Sweet Spot Sunday: Fly Alaska Airlines to multiple destinations using Japan Airlines miles

Many TPG staffers love flying Alaska Airlines. And many of these same staffers would argue that Alaska Mileage Plan is one of the best frequent flyer programs. Even so, Alaska Mileage Plan may not be the best option every time you want to redeem miles to fly on Alaska-operated flights.

So, today I'll discuss a lesser-known sweet spot: using Japan Airlines Mileage Bank for multi-city Alaska-operated awards.

[table-of-contents /]

Why it's special

The Japan Airlines Mileage Bank program has a distance-based partner award chart. This award chart is appealing for trips where you want to fly on multiple relatively short Alaska-operated flights. Here's a look at the economy award chart:

- Up to 1,000 miles trip distance: 12,000 miles

- 1,001 to 2,000 miles trip distance: 15,000 miles

- 2,001 to 4,000 miles trip distance: 23,000 miles

- 4,001 to 6,000 miles trip distance: 37,000 miles

- 6,001 to 8,000 miles trip distance: 45,000 miles

- 8,001 to 10,000 miles trip distance: 47,000 miles

- 10,001 to 12,000 miles trip distance: 50,000 miles

- 12,001 to 14,000 miles trip distance: 55,000 miles

- 14,001 to 20,000 miles trip distance: 70,000 miles

- 20,001 to 25,000 miles trip distance: 90,000 miles

- 25,001 to 29,000 miles trip distance: 110,000 miles

- 29,001 to 34,000 miles trip distance: 130,000 miles

- 34,001 to 50,000 miles trip distance: 150,000 miles

As you can see, the number of miles required for an award ticket depends on your total trip distance. However, there are several complexities to consider, including:

- One award can have up to six flights and up to three stopovers of more than 24 hours.

- An award can open-jaw on at most one stopover -- but surface sector distance during this stopover won't count toward the total trip distance.

- Itineraries with surface sectors may not be allowed as one award ticket in some cases.

- You can include the same city in an itinerary up to three times, but you can only stop in a city once.

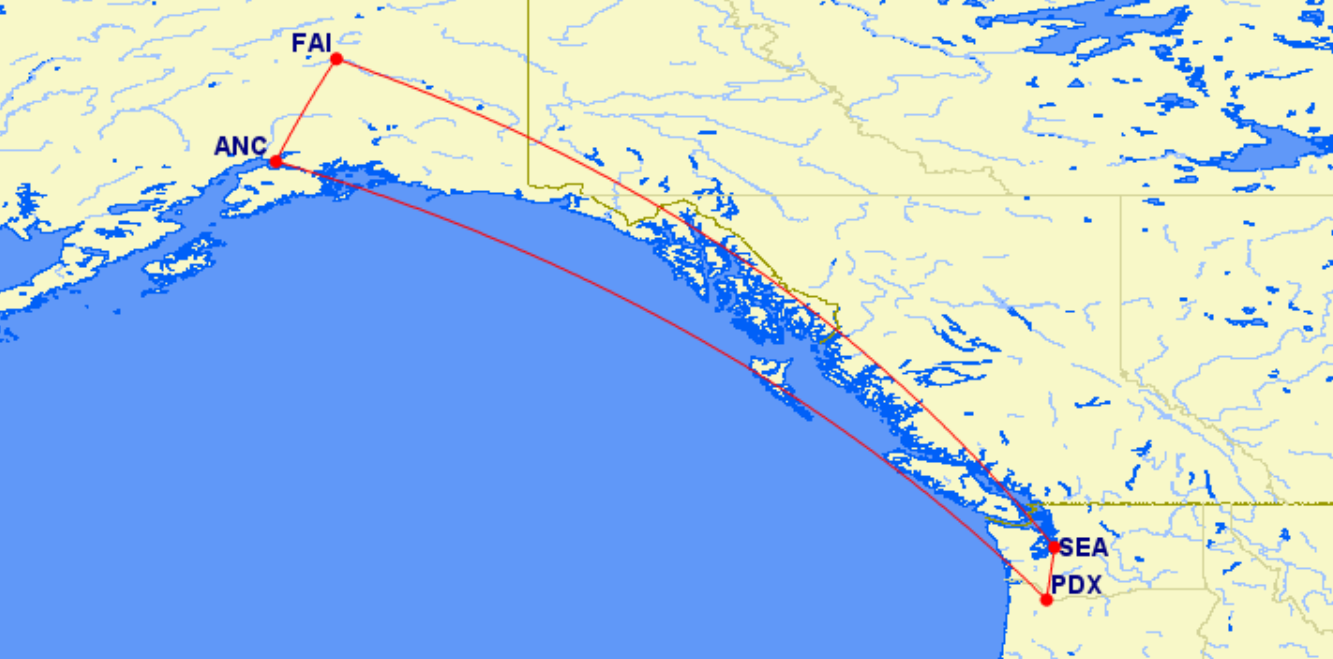

For example, you could start in Seattle and stopover in Fairbanks, Anchorage and Portland before returning to Seattle. This 3,465-mile route would cost 23,000 miles per person plus taxes and fees in economy.

