United Airlines makes big changes to how we earn elite status, upgrades

Update: Some offers mentioned below are no longer available. View the current offers here.

Listen up, United Airlines frequent flyers — big changes are coming to the way you earn elite status. As of next year, you'll no longer earn miles toward status tiers; instead, qualification will be based solely on two new metrics: Premier Qualifying Points (PQPs) and Premier Qualifying Flights (PQFs).

These major changes are in addition to the award redemption devaluation kicking in next month and the new PlusPoints upgrade system. It's not all doom and gloom though; I'll walk you through it.

United's increased spend requirements

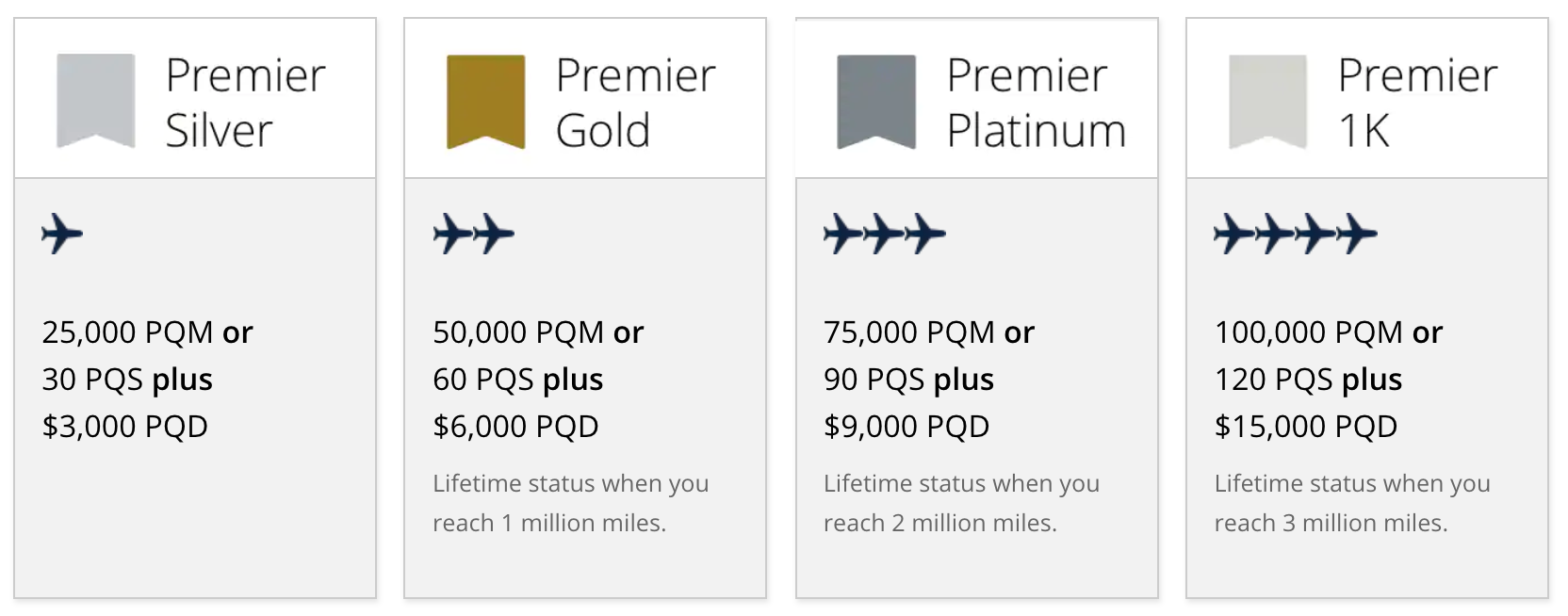

For the qualification year ending Dec. 31, 2019 — for status valid through Jan. 31, 2021 — members will continue to qualify with a combination of flying and spending, as outlined below:

Beginning Jan. 1, 2020, those spend requirements are going up across the board. As of next year, you'll need to spend at least the following (before taxes and fees) in order to qualify for each level:

- Premier Silver: $4,000

- Premier Gold: $8,000

- Premier Platinum: $12,000

- Premier 1K: $18,000

You'll need to do a certain amount of flying to qualify as well — more on that below.

