Your cab ride to and from NYC's airports may get more expensive

A trip to and from New York City's airports may be about to get more expensive. New York's Taxi and Limousine Commission (TLC) is proposing a rate hike on taxi rides between John F. Kennedy International Airport (JFK) and Manhattan. It's also proposing adding a flat rate on trips from LaGuardia Airport (LGA) to parts of Manhattan.

If approved, the change would raise the flat fare on one-way cab trips between JFK and Manhattan from $45 to $52. The change would create a $39 one-way flat fare for trips between LaGuardia and Manhattan, south of West 110th Street and East 96th Street. Currently, there is no flat fare for cab rides between Manhattan and LaGuardia. We should note, however, that it can be quite a bit more expensive than $39 to take a cab to Manhattan from LGA, especially during rush hour.

The TLC believes the proposed fares will help put more money in the pockets of drivers, and make it easier for passengers arriving at the airports to find a cab. The proposal still needs city approval before it would take effect.

Supply and demand problems

Have you ever arrived at JFK or LaGuardia and had trouble finding a cab? According to New York City records reviewed by TPG, this is an "issue of concern," according to the TLC.

The commission said taxi drivers spend an average of 78 minutes waiting to pick up passengers at LaGuardia, and an hour and 45 minutes at JFK. The TLC said drivers often end up deciding to "deadhead," or return to Manhattan without a passenger, in hopes of accruing more fares in the city. That leads to fewer cabs waiting at the airport, and arriving passengers struggling to find cabs.

The TLC said this problem is of particular concern in the evening hours and on weekends. The commission hopes that by adding a flat rate fare at LaGuardia and increasing the fare at JFK, drivers will have more incentive to wait for passengers.

Related: Uber and Lyft add fuel surcharges.

According to the filing with the city, the current $45 flat taxi rate between JFK and Manhattan has been in place nearly 10 years since September 2012.

Options for getting to Manhattan from JFK

There are options if you're looking to save some money at the expense of time. Using public transportation, you can take the AirTrain from JFK and connect to either the NYC subway or the Long Island Rail Road (LIRR).

A ride on the AirTrain costs $8 as of this month. You can then connect to a subway at a cost of $2.75 per ride. That brings the total cost to get to Manhattan from the airport to $10.75.

If you're looking for a bit more speed, you could instead take the AirTrain for $8 to the Jamaica station and connect to the LIRR. The total fare depends on where you're headed. A trip to Penn Station near Times Square would cost you $7.75 during off-peak hours or $10.75 during peak hours, bringing your total cost to $15.75 or $18.75.