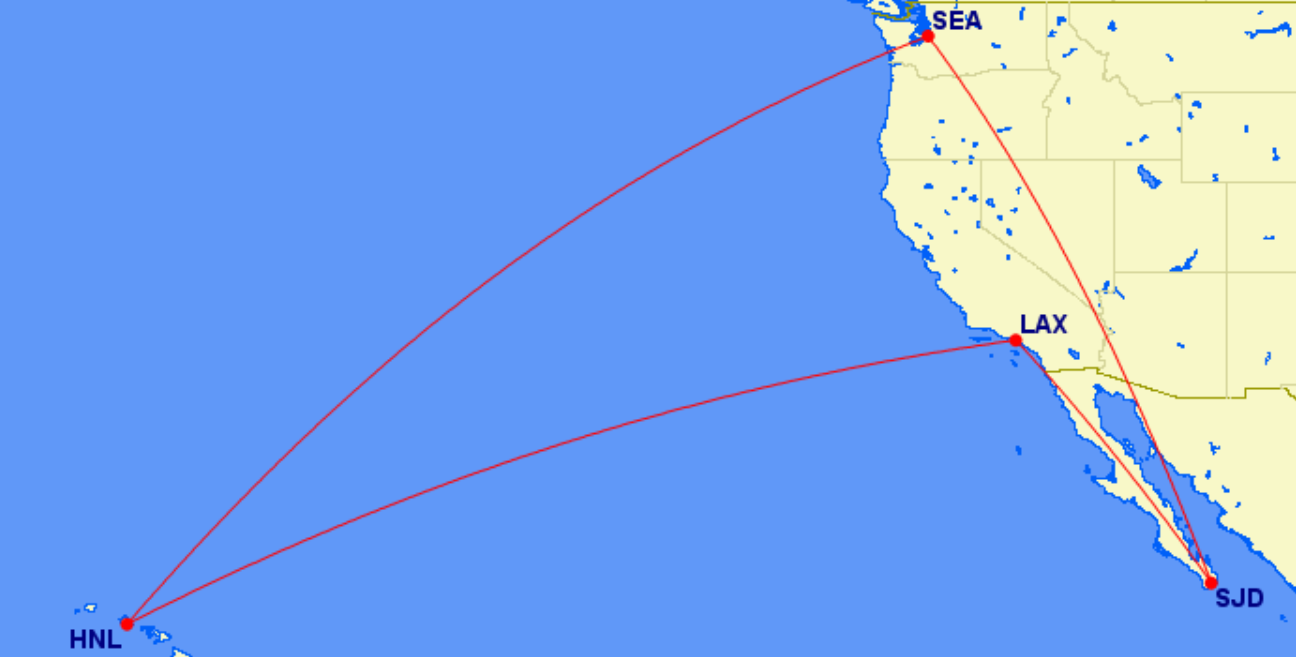

Or, you could start in Seattle and stopover in Honolulu, Los Angeles and San Jose del Cabo before returning to Seattle. This 7,958-mile route would cost 45,000 miles per person plus taxes and fees in economy.

