Earn Up to a 100% Bonus When You Buy United Miles

Update: Some offers mentioned below are no longer available. View the current offers here

Here's another great opportunity to buy United miles on the cheap! The airline is once again offering a bonus when you purchase MileagePlus miles — this current promo's available today through 11:59pm CDT on Monday, August 15. If you do purchase miles during this timeframe, though, you can earn up to a 100% bonus.

This appears to be a tiered offer, with bonuses ranging from 25% to 100% depending on how many miles you buy.

Here's how to take advantage of the promotion:

- Visit United's Buy Miles page.

- Click on Buy Personal Miles or Give Miles (both are eligible for the bonus).

- Log in to your United MileagePlus account.

- Select the number of miles you want to buy/give and click Continue.

- Fill in the required information to finalize your purchase.

Keep in mind that the usual restrictions for purchasing United miles apply to this promotion, including the following:

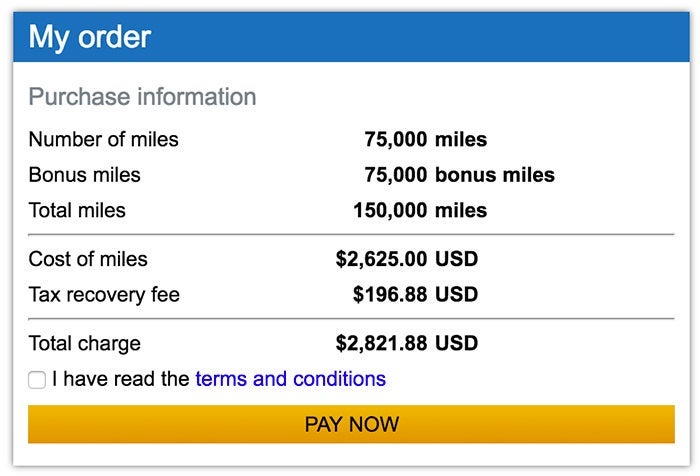

- You must purchase at least 2,000 miles but can only purchase 150,000 miles per account per calendar year.

- Miles may be purchased in increments of 1,000 miles up to a maximum of 100,000 miles and in increments of 5,000 miles up to a maximum of 150,000 miles.

- Miles may take up to 48 hours to post to your account.

- Purchased or gifted miles do not count toward MileagePlus Premier status.

Should You Buy?

TPG values United miles at 1.5 cents apiece, but depending on your redemption you can definitely get more value out of these rewards. The usual cost to buy miles is ~3.76 per mile ($35 per 1,000 miles plus a tax recovery fee), and even the lowest tier of this promotion gets you a significantly lower price. Here's how the effective cost breaks down by tier:

- Buy 5,000-14,000 miles (25% bonus): 3 cents per mile

- Buy 15,000-29,000 miles (60% bonus): 2.35 cents per mile

- Buy 30,000-75,000 miles (100% bonus): 1.88 cents per mile

Clearly, you'll get a better deal if you maximize the promo by purchasing at least 30,000 miles to get the 100% bonus at an effective per-mile cost of 1.88 cents. But since earning the 100% bonus requires spending at least $1,129, this promo really only makes sense if you have a redemption in mind.

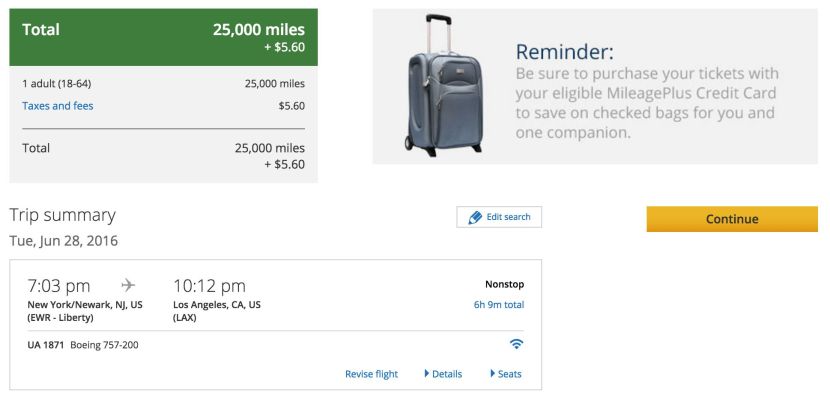

For example, these miles could come in handy for last-minute travel, such as this sample one-way from EWR to LAX for tomorrow:

Business fares start at $1,672, but a business Saver award will cost you 25,000 miles plus $5.60 in taxes and fees. If you were low on miles and wanted to book this award, you could purchase 16,000 miles (with a 9,600-mile bonus) for $602 and come out $1,070 ahead. Of course, you could also buy miles toward more aspirational redemptions like Lufthansa first class on the A380 from Europe to the US, which will cost you 110,000 miles one-way ($2,070 if your account balance is zeroed out and you take advantage of the current promotion).

Also note that buying miles isn't your only option for topping up your MileagePlus account. United is a Chase Ultimate Rewards transfer partner, so you can move points earned with the Chase Sapphire Preferred Card and the Ink Business Plus Card over to the frequent flyer program at a 1:1 ratio. You can also stock up on miles by opening the United MileagePlus Explorer Card, which is currently offering a sign-up bonus of 30,000 miles when you spend $1,000 in the first three months (check to see if you're targeted for a higher offer). This card can also open up additional award inventory (including at the Saver level), which makes it easier to put your miles to good use.

Which Card to Use?

Since United miles purchases are processed by Points.com, they're not eligible for bonus rewards with cards like the United MileagePlus Explorer Card. This means you're best off choosing a card that offers a high return on non-bonus category spending, such as the Chase Freedom Unlimited Card or the Starwood Preferred Guest Card from American Express.

Bottom Line

This promotion offers a chance to buy United miles at a relatively low price — even if you don't maximize the tiered system by purchasing at least 30,000 miles, you'll be getting a better per-mile cost than the standard offer. However, it's probably only worth taking advantage of this promo if you have a specific redemption in mind.

Will you take advantage of this promotion? If so, share how you'll use your miles in the comments below!

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app