Premier Qualifying Flights and Points

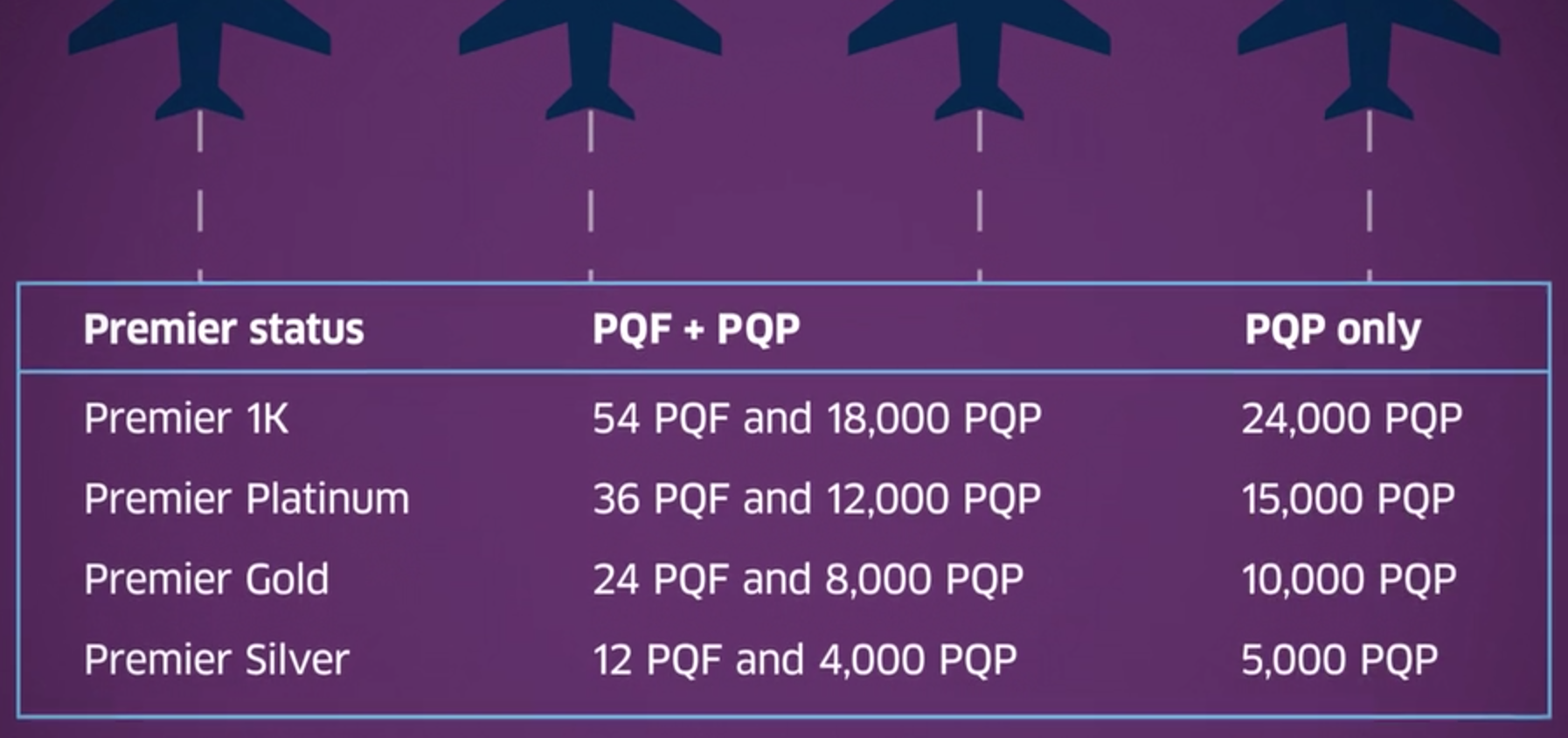

Currently, United elites earn status with a combination of Premier Qualifying Miles (PQMs), Premier Qualifying Dollars (PQDs) and Premier Qualifying Segments (PQSs). Come Jan. 1, 2020, all three will be replaced — by Premier Qualifying Points (PQPs) and Premier Qualifying Flights (PQFs). Yeah, it's okay to be confused — it should all be clear in a moment.

Customers earn PQPs for pre-tax United airfares, in addition to select other United purchases and partner flights. I'll explain more in the sections below. There are two different qualification requirements for each tier — "points only," which is based entirely on spend (1 PQP = $1); or PQPs + PQFs, which requires 12, 24, 36 or 54 individual flight segments, depending on your tier.

