United offering chance to buy higher level of elite status -- Is it worth it?

Like most other frequent flyer programs, United MileagePlus extended elite status levels for an extra year in 2020. Instead of requiring that its members hit certain spending or flying thresholds in all the weirdness that was last year, they didn't penalize anyone who didn't hit the thresholds in 2020 and bumped status expiration out a full year into 2022.

But, now that 2021 has arrived, United is sending out some targeted emails to provide select members the opportunity to buy-up to the next level of status in exchange for cold hard cash.

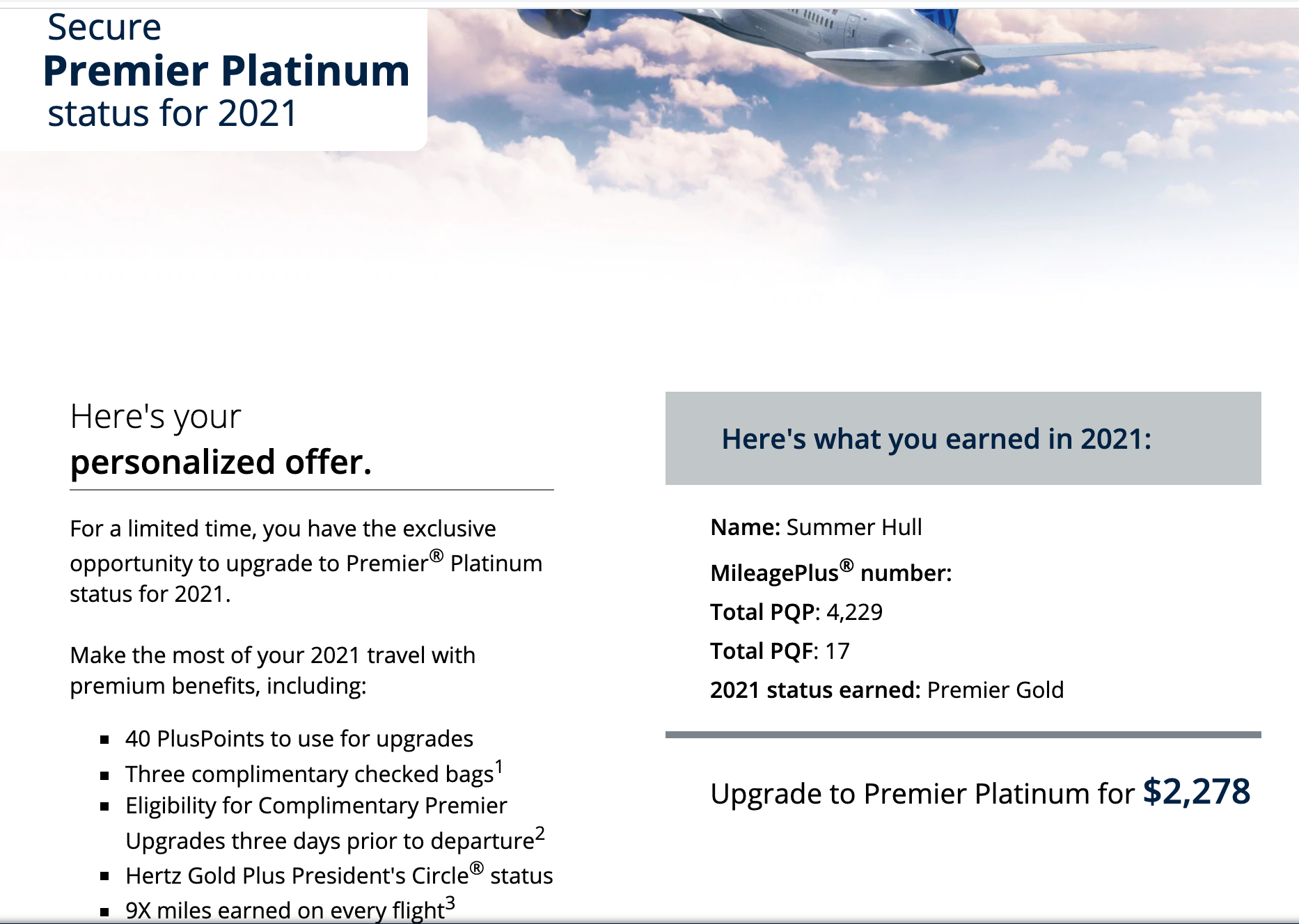

I have earned United Gold elite status the last few years, and in 2020 and managed to earn 4,229 Premier Qualifying Points (PQPs) and 17 flight segments. That was 1,771 PQPs (which are essentially dollars spent with the airline) and one flight segment away from earning a higher Platinum status at the reduced 2020 qualification levels.

But if I'm interested in upping my status level for the next year, United will now sell that missed Platinum status level to me for $2,278 via an offer valid until Feb. 28.

That offer would confer the increased status level until early 2022. In this case, Platinum status would come with an earlier upgrade priority, starting 72 hours before departure, the ability to secure up to eight extra-legroom Economy Plus seats at the time of booking, earn an increased 9x redeemable miles on flights and 40 PlusPoints that can be used toward confirmable upgrades.

