How to refund a British Airways Avios redemption online

After a frustrating two years, Avios redemptions can once again be canceled and refunded online.

This will be music to the ears of anyone who has spent hours on hold with the British Airways Executive Club call center during the last two years and — more often than not — was told to call back later due to "unusually high call volume."

The new functionality has been added to the "Manage My Booking" section of the British Airways website. As first reported by Head For Points, it allows for easy online cancellations with all Avios and fees, taxes and surcharges refunded (minus cancellation fees, as discussed below).

Here's how it works.

How to cancel an Avios redemption online

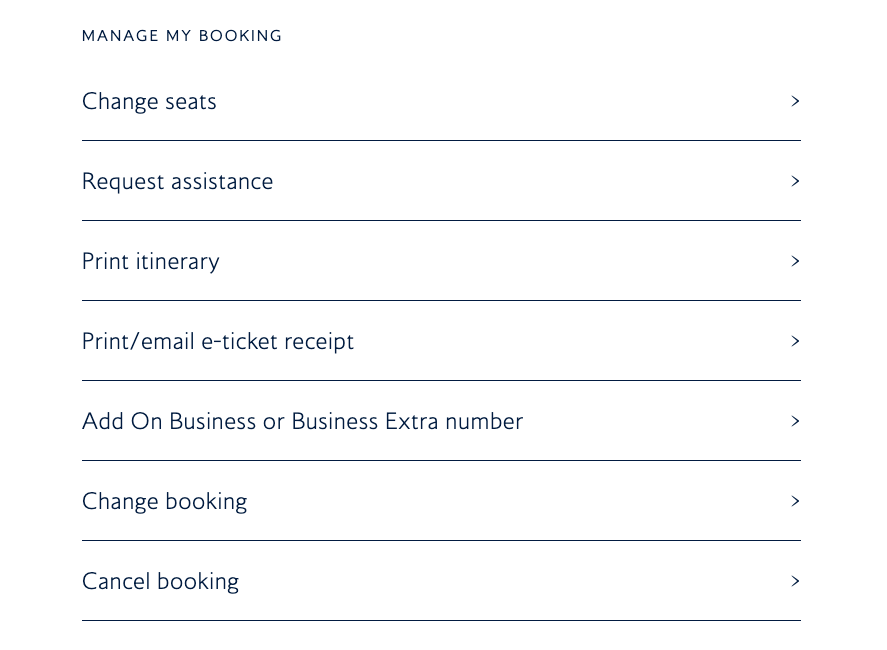

First, navigate to the "Manage My Booking" section of any Avios redemption you wish to cancel, either by searching your upcoming bookings in your Executive Club account or entering your six-digit PNR. Then, click on the blue "Manage My Booking" bar at the bottom of the page, which will bring up the following options:

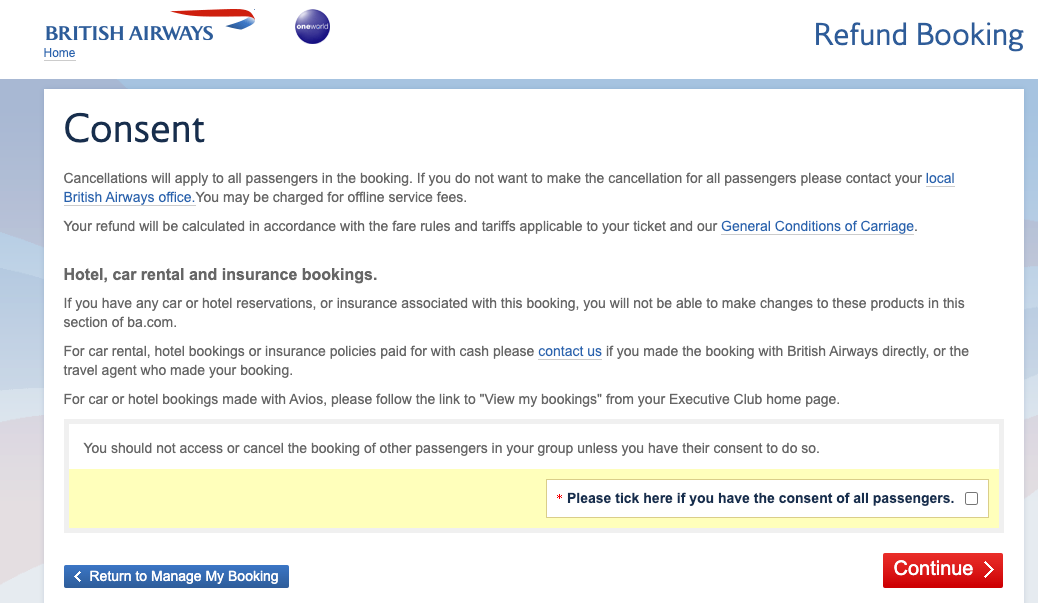

From here, click on the "Cancel booking" option and you will be directed to a consent page. Here, you will need to confirm you have the consent of all passengers to cancel and refund the booking online.

