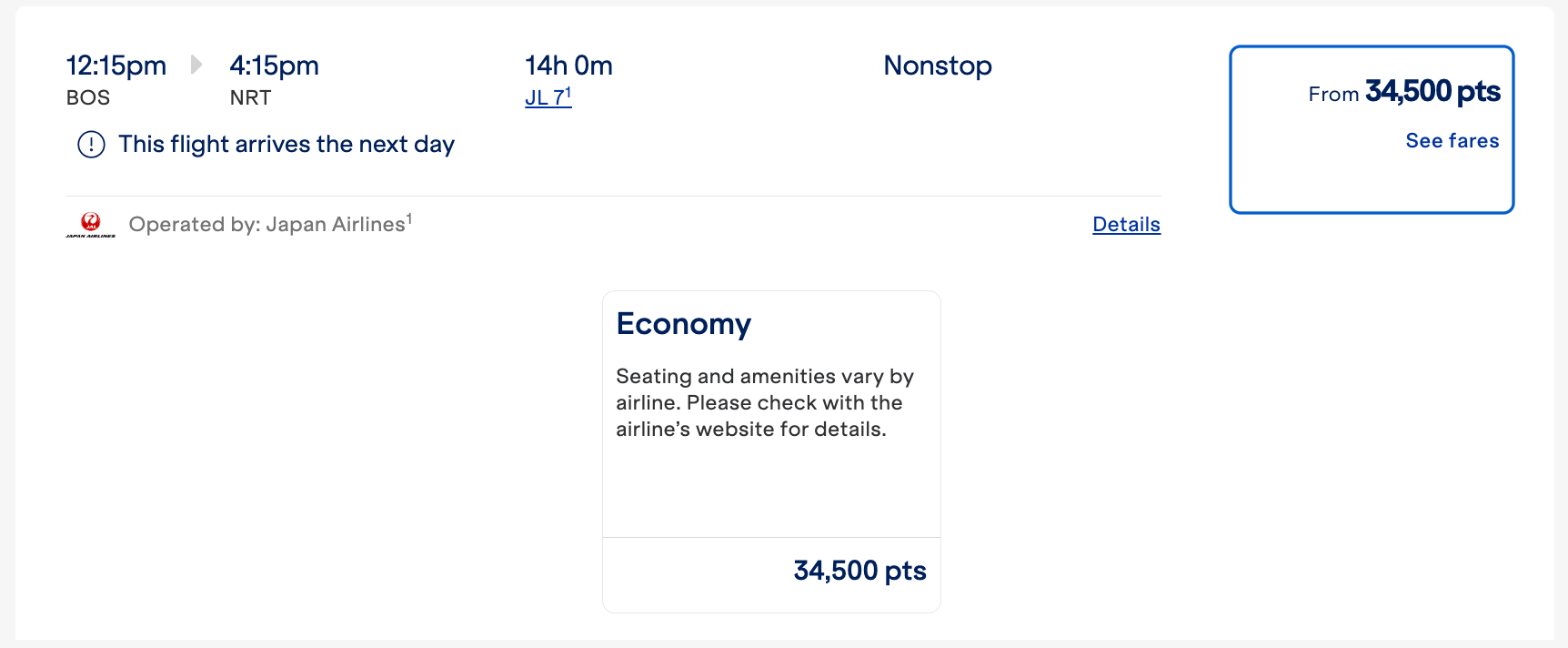

For instance, this nonstop flight in economy from Boston to Tokyo will only set you back 34,500 TrueBlue points plus $205 in taxes and fees. Since the cash rate is $1,306, that comes out to a stellar value of about 3.19 cents per TrueBlue point. As of April 2025, TPG values TrueBlue points at 1.35 cents each, so you're getting more than double the value.

