TPG Points Lab: How many miles do you really save with a United credit card?

Update: Some offers mentioned below are no longer available. View the current offers here.

The Points Lab is TPG's newest team, dedicated to using data and leveraging technology to create resources, tools and analyses to help readers more effectively and efficiently use their points and miles. Past articles have included deep-dives into Lufthansa first-class award availability, Marriott's peak and off-peak pricing and award flights to Tahiti. Today we're looking at the enhanced award availability benefit on United credit cards.

Airline credit cards confer an array of perks to members, including free checked bags, priority boarding, inflight discounts and more. In some cases, these benefits extend to award travel, allowing cardholders to redeem their hard-earned points and miles more effectively or efficiently than non-cardholders. And one of the most unique perks along these lines has been the enhanced economy award availability offered by select United credit cards.

But just how valuable is this added inventory? Can it make or break your decision to apply for the card? What do things look like in an era of United's dynamic award pricing? Does it indicate whether to keep the card in the long-run?

We set out to answer that question by crunching the numbers.

[table-of-contents /]

Overview of the benefit

Let's begin with a quick overview of the benefit. If you hold a United cobranded credit card — like the United Explorer Card, United Club Card— you have access to additional economy award availability beyond what's available to a traveler without the card. Here's how this perk is described on the Explorer card's application page:

"As the primary Cardmember, you will also enjoy expanded award availability when you use miles to book any United-operated flight, any time, with no restrictions or blackout dates."

In practice, this works in three ways:

- Some flights will price at the same award rate, regardless of whether you have a card or not.

- Some flights will price at a lower award rate than what a non-cardholder would pay.

- Some flights that aren't available to non-cardholders at all will be available for you.

In order to see this perk in action, simple sign in to your MileagePlus account when searching for award tickets. Any United-operated flights that are only available to cardholders will have this designation:

"Exclusively available to you as a MileagePlus Chase Cardmember"