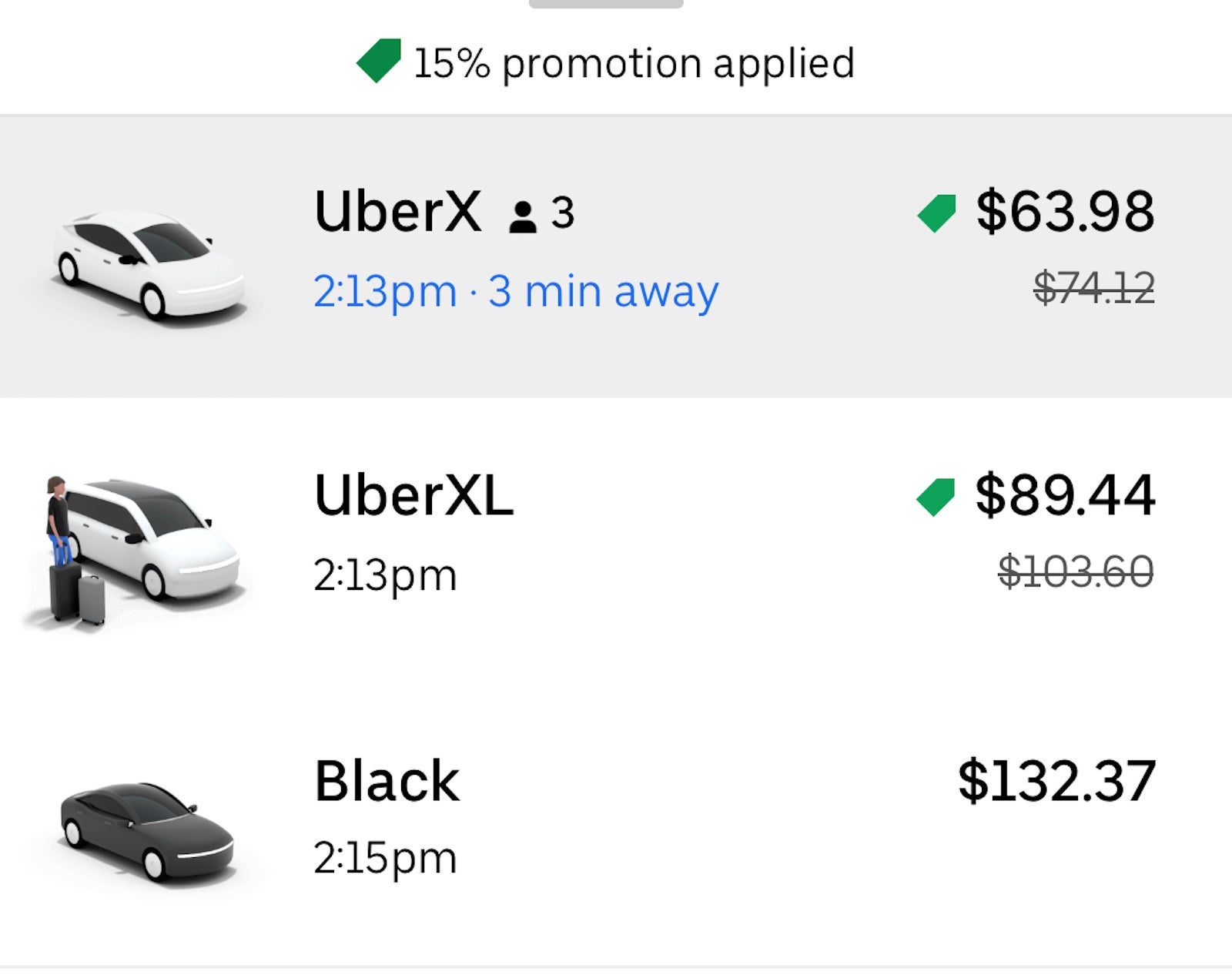

There are, of course, any number of rideshare options. Writing this story at midday on a Friday, I plugged a trip into my Uber app from JFK to Times Square. For a standard UberX car, the fare was $63.98 (with a 15% promotion applied) and my estimated wait time for a car was three minutes. The app also offered an UberXL (necessary for a larger group) for $89.44 with the 15% promotion applied. As rideshare users know, those rates can fluctuate depending on demand.

Options for getting to Manhattan from LGA

Most of your taxicab alternatives to and from LaGuardia are going to involve a bus. You can take a bus for $2.75 from the airport to a subway station or to the Long Island Railroad. You can then take the subway to Manhattan. Or, a ride from the Flushing LIRR station to Penn Station costs $7.75 during non-peak or $10.75 during peak hours, bringing your total cost to $10.50 or $13.50.

