Forget points, this loyalty program rewards your spending with stocks

Traditionally, there have been three main kinds of rewards you could earn with loyalty programs: cash-back, points/miles or a free item/discount after a certain number of transactions. Generally, these rewards get devalued over time, so it's not good to hoard them.

Well, there is now a loyalty program that's trying to change that.

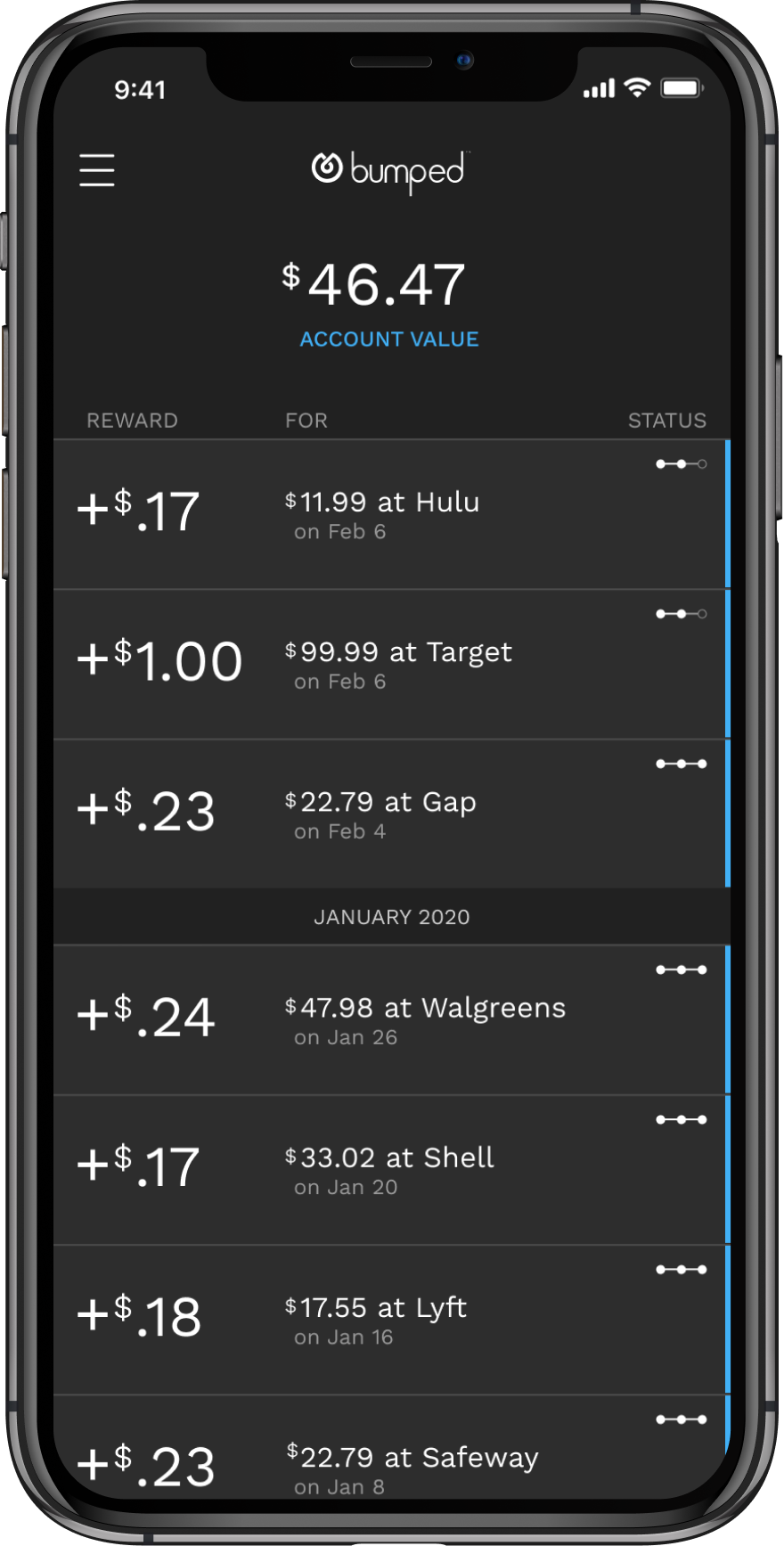

Enter Bumped. This relatively new program rewards consumers with equity in brands they shop with. The hope is that these investments become more valuable over time. Even better, rewards earned through Bumped are in addition to any rewards you may earn through a retailer's own loyalty program.