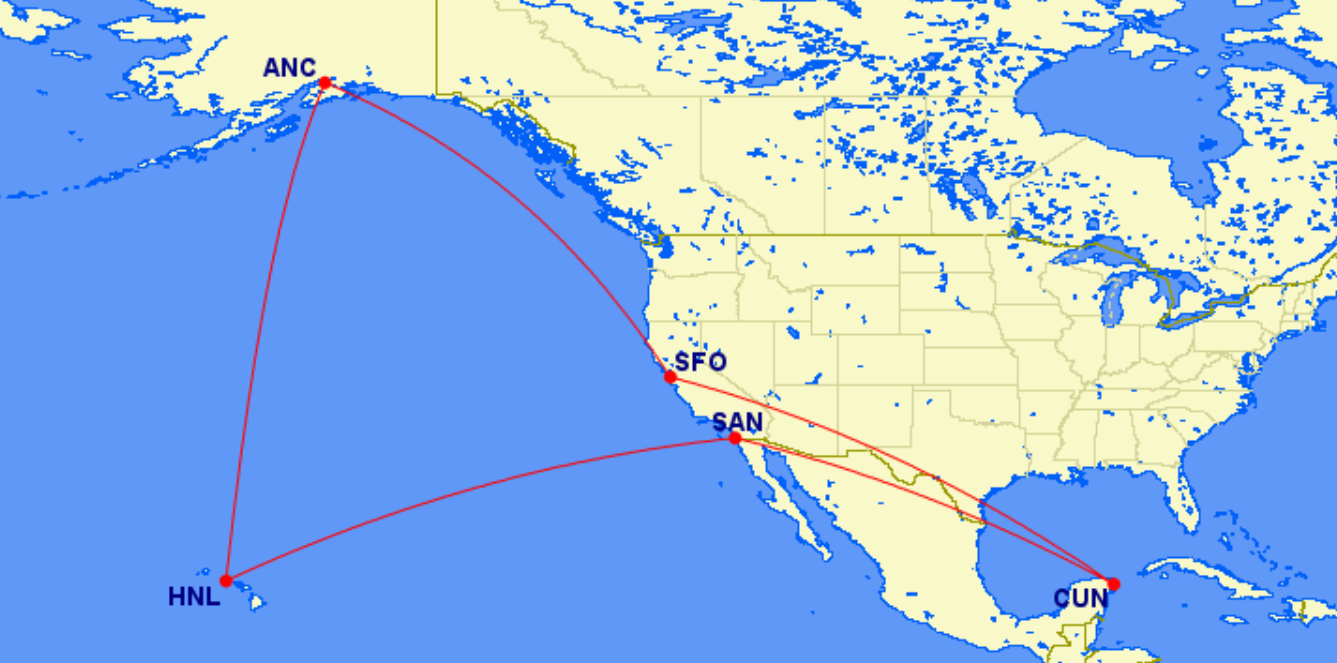

You could also start in San Francisco and stopover in Anchorage, Honolulu and Cancun (after connecting through San Diego) before returning to San Francisco. This 11,844-mile award would cost 50,000 miles per person plus taxes and fees in economy.

In short, the options are essentially limitless if you can find partner award availability for each segment.