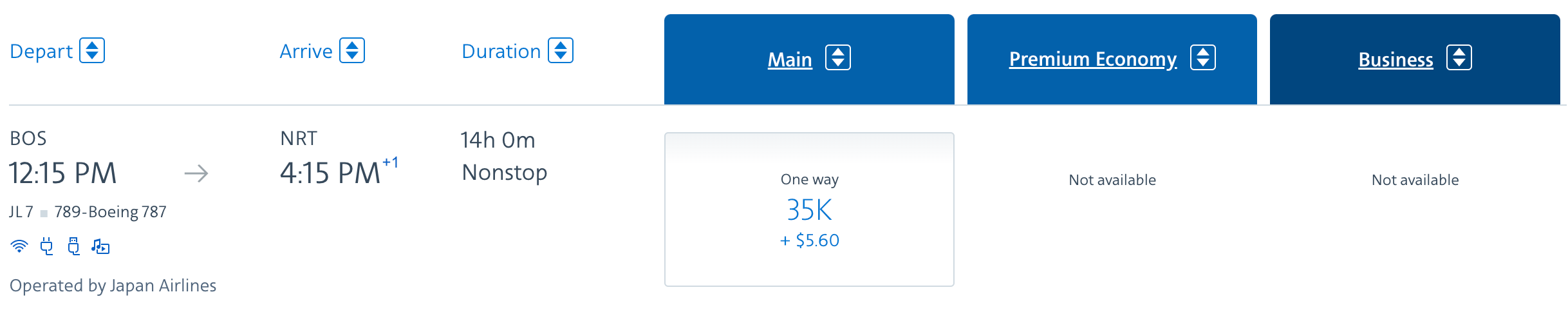

You can book this same flight for 35,000 AAdvantage miles and about $6 in taxes and fees, but these miles are much harder to earn now that American has no credit card transfer partners.