Let's take a closer look at how the program works and how you can start earning free stocks.

Bumped Loyalty Rewards

The concept of Bumped is simple. When spending money with certain companies, you can earn a percentage of your purchases back in fractional stock shares.

Participating brands include big names like Starbucks, Netflix, Chipotle and Lyft. Reward rates vary by retailer and whether you're making your purchase in-store or online, but they tend to be around 1 to 2 percent. Plus, they stack with any rewards by a brand's own loyalty program, so you can double-dip your earnings.

Bumped's founder and CEO David Nelsen explained to TPG, "If you're a member of Starbucks' loyalty program, you don't have to sacrifice your stars to earn SBUX stock. The same goes for cards you earn miles or points on — link your favorite and most rewarding cards to Bumped to get stock rewards on top of those other loyalty programs when you spend with your favorite brands."

Related: How to stack Amex Offers for cash back and bonus points

How it works

To get started, you need to create an account (referral link) via Bumped's website or mobile app. Since you're earning real stocks, you'll also be opening a brokerage account when you sign up. As such, you need to provide some more personal information, including your social security number. That said, you'll never be charged any brokerage fees.

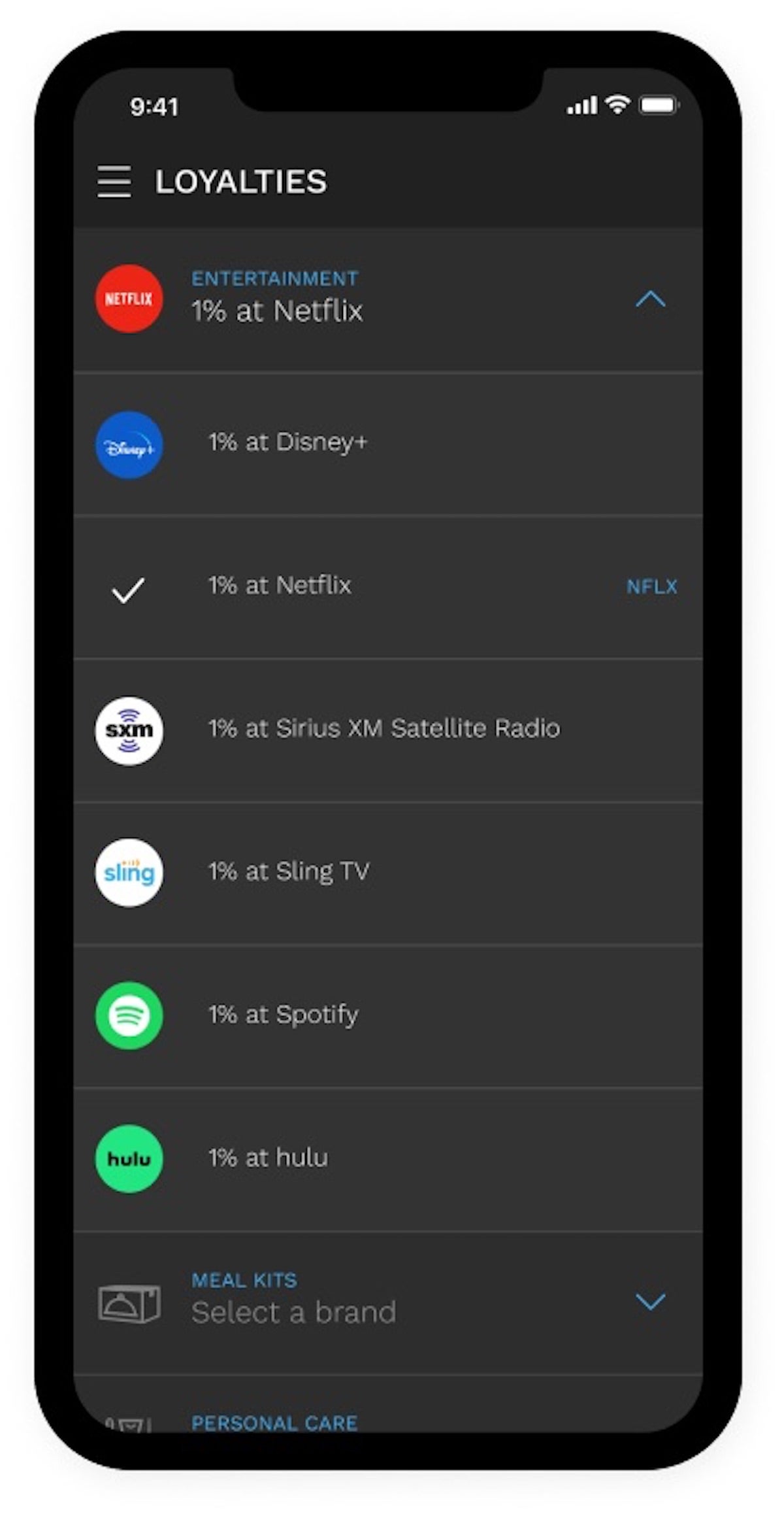

You'll then need to link your credit or debit cards and choose the brands you want to earn rewards with. You can pick one brand in each loyalty category. The categories include apparel, club warehouse, coffee, entertainment (streaming services), meal kits, personal care, pet supplies, quick eats, sportswear and transport (gas stations and rideshare apps). You can change your brand loyalty in a category once per 30 days, up to three times a year. After all, the goal of the program is for you to build loyalty with these brands and maintain long-term positions.