Related: Sweet Spot Sunday: Fly to Hawaii for 20,000 AAdvantage miles each way

How to book this award

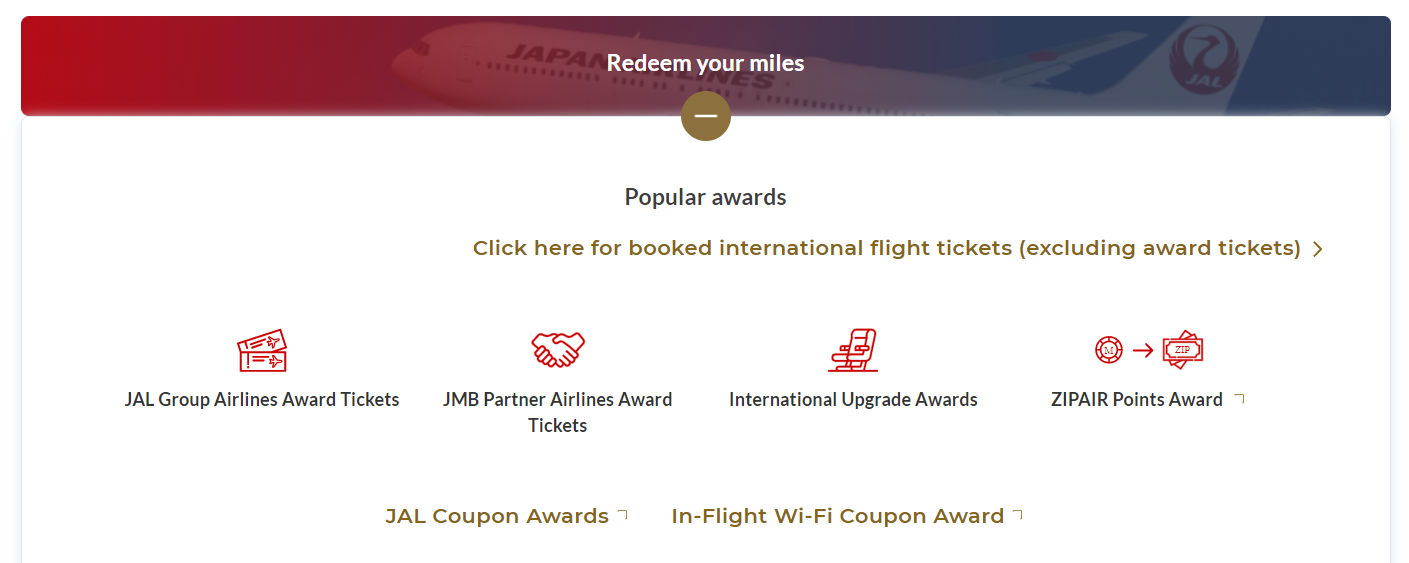

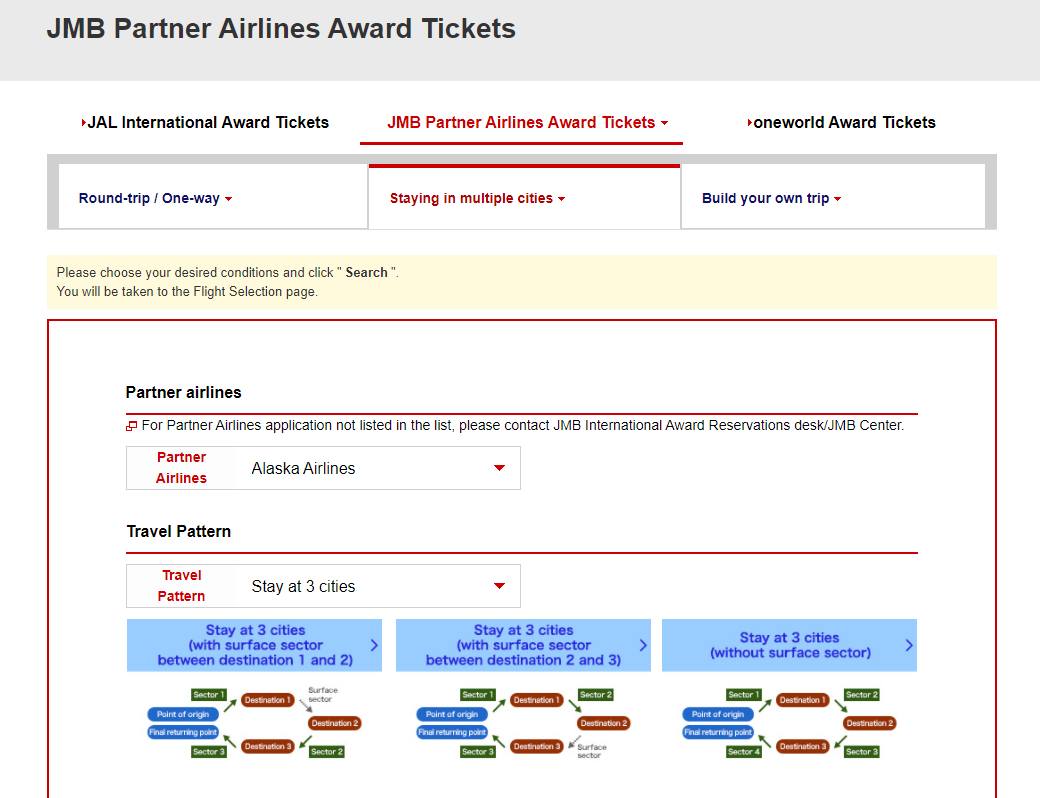

I recommend searching for (and finding) award availability on American Airlines' website. Then, go to the Japan Airlines website and log into your Mileage Bank account. Click on JAL Mileage Bank on the top menu bar and select "JMB Partner Airlines Award Ticket" under the "Redeem your miles" section. Next, click on "JMB Partner Airlines Award Ticket" under "Book ticket."

