Is the Capital One Venture X worth the $395 annual fee?

Editor's Note

Most frequent travelers can benefit from a premium credit card like the Capital One Venture X Rewards Credit Card. However, the steep annual fees mean it's important to carefully consider how useful the card's perks will be for you.

The Venture X is easier to justify than many other cards at its level since it has an annual fee of just $395. That's $200 cheaper than the next most affordable premium card from a major issuer, the Citi Strata Elite℠ Card (see rates and fees).

Here are the benefits that could make the Venture X worth a spot in your wallet.

Welcome offer

The Venture X's current welcome bonus offers new applicants to earn 75,000 bonus miles after spending $4,000 on purchases in the first three months of account opening.

According to TPG's November 2025 valuations, these miles are pegged at 1.85 cents apiece, making this bonus worth $1,388.

It's worth noting that Capital One can be picky when approving credit card applications; the bank is known for being very sensitive about the information on your credit report, including the number of recent hard inquiries, new accounts and accounts with other issuers.

The value of this welcome bonus alone covers this card's annual fee a few times over, but I personally believe that a great welcome offer alone isn't enough to justify paying a premium annual fee. Fortunately, the Venture X has plenty of other perks to offer.

Related: The ultimate guide to credit card application restrictions

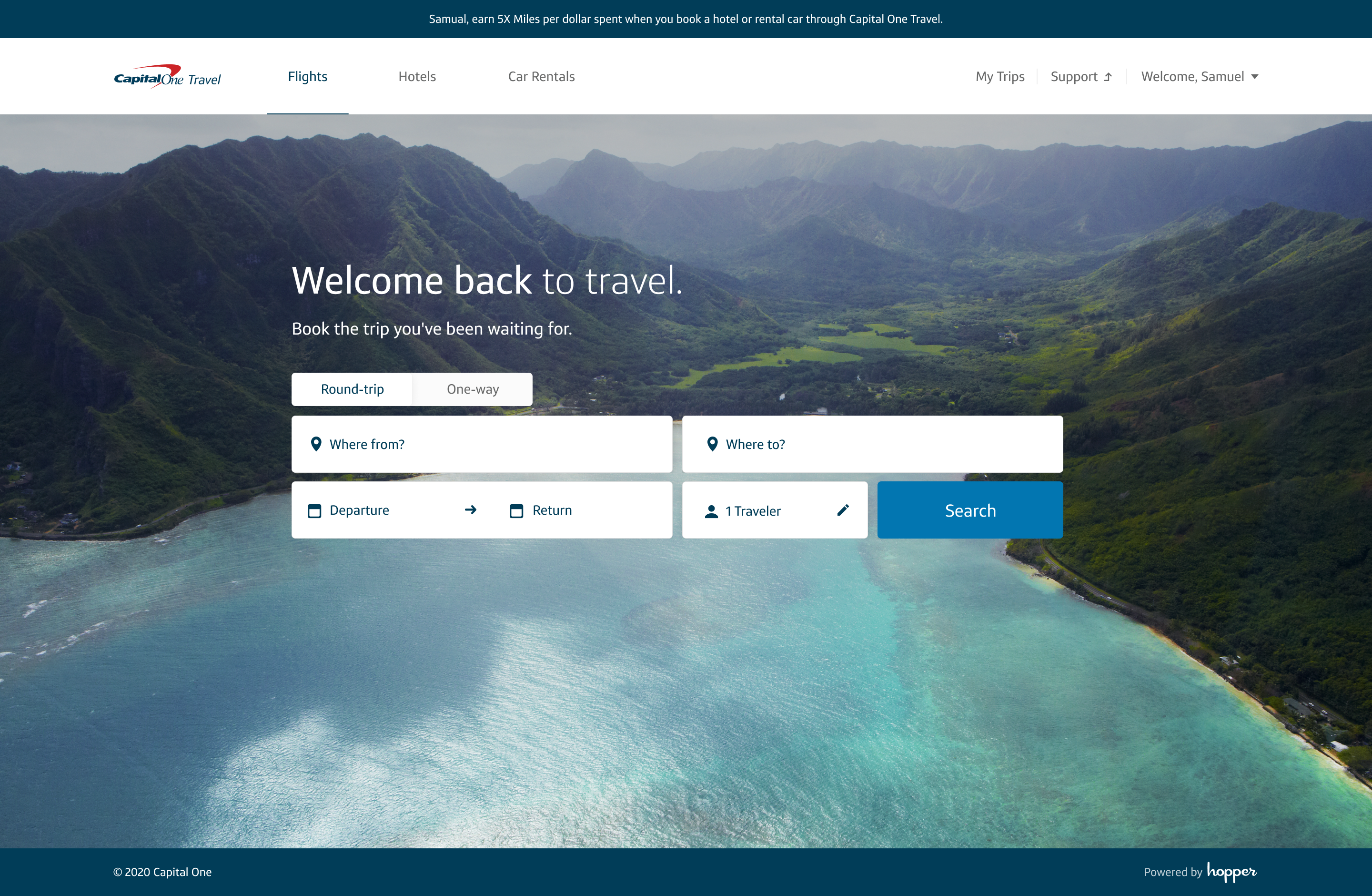

Travel credit

The easiest way to recoup most of the Venture X's annual fee is through its annual $300 Capital One Travel credit. This likely won't be enough to cover a hotel stay at a top property or a round-trip flight to Europe, but it's a great way to pay for a long weekend getaway or a short stay at a boutique hotel.