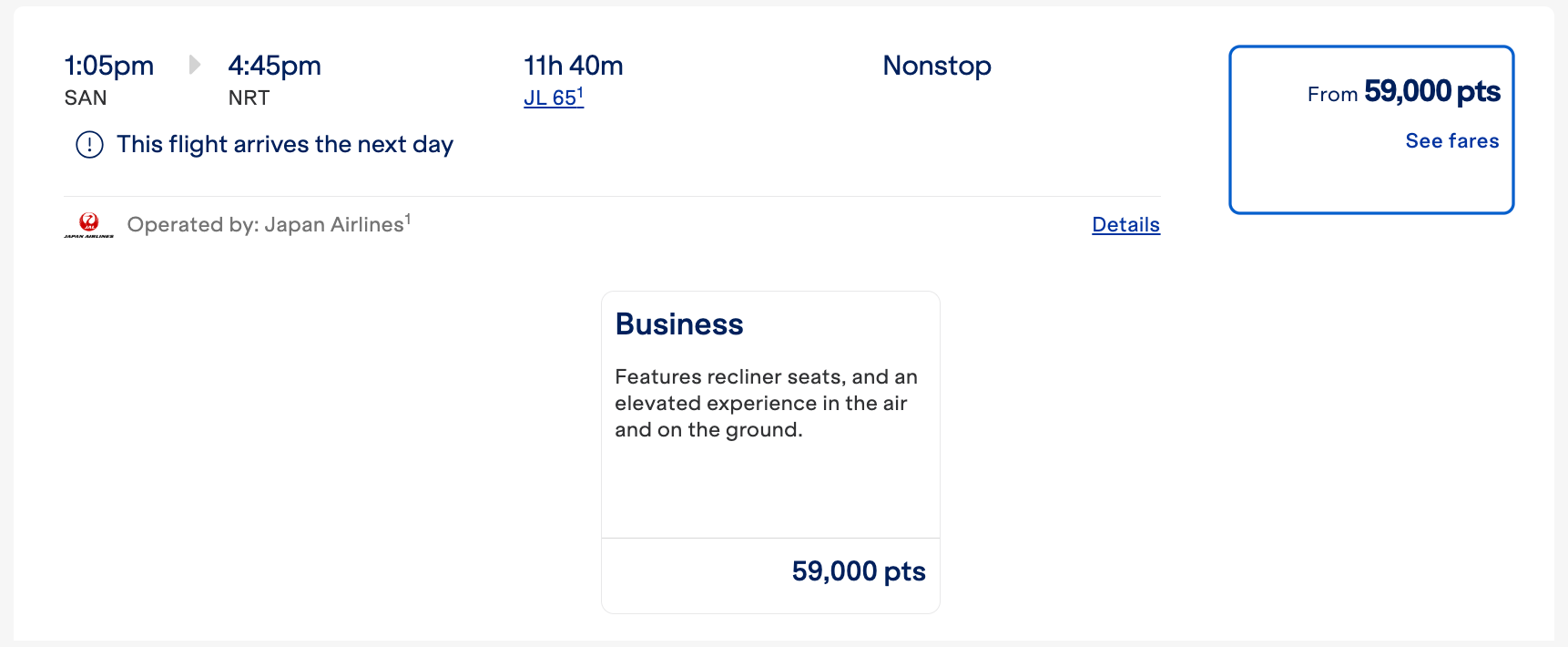

Similarly, this business-class flight from San Diego to Tokyo only costs 59,000 TrueBlue points and $205 in taxes and fees.

We've seen the same award rate (59,000 points) for business-class seats from other destinations, including Seattle, San Francisco and Honolulu. For a lie-flat seat on a long-haul flight to Japan that costs almost $8,400, that is a hard award price to beat. This would give you a valuation of 13.9 cents per point — what a steal!

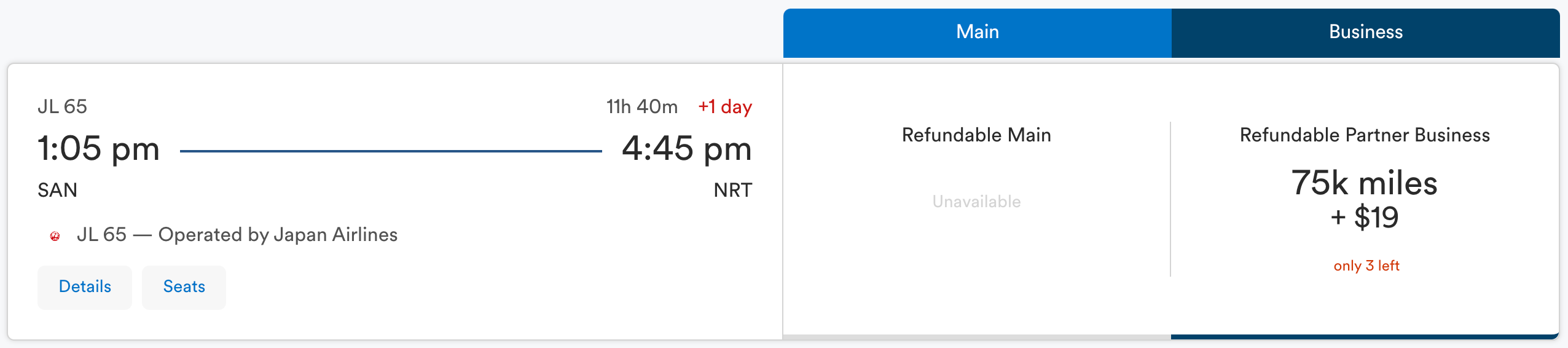

The same flight booked through Alaska Airlines Mileage Plan would set you back 75,000 miles and $19 in taxes and fees.

As you can see, you'll pay more in taxes and fees when booking Japan Airlines flights through JetBlue TrueBlue compared to some of JAL's other partners. But the taxes and fees are still reasonable, and you can potentially save a lot of points this way.

