Why do airlines bill in advance when hotels let you pay after your stay?

Reader Questions are answered twice a week by TPG Senior Points & Miles Contributor Ethan Steinberg.

The ongoing coronavirus pandemic has turned a spotlight on the economics of the aviation industry, between the years of multibillion dollar stock buybacks that are making government bailouts harder to swallow and the difficulty many travelers are facing in getting refunds for canceled flights. TPG reader Marla wants to know why airlines collect your money months in advance, while many hotels let you wait to pay until you check out ...

[pullquote source="TPG READER MARLA"]Why do airlines collect airfare at the time of booking when other travel-related industries don't? Hotels don't — we consumers book reservations, but don't pay until we check out. Rental cars don't — we don't pay until we return the car. How did it evolve to be the case that airlines collect our money upfront and then hold onto it, sometimes for as long as 9 to 10 months, before eventually providing the goods/service purchased?[/pullquote]

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

Marla poses an interesting question, one that I'm sure many travelers who've been given the runaround when trying to get a refund are asking as well. The short answer is that airlines do offer a more flexible booking option in the form of refundable tickets, but they price them at such an expensive premium that they simply aren't an option for most price-conscious travelers. Even if you do book a refundable ticket, you pay for it up front and just retain the option to get your money back down the road.

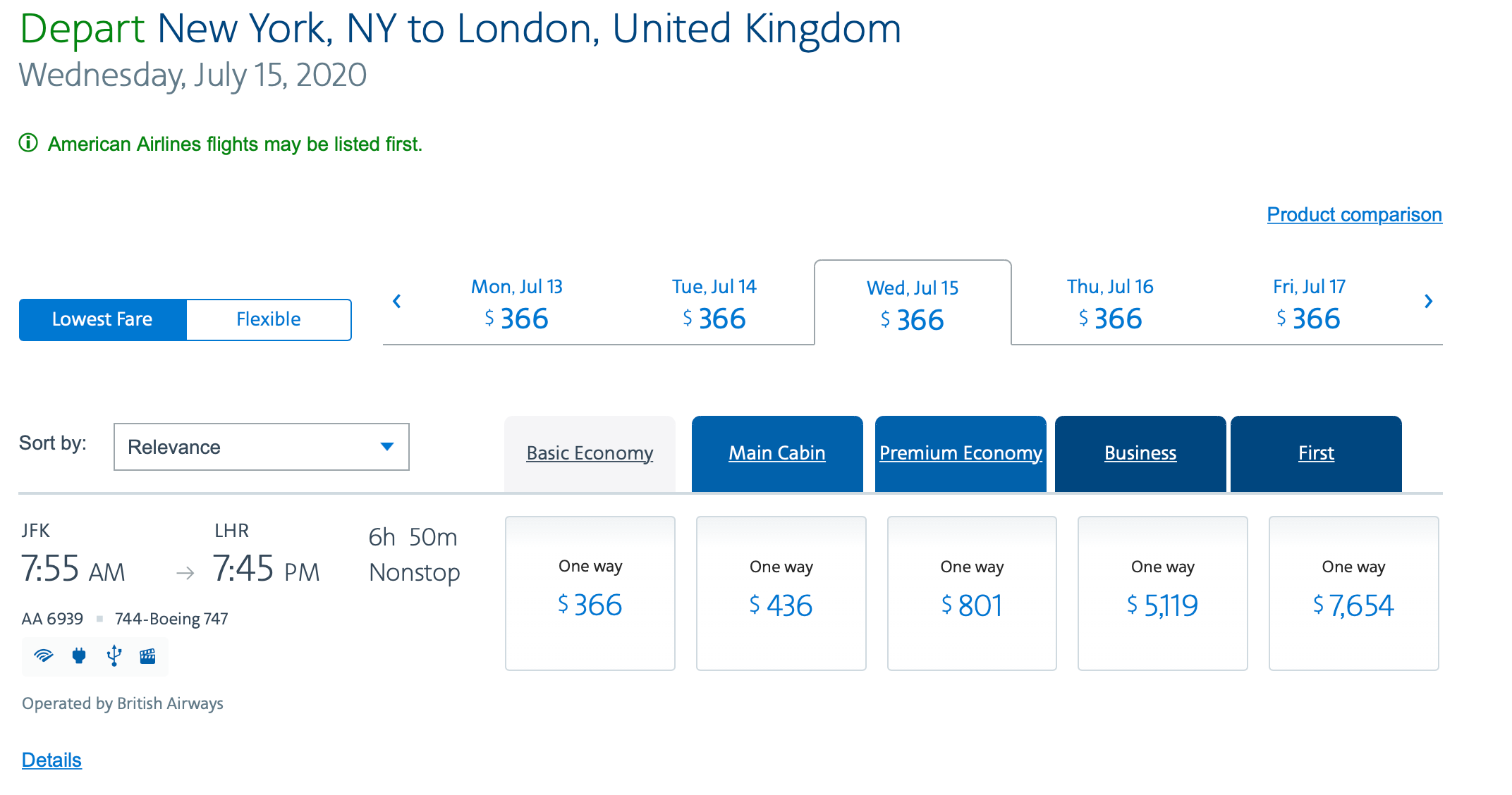

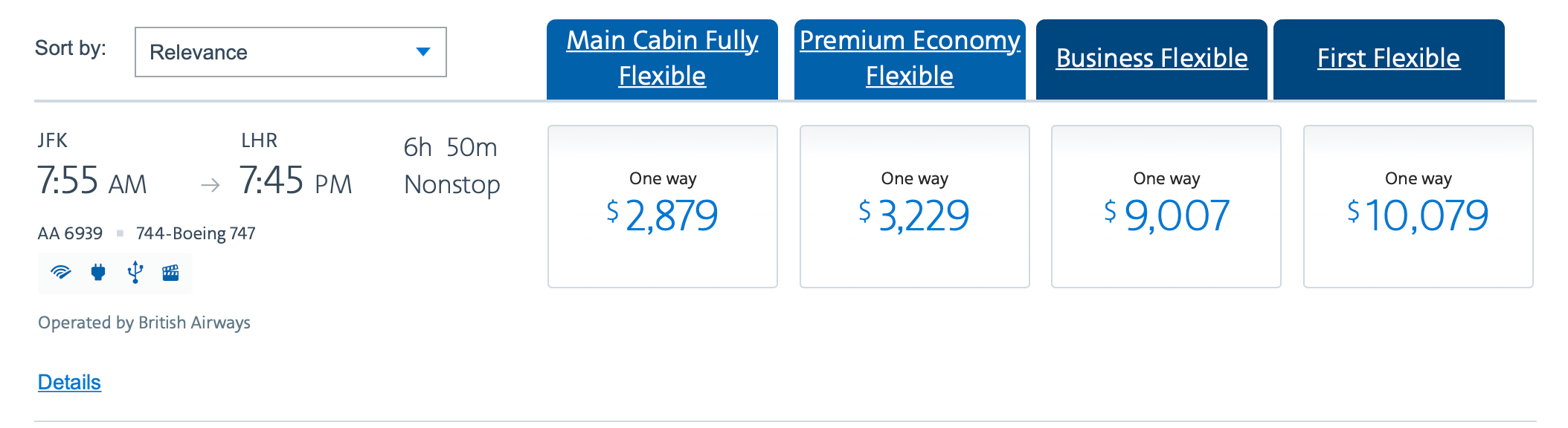

Take a look at this one-way American Airlines flight from New York-JFK to London (LHR). You can see that in every cabin, the flexible/refundable tickets shown in the second image are significantly more expensive than the regular versions. In economy, you need to pay 6.5 times as much for the privilege of having a refundable ticket!

Hotels, by comparison, charge a much smaller premium. Even at luxury properties, the difference between a fully-refundable and nonrefundable room rate is often $50 or less, and while that may still be a large percentage out of the rate, it's more affordable for people in real dollar terms.

Related: When plans go wrong: Your guide to booking refundable travel

