Supersonic Jet Company Boom Technology Just Got a Big New Investor

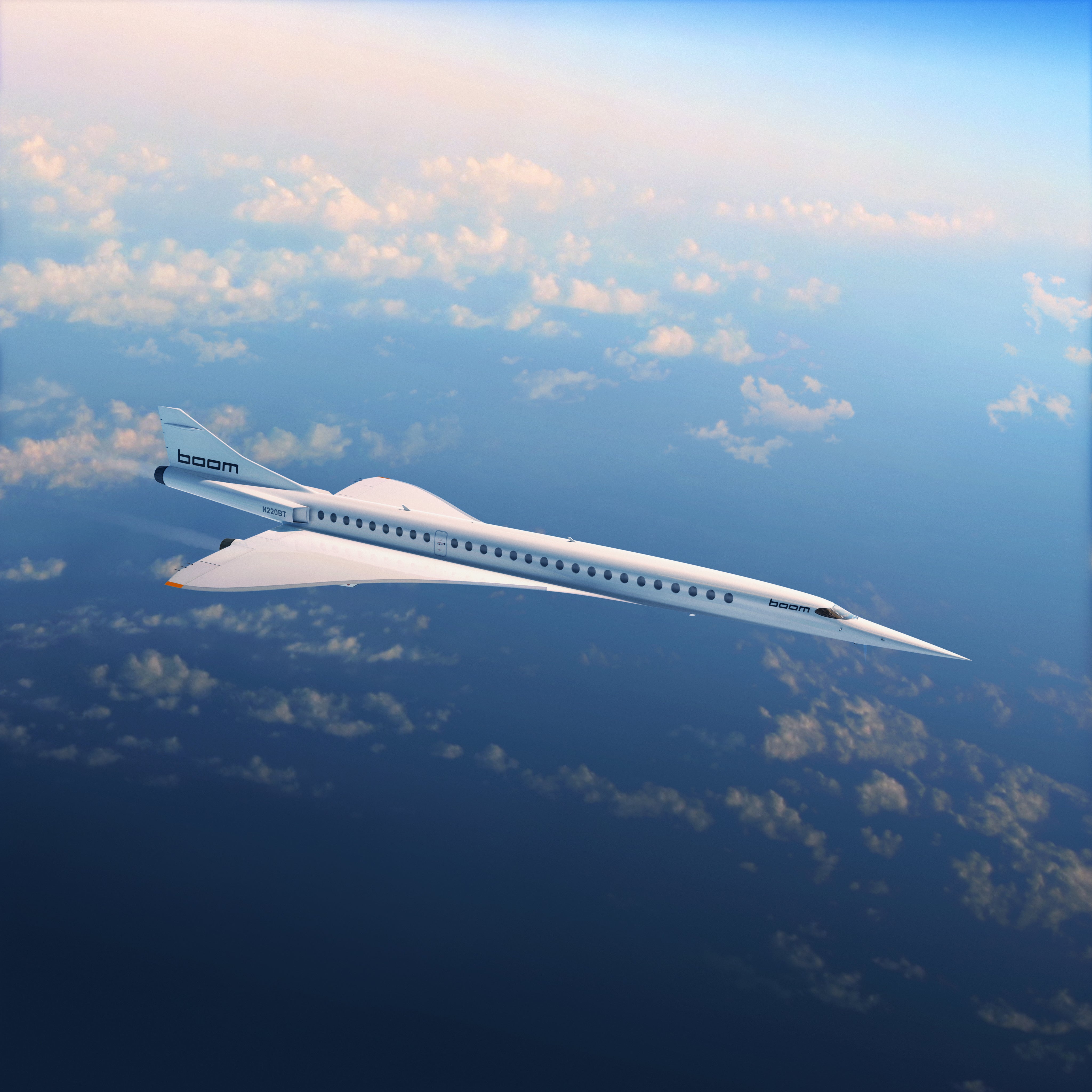

Aviation startup Boom Technology is developing a supersonic passenger plane that will seat 45 to 55 passengers. The Denver-based aircraft company gained a new investor on Wednesday: Chinese travel conglomerate Ctrip.

The new investor is a major step toward Boom's goal of having the supersonic jet on the market by 2023. Industry insiders have compared the jet to the now-defunct Concorde, which was known for completing its iconic transatlantic route in less than half the time of traditional aircraft.

Boom Technology's plane would offer a similar service on transpacific routes to Asia. "San Francisco to Shanghai, for example, could shrink from 11 hours to 6 — and a typical round-trip itinerary can be accomplished two whole days faster," Boom CEO Blake Scholl said in a press release. The plans for the aircraft show it reaching speeds up to Mach 2.2 (1,451 miles/hour), which is about twice as fast as the average passenger jet.

It is not clear exactly how much Ctrip is investing in the Boom. The company had raised $47.3 million as of December 2017, after a $10 million investment from Japan Airlines, according to numbers from funding tracker site Crunchbase.

"All that I can say from my end is that Boom has raised (so far) over US$85 million, including seed investment, venture capital, and investments from strategic partners," Ctrip Senior International PR Manager Wei Yuan Min told Jing Travel. "At Ctrip, we invest in the future to ensure that our users are able to have access to futuristic experiences."

It is possible that Ctrip invested the difference between the $47.3 million Boom raised in its December funding round and the $85 million it says it has now. An investment of about $40 million would not be untypical for Ctrip. In 2016, it executed a $1.74 billion acquisition of Scottish travel fare metasearch engine Skyscanner.

According to Ctrip Co-founder and Executive Chairman James Liang: "As a leading innovator in the commercial aviation industry, Boom will be positioned to provide exciting premium global flight options for Ctrip users and Ctrip is making a strategic investment in the next generation of travel."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app