Each flight earns one credit toward the PQF requirement, including all fare classes except Basic Economy (and award tickets).So a connecting round-trip with two segments in each direction would earn 4 PQFs. Revenue partner flights count towards this segment requirement, with the exception of fares that currently don't earn Premier-qualifying credits, such as deep-discounted economy on certain carriers.

Finally, note that with this change, there's no more spend exemption for members living outside the United States — everyone will be required to qualify under the new system. Additionally, all tiers require at least four United-operated segments, and there won't be a waiver for co-branded cardholders.

More ways to earn PQPs

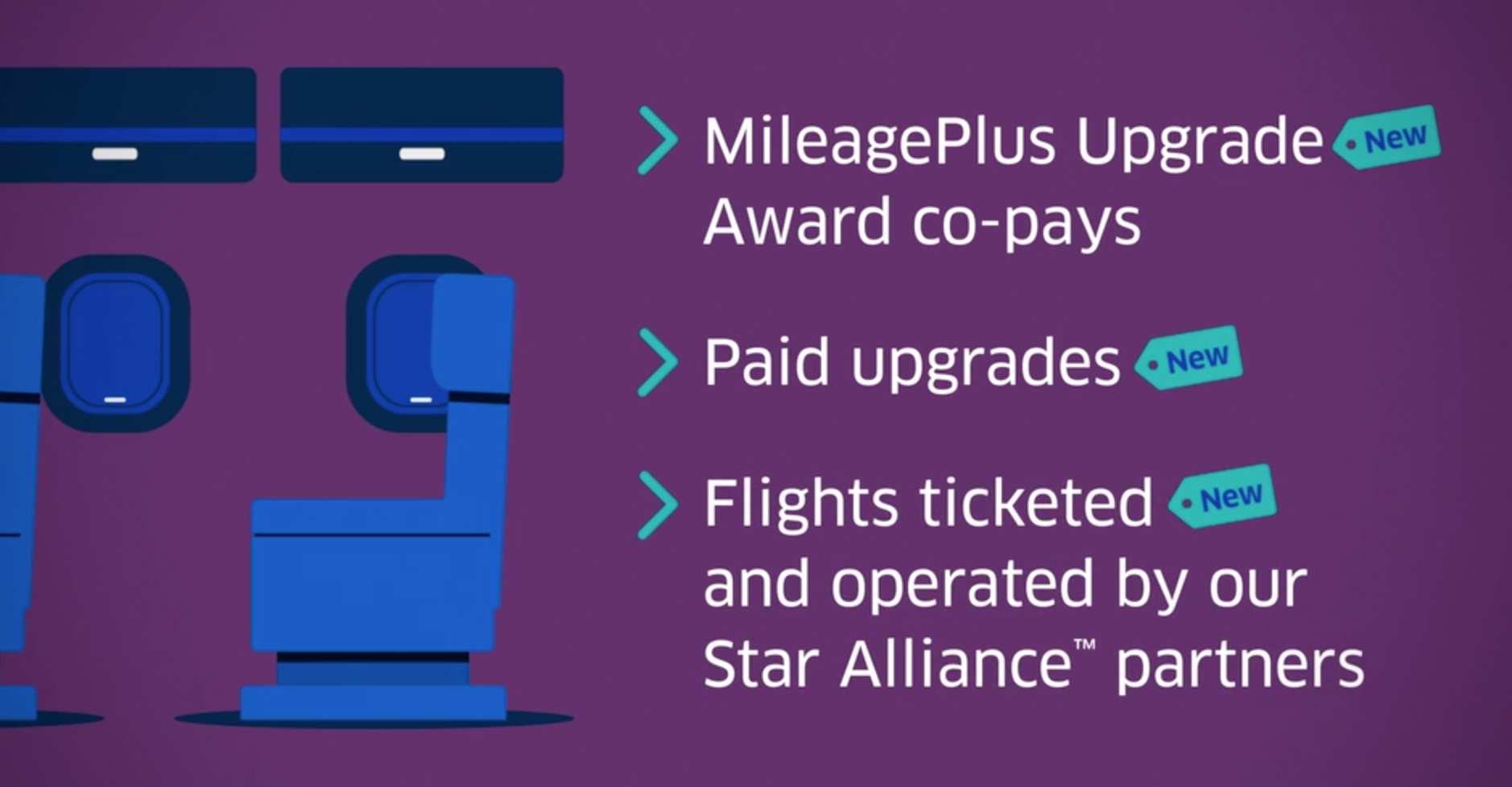

Currently, MileagePlus members earn PQPs via the following:

