How (and why) to calculate award redemption values

Editor's Note

Picture this: You're booking a trip to Europe and see two options — 60,000 miles for a round-trip flight or $650 in cash. Which do you choose? Without crunching the numbers, it's just a guess.

That's where calculating the value of an award redemption saves the day. With simple math, you can determine whether you should book with cash or redeem your points and miles.

Related: I broke a points rule and still got a good award deal to Europe

What is award redemption value?

Award redemption value tells you how much your points or miles are worth for a specific booking compared to paying cash. At TPG, we measure this in cents per point or mile, so you can easily measure whether a redemption is above or below average value.

Related: How much are Chase Ultimate Rewards points worth?

Calculating award redemption value

Calculating the value of an award redemption requires a simple formula:

Redemption value = (cash price – taxes and fees) ÷ points or miles used × 100

This gives you the value of each point or mile in cents.

Example: New York to Los Angeles on Delta

Let's put this into practice. Say you're booking a round-trip flight from New York's John F. Kennedy International Airport (JFK) to Los Angeles International Airport (LAX) on Delta Air Lines. The cash fare is $450, or you can redeem 32,000 SkyMiles plus $12 in taxes and fees.

Using the formula: ($450 – $12) ÷ 32,000 × 100 = 1.37 cents per mile.

When to redeem rewards vs. pay cash

So, you've calculated your redemption value — now comes the big question: Should you actually use your rewards or pay cash?

That's where TPG's monthly valuations come in.

For the Delta example above, we calculated 1.37 cents per mile. Since TPG currently values Delta SkyMiles at 1.15 cents each, this redemption is better than average — a strong use of your miles.

Here's a general framework to guide your decision:

- Higher than TPG's valuation: Lean toward redeeming points or miles.

- Lower than TPG's valuation: Consider paying cash, especially if you want to save points or miles for better uses later.

- Equal to TPG's valuation: Consider your personal situation — redeeming points or miles saves cash now, while paying cash helps you earn rewards for future travel and work toward elite status.