The answer as to why things work this way is complicated, and is a mix of "because it's always worked that way" and the fact that airlines have much more varied expenses to cover. An airline needs to spend a lot more money up front or your flight won't take off. Fuel and catering supplies need to be delivered before the flight, and the minute your aircraft touches down and pulls into the gate the airline is subject to taxes and fees, even if your flight doesn't take off for another 10 hours. This is to say nothing of the ground crew, baggage handlers, gate agents and more who need to be paid to work your flight. There's also the cost of the plane itself, something the airline starts paying for (with help from your ticket sales) months or years before your specific flight takes off.

It's also important to note that airlines are not the only travel companies that collect payment at the time of booking. Many trains, buses and cruises require passengers to pay some or all of the cost of the ticket upfront, for many of the same reasons mentioned here. In fact hotels are a notable exception in the travel industry, and that inevitably leads to some last-minute changes and cancellations when travelers aren't financially committed to the reservations they've made.

Of course, none of these are reasons that things have to be done this way as much as they're an explanation for why they currently are. An airline could switch its sales model at any point, though that would create a huge temporary liquidity crisis and could only be done if said airline had sufficient cash reserves. At the end of the day, the best answer to Marla's question is likely that this is always the way things have worked, and there's no real incentive for any one airline to buck the industry-wide trend at their own expense.

Related: How to refund a nonrefundable airline ticket

Bottom line

I hear Marla's frustration in asking this question, as airlines charge quite the hefty premium for customers who want the option of refundable tickets, and they still collect many from those passengers at the time of booking. Once things become set in stone it's hard to change, and airlines must have decided that the immediate cost of changing the sales model wouldn't result in any significant financial benefit.

Thanks for the question, Marla, and if you're a TPG reader who'd like us to answer a question of your own, tweet us @thepointsguy, message us on Facebook or email us at info@thepointsguy.com.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app