American Airlines launches 'Web Special' pricing for business and first-class awards

In October 2018, American Airlines launched a new mileage discount program called Economy Web Specials. Since then, AA has expanded the program from just a few domestic routes to now cover every route — both domestic and international. As we've seen, this has been both good and bad for award travelers.

Now, American Airlines is launching "web specials" for first- and business-class awards.

The new pricing set-up for business- and first-class awards was first discovered by TPG on Wednesday afternoon. An airline spokesperson confirmed late Wednesday that "we're now testing web specials in the premium cabin in select markets."

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

American Airlines still maintains a traditional award chart — although it prices some awards well above published rates. However, these "web specials" allow the airline to dynamically price awards at a discount to what the award price would be based on the award chart.

This new hybrid model brings American Airlines closer to the system Delta and United have adopted where awards are tied to demand instead of tied to an award chart. With this move, American keeps its award chart, but also expands its experimentation with dynamic pricing for some awards.

AA is starting the rollout of web specials on a limited number of domestic routes — just as it did with the introduction of Economy Web Specials.

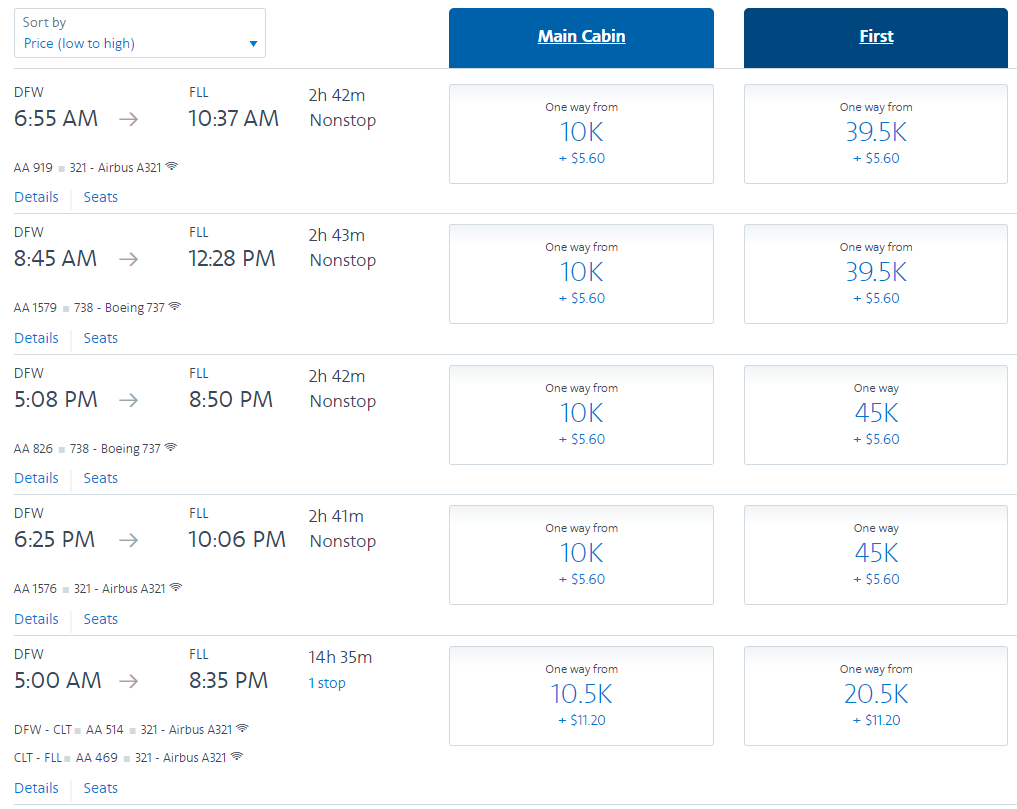

For reference, based on AA's award chart, domestic first-class MileSAAver awards cost 25,000 miles one-way and AAnytime Level 1 awards cost 45,000 miles each way.

