Your next credit card approval is in the hands of these 3 agencies

Editor's note: This post has been updated with new information.

Your credit score plays a large role in your overall finances. We talk a lot about what goes into a credit score and how you can keep it in tip-top shape, but where does your score actually come from?

Let's take a look at the three major credit reporting agencies that determine your score.

The 3 major credit reporting agencies

Three major credit reporting agencies—TransUnion, Equifax, and Experian — collect your financial information and compile it into a report. Those reports are a key part of your credit score, and they're what banks and creditors pull when you apply for a credit card, loan or other lines of credit.

Each credit reporting agency has its own method for compiling your credit report and determining your credit score, which is why your score may vary by agency. Let's examine each agency and the scores it produces. Then, we'll discuss which issuers look at which scores when you apply for a new card.

TransUnion

TransUnion was created in 1968 as the parent holding company of Union Tank Car Company, a railcar leasing operation. In 1969, the company entered the credit reporting business when it acquired the Credit Bureau of Cook County (CBCC). Since then, it has expanded its services beyond credit reporting, but it remains one of the primary credit bureaus in the country.

One of TransUnion's defining characteristics is that it offers a service called Identity Lock. If you believe you are a victim of identity theft, TransUnion will freeze your report and contact Experian and Equifax to inform them of the freeze.

Equifax

Equifax is a global data, analytics and technology company. Like TransUnion, it is another major credit reporting agency used by lenders, although it also offers other financial services. Equifax has been in the spotlight for the past few years after a massive data breach was reported in 2017 that affected 147 million people. In the years since, the company committed to a security transformation, hired new leadership and put forth steps to rebuild its reputation and security infrastructure.

Experian

The last of the ""Big Three"" is Experian. I've found that Experian has more to offer in terms of credit education. Based on the data and analytics collected by the company, Experian releases numerous reports each year. Of course, Experian also offers credit reporting and monitoring services.

The company, now called Experian, actually started as a London-based forum back in 1803. However, the U.S. credit reporting operation really began under the company name TRW, which acquired Credit Data (a credit reporting agency) in 1968. Eventually, the London and U.S. companies merged to form Experian, the global company it is today.

Related: How to check your credit score for absolutely free

FICO vs. VantageScore

FICO and VantageScore are the two primary methods credit reporting agencies use to determine credit scores. All three agencies use both of these methodologies to determine different types of scores. FICO is the more established methodology and has been around for much longer. VantageScore is newer, developed by all three of the major credit reporting agencies back in 2006.

Both types of scores range from 300 to 850 — and the higher the score, the more reliable the borrower is. While there is a lot of overlap in the factors each methodology takes into consideration, there are some slight differences between the two.

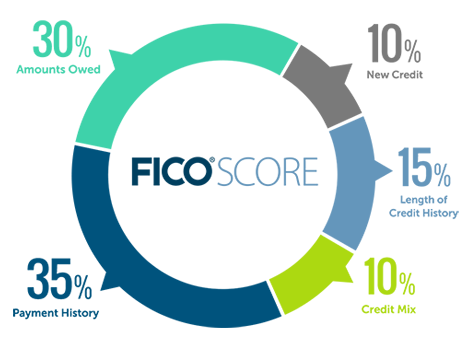

FICO gives specific percentage weights to each factor:

- Payment history (35%)

- Amounts owed (30%)

- Length of credit history (15%)

- New credit (10%)

- Credit mix (10%)

VantageScore keeps its formula on the vague side, listing out the general level of importance of each factor:

- Payment history (extremely influential)

- Age and type of credit (highly influential)

- Percentage of credit limit used (highly influential)

- Total balances and debt (moderately influential)

- Recent credit behavior and inquiries (less influential)

- Available credit (less influential)

There is no singular credit score used by every credit card issuer, bank and lender. Also, each credit reporting agency may have different financial information on file. Unfortunately, this can mean that your approval odds differ depending on which type of score is being pulled to make a decision.

Related: Your FICO score and which credit issuers offer it for free

Which credit bureaus do banks check?

When you apply for a credit card, the issuer contacts a credit bureau (or several) to purchase a copy of your credit report. Your credit report includes the categories mentioned above. Knowing which credit reporting agency a card issuer uses to pull reports might help give you a better picture of your approval odds.

You can also use this knowledge to space out your applications (or bundle them, as the case may be) in such a way that helps you maintain an optimal credit score, even if you are applying for multiple cards in a shorter time frame.

Many credit card companies rely on one bureau to process credit card applications. However, the credit bureau they use to buy reports may change depending on the state you live in and the specific card you want.

Here are a few anecdotal data points that have been reported over the years:

- Amex primarily pulls Experian, though sometimes Equifax or TransUnion reports.

- Capital One doesn't have a favorite — but often pulls more than one.

- Chase favors Experian but may also pull Equifax or TransUnion reports.

- Citi usually pulls credit reports from Equifax or Experian.

Let's say you find out that Citi usually pulls from Equifax, and Chase primarily uses Experian. You could apply for cards from both issuers in a single day and potentially improve your approval odds for both.

Unfortunately, credit card companies don't publicly reveal which credit bureau they favor. However, there are online resources that gather customer feedback to provide an overall average of which issuer uses which credit bureau.

These resources aren't perfect and are subject to unverified (and perhaps outdated) user input. Still, you may be able to glean information to help you in your search, as long as you understand that it may not be 100% accurate.

