Earn more and spend less: 5 tips on how to use your points and miles better in 2025

Editor's Note

At TPG, we try to cross off a few destinations from our travel wish list yearly. However, finding the most economical way to get there and back is challenging. Although many TPG readers and staffers use credit card rewards for flight bookings, you might be unsure if you're getting the best deal from your rewards.

To address this, we made it a New Year's resolution to help our readers understand how to maximize their points and miles. You can minimize your travel expenses and explore more places by using your rewards more efficiently.

Here are five easy tips to maximize your travel rewards in 2025.

Related: How to choose your best credit card strategy

Redeem Chase points for Hyatt stays

There are many ways you can redeem Chase Ultimate Rewards points for hotels, experiences and sporting events to help reduce the cost of your vacation.

For example, you can use Chase Ultimate Rewards points to book a Hyatt stay by transferring them to World of Hyatt. You can also transfer Chase Ultimate Rewards points to IHG One Rewards and Marriott Bonvoy, but Hyatt points are worth significantly more in TPG's December 2024 valuations.

For example, 21,000 World of Hyatt points are enough for a standard free night on an off-peak date at a Category 6 property like the Great Scotland Yard Hotel or the Park Hyatt Chicago. Redeeming these points could get you into a room that would otherwise cost more than $500 per night on most dates. World of Hyatt gives all members waived resort fees on award stays, which can add to the savings.

Related: The best Hyatt hotels in the world

Here are some of the best cards to earn Ultimate Rewards points:

- Chase Sapphire Preferred® Card (see rates and fees): Earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

- Chase Sapphire Reserve® (see rates and fees): Earn 125,000 bonus points after spending $6,000 on purchases in the first 3 months from account opening.

- Ink Business Preferred® Credit Card (see rates and fees): Earn 100,000 bonus points after you spend $8,000 on purchases in the first three months from account opening.

- Ink Business Cash® Credit Card (see rates and fees): Earn $750 cash back after spending $6,000 on purchases in the first three months from account opening.

- Ink Business Unlimited® Credit Card (see rates and fees): Earn $750 bonus cash back after spending $6,000 on purchases in the first three months from account opening.

- Chase Freedom Flex® (see rates and fees): Earn a $200 bonus after spending $500 on purchases in your first three months from account opening.

- Chase Freedom Unlimited® (see rates and fees): Earn a $200 bonus after spending $500 on purchases within the first three months from account opening.

The first three cards earn fully transferable Ultimate Rewards points, while the remaining four are technically billed as cash-back credit cards.

However, if you also have an Ultimate Rewards points-earning card, you can convert your Chase cash-back rewards to Ultimate Rewards points. For this reason, having more than one Chase card in the family can make sense to maximize your earning and redeeming potential.

