Why you might actually need road trip travel insurance

If you're planning to pack up a car or RV this summer for your version of the Great American Road Trip, consider adding one thing to your packing list: road-trip-specific travel insurance.

Throughout the pandemic, many people have been purchasing travel insurance, most commonly used for high-ticket foreign-travel journeys in order to cover potential medical emergencies or protect high-cost trip investments.

However, an increasing number of people are considering travel insurance for domestic, land-based vacations.

"People tend to only think about travel insurance when they're flying abroad — but when you're on the road, perhaps hundreds of miles away from home, there are things that can go wrong that could wind up costing you a lot of money," said Carol Mueller, vice president at Berkshire Hathaway Travel Protection. "Road-trippers should be thinking about protecting their investment in their vacation."

The Points Guy looked at some travel insurance companies to explore the latest insurance options on the market. Here's a guide to why these products might be a worthwhile addition to your summer road trip.

Want more travel tips and advice from TPG? Sign up for our daily newsletter.

[table-of-contents /]

3 reasons you might want travel insurance for a road trip

Standard auto insurance policies cover the usual mishaps of the road, including collision, liability, theft and medical costs (depending on your specific policy). However, travel insurance can cover the related travel expenses connected to such accidents.

For example, if you paid for a non-refundable vacation at Walt Disney World that you weren't able to use in time because your car sank into a bog while en route in Georgia, a travel insurance policy could cover the cost of your missed hotel stays, tours and attraction tickets. (And yes, that's my SUV in the above photo. I didn't get stuck in a bog on the way to Disney World — but I did get stuck in a mud pit near Lake Tahoe.) Road trip insurance can save the day in any domestic destination.

Related: The best credit cards for rental car insurance

Travel insurance covers pre-paid road trip costs due to cancellation

Whether your planned road trip is an epic cross-country journey or just a cross-state weekend escape, if you've booked hotels, attractions or experiences in advance, you might want to think about travel insurance in case you have to cancel the trip before it begins.

Many travel insurance policies also now have coverage in case you or someone in your group has contracted COVID-19 and needs to cancel. Other policies allow you to cancel for any reason. Policies can also cover cancellation due to reasons like jury duty, a documented death in the family, financial insolvency, weather disasters and other problems that would prevent you from taking your planned trip.

Read the fine print carefully to determine exactly what cancellation reasons are accepted, as well as what sort of documentation you need.

Travel insurance covers pre-paid trip costs due to traffic accidents or other road delays

Road-trip-specific travel insurance policies would cover costs associated with trip interruptions or cancellations due to traffic accidents or significant delays brought on by weather or road closures during your journey. For example, if a dust storm shuts down major highways and your group can't make it to Coachella in time, a travel insurance policy could cover the cost of your festival tickets.

As far as damage coverage for rental cars goes, you typically wouldn't want to duplicate your credit card or car insurance coverage with travel insurance. However, Generali Global Assistance suggests signing up for its rental car coverage for additional security – and to avoid "exposing your auto plan to risk" in the shape of higher future rates if you file a claim through your personal policy.

Travel insurance covers medical expenses and evacuation

You won't face the same potential costs of medical evacuation from a foreign country during a domestic road trip. You might need out-of-network doctor care while on the road, though. Generali Global Assistance makes the point on its website that "you don't think travelers only fall off of foreign cliffs, do you? Or people only get stung by non-domestic bees?"

When confronting medical emergencies such as these, typical out-of-network fees can be exorbitant for many medical policies. So it might make financial sense (and give you peace of mind) to purchase a travel insurance policy covering medical expenses even while traveling in the U.S. Additionally, travel insurance may be able to pay for deductibles and copays needed even for in-network providers for any emergencies that come up on the road.

Related: 8 times your credit card insurance might not cover you

How road trip insurance plans can protect you at a reduced cost

Typical travel insurance plans incorporate costs to cover you for flight changes, cancellations, baggage loss or delays, foreign medical treatments, and medical evacuation back to the U.S., as well as many cruise-specific items. If you're just taking a domestic road trip, many of these coverage areas wouldn't apply, so it doesn't make sense to pay a higher premium for them.