CreditBoards.com

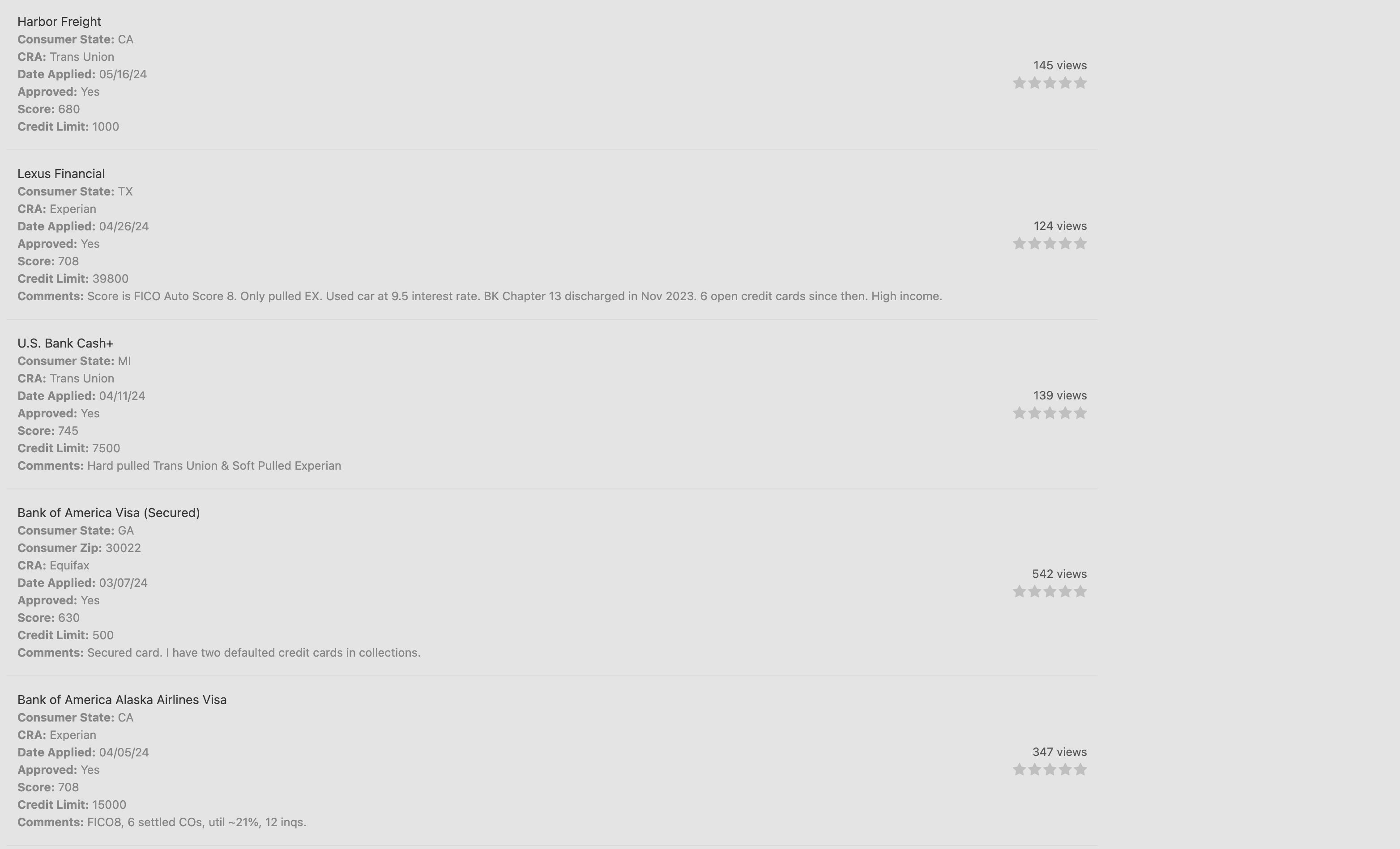

The CreditPulls database on CreditBoards.com is a popular online resource for information about credit card applications. You can use the database to determine which credit report will likely be pulled for your application and the score you may need to get approved for a particular card. (Tip: Check the dates of the posts; there may have been changes since the data was posted.)

Access the database using the following steps:

- Visit CreditBoards.com

- Click the CreditPulls option on the menu bar

- Select your search criteria — the applicant's state of residence, credit reporting agency (CRA), date applied and whether the application was approved or denied.

- Click "Update"

To see a wider range of card issuer options, only fill in your state and date range in the search criteria. For example, I looked up data for credit pulls throughout the US in 2024. Here are some of the results:

However, I must stress again that the card issuer's agency to pull reports can fluctuate between cities and even individual customers. To get the best picture possible, you should check the site for yourself and enter your own information. Even then, your application results aren't guaranteed to be the same as what others experienced.

This is really just a guide to help you make an educated guess as to where an issuer may get your data.

Related: Best credit cards for excellent credit

Bottom line

When you apply for a new credit card, your issuer will pull data from one of the "big three" credit reporting agencies. Because the information from each agency differs (and therefore, your scores from each vary), it's important to stay updated on your credit score at each company.

Under U.S. law, you are allowed to receive your full credit report for free from each agency once per year. Ensure you're taking advantage of that to keep an eye on your report and the information being compiled (even if you are also monitoring your scores through your credit card issuer's mobile apps or other financial services).

Related: The best credit cards

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app