Earn American miles and Loyalty Points with the SimplyMiles program

Editor's note: This is a recurring post, regularly updated with new information and offers.

Within the American Airlines AAdvantage program, travelers often look for ways to earn American miles to redeem for award flights. But many travelers are also seeking ways to earn Loyalty Points toward a specific American Airlines elite status tier or Loyalty Point Rewards milestone.

Luckily, U.S. residents with a Mastercard can earn American miles and Loyalty Points on many everyday purchases through the SimplyMiles program. Here's what you need to know.

What is SimplyMiles?

The SimplyMiles program is similar to Amex Offers, Chase Offers and Citi Merchant Offers in that you enroll in offers and get rewards. But while you enroll a specific card for credit card merchant offers, SimplyMiles offers let you pay with any linked Mastercard once you enroll in an offer.

To enroll in SimplyMiles, head to the SimplyMiles website and click the "Join" link in the upper right-hand corner. Log into your American AAdvantage account and add at least one Mastercard to your SimplyMiles account to get started. However, I recommend adding all your Mastercards to your SimplyMiles account so you don't miss out on earning opportunities.

Related: Best uses of American Airlines AAdvantage miles

Using American Airlines SimplyMiles

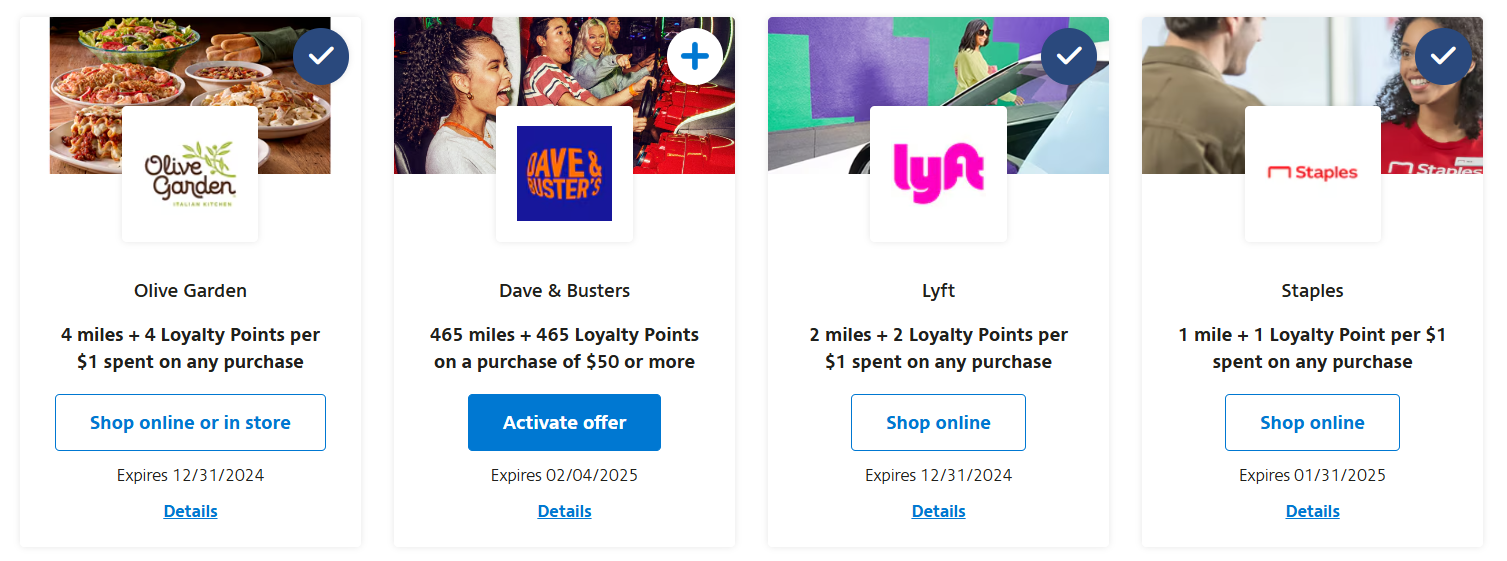

Once enrolled, occasionally head to the SimplyMiles website to check your offers. Some offers provide miles based on your spending, while others award a set amount when you spend a specific amount with a merchant.

While looking through your offers, add any you want to use to your account by clicking "Activate offer." However, some offers can only be redeemed online or in-store, while other offers require you to click through a specific link or are only valid for specific purchases. So be sure to read the terms of each offer before making a purchase.