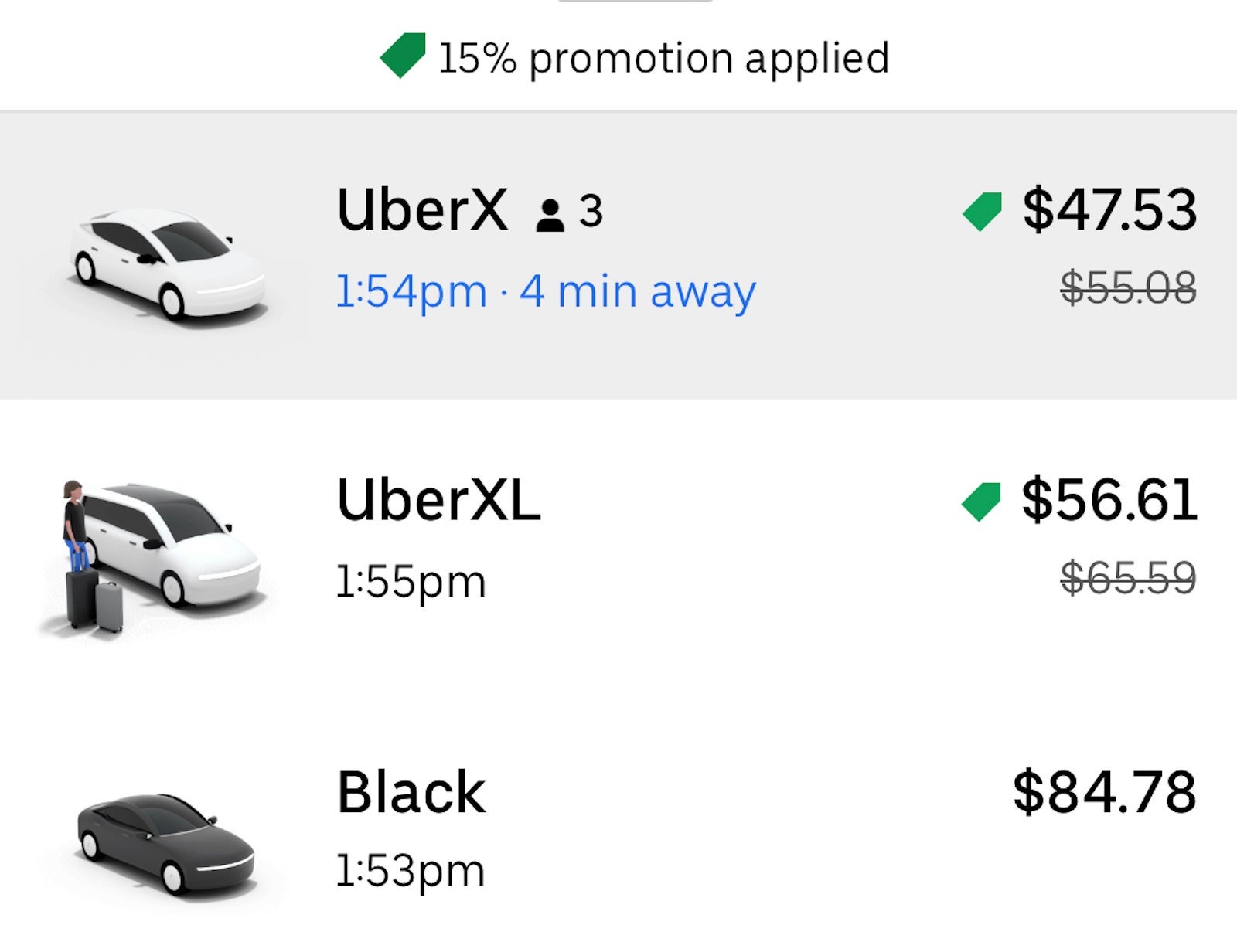

Checking Uber at midday on a Friday for a similar comparison to the JFK scenario, the app showed me a $47.53 UberX fare (with a 15% promotion applied) or $56.61 for an UberXL. Estimated wait time: four minutes.

What about a helicopter instead?

If you're willing to spend more money on your commute in the interest of speed (and novelty) there's another option TPG has reported on in recent years. Blade offers a special type of taxi service in the form of a helicopter ride. The service can get you from New York's airports to Manhattan and other destinations in minutes.

Blade currently has a deal for flights between Newark Liberty International Airport (EWR) and Manhattan: $97 each way, for flights booked by March 28, with a return flight scheduled within 14 days of the departure. The checkout code is EWR22.

Related: Blade resumes service to NYC airports

Bottom line

If New York City leaders approve these fare changes, your taxi ride to and from JFK and LaGuardia would get more expensive. In the case of JFK, the cab fare would cost you $7 (or about 15%) more. At the same time, the TLC thinks this will make it easier for arriving passengers to find a cab, perhaps reducing wait times and frustration.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app