United just unveiled a new 'Money + Miles' redemption option, but is it a good deal?

United's MileagePlus loyalty program officially has a new redemption option.

On Monday, the Chicago-based carrier unveiled the ability to use a mix of both cash and miles towards the purchase of a ticket. Dubbed "Money + Miles," this new redemption option is now available for most domestic United and United Express flights.

By combining cash with MileagePlus miles, the big benefit is that you can redeem fewer miles than if you were outright purchasing an award ticket. As for whether the new program offers a good value, well, that one is trickier.

[table-of-contents /]

United's new "Money + Miles" redemption rate

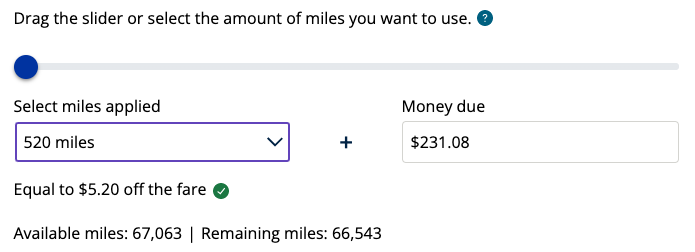

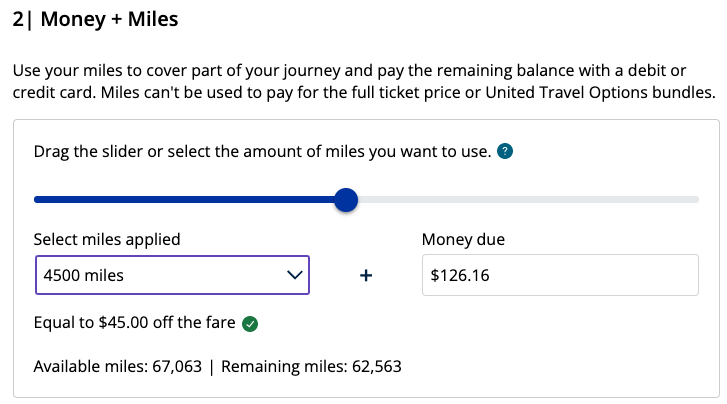

For the flights that TPG tested, the "Money + Miles" redemption option offered a fixed 1 cent per mile redemption value. For a trip from Denver to Fort Lauderdale, the minimum number of miles available for redemption was 520, which equated to $5.20 off the fare.

The maximum available for redemption was 13,000, which equated to $130 off the fare. "Money + Miles" redemptions were available in 130-mile increments, with each increment offering $1.30 off the fare.

The same redemption rate was observed for both domestic coach- and business-class fares, including basic economy.