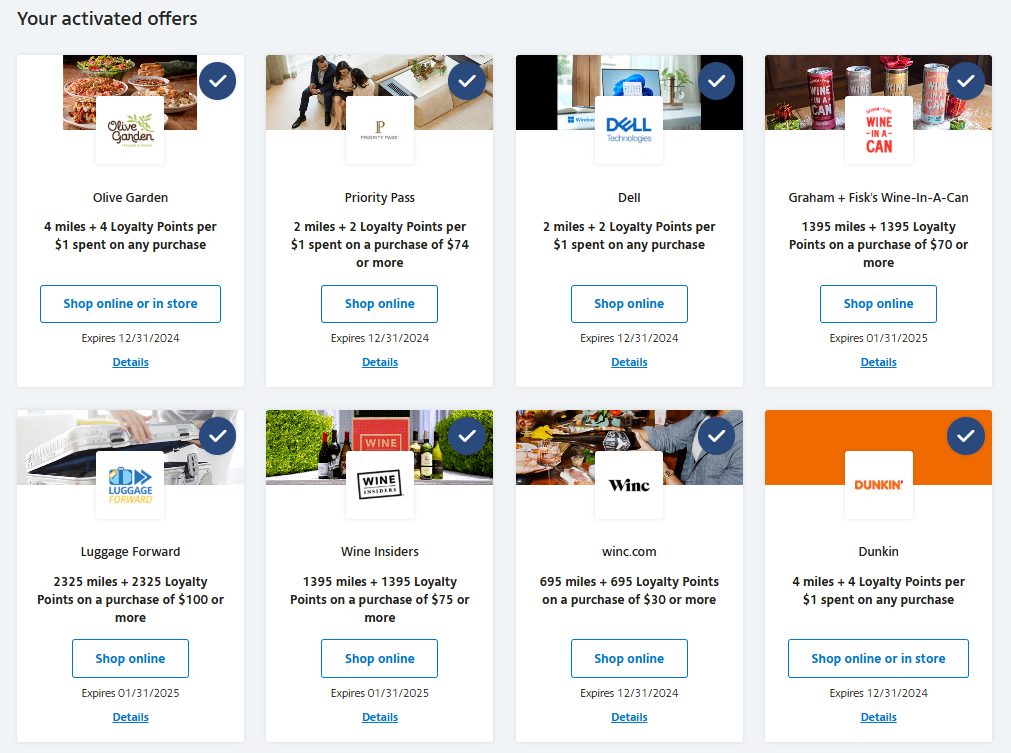

I usually have various offers ranging from meal delivery services to wine services and technology companies. You'll see all the offers you've already activated near the bottom of the screen.

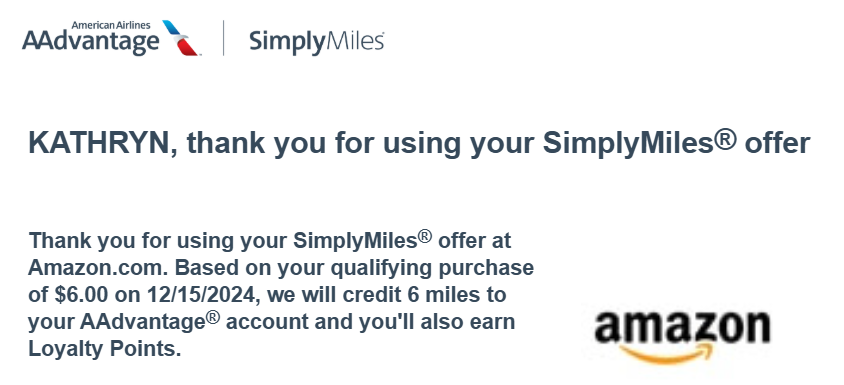

You'll usually earn AAdvantage miles and Loyalty Points when you make an eligible purchase with a card you've added to your SimplyMiles account; some offers may only offer bonus miles or Loyalty Points, though. Then, each time you make an eligible purchase, you'll receive an email with "Thank you for using your SimplyMiles offer" in the title.