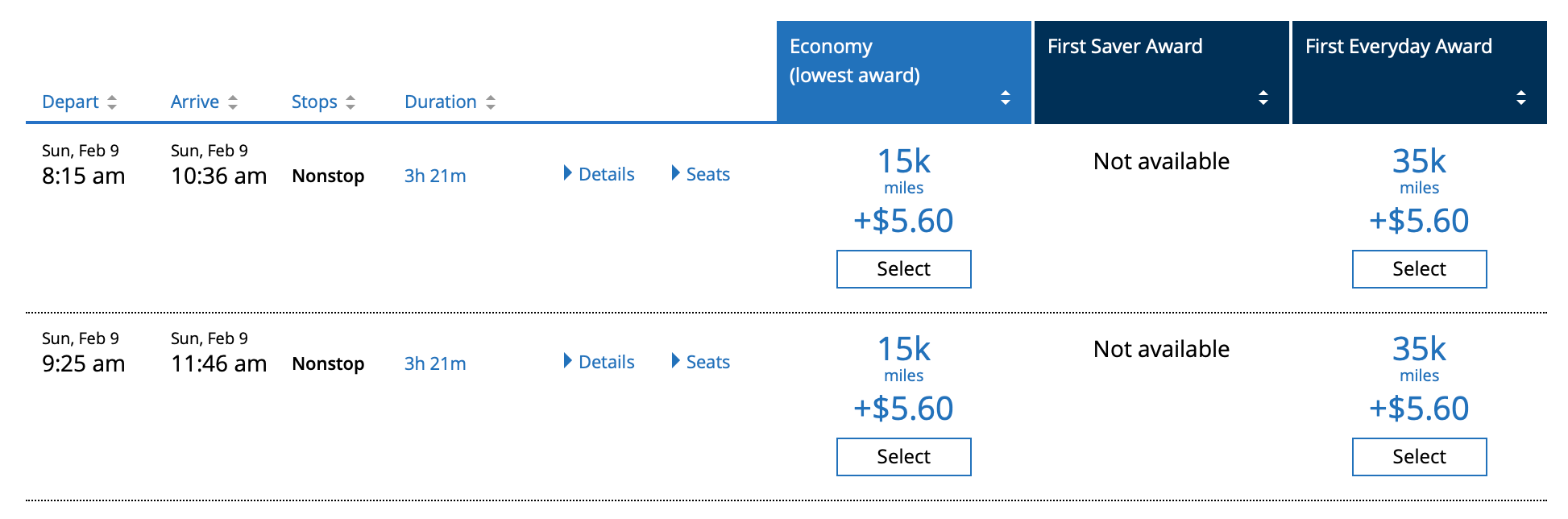

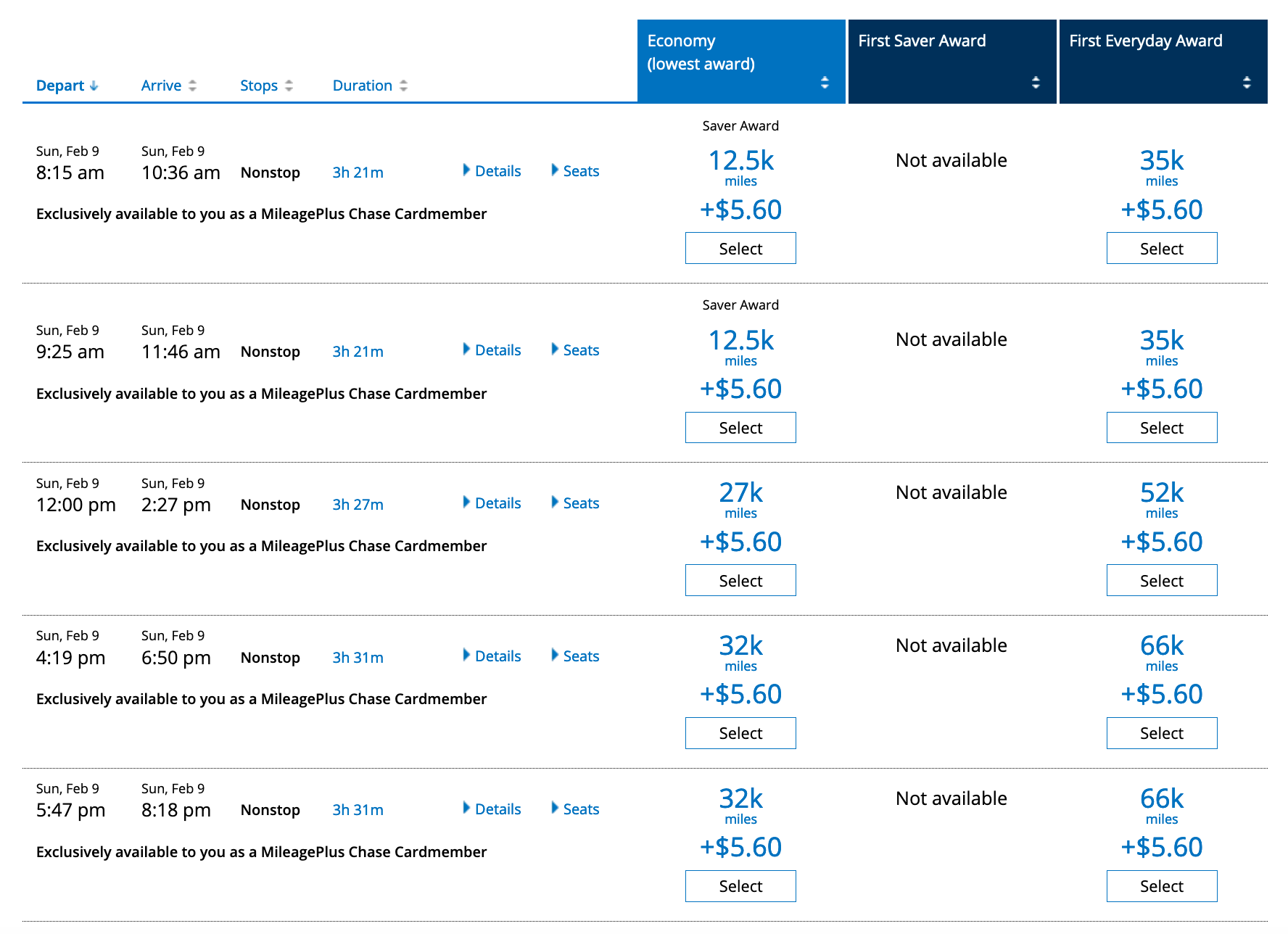

Here's an example of this in action. Let's say you needed to fly from Miami (MIA) to Chicago-O'Hare (ORD) on Sunday Feb. 9, 2020. If you search for award tickets without logging in, you'll see the following results:

However, when a United cardholder logs in and searches, the results change:

Note that the 8:15 a.m. and 9:25 a.m. flights appear on both, but the award rate on each is 2,500 miles lower for cardholders. In addition, the three afternoon departures are only available to cardholders — albeit at high award prices. Nonetheless, it's nice to have the chance to book more flights at a potentially lower award rate, simply by holding a credit card.