Related: Maximizing the British Airways distance-based award chart

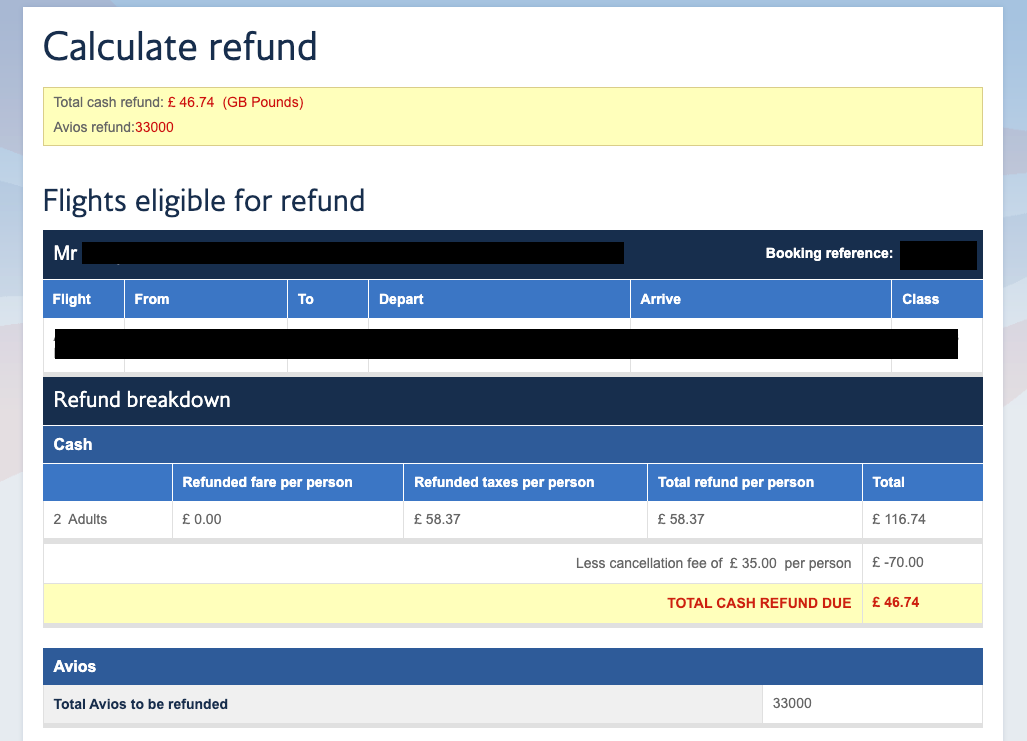

You will then see your online cancellation options.

You can cancel Avios redemptions online for flights operated by British Airways or its partner airlines. In my case, a flight operated by Finnair can be refunded with a cancellation fee of 35 British pounds ($39.77) per person. So, since I paid 116.74 British pounds ($132.66) in fees, taxes and surcharges, I would receive a cash refund of 46.74 British pounds ($53.11). I was charged a 70 British pounds ($79.55) cancellation fee for two passengers.

The full 33,000 Avios redeemed for these flights would be refunded to my Executive Club account.

The standard cancellation and refund fee is 35 British pounds ($39.77) per person. Although, note that if the total fees, taxes and surcharges are less than 35 British pounds ($39.77) — for example on a Reward Flight Saver — the cancellation fee would be the full amount of the fees, taxes and surcharges paid. This is particularly useful for anyone choosing to pay only $0.57 per flight for a Reward Flight Saver, as the cancellation fee is almost nothing.

Remember that Avios redemptions for flights leaving less than 24 hours in advance cannot be refunded online.

Related: The ultimate guide to British Airways Avios

Bottom line

This is a long overdue and welcome improvement to the Executive Club program. Though British Airways wait times have improved from 12 months ago, it is still far better to be able to cancel and refund Avios redemptions online yourself rather than calling someone to do it for you.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app