Trans States Airlines to shut down April 1, first US carrier to close amid coronavirus crisis

Regional carrier Trans States Airlines appears set to become the first U.S. airline to shutter its doors in the wake of the coronavirus crisis that has grounded flights around the world.

The United Airlines affiliate will shut down on April 1 due to the "unforeseen impact of the coronavirus," Trans States CEO Richard Leach told employees in an internal memo Tuesday viewed by TPG. The carrier was already planning to shut down by year-end, but the demand-related fallout surrounding COVID-19 has hastened its demise.

The move does not impact other carriers owned by its parent company St. Louis-based Trans States Holdings, including Compass Airlines and GoJet Airlines.

Get Coronavirus travel updates. Stay on top of industry impacts, flight cancellations, and more.

Trans States was not immediately available for comment on the memo.

The regional carrier's shut down comes as airlines around the world cull schedules to keep up with plummeting demand. American Airlines plans to cut domestic capacity by up 30%, Delta Air Lines system capacity by 40%, and United is halving its operation.

Industry organization Airlines for America (A4A), which represents large airlines like American, Delta and United, has asked for more than $50 billion in aid from the U.S. government to get carriers through the crisis.

Related: US airlines seek at least $50 billion in aid to combat coronavirus crisis

That aid, if granted, will come too late for the likes of Trans States.

"It's difficult to articulate or even comprehend the speed at which the coronavirus has changed our industry," said Leach in the memo. "As of last week, we knew that the wind down would be accelerated, but we were confident that we would continue flying for United for some months."

Leach explained that capacity cuts by United to Trans States' schedule were "far deeper than we feared" and that the drawdown in its United Express operations was "faster than we could ever have imagined."

Related: United Airlines affiliate Trans States Airlines to cease flying

The International Air Transport Association (IATA) director general Alexandre de Juniac warned Tuesday that the coronavirus-driven cash crunch that airlines face will lead to both consolidation and "unfortunately some airlines will be disappearing."

The UK's largest regional airline, Flybe, has already ceased operations due to the COVID-19 pandemic.

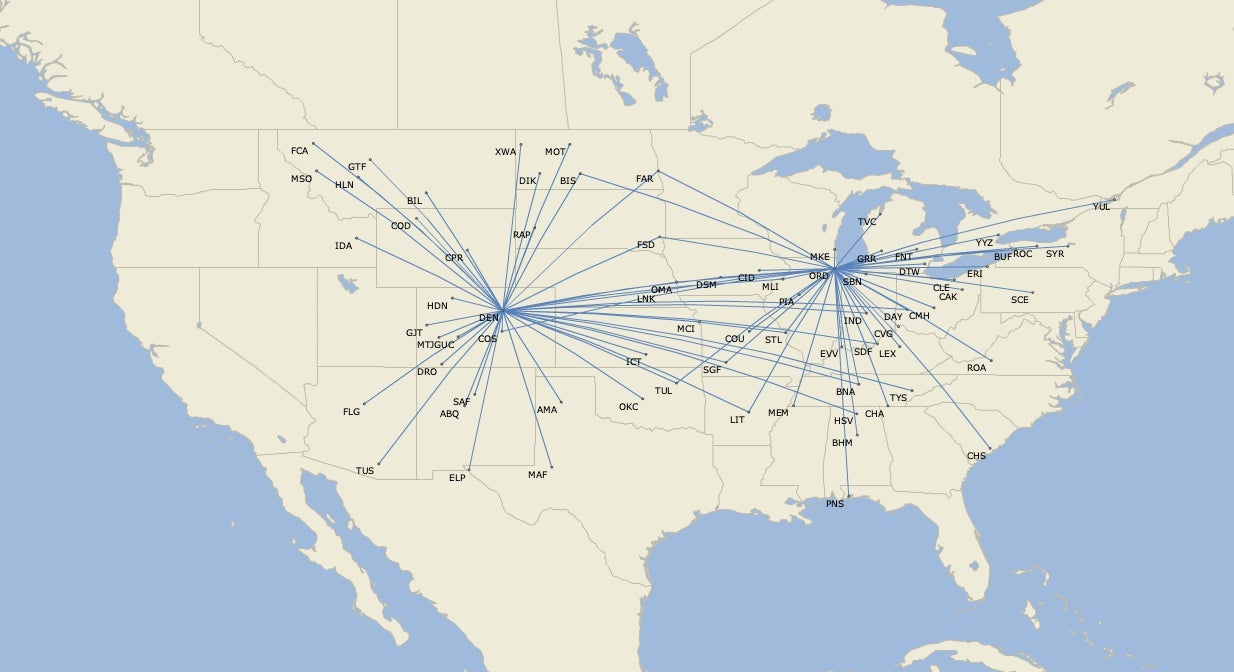

Trans States operated 43 Embraer ERJ-145s for United at the end of December, the mainline carrier's latest fleet plan shows.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app