Why are the fees, taxes and surcharges on Avios redemptions so high?

Earlier this week, we learned the unfortunate news that the already high fees, taxes and surcharges on long-haul British Airways premium cabin redemptions were increasing even further, without notice.

This means that if you are, say, redeeming a British Airways companion voucher for return business-class flights to the U.S., you will only be required to pay the Avios for one passenger. At the same time, you must pay the full fees, taxes and surcharges for both passengers, which may now be more than $2,000 in total.

You may be wondering why these amounts are so high, and why they just increased. Let's take a closer look at what you are paying for.

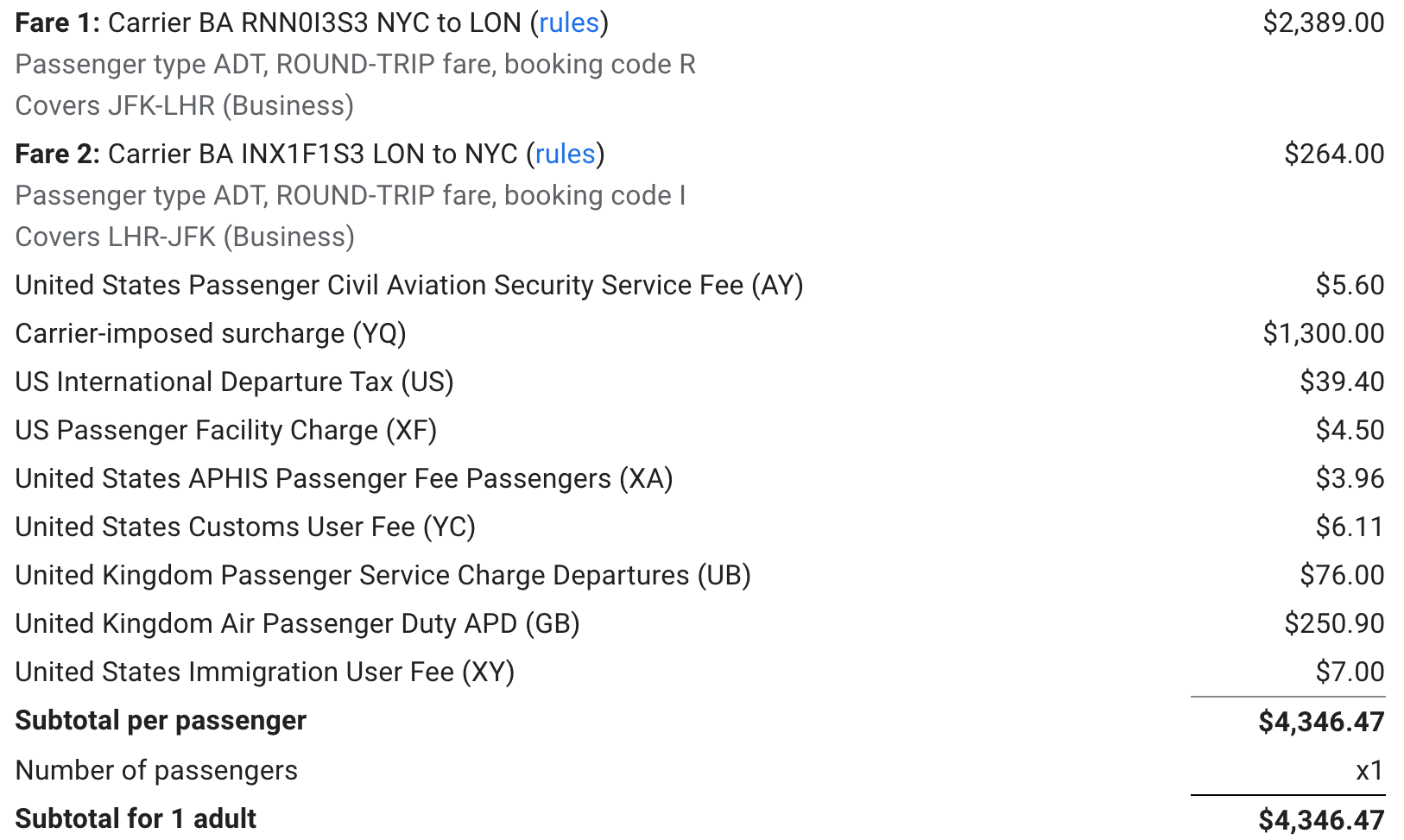

This November, a British Airways round-trip business-class fare from New York-JFK to London Heathrow (LHR) is $4,346 per person.

This total cost comprises the base fare (the $2,389 plus $264 amounts below), plus fees, taxes and surcharges. If you redeem Avios, you will not pay the base fare (your Avios cover this), but you will still need to pay the full fees, taxes and surcharges.

