Successfully completing a status challenge: AA Executive Platinum to Delta Platinum

Update: Some offers mentioned below are no longer available. View the current offers here.

I've been a major lifelong fan of American Airlines. I joined the AAdvantage program way back in 1997, and I've been an executive platinum for several years now. As The Points Guy has reported, the AAdvantage program has gone through a few devaluations, and airline operations have had some challenges in the past few years.

Overall, though, I've been treated very well by American Airlines and despite bumps in the road, I'd never thought about switching carriers