Learn how to transfer credit card rewards

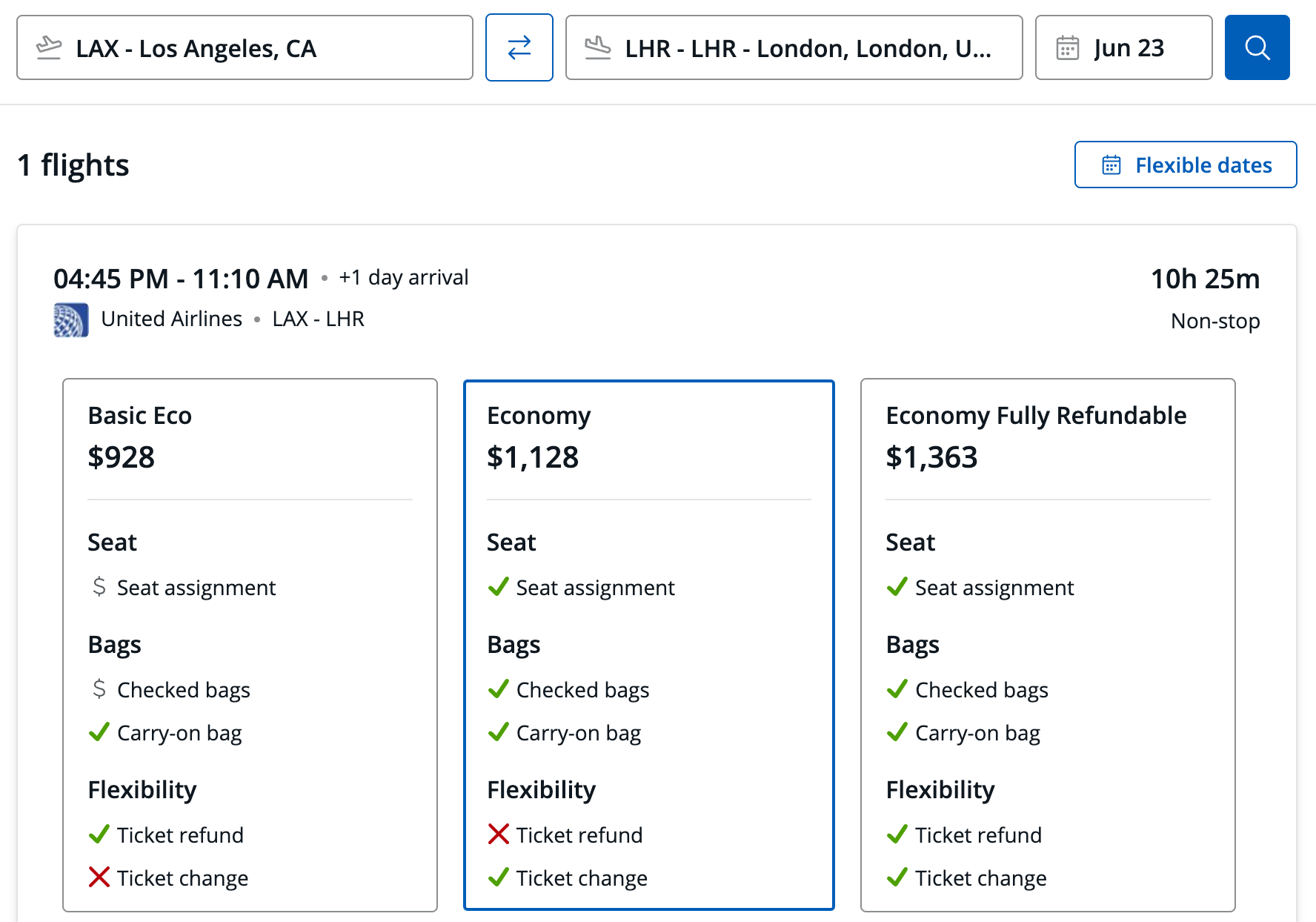

You might consider using your Chase Ultimate Rewards points to book travel directly in the Chase Travel℠ portal, but let's look at what that means for a one-way flight from Los Angeles International Airport (LAX) to Heathrow Airport (LHR) next summer.

I picked a nonstop sample United Airlines flight that would cost $1,128 in regular economy class if I booked through Chase Travel.

If you have the Chase Sapphire Reserve, you can redeem Chase Ultimate Rewards points for travel through the portal at up to 2 cents apiece. So, this flight would require 75,200 Ultimate Rewards points if you have the Chase Sapphire Reserve and redeem for this flight through Chase's travel portal. If you had the Chase Sapphire Preferred, your Ultimate Rewards points are worth a slightly lower 1.75 cents each when redeemed through Chase Travel, so you would need 90,240 Ultimate Rewards points.