Related: Why all travelers should earn transferable credit card points

Using TPG's Award Calculator

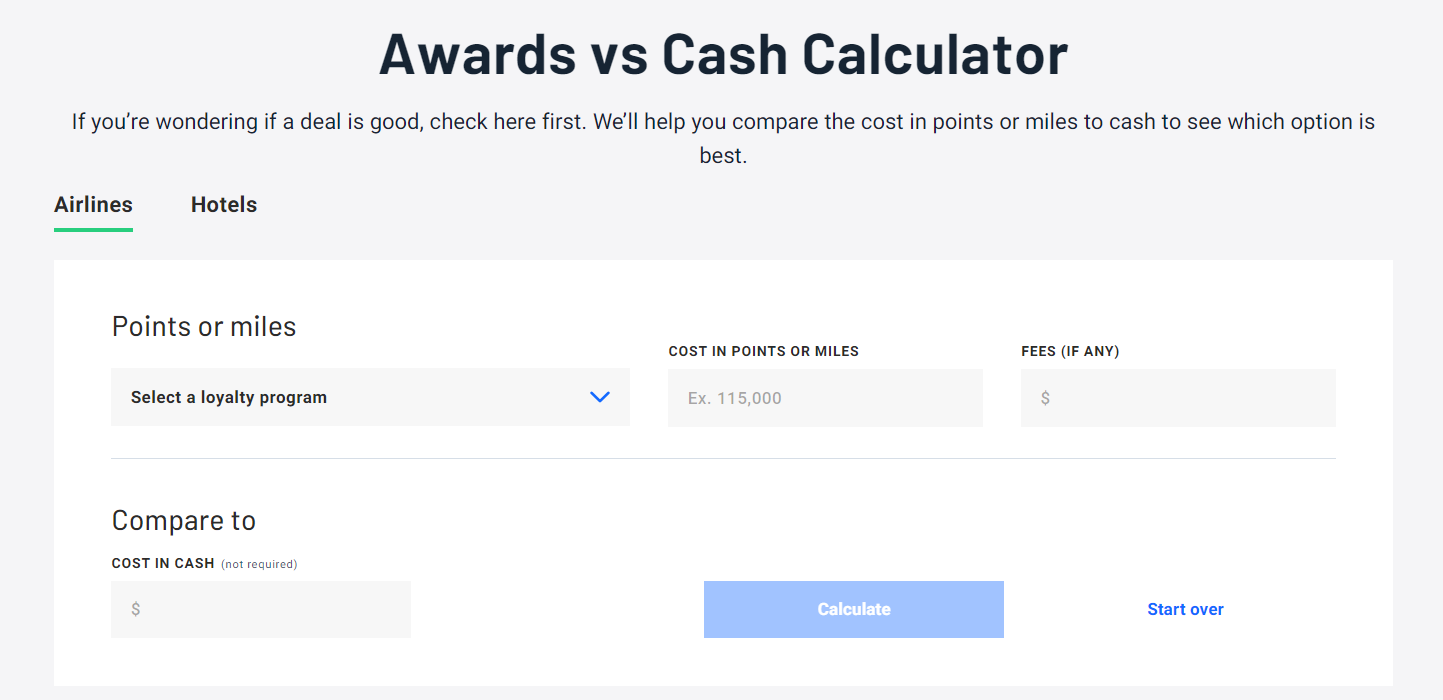

Not in the mood to do the math yourself? That's why we built the TPG Award Calculator — to make calculating redemption value quick and easy.

Here's how to use it:

- Select whether you're calculating with airline miles or hotel points.

- Choose the loyalty program.

- Enter the cash price, number of points or miles required, and any taxes or fees.

- Click "Calculate" to see the value.