TPGers who hold the Venture X often highlight this credit as one of the top reasons they keep the card year after year. TPG senior points and miles writer Ben Smithson used his Venture X's Capital One Travel credit to cover a flight from Miami to the Caribbean. Contributing credit cards editor Matt Moffitt uses his to cover Hertz car rentals.

Related: How the Capital One Venture X travel credit can save you $300 on your next trip

Anniversary bonus miles

TPGers with the Venture X generally use the value of the anniversary bonus miles to offset the remaining portion of the card's annual fee after the Capital One Travel credit.

The Venture X offers 10,000 bonus miles after each account anniversary. According to our November 2025 valuations, that's $185 in value. Of course, that's assuming you transfer your miles to Capital One's travel partners.

Related: Who should (and shouldn't) get the Capital One Venture X?

Lounge access

Venture X cardholders have access to two types of lounges: Priority Pass and Capital One's own lounges for themselves and up to two guests (guest access will be restricted from Feb. 1, 2026).

While Capital One's lounge footprint isn't as extensive as American Express' Centurion Lounge network, gaining access to these lounges through your Venture X can mean a lot if you live near or frequently transit through an airport with one.

Priority Pass access comes with virtually every worthwhile premium card, but it's a valuable perk if you don't already have a card that provides it.

The exact monetary value of lounge access is hard to quantify since it depends on how often you visit lounges and what you actually do while you're there. I typically value each lounge visit at around $30, as that's likely what I'd spend on a nice meal if I weren't in the lounge.

However, if you aren't eating a lot when you visit lounges and aren't using the other amenities that may be included, you might value each visit a lot less.

Related: Best credit cards for airport lounge access

Car rental perks

If you're open to booking a rental car through an issuer's travel portal, the Venture X is a great option. You'll earn 10 miles per dollar spent on car rentals booked through the portal, one of the best returns of any premium card.

Venture X cardholders also receive top-tier Hertz President's Circle status*. Assuming you rent a car once or twice a year, this perk can offer significant value.

After registering, you'll receive guaranteed upgrades, the widest choice of cars when starting your rental and a free additional driver (which typically costs $13.50 per day, up to a maximum of $189 during your rental).

*Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at that status level through the duration of the offer. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (i.e., at hertz.com) will not automatically detect a cardholder as being eligible for the program, and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Related: Stacking rental car perks with Hertz and the Venture X

Access to luxury hotel programs

Venture X cardholders can access Capital One's Premier Collection and Lifestyle Collection hotel programs. Cardholders can pay cash or redeem their miles at a rate of 1 cent each to book stays.

Benefits at top-tier Premier Collection properties include:

- $100 on-property credit for things like meals and spa visits

- Free daily breakfast for two people

- Room upgrades (when available)

- Free Wi-Fi during your stay

Lifestyle Collection properties are mostly lower-tier boutique properties, but they still offer useful benefits for Venture X cardholders, such as a $50 credit to use toward eligible charges and early check-in and late checkout (where available).

Since you'll book through Capital One Travel, you'll earn 10 miles per dollar spent when paying for your stay with the Venture X.

Related: A comparison of luxury hotel programs from credit card issuers: Amex, Capital One, Chase and Citi

Other key perks

Venture X cardholders receive reimbursement for their application fee for TSA PreCheck or Global Entry. This benefit is available once every four years and is worth up to $120. I recommend Global Entry for any frequent traveler since it comes with TSA PreCheck.

Cardholders also have access to several travel and shopping protections when paying with their card:

- Cellphone protection

- Extended warranty and return protection

- Lost luggage reimbursement

- Primary rental car insurance

- Trip cancellation and interruption insurance

- Trip delay reimbursement

Related: 6 things to do when you get the Capital One Venture X

Valuable authorized user perks

One of the Venture X's big draws for many is its extensive authorized user perks. Cardholders can add multiple free authorized users to their accounts, who enjoy the following benefits:

- Access to Capital One lounges and Priority Pass lounges (additional $125 fee from Feb. 1, 2026)

- Purchase and travel protections, such as trip cancellation/interruption insurance, trip delay reimbursement and cellphone protection

For comparison, the American Express Platinum Card® and the Chase Sapphire Reserve® (see rates and fees) both charge $195 for each authorized user (see rates and fees for the Amex Platinum).

Related: Why you should add authorized users on the Capital One Venture X

Bottom line

The Venture X is one of our favorite premium travel cards for a reason. It's easy to get outsize value from its $395 annual fee if you're able to maximize its annual $300 Capital One Travel credit and 10,000 anniversary bonus miles.

If the Venture X has been on your wish list for a while, now is the time to apply.

To learn more, check out our full review of the Capital One Venture X.

Learn more: Capital One Venture X Rewards Credit Card

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For rates and fees of the Amex Platinum, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app