Amex launches new flexible payment option for flights as travel bookings surge by 50%

As we approach summer, travel is on the mend.

With a large portion of the U.S. fully vaccinated, the historically busy travel season will be roaring back to life. Airlines have responded by pouring additional capacity to leisure-focused destinations, all the way from the sun-soaked beaches of Florida to iceberg-fringed shores of Alaska.

On the credit card front, spending is also seeing a major resurgence.

In its fourth-quarter earnings call, American Express said its goods and services spending --- the vast majority of spend on the Amex network -- was up 11% versus the first quarter of 2019. That's particularly notable since the increase is compared to a pre-pandemic period, showing a signal of pent-up consumer demand as cardholders swipe in earnest.

And travel is a huge part of the equation. In fact, Amex says that Amex Travel bookings jumped by 50% in the first quarter of 2021 compared with the fourth quarter of 2020.

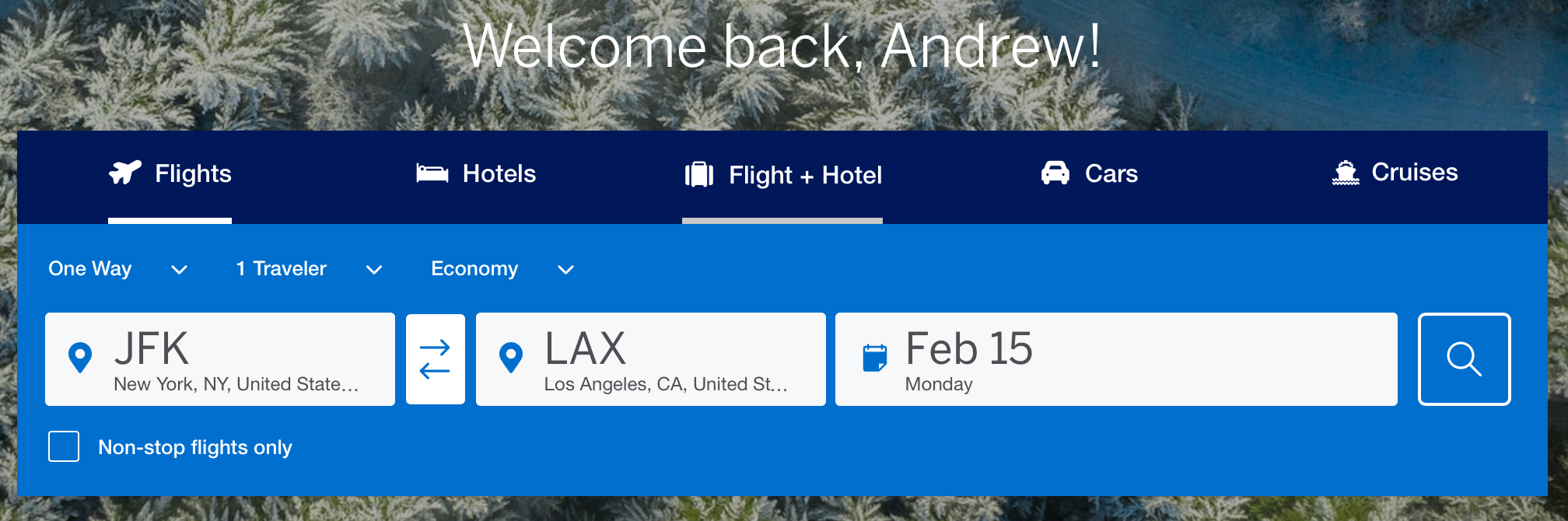

To provide cardholders with further flexibility when paying for travel, Amex consumer cardholders in the U.S. will now be able to use the "Plan It" feature at checkout for flight purchases on Amex Travel.

Related: Amex adds new payment options to Green, Gold and Platinum cards

"Plan It" will be directly integrated into the checkout experience for the first time, offering up to three distinct plans to pay for any flight purchase of $100 or more.

While you won't pay any interest, there is a fixed monthly fee, so you'll know exactly how much you owe each month. You can combine up to 10 eligible purchases into a plan, and you can have up to 10 plans running at a given time.

At checkout, my account is showing a no-fee "Plan It" option through May 31, 2021 for all flight bookings.

Related: Vaccinated Americans are raring to travel, survey shows, and are booking up summer vacations

Amex says that "Plan It" for hotel bookings will be launched later this year.

For those that pay everything in full -- which is the first rule in TPG's 10 commandments of credit card rewards -- you won't be impacted by this move. However, the additional flexibility will be a nice-to-have perk for some cardholders as they prepare for some of their first travels since the onset of the pandemic.

According to Amex Trendex data, 44% of U.S. consumers said that a buy now, pay later offering on a credit card would be of interest to them. That number jumped to 62% for all millennial-aged cardholders.

The results are not surprising: In recent years, Amex has been actively extending its flexible payment features, including "Pay It" and "Plan It." This integration with Amex Travel will give cardholders more options as they hit the road, take to the skies and go everywhere in between once again.

TPG has the guides and tips you need to reenter the world of travel, so be sure to stay tuned here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app