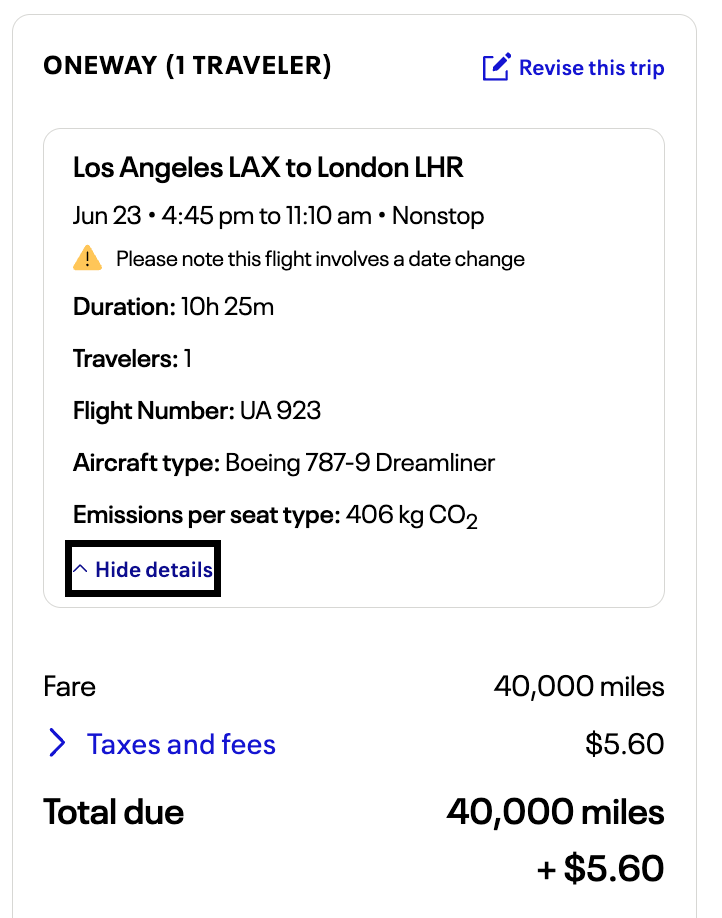

Alternatively, you can book this flight in regular economy for 40,000 MileagePlus miles and just $5.60 in taxes and fees. Remember, you can transfer Chase Ultimate Rewards points to United MileagePlus at 1:1.

When you transfer credit card rewards to a loyalty program, you usually won't earn frequent flyer miles on your ticket (which you typically would accrue when booking through the Ultimate Rewards travel portal). However, you'll likely come out well in front if you save tens of thousands of credit card points by transferring them to a partner airline program rather than redeeming them through a credit card travel portal.

Check award rates with transfer partners before redeeming rewards through your credit card issuer's travel portal. Transferring rewards to book award flights or stays may make sense when paid rates are high (like on peak summer dates) or award rates are low.

Related: How (and why) you should earn transferable points

Track your points and miles

Using your points and miles properly is difficult if you don't track them accurately. Luckily, there are many ways to track your points and miles.

Many of us used to track our rewards manually in a Word or Excel document, but this was time-consuming and cumbersome to keep up to date. So, you might want to use an automated tool. One option is the TPG App, which keeps track of all your balances in the same place, automatically calculates their value and gives you a heads-up when they will expire.

The TPG App gives you a snapshot of your current situation and can help inform your travel plans. When you log in, you'll see where you have the most rewards with the accounts you've synced (and the value using TPG's monthly points and miles valuations).

Related: How to keep your points and miles from expiring

Sign up for all loyalty programs

Many people fail to sign up for every loyalty program because they think they'll never really fly JetBlue or stay at a Hilton. But that mindset has cost travelers millions of points and miles.

Even if you aren't loyal to one airline or hotel chain, signing up for the program when you fly or stay means adding more rewards to your balance whenever you use the program again. You might even get extra perks, such as free Wi-Fi during your hotel stay, just for being a member.

While you might not want to join every program now, consider ensuring you have a loyalty number listed on every flight you take. Doing so will build up rewards in various programs that could eventually get you a free trip.

Related: These airline and hotel programs offer free points when you sign up

Use online shopping portals to stack award points

You could earn more rewards on purchases for yourself or loved ones this holiday season through a shopping portal. These portals are essentially online shopping malls that partner with thousands of merchants. By starting at the portal rather than going directly to the retailer's site, you can earn bonus points or miles on thousands of items.

For example, let's assume you want to buy a transfer or tour through Viator. If you go directly to the Viator website, you'll only earn rewards for your credit card purchase. If you instead click through the AAdvantage shopping portal, for example, before making your purchase, you could snag extra rewards.

Should you prefer earning cash back instead of points and miles, you can explore online shopping portals like Rakuten and TopCashback. We recommend using a shopping portal aggregator each time you make an online purchase to find the program that offers the best return for your merchant.

Related: The beginners guide to airline shopping portals

Bottom line

With the start of a new year, there are numerous possibilities to modify your strategy for earning and redeeming points and miles.

Following a simple strategy, such as ensuring you have a frequent flyer number associated with every flight you take, can significantly reward you.

We're already dreaming of our next adventure using points and miles.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app