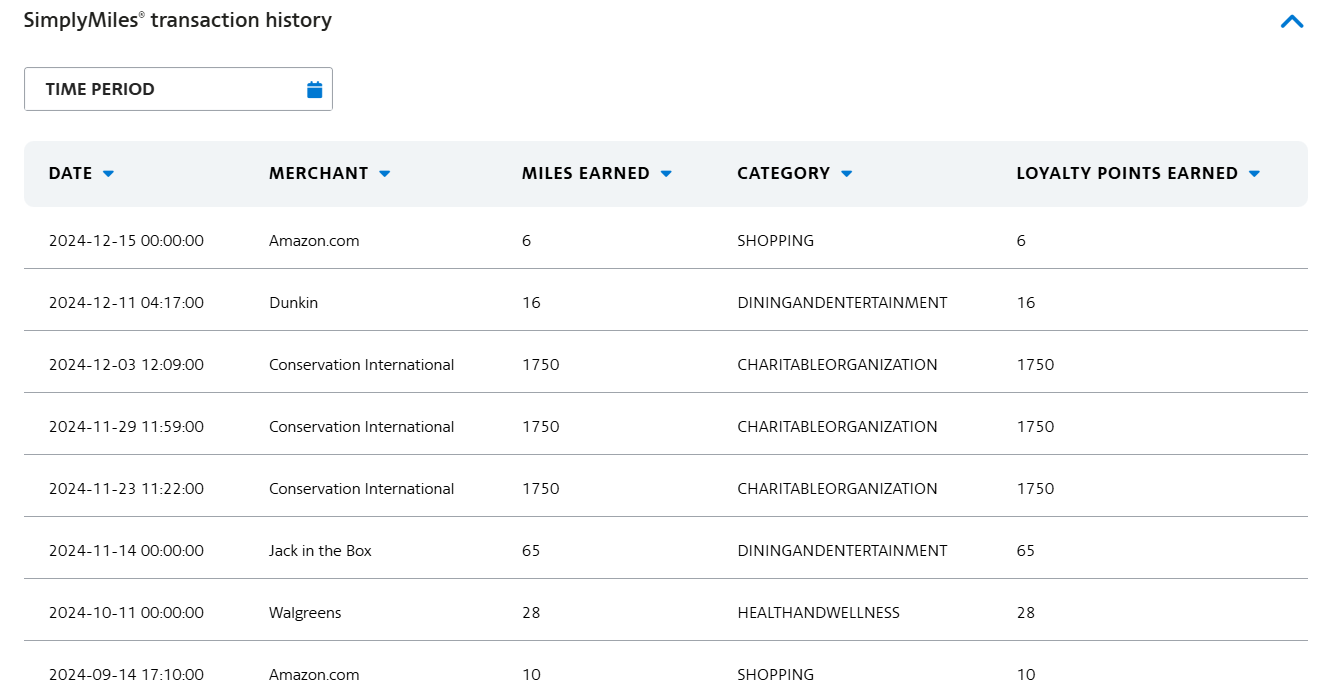

You can also check your earnings by clicking "My activity" near the top of the webpage. Once the page loads, scroll down to the "Activity details" section and expand the "SimplyMiles transaction history" to see your recent earnings.

Miles will usually appear in your account within 10 to 15 business days of your purchase. However, it can sometimes take up to 30 business days for your earnings to post.

Related: AAdvantage Dining program: Earn American miles and Loyalty Points at local restaurants

Stack your earnings

Earning American Airlines miles and Loyalty Points through the SimplyMiles program is great. The terms and conditions state: "Offers cannot be combined or stacked with offers from other programs." However, the offers are sometimes still stackable.

For example, you might be able to stack all the following earning methods on one purchase made with a Mastercard you've enrolled in SimplyMiles:

- SimplyMiles

- Shopping portal rewards

- Credit card rewards

Of course, for this triple stack to potentially work, the merchant needs to participate in SimplyMiles (without a requirement to use a specific link) and a shopping portal. For example, let's assume I wanted to buy some accessories from Dell Technologies.

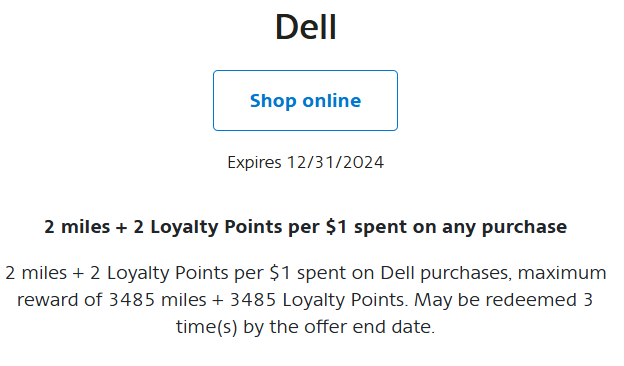

Currently, the SimplyMiles portal would give me 2 miles and 2 Loyalty Points per dollar on up to three purchases with Dell Technologies using a linked Mastercard. However, you can't earn more than 3,485 miles and 3,485 Loyalty Points through this SimplyMiles offer.