But this is a single route on a single date. How widespread does this perk extend? Read on for what we found.

Methodology

Searching the entire route network of one of the largest airlines in the world would be a time-consuming endeavor, so to get an idea of how this perk applies, we selected five routes on which United offers at least once daily service:

- Las Vegas (LAS) to Denver (DEN)

- Miami (MIA) to Chicago-O'Hare (ORD)

- Washington-Dulles (IAD) to Seattle (SEA)

- Houston (IAH) to Liberia, Costa Rica (LIR)

- Newark (EWR) to London-Heathrow (LHR)

We then looked at award availability on every one-way, nonstop flight on these routes covering three different months: November 2019, February 2020 and June 2020. We did side-by-side searches on each date using two different browsers: one logged in as a cardholder, the other logged in as a non-cardholder. Even though it took a few days to gather all of the data, we made sure that searches for each individual route on a given date were conducted on the two browsers within seconds of each other to minimize the chances of inaccuracies.

The goal: Provide an accurate snapshot of award availability across a variety of routes using some seasonal variation and different advanced booking windows — all in an effort to quantify just how valuable this benefit is or isn't.

Overall findings

Let's start with some of the overall data we found. Here's a quick infographic with the major data points:

In all, we came across 1,440 flights that were offering award tickets to both cardholders and non-cardholders. Of those flights, 384 (or 26.67%) were offering discounted rates to those travelers with a United credit card. These lower rates were highly variable, ranging from a discount of 1,000 miles to a discount of 26,000 miles on one EWR-LHR flight in June.

The average savings across all flights — including those priced identically — was 1,834 miles. This translates into an effective discount of $23.84 based on TPG's most recent valuations, or $47.68 for a round-trip flight. However, if you filter out the flights that were priced identically, the average savings jumps to 6,878 miles per flight, which TPG values at $89.41.

Another way to look at the data is to consider the proportion of dates that offered at least one discounted flight option. When combining the one-way routes noted above, 43.37% of the dates offered at least one flight that came in at a lower price if you have a United card in your wallet.