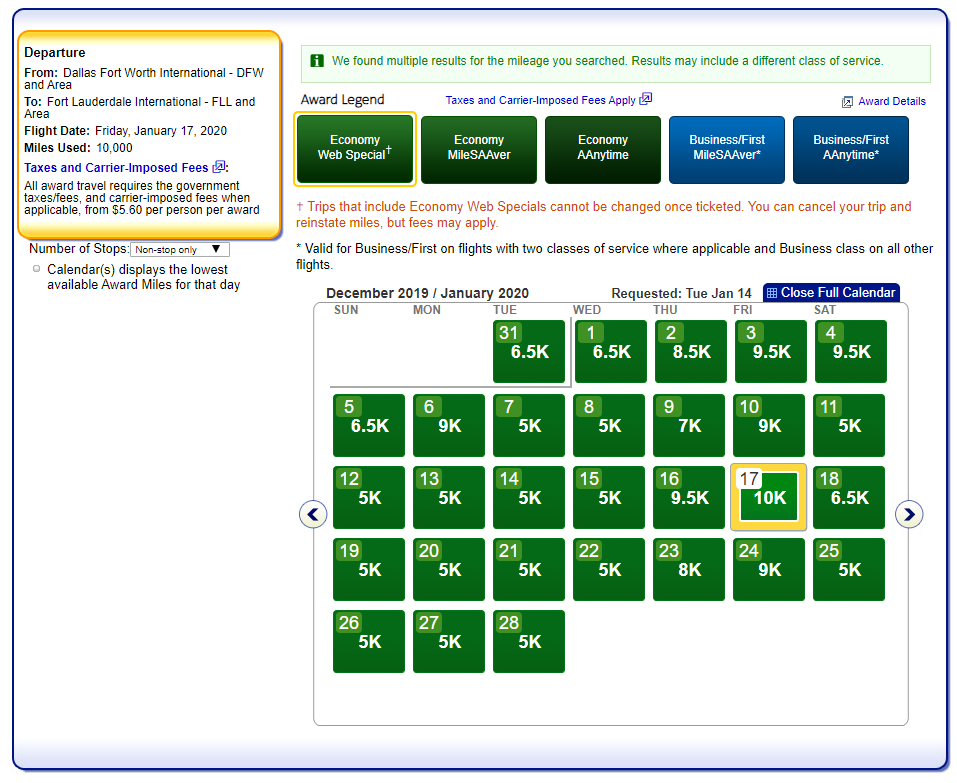

One of the routes found by TPG with the new pricing scheme is between Dallas/Fort Worth (DFW) and Fort Lauderdale (FLL). While some nonstop flights are pricing at the AAnytime Level 1 pricing of 45,000 each way, other nonstop awards are pricing at a non-standard 39,500 miles each. There's also a one-stop first-class award pricing at just 20,500 miles each way — which is less than the domestic first-class MileSAAver rate:

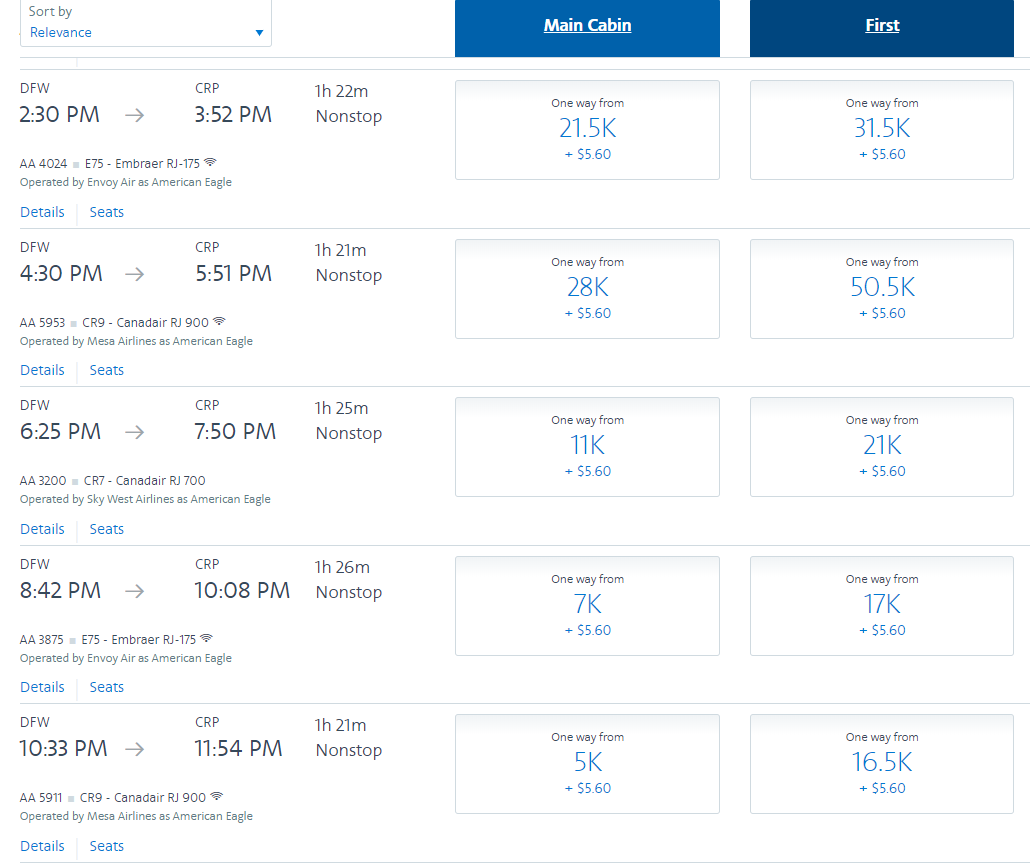

Another route we found is between Dallas/Fort Worth and Corpus Christi (CRP). As this route is less than 500 miles in length, the MileSAAver award pricing is 7,500 miles in economy or 15,000 miles in first class. However, for the date I searched, no awards were available at either of those rates:

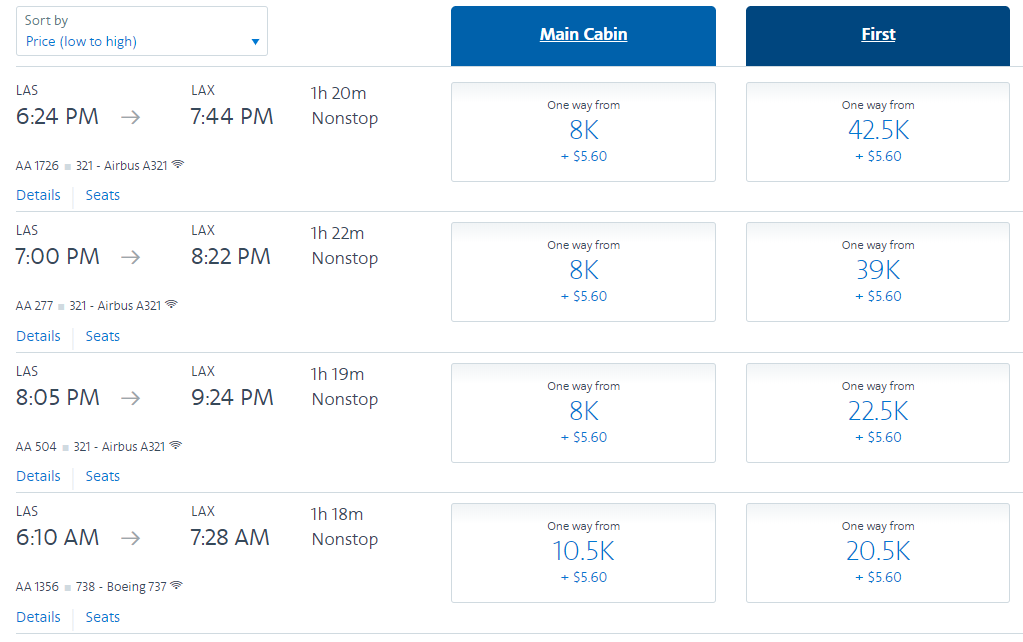

Another sub-500 mile route that we're finding with the new award pricing in both economy and first class is between Los Angeles (LAX) and Las Vegas (LAS):