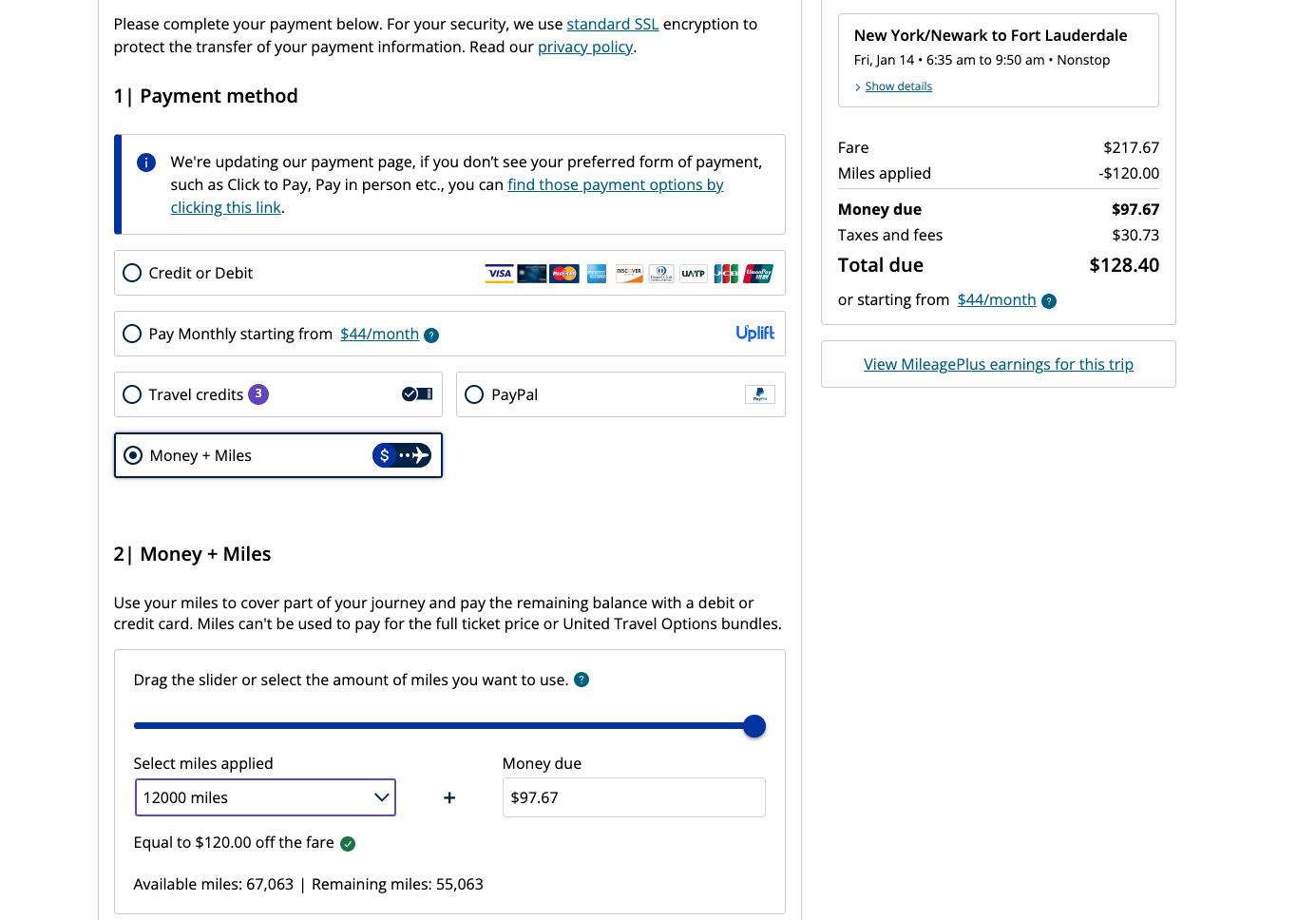

Notably, you're only allowed to use 90% of the total miles you've earned toward a "Money + Miles" redemption, and it appears that United will only allow you to redeem enough miles to pay roughly half of the revenue fare.

For instance, on a $248.40 flight from Newark to Fort Lauderdale, the maximum number of miles available for redemption was 12,000, equal to $120 (or roughly 50%) of the fare, despite having over 60,000 miles in the account that was used for testing.

At TPG, we currently value United MileagePlus miles at 1.3 cents per mile. While the 1 cent per mile "Money + Miles" redemption rate is below the TPG valuation, it could nonetheless make sense to use the feature if you aren't a frequent United flyer and you have a small stash of MileagePlus miles.

For everyone else, it'd likely make sense to continue using miles for traditional award tickets. Personally, I've managed to redeem my MileagePlus miles for premium-cabin Star Alliance partner redemptions, which can offer an even better value than TPG's 1.3 cents per point valuation.

However, one big consideration (which I'll discuss below) is that, unlike traditional award redemptions, you earn redeemable miles and Premier-qualifying credit from the paid portion of a "Money + Miles" redemption.

Details about United's "Money + Miles"

There are some additional tidbits about United's new "Money + Miles" feature that are worth highlighting.

For one, as mentioned, you'll earn redeemable MileagePlus miles for the base fare paid with money, excluding taxes and fees. Note that you cannot credit a "Money + Miles" ticket to a Star Alliance partner program (in the hopes of earning full mileage credit with that partner).

For Premier-qualifying activity, you'll earn Premier qualifying points (PQPs) on the cash portion of the base fare paid, along with a Premier qualifying flight (PQF) for each segment flown.

For those chasing lifetime Million Miler elite status, note that you'll earn lifetime miles for the entire flown itinerary, regardless of how many miles you redeemed.

If you're a Premier elite member, you can enjoy all your benefits on "Money + Miles" tickets, including a shot at a complimentary upgrade, extra-legroom seating, expanded baggage benefits and more. You won't be able to upgrade your ticket using MileagePlus miles, but you can redeem PlusPoints to confirm an upgrade to Premium Plus or business class.

If you need to change a ticket paid with "Money + Miles," you'll be subject to the fare rules of the ticket. Late last year, United permanently eliminated change fees for all tickets, except those booked in basic economy.

If the new ticket is priced higher, the fare difference will be collected in money. Any residual value from switching to a less-expensive flight will be issued as future flight credit — and the miles redeemed will be converted to future flight credit as money.

"Money + Miles" flights can only be changed to other itineraries operated by United or United Express — not with any partner carriers.

You can't make changes to "Money + Miles" flights during the 24-hour flexible booking period, but you will be allowed to cancel the itinerary for a full refund, both in money and in miles.

Same-day changes on the day of departure are allowed on "Money + Miles" tickets.

How to use United's "Money + Miles" feature

To make a "Money + Miles" redemption, you need to search for a United flight either on the carrier's website or mobile app. Be sure not to use the "book with miles" search feature.

On the payment screen, you'll see a new "Money + Miles" payment method. You can then move the interactive slider or use the dropdown to select how many miles to use.

You can make a "Money + Miles" redemption for someone else's flight, though you need to be logged into your MileagePlus account in order to see the redemption option.

Bottom line

Historically, when airlines have introduced mixed mileage and cash awards, the redemption rate has never been better than booking a traditional award ticket. The same is true with United's new "Money + Miles" feature in most instances.

At a fixed 1 cent per point redemption rate, most loyalists will prefer redeeming traditional award tickets. However, for those infrequent travelers with a small stash of United miles, this new feature will likely make sense. Alternatively, if you want to conserve cash but need to pick up additional PQFs to hit the next status level, this could be an option.

United is the second of the Big 3 U.S. airlines to offer mixed mileage and cash redemption options. Delta offers both a Miles + Cash option, as well as a Pay with Miles feature, the latter of which is available exclusively to cobranded Delta Amex cardholders and also pegs its miles at 1 cent each when used in that manner to get a cash discount on a Delta-operated flight.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app