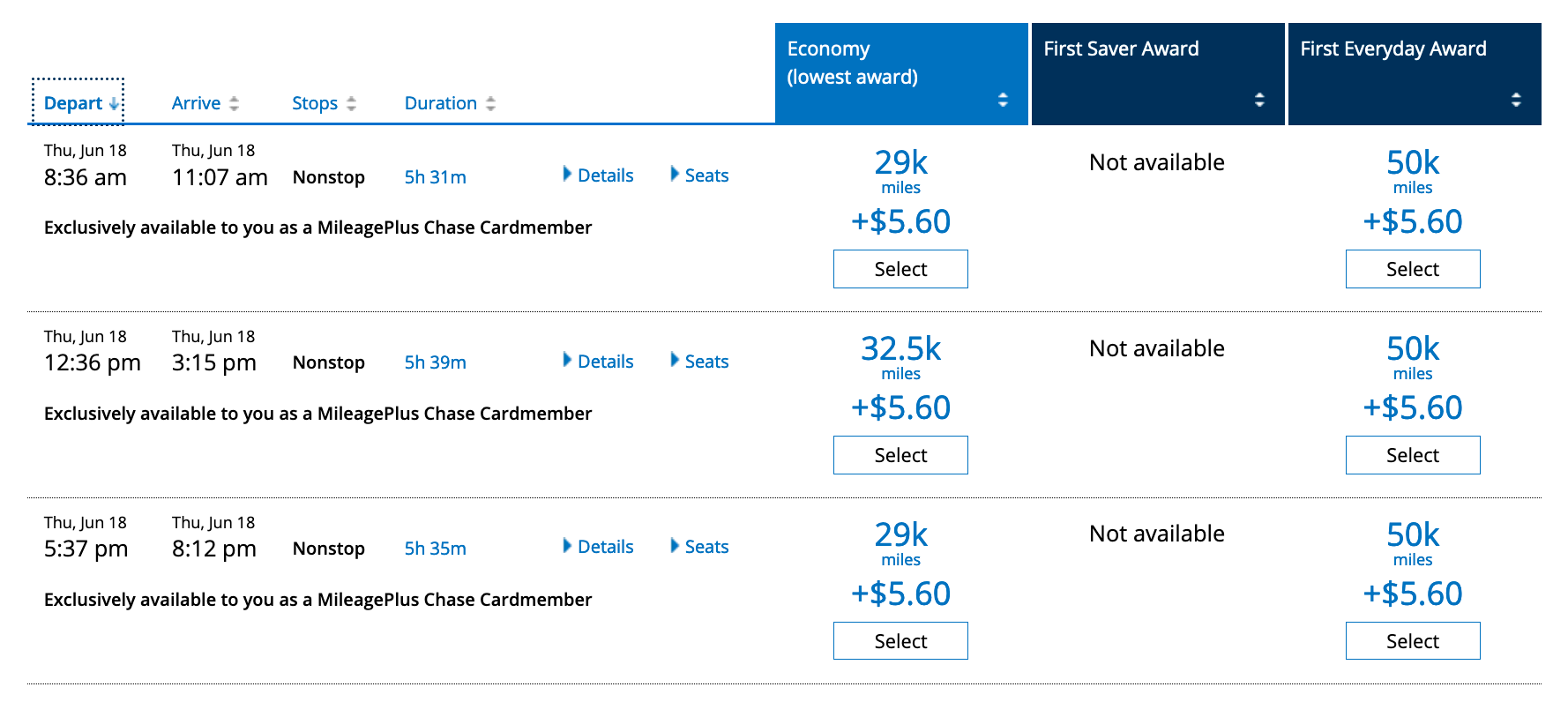

Finally, as covered above, cardholders also gain access to added award inventory on flights that are not available to non-cardholders at all. For the five routes above across the 89 days we analyzed, that resulted in 316 additional flight options, like these three:

Again, these are often at very high award rates, but if you need to get somewhere on a specific date and time, it's nice to know that this perk will help you do it.

Findings by route

Let's take a closer look now at the results we found for individual routes. As you're about to see, there's some significant variability.

| Route | Average savings (all flights) | Average savings (discounted flights) | % of flights with a discount | % of dates with at least one discounted flight | Additional flights for cardholders |

|---|---|---|---|---|---|

LAS-DEN | 1,344 miles | 5,266 miles | 25.51% | 60.67% | 14 |

MIA-ORD | 2,098 miles | 3,461 miles | 60.64% | 57.30% | 47 |

IAD-SEA | 918 miles | 5,200 miles | 17.65% | 24.72% | 58 |

IAH-LIR | 3,304 miles | 7,804 miles | 42.33% | 46.07% | 37 |

EWR-LHR | 2,076 miles | 19,128 miles | 10.85% | 28.09% | 2 |

Note the two columns with the numbers of miles you'd save on these routes. The average discount on the IAH-LIR flight is over 3,300 miles, nearly double the overall average. And when flights are discounted from EWR-LHR, the average rate is a whopping 19,128 miles lower for cardholders. With that discount, having the card is clearly a winning proposition.

Personally, however, I'm more intrigued by the next two columns. Note how the percentage of flights with a discount varies — from over 60% from MIA-ORD to just under 11% for EWR-LHR. What's especially interesting is when you compare those rates with the probabilities of finding at least one flight on a given date. This data ranged from a high of 60.67% (LAS-DEN) to a low of 24.72% (IAD-SEA). The flights from EWR-LHR are also lower than 30% by this metric, putting both of those routes well below the average.

Consider how these numbers translate to real life for the LAS-DEN flights. While you have just a 1 in 4 chance of finding a specific flight available at a lower award rate, 6 out of every 10 dates has at least one discounted option.

But how much of these differences can be explained by seasonality?