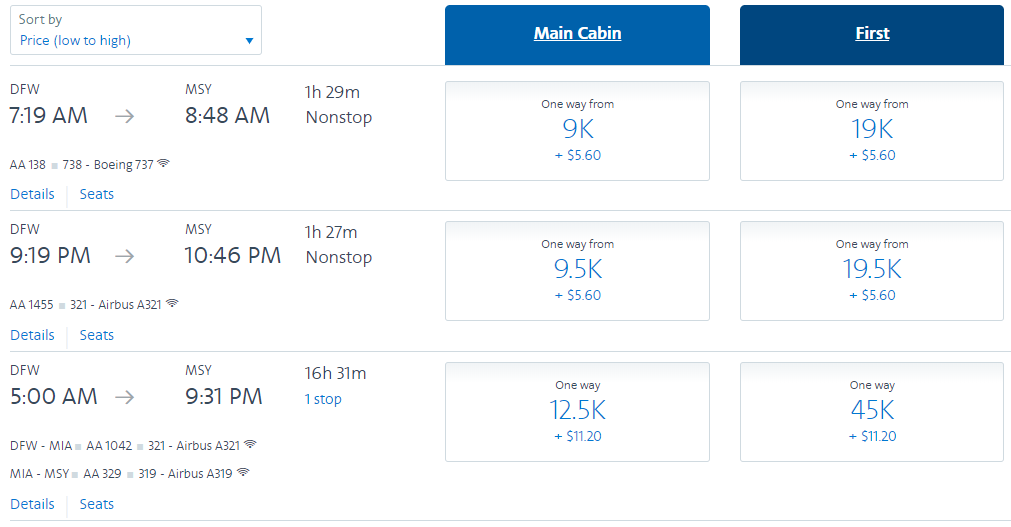

A third short-haul route is between Dallas/Fort Worth and New Orleans (MSY), where we can see the new award pricing apply to the nonstop options. Meanwhile, AA's infamous married-segment logic is requiring nearly a 12-hour layover in Miami to get economy MileSAAver award availability:

An AA spokesperson confirmed that the new pricing will be available on both of AA's award searching tools — AA's new award searching system launched as part of introducing premium economy awards and its legacy award searching system. However, AA hasn't added a "premium web special" tab to the legacy award system. So, it's unclear how you'll be able to search these first-class web special awards at this time:

An airline spokesperson noted that the routes being tested are almost exclusively domestic routes at this time, but AA may test the new pricing system on a couple of international routes as part of the rollout. AA didn't provide a timeline for the rollout of this new pricing system to additional international routes. However, as with the Economy Web Specials, it seems inevitable that this that a more-dynamic pricing scheme could soon be coming to all routes.

Related: Maximizing redemptions with American Airlines AAdvantage

In some aspects, American Airlines has been effectively dynamically pricing AAdvantage awards for years. In 2016, AA introduced AAnytime Level 4 pricing -- giving itself the ability to price awards up to 6x the MileSAAver award rate. Since then, we've seen some extraordinarily-pricey awards during peak travel times like the Sunday after Thanksgiving.

However, AA has been limited to a five-tier pricing structure (MileSAAver and AAnytime Levels 1-4) when pricing first and business class awards. In order to deviate from these set price tiers, AA has needed to run AAnytime award sales to bridge the award pricing gap between MileSAAver and AAnytime Level 1.

Now, with these new "web special" pricing system, AA has the ability to price awards at any rate it wants. As we have seen with economy awards, that can be both good news and bad news.

We've seen Economy Web Specials drop the mileage rate on coast-to-coast routes as low as 5,000 miles, Europe for as little as 9,000 miles each way, and Hawaii from 10,000 miles each way.