- United and United Express flights

- Partner flights issued on "016" (United) ticket stock

- Economy Plus purchases

- Preferred seating purchases

As of Jan. 1, those transactions will still qualify, as will:

- Paid upgrades

- The cash co-pay for MileagePlus Upgrade Awards

- Non-016 partner travel (more on that below)

Another silver lining

Now, this is some great news, and the potential saving grace for flyers otherwise unable to meet United's steep spend requirements. Beginning Jan. 1, partner flights will earn PQPs, even if they aren't issued on United ticket stock. That means you can book a Singapore Airlines flight issued by Singapore and have that count towards your United spending requirements.

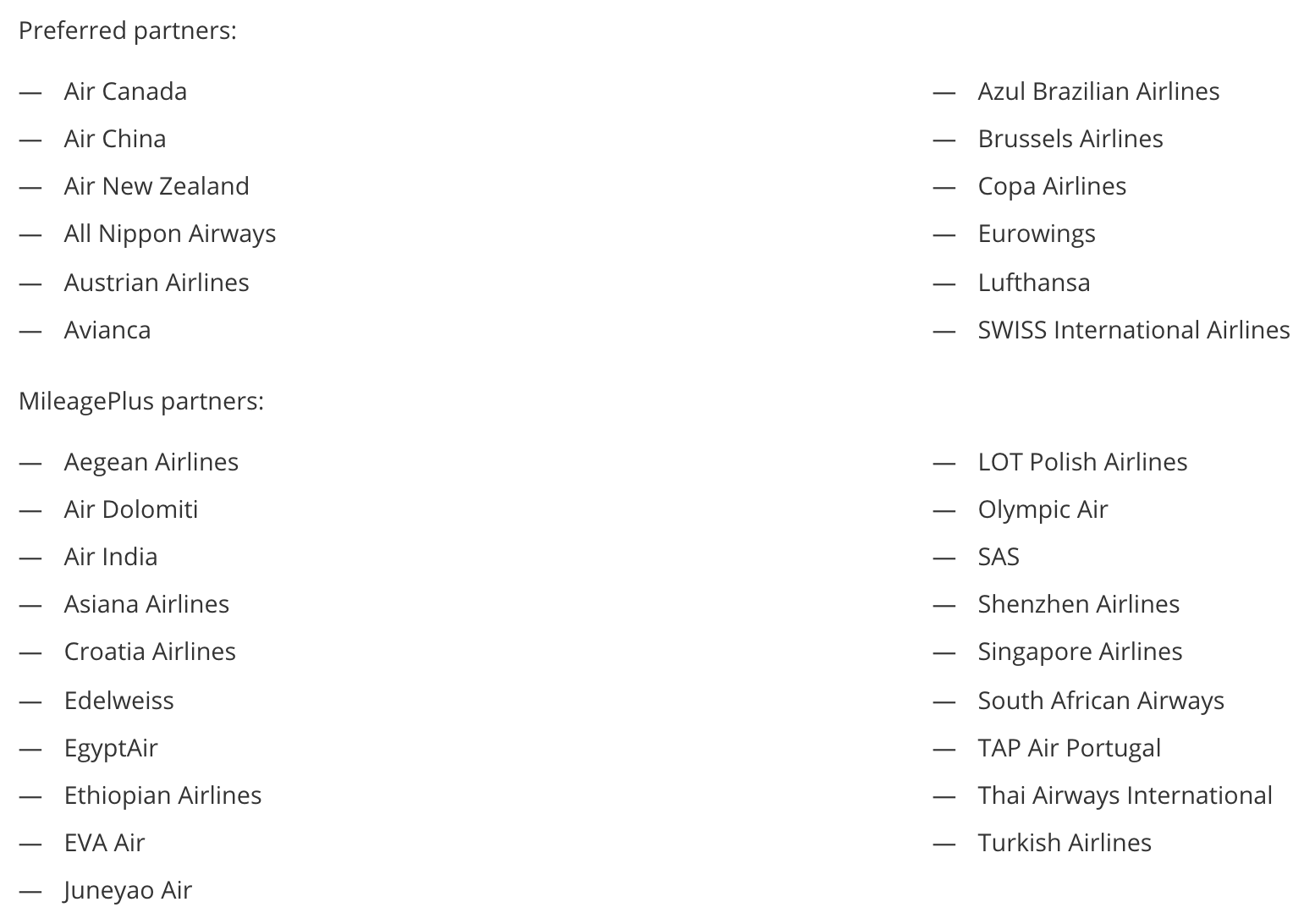

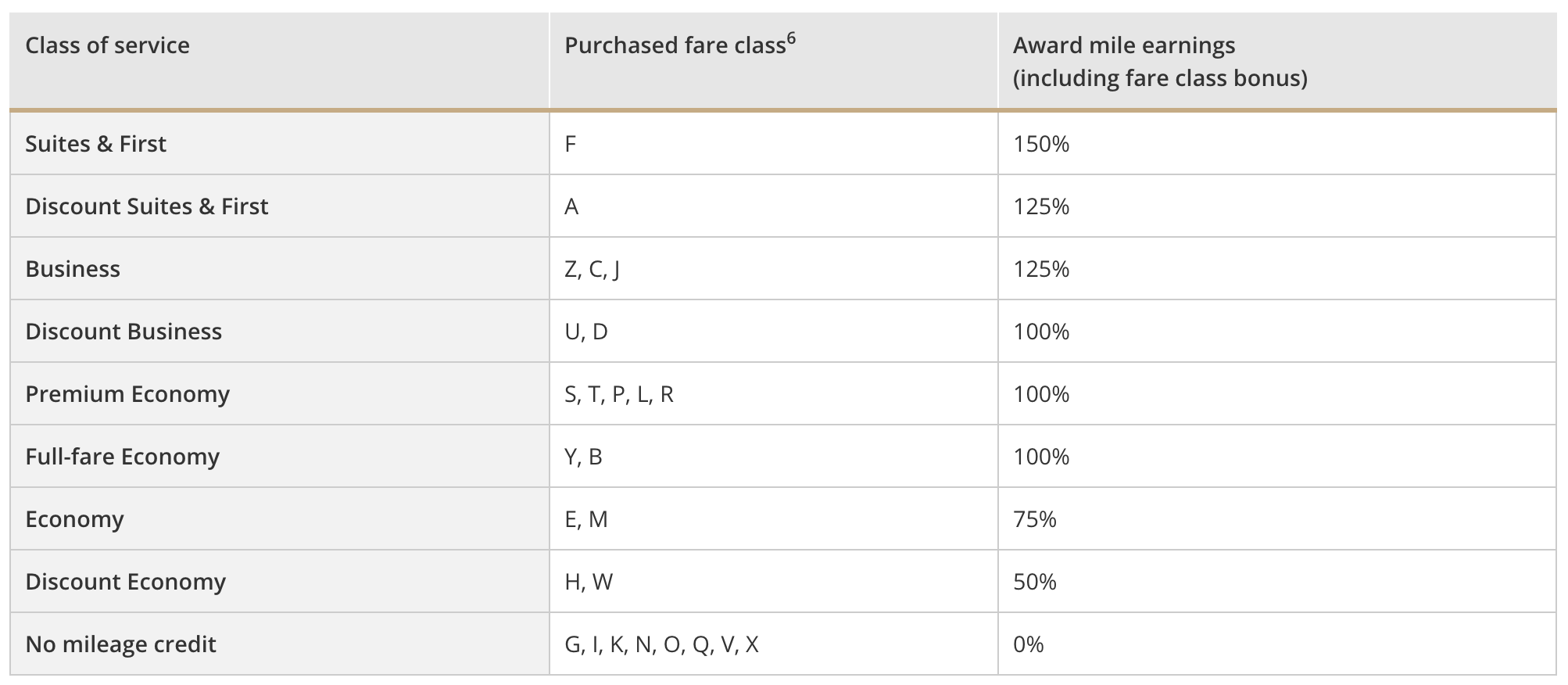

While "016" United-issued tickets will still be assigned PQPs based on the actual cost of the ticket, United will credit partner flights as follows:

- Preferred partners: Award miles divided by 5

- All other partners: Award miles divided by 6

Here's a list of how the partners break down:

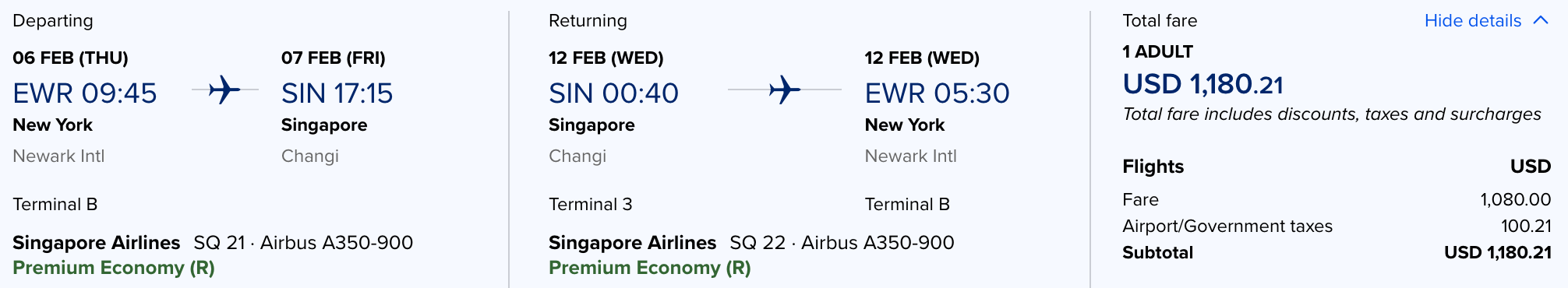

So how will this work in practice? Let's take a look at an especially lucrative option, on Singapore's nonstop flights between Newark (EWR) and Changi Airport (SIN). The world's longest flight clocks in at roughly 9,500 miles, or 19,000 miles round-trip, and you can consistently book premium economy for less than $1,200 round trip.

United awards miles at a 100% rate for Singapore premium economy flights booked in the discounted "R" fare class, such as the one above. With a miles/6 PQP earning rate, you'll walk away with 3,166 PQPs for this $1,180 flight. In other words, you're earning at 2.68x the rate of a United flight with the same fare.

So how does that factor into United's new $18,000 spend requirement for Premier 1K? Well, first, it's important to note that you'll only qualify with $18,000 in spend if you also fly 54 segments. Assuming 50 of those are on Singapore and the remaining 4 are on United — the latter of which is required for any United status level — you'd need to spend just $6,717 to earn 1K, without even factoring in the PQPs earned from those four United flights. Or, ignoring the flight requirement, you'd need 24,000 PQPs — $8,956 spent on Singapore flights.

Of course, it's unlikely that anyone will qualify exclusively traveling on the world's longest flight — plus 4 United segments — but you get the idea. Ultimately, this addition has the potential to make it far easier to qualify for status, even as the spend requirements go up.

PlusPoints earning

Another component of this change is an adjustment to the way you'll earn PlusPoints. Members will still earn their initial lot as follows:

- 40 upon reaching Platinum

- 280 upon reaching 1K or Global Services

But, rather than earning an additional 40 for each subsequent 25,000 PQMs — since, remember, PQMs are going away — you'll earn 20 for each additional 3,000 PQPs. That'll likely represent a devaluation for most elites, unfortunately, but at least you'll continue to earn some points after reaching 1K.

Co-branded credit card shortcuts

As I mentioned, United is no longer offering a waiver for customers with a co-branded credit card, including the United Explorer Card, the United Explorer Business Card and the United Club Card. Additionally, legacy cards will no longer offer an opportunity to earn Premier Qualifying Miles, since PQMs are going away.

Co-branded cards will offer a new shortcut to status, though — an opportunity to earn some PQPs. For the first $12,000 in spend each calendar year, members will earn 500 PQPs, with an opportunity to earn an additional 500 PQPs with an additional $12,000 in spend, for a grand total of 1,000 PQPs.

Note that these "bonus" PQPs will only count towards status up to Platinum. However certain legacy cards will allow members to earn 1,000 PQPs towards 1K — United will communicate that earning opportunity directly to customers with eligible discontinued cards.

The information for the United Club card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Ultimately, United does expect a "rebalancing" within certain tiers — customers who qualify for Premier Platinum under the 2019 system may reach 1K in 2020, and vice versa. But, overall, the airline anticipates that this new qualification structure will result in even more elite members than there are today.

And what about Global Services? United MileagePlus head Luc Bondar noted that United's GS program won't be impacted by these changes — it'll remain invite-only, and, presumably, based exclusively on spend for United-issued flights.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app