Findings by date

Let's compare individual probabilities for these routes across the calendar — and look at total probabilities for each month.

| Route | November 2019 | February 2020 | June 2020 |

|---|---|---|---|

LAS-DEN | 46.67% | 75.86% | 60% |

MIA-ORD | 53.33% | 65.52% | 53.33% |

IAD-SEA | 33.33% | 37.93% | 3.33% |

IAH-LIR | 30% | 48.28% | 60% |

EWR-LHR | 50% | 6.9% | 26.67% |

TOTALS | 42.67% | 46.9% | 40.67% |

As you can see, the monthly probabilities of finding discounted awards (percentages in the last row) are relatively consistent across the three months — and fall near the overall average of 43.37%. However, you see some wild variations based on the individual routes. For example, EWR-LHR has exactly 15 days in November with at least one discounted award available. However, there were only two in February and eight in June. Given that June is approaching peak summer travel time to Europe, I'm actually surprised that those numbers weren't reversed.

Flights from IAD-SEA in June, however, are even worse. Just a single day — June 2, 2020 — had a discounted award currently available for cardholders.

Overall takeaways

So what does all of this mean? Here are some key takeaways based on the above data:

- This has the potential to be quite valuable. Across all of the flights we found, the average savings rate was 1,834 miles. If you expand that to a round-trip flight, you're looking at a total value of $47.68 based on TPG's valuations. In other words, if you can use this perk once per year, the sample data above indicates that you'll cover over half of the card's $95 annual fee in one fell swoop.

- Flexibility is key. As noted above, your chances of finding a discounted award rate as a cardholder largely depends on how flexible you can be. If you need one, specific flight from LAS-DEN (as an example), your chances aren't great. But if you have flexibility on that date — or could potentially travel on another date — the probability of finding a discounted award increases.

- There's no obvious rhyme or reason for the discounts. One of the most surprising things I found was a lack of consistency. I expected to uncover more clearly-defined patterns for these award rates, but they're all over the place. One day, a 27,000-mile award might be discounted to 12,500 miles, and then a week later, a 20,000-mile one on the exact same flight and the same day of the week has no discount. Generally speaking, a lower, non-saver rate available to a general member was more likely to be discounted than a pricier one, but there were plenty of exceptions to that rule.

Important caveats

Of course, it's also critical to emphasize the caveats of this analysis. For starters, this sample size was just a small fraction of United's overall route network, and it applied to a limited set of dates (the 89 days represent roughly a quarter of the overall booking calendar). I'm confident that these numbers will give you an idea of how valuable this perk is, but other routes and dates could be more or less rewarding. If you're trying to figure out if the United Explorer Card is right for you, be sure to investigate award prices on routes that you'd plan to fly to get an idea of how the benefit fits with your typical travel patterns.

In addition, the upcoming award chart removal may shift this dramatically. I noticed that the vast majority of the above dates were still pricing at what would be considered the "saver" level on current award charts. When those charts are removed on Nov. 15, it'll be interesting to see if this will shift some more. I did see a few examples of 1,000-mile discounts for cardholders on flights that were already below the traditional "saver" level, but there's no telling what will happen when award charts for United operate flights are completely pulled. However, you can be sure that we'll be back to crunch the revised numbers to see if the perk has become more or less valuable in the era of full dynamic pricing — though bear in mind that two of our test travel months are completely after the Nov. 15 cutover date.

Finally, there are many other perks on United cards beyond the enhanced award availability we analyzed today. For the United Explorer Card, this includes things like:

- A free checked bag for you and a travel companion when you purchase your ticket with the card

- 2x miles with United, at restaurants and on hotels when purchased directly with the hotel

- A statement credit for Global Entry or TSA PreCheck every four years

- Two, one-time United Club passes each year

For full details, check out our full review of the Explorer card.

Bottom line

United's cobranded credit cards offer some terrific benefits for the carrier's regular customers, but even a more casual United traveler can still get some solid value. This is especially true if you're looking to redeem your MileagePlus miles for United-operated economy flights thanks to the expanded award availability you can access. The data shows that, on average, you could save roughly 1,800 miles for each one-way flight you book, though you could come across an even more lucrative option. And this, coupled with the other perks it offers, makes the United Explorer Card a keeper in my wallet.

For additional reading, check out the following guides:

- The best credit cards for flying United

- Credit card review: United Explorer Card

- 4 reasons someone in your family needs a United credit card

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app