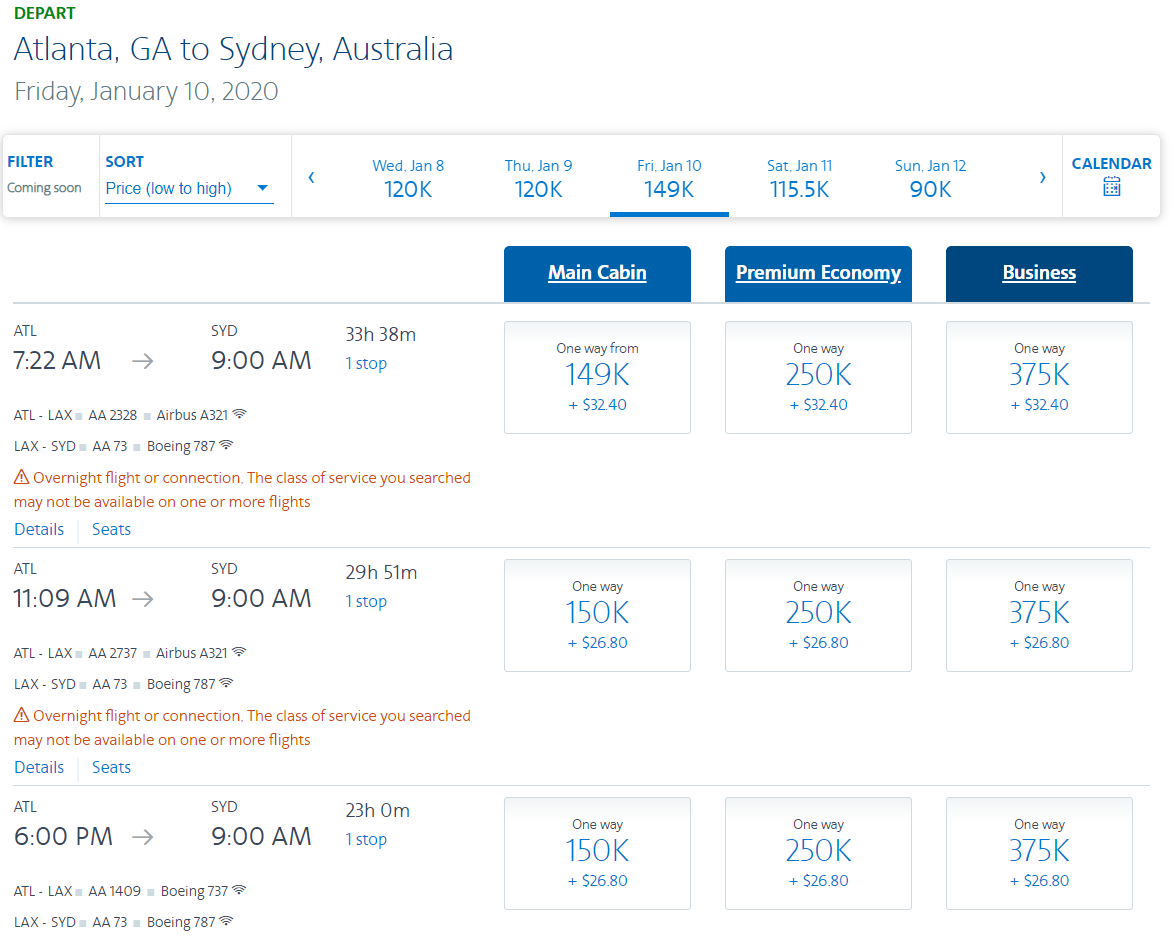

But, of course, there are downsides to this type of pricing. We've also seen award prices to Australia soar to 149,000 miles each way — which is just a 1,000-mile "discount" from the AAnytime Level 4 pricing:

We don't have to look far to find out how dynamic pricing can lead to exceptionally high prices, especially in international business and first class. Delta has had dynamic award pricing on its awards for years, and the value of Delta SkyMiles has suffered as Delta has effectively capped the value of its miles through dynamic award pricing.

Related: How to earn American Airlines miles

The good news with AA's new award pricing is that these "web special" awards have always been pricing less than the highest AAnytime award level. For now, that means that there's an upper bound on how much AA will price these awards. Let's hope that cap remains in place going forward.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app