Related: What airline fare classes tell you about your ticket

Fees

The various fees in this ticket are several small amounts charged by customs, immigration and airport operators at both the origin and destination. These are charged to the airline by, for example, U.S. Customs and Border Protection for the services it provides to traveling passengers. The airline then passes these charges on to the passenger.

Taxes

Government taxes include things like the U.S. International Arrival Tax. The U.S. government levies this tax on all arriving passengers for various federal services, like environmental protection and airport maintenance.

You will also notice the Air Passenger Duty, which the airline is required to pay for each passenger departing the United Kingdom. This tax is higher than the U.S. taxes and fees and is unique to flights that depart the U.K.

Related: Flying from the UK is about to get more expensive because of Air Passenger Duty increase

The U.K. has the highest airfare taxes of any country in the world. The longer the passenger's flight and the higher the class of service, the higher the APD charged. The airline must pay this for each traveler, so it's again passed on to the passenger.

Thankfully, you can avoid paying U.K. APD taxes if you start your journey outside the U.K. (even if you connect via the country). You may also find that overall fares are less expensive on indirect flights from mainland Europe than direct flights from Heathrow.

Regardless, these taxes and fees are relatively small and do not add up to the almost $1,700 in total fees, taxes and surcharges that you must pay on an Avios redemption.

Related: How to use the ITA Matrix to find cheap flights

Surcharges

The largest fee, tax or surcharge on a British Airways ticket is the "Carrier-imposed surcharge (YQ)" that clocks in at a huge $1,300.

This charge is exactly what it sounds like — an additional surcharge imposed by the carrier (British Airways). It is completely discretionary, and 100% goes to the airline. It is not passed on to the customer by any airport or government agency.

So, where does this large mystery amount come from?

The "YQ" surcharge is commonly known as a fuel surcharge. Fuel is a significant expense for airlines, and global fuel prices can fluctuate significantly. While airlines are free to change base fares as they see fit, airlines do not have the same flexibility with Avios redemptions. This is because the Avios required for a flight remain the same if oil costs $20 or $100 per barrel.

Airlines introduced and tinkered with this fuel surcharge to combat rising fuel costs many years ago. When oil prices increased, airlines increased fuel surcharges to compensate for these unexpected increased costs.

However, when oil prices decreased, airlines were hesitant to decrease the surcharges. After all, it was easy money that went straight into their pockets for every cash or redemption fare.

The global price of oil plummeted during 2020 as the coronavirus pandemic locked down much of the world. Less travel meant less demand for oil, and the price fell accordingly.

Unfortunately, British Airways did not decrease fuel surcharges when fuel costs decreased. The airline was hemorrhaging money elsewhere when travel demand dried up, and it needed a lifeline from the few who were still on the road.

In fairness, as you can see from the graph above, the price of fuel has increased in recent months, which may explain British Airways' most recent fuel surcharge increase.

This increase would be understandable if the airline continually adjusted its fuel surcharge to mirror fuel prices. Instead, BA kept some of the highest fuel surcharges of any airline in the industry for years, and they are now higher than ever.

Fuel surcharges are sometimes referred to as "junk fees" by travel analysts, as they're fees charged to customers that do not have any real relation to actual fuel costs.

Of course, BA could roll any fuel costs into the base fare, and it would not need to be listed as a separate line item. However, if BA did this, it would not recover the cost on Avios redemptions since the base fare is not charged on these redemptions.

How to reduce the cost

If you're traveling home from the U.K., you can reduce taxes by starting your journey outside of the country.

And to reduce the fuel surcharges, you may consider flying a partner airline on the same or similar route. After all, other airlines add much lower fuel surcharges than BA. You can use ITA Matrix to check (look for the "YQ" line item).

Suppose you have transferable points like American Express Membership Rewards points. You can also choose to transfer these points to a program that doesn't add high fuel surcharges to award tickets.

For example, Air Canada Aeroplan doesn't add fuel surcharges to award tickets, including flights to and from Europe operated by partners like Austrian Airlines, Brussels Airways, Lufthansa, Swiss and United.

Related: Good news: Cathay Pacific gets rid of fuel surcharges for most regions

Bottom line

Even if global fuel prices drop, it's unlikely that airlines like British Airways will reduce their fuel surcharges in response. Consider the frustrating fees, taxes and surcharges a loyalty fee for redeeming your points and miles for that "free" travel.

And while travelers can easily choose between different airlines for cash fares, they are limited to the points and miles they've accrued when it comes to award travel.

This further stresses the importance of earning transferable points currencies like Amex Membership Rewards and Chase Ultimate Rewards points. These currencies transfer to a handful of different airline partners, so you can book with whichever airline partner has the lowest points and cash price on your next trip.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app