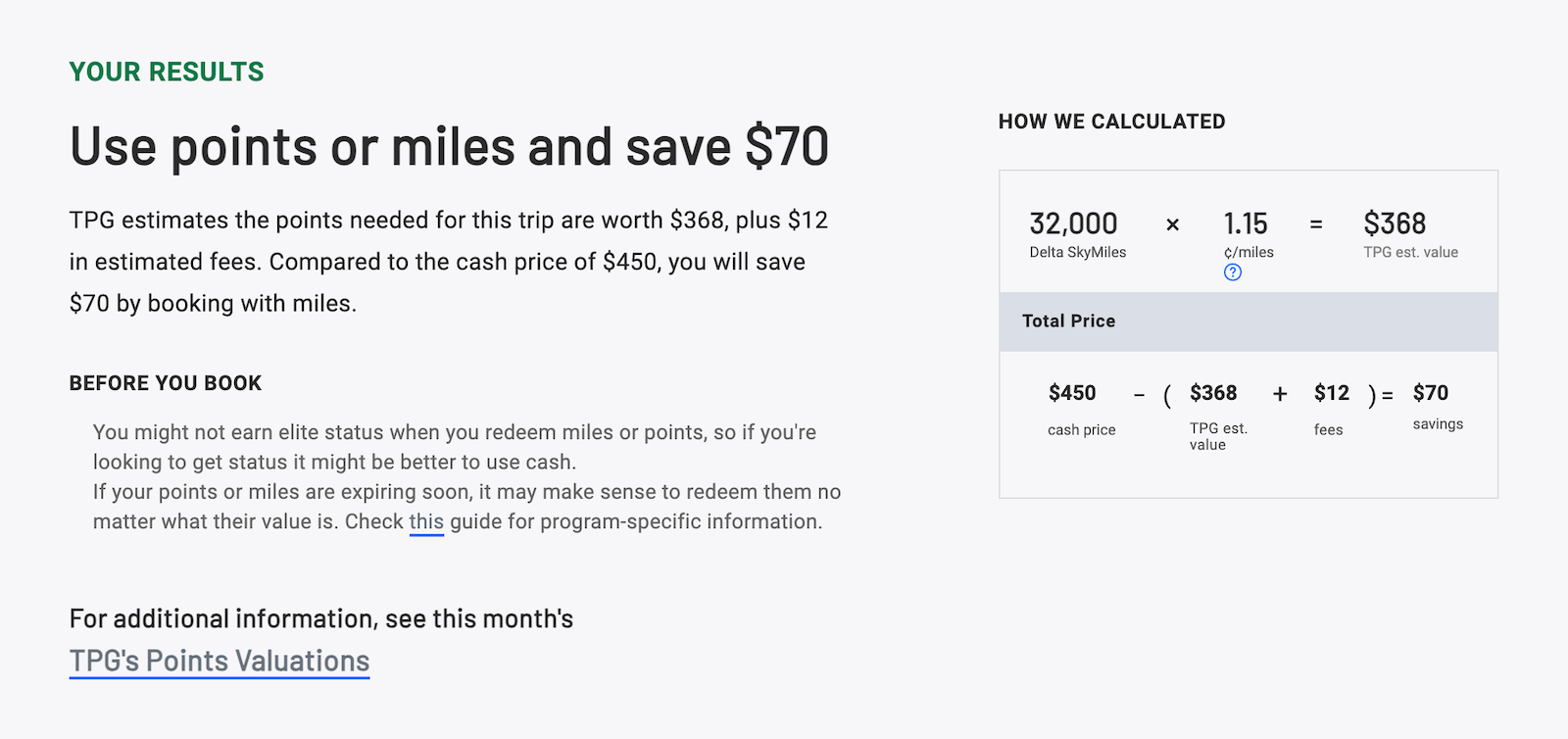

In just seconds, you'll get a detailed breakdown of your redemption — like this result from our Delta SkyMiles example above:

According to the calculator, using 32,000 SkyMiles plus $12 in fees for a $450 flight gives you an estimated value of $368, or 1.15 cents per mile. Compared to paying cash, you'd save $70 by booking with miles.

Whether you're maximizing every cent or just want a quick sanity check, the TPG Award Calculator helps you get the most from your hard-earned points and miles — no math degree necessary.

Related: Apps and websites that make award redemptions easier to find

Why taxes, fees and surcharges matter

When calculating redemption value, it's important to account for all fees — failing to do so can make a "good deal" look better than it actually is. Here's how fees and surcharges can affect redemption value across different types of bookings:

- Hotels: Taxes are usually based on the cash rate, so using points can help you avoid these extra costs. Resort fees, however, may or may not be waived on award stays depending on the program. For example, World of Hyatt waives resort fees for award bookings, while Marriott Bonvoy does not.

- Flights: Some airlines add high carrier-imposed surcharges to award tickets, which can skew redemption value. For example, Virgin Atlantic Flying Club awards may include fees that exceed a discounted cash fare. Always include these fees in your calculation to get an accurate comparison.

- Mixed points-and-cash awards: You can use the same approach for awards that combine points and cash. Subtract the cash portion from the total cash price, then divide the remaining amount by the points used. This ensures your cents-per-point calculation reflects the true value of the points portion.

By including taxes, fees and surcharges in your calculation, you'll avoid overestimating the value of a redemption and make smarter decisions about when to use points or miles versus paying cash.

Related: Can you pay taxes with a credit card?

Other things to keep in mind

Redemption value is a helpful benchmark, but it's not the only factor when deciding whether to use rewards or cash.

- Opportunity cost: Paying cash can earn you points or miles for future trips. For example, a $300 flight might earn 3,000 miles that you could redeem later, which you miss out on if you use rewards now.

- Comparable options: Not all flights or hotels are created equal. If one airline charges 25,000 miles for a route and another offers a similar flight for $100 cash, consider which option gives the better overall value — even if the math for the first option looks "good."

- Personal value: Sometimes the best redemption isn't about maximizing cents per point. You might redeem points for a special experience, like a first-class flight you wouldn't pay cash for, even if the redemption value is lower.

- Other perks: Using cash instead of points can help you qualify for elite status, earn bonus points or unlock loyalty program benefits that could save you money or improve your travel experience in the long run.

Related: Why the best point redemptions are sometimes the most practical

Bottom line

Calculating award redemption value helps you cut through the guesswork and make smarter decisions with your rewards. The math is simple: Subtract fees, divide by points and compare against TPG's valuations. Better yet, plug your numbers into TPG's Award Calculator for an instant answer.

Just remember: The "best" redemption isn't always about squeezing every last cent out of your points. Sometimes the right move is booking the trip that makes sense for you, aka saving money. But by knowing how to calculate value, you'll be sure you're getting the most from your hard-earned points and miles.

Related: How I manage credit card redemption analysis paralysis

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app