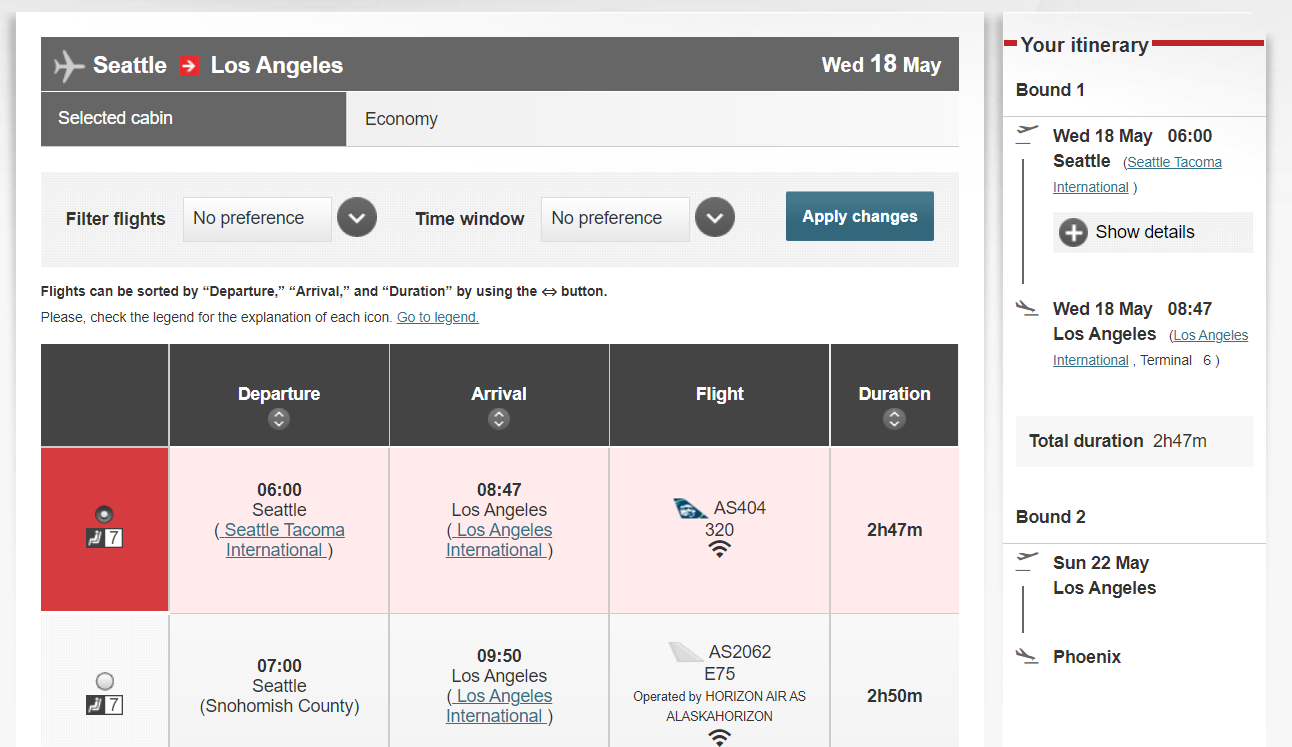

Now select "Staying in multiple cities" and choose Alaska Airlines as the partner airline. Then choose your travel pattern and enter your flight information.

If there's award availability on your dates, you'll see options on the next page after you click "Search."

You can also call the U.S. and Canada English-language JAL Mileage Bank Center at 1-800-525-3663. However, there's a $50 ticket service fee when you book over the phone (you won't pay this fee when booking online).

Related: How to search award availability for the major airlines

How to earn Japan Airlines miles for this award

Perhaps the biggest shortcoming to this sweet spot is that it can be challenging to earn Japan Airlines miles. After all, the only major transferrable currency that transfers to JAL MileageBank is Marriott Bonvoy, at a 3:1 ratio, with a 5,000 mile bonus awarded for every 60,000 Marriott points transferred.

If you're looking to earn more Marriott Bonvoy points, consider opening a Marriott Bonvoy cobranded credit cards. Many of these cards are offering higher than usual welcome bonuses, and can be a great way to top up your Marriott account. Just be aware that you may lose value when transferring Marriott points to an airline instead of redeeming for hotel nights.

There is also a JAL MileageBank credit card available in the U.S: the JAL USA CARD. This card has a lower annual fee version that earns 0.5x points on qualifying purchases and a higher annual fee version that offers 1x points.

Related: Airline miles that are hardest to earn — and why you want them anyway

Bottom line

Since it's often difficult to earn Japan Airlines miles, this sweet spot is easy to overlook. And it won't be a reasonable option every time you want to redeem miles to fly on an Alaska-operated flight.

But if you find partner award availability and can maximize the up to three allowable stopovers on your award, this sweet spot may be appealing. However, note that you can't redeem Japan Airlines miles within the first 60 days of enrolling in the Japan Airlines Mileage Bank program. And you can only redeem miles for travel by yourself and select family members.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app