Related: Complete guide to airline elite status during the coronavirus outbreak

Other United status buy-up offers going out

These status buy-up opportunities have been going out via email. Mine had the subject line "Secure Premier Platinum status for 2021." While not every MileagePlus member received one, I am aware of offers going out from the entry-level Silver status opportunities, up to the top-tier 1K status level. (I have yet to hear of any buy-ups to the highest invite-only Global Services level.)

In the TPG Facebook Lounge and among TPG staffers, reports range from $700 for Silver status to $900 to buy-up to Platinum status and up to $4,000 to secure 1K status. While not confirmed, it's likely that how close you were to securing that next status level may impact the price to buy it and close that gap.

Related: How to earn airline status with credit cards

Is it worth it to buy status?

Loyalty program elite status is only worth what you get out of it. Triple-platinum-titanium-diamond-minted status is worth exactly $0 if you don't use the perks. On the other hand, in a normal year, United elite status is valued at thousands of dollars by TPG.

If you aren't yet sure whether or not you will fly with United in 2021, I wouldn't recommend spending hard-earned cash to secure a higher status level.

But, if you have a high degree of certainty that you will be back in the friendly skies with United in 2021, it can be worth at least running the math if you received an offer.

If your offer is to spend around $2,000 to go from Platinum to 1K status, a tangible perk would be the additional 280 PlusPoints you'd earn by making that status jump. It costs 20 PlusPoints to secure a space-available upgrade from economy to domestic first/regional business class, 40 PlusPoints to go from economy to Polaris in certain fare classes, and so on. Theoretically, those 280 PlusPoints that come from unlocking 1K could secure up to 14 regional or domestic upgrades or up to six upgrades to Polaris on long-haul flights.

Ignoring all the other United 1K status benefits for the moment, that comes to about $143 per domestic/regional first-class upgrade or around $333 for each Polaris upgrade -- all subject to space availability. Add on top of that the additional 1K perks (above what Platinums would already receive), including being almost at the top of the pecking order for 'free' upgrades starting 96 hours before departure, a free beverage/snack when flying economy and earning 11x redeemable miles per dollar spent on airfare, etc.

Related: Guide to United PlusPoints

If you were certain you would max out those PlusPoints, as well as the other perks, there are fringe cases when a relatively sizeable investment could be recouped by jumping from Platinum to 1K. However, that will rely largely on how much you fly in 2021.

Related: Why United’s recent changes have me reconsidering going for top-tier status

What I'm doing

I'd very much love to be a United Platinum elite again, as it's been many years since I had that pretty valuable status level.

However, it's not worth $2,278 to me this year to make that leap up from Gold. The 40 PlusPoints would be nice, but that's only enough for two domestic first-class upgrades or one international Polaris upgrade. All in, those perks aren't worth anywhere near $2,000+ for me at the moment.

I'd consider the offer if it was in the $500-ish range, but at the asking price, it's well beyond what I'm certain will be worth in my current situation.

Related: Reconsidering top-tier elite status with United

Bottom line

If you have a fair amount of United flying planned for 2021, scan your inbox to see if you have an offer to upgrade your elite status. Based on the reports we have seen, it certainly won't always be worth it to spend the cash to secure that next status level, but there may be some niche cases that are worth plunking down your credit card and locking in more perks.

TPG featured card

Rewards

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro offer

Annual Fee

Recommended Credit

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

Rewards Rate

| 4X | Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 4X | Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. |

| 3X | Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. |

| 2X | Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. |

| 1X | Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases. |

Intro Offer

You may be eligible for as high as 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.As High As 100,000 points. Find Out Your Offer.Annual Fee

$325Recommended Credit

Credit ranges are a variation of FICO® Score 8, one of many types of credit scores lenders may use when considering your credit card application.Excellent to Good

Why We Chose It

There’s a lot to love about the Amex Gold. It’s a fan favorite thanks to its fantastic bonus-earning rates at restaurants worldwide and at U.S. supermarkets. If you’re hitting the skies soon, you’ll also earn bonus Membership Rewards points on travel. Paired with up to $120 in Uber Cash annually (for U.S. Uber rides or Uber Eats orders, card must be added to Uber app and you can redeem with any Amex card), up to $120 in annual dining statement credits to be used with eligible partners, an up to $84 Dunkin’ credit each year at U.S. Dunkin Donuts and an up to $100 Resy credit annually, there’s no reason that foodies shouldn’t add the Amex Gold to their wallet. These benefits alone are worth more than $400, which offsets the $325 annual fee on the Amex Gold card. Enrollment is required for select benefits. (Partner offer)Pros

- 4 points per dollar spent on dining at restaurants worldwide and U.S. supermarkets (on the first $50,000 in purchases per calendar year; then 1 point per dollar spent thereafter and $25,000 in purchases per calendar year; then 1 point per dollar spent thereafter, respectively)

- 3 points per dollar spent on flights booked directly with the airline or with amextravel.com

- Packed with credits foodies will enjoy

- Solid welcome bonus

Cons

- Not as useful for those living outside the U.S.

- Some may have trouble using Uber and other dining credits

- You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That’s up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards® points for Uber Eats purchases made with restaurants or U.S. supermarkets. Point caps and terms apply.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at U.S. Dunkin' locations. Enrollment is required to receive this benefit.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.