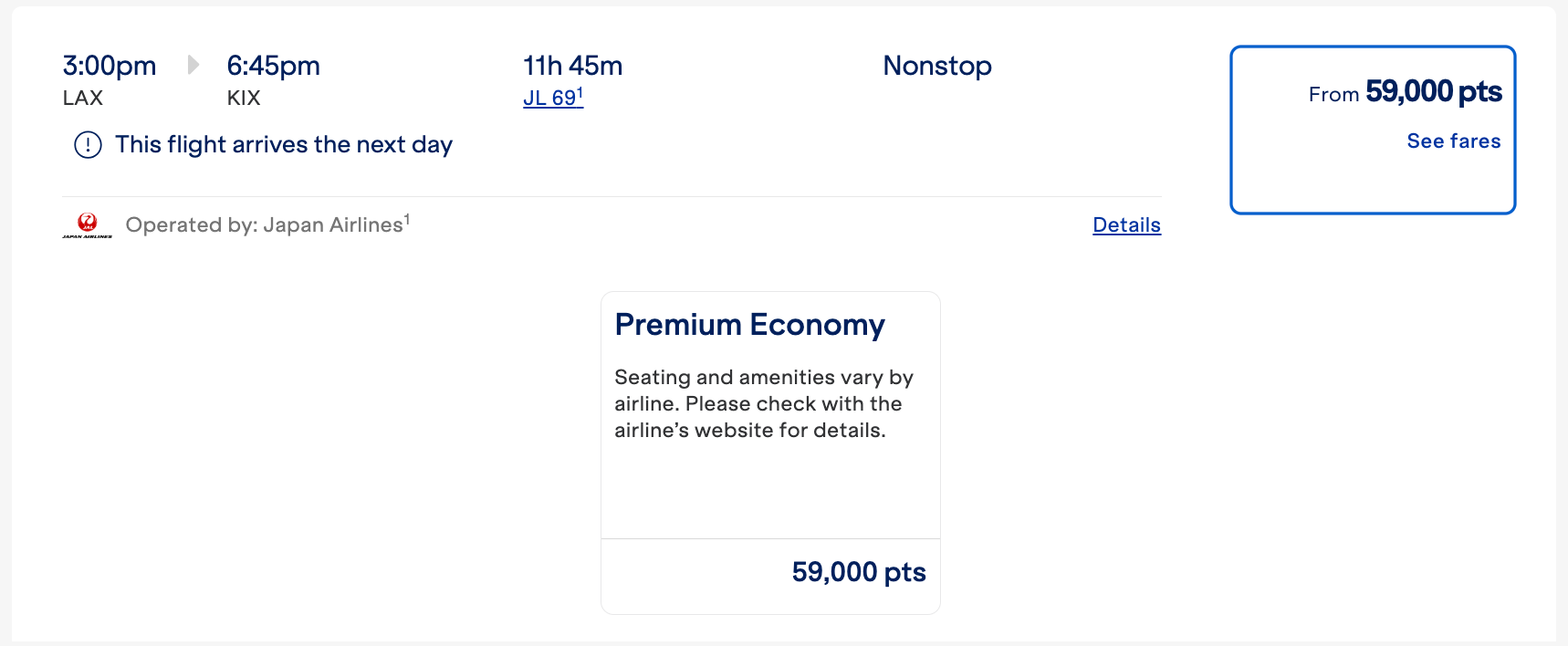

However, not all JAL flights present a good value when booked through JetBlue. We wouldn't recommend this premium economy fare from LAX to Kansai International Airport (KIX) for 59,000 TrueBlue points plus $205 in taxes and fees; you're better off booking the same flight through Alaska or American for 50,000 miles and under $20 in taxes and fees.

When deciding whether to book a Japan Airlines flight with TrueBlue points, check JAL's other partners as well as credit card portals to ensure you're getting the best value possible from your points.

Bottom line

Since JetBlue's loyalty program partners with most major credit card rewards programs, you can easily book these JAL redemptions by transferring your points. Remember that point transfers are irreversible, so make sure you find award availability before transferring your credit card points.

Overall, JetBlue's expanded partnership with Japan Airlines gives travelers some excellent new options for visiting the Land of the Rising Sun on a budget.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app