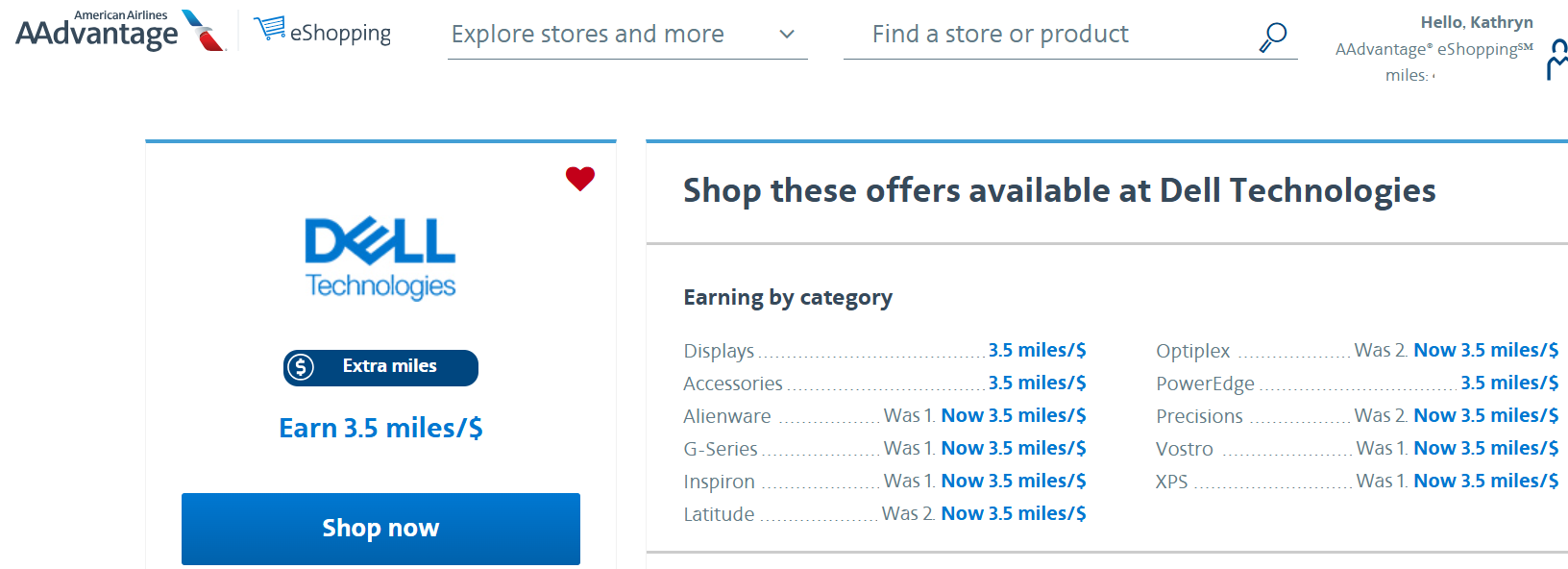

I could use an enrolled Citi AAdvantage card to earn 1 mile per dollar on my Dell Technologies purchase. And the AAdvantage eShopping portal would give me 3.5 miles per dollar on Dell Technologies accessories.

You might also try to stack a Citi Merchant Offers deal. However, you can no longer stack most SimplyMiles offers with most Citi Merchant Offers. For example, you'll usually see the merchant disappear from SimplyMiles when you enroll in a Citi Merchant Offer. And if you add a SimplyMiles offer to your account before enrolling in a Citi Merchant Offer, your SimplyMiles offer for the merchant will usually be removed. So you may want to avoid enrolling in conflicting Citi Merchant Offers if you'd rather earn via SimplyMiles.

Bottom line

There is no shortage of ways to earn AAdvantage miles and Loyalty Points. From the AAdvantage eShopping portal to American Airlines credit cards, you don't have to fly frequently to earn American Airlines miles and status.

The SimplyMiles program is a great tool if you're looking to earn more miles and Loyalty Points when shopping. From gas stations to clothing and luggage delivery services, you'll find various merchants on the SimplyMiles website. However, offers are frequently added, so you'll want to check for new offers every week to maximize your earnings.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app