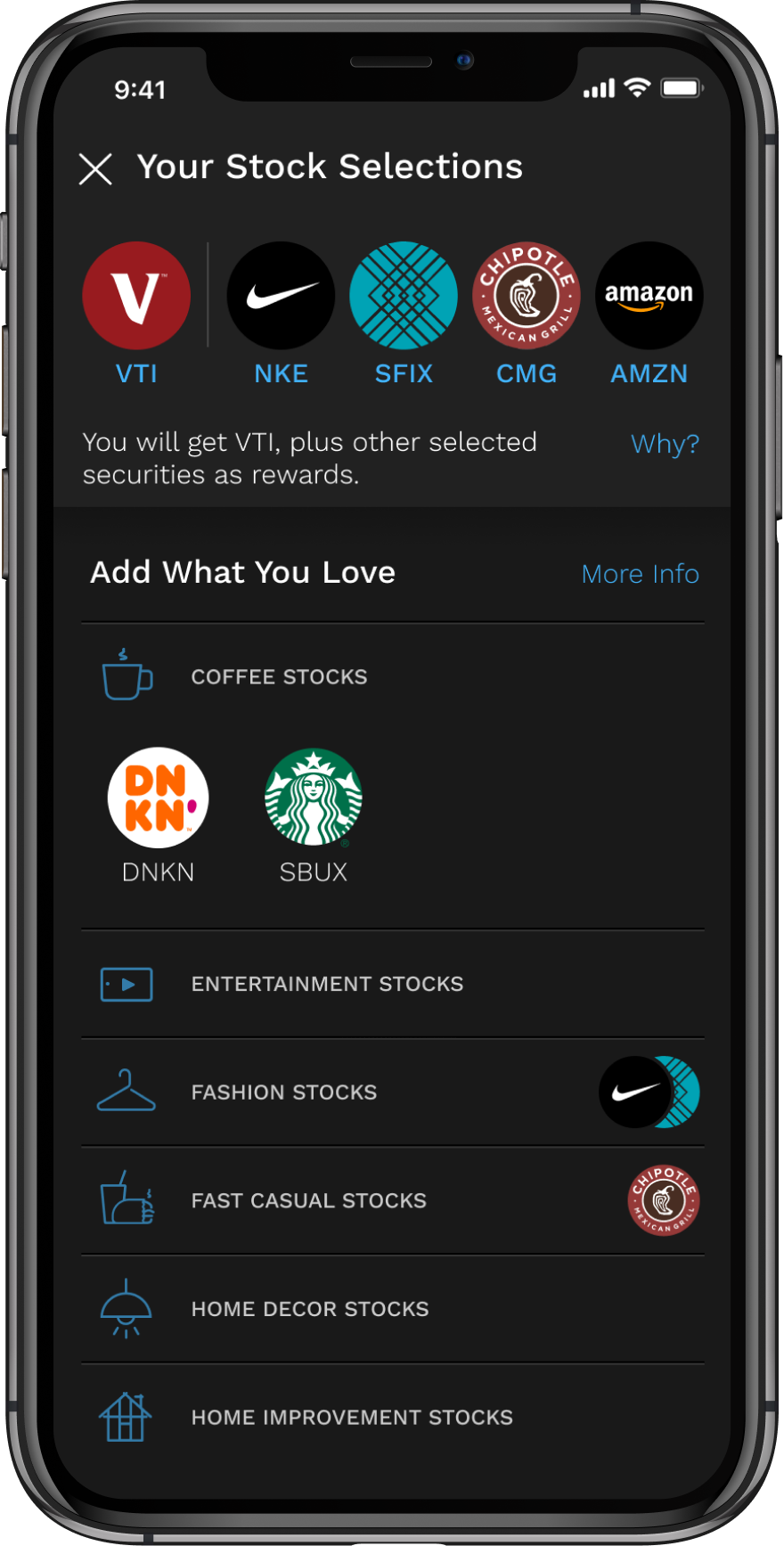

Bumped lets you decide whether you want to earn equity in the companies you're transacting with or put those rewards toward your custom portfolio. If you go the custom route, your rewards will be split across Vanguard's Total Stock Market Index Fund VTI and up to four stocks of your choice. There are over 50 popular stocks across a variety of industries that you can choose from.

Related: Is it possible to invest my points?

According to Bumped, stock rewards typically take up to seven business days to process before they are ordered and settled. You can sell your shares with no fees, though it can take up to three to five business days for the process to complete. Any cash in your account can then be withdrawn. You can't buy more shares through Bumped, though any applicable dividends will automatically be reinvested.

On occasion, users may be asked to complete an action to maintain access to certain features (i.e., earning Loyalty Rewards or access to a new brand). While the program says that this area is still being refined, one requirement could be to make a purchase through the Shop Now section (more on that soon) to continue earning Loyalty Rewards for another three months.

Related: Is earning Bitcoin with each swipe the credit card reward of the future? These cards think so

Shop Now feature

In addition to the automatic stock you earn with your selected brands, you can earn rewards when shopping online with hundreds of stores via the Shop Now feature. It works just like any other online shopping portal, except you're rewarded in stock.

You can search for stores via Bumped's website or app, then need to click through to the retailer's website to complete the purchase. Note, however, that these rewards take much longer to post to your account (60-120 days) and, like other online shopping portals, there may be exclusions for certain transactions (i.e., if you use a promo code from another site).

Related: Your guide to maximizing shopping portals for your online purchases

Bottom line

There haven't been many major innovations in the loyalty space recently, so the addition of stocks as a reward currency is definitely welcome. Unlike points and miles, which are almost certain to lose value over time, stocks have the potential to appreciate. Perhaps most excitingly, you don't need to forgo your usual rewards to earn equity, as Bumped stacks with other loyalty programs. In other words, there's no reason not to join.

"Points, miles, and cash-back can be great, but I wanted to create a reward that could empower people, that could grow over time and could serve the relationship between consumers and the brands they love," Nelsen said. "I can't think of any reward that goes beyond the transaction like ownership does."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app