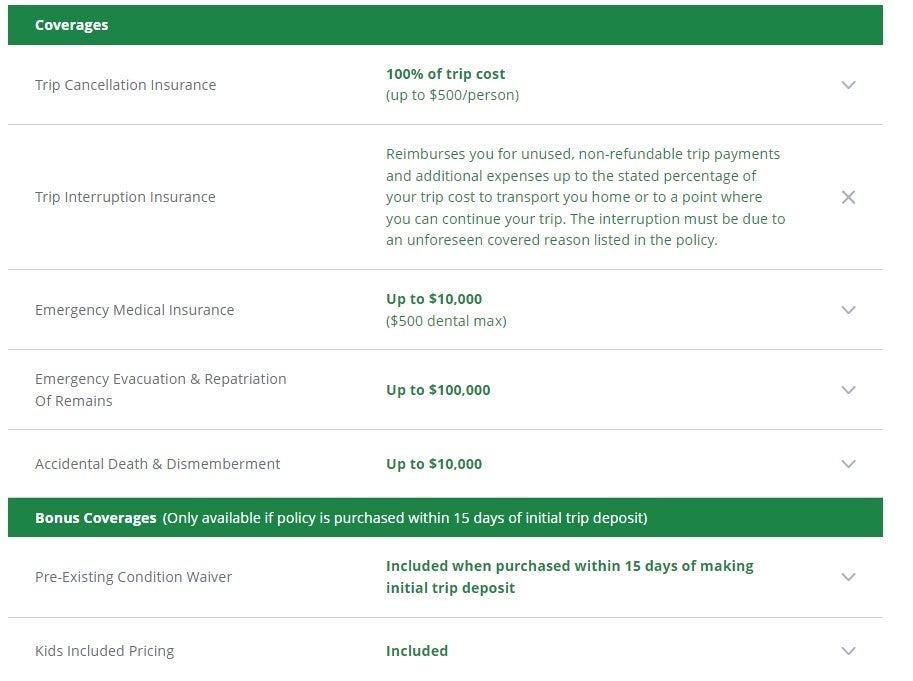

If you're looking into a travel insurance policy, it's worth it to explore a la carte pricing for specific coverage areas, if the insurance provider offers such options like medical-only coverage, or only pre-trip cancellation coverage. Some companies, like Berkshire Hathaway, are creating road-trip-specific insurance products that are essentially stripped down versions of standard travel insurance policies.

For example, Berkshire's "ExactCare Lite" insurance policy covers medical emergencies while traveling in the U.S., Canada and Mexico, with some limited pre-paid expense reimbursement. One sample policy priced out at just $56 for medical coverage for a two-week trip, as well as covering up to $500 of pre-paid trip expenses should you cancel the trip.

If you book an expensive hotel or tour during your road trip, you may want to opt into a more comprehensive (and expensive) policy. A sample: Berkshire's "ExactCare Value" policy would cover a full $7,000 trip value, but at a price of $340. It also includes some flight and baggage coverage (which obviously wouldn't apply for a road trip).

Allianz Travel offers insurance policies that can cover you for any trip that's at least 100 miles from home, according to Daniel Durazo, its director of external communications. He added: "And if you feel you don't need medical coverage, Allianz offers a very inexpensive policy, called One Trip Cancellation Plus that offers trip cancellation and interruption coverage, but does not cover medical emergencies or other 'post-departure' situations." Pricing for the policy begins at just $14, Durazo said.

Related: Best credit cards for paying your medical bills

Bottom line

With the uncertainty of current times, it's a good idea to look into travel insurance, particularly if you have a lot of pre-paid expenses in your planned trip. A domestic road trip doesn't have all of the same potential risks as a foreign trip, so your policy should be tailored to cover only those areas relevant to your specific trip.

Some companies offer branded road-trip products. However, you can also look into a la carte trip insurance pricing (often on convenient online menus) to find the policy that's right for your coverage and price point. As always, read the fine print on all insurance coverage areas, payouts and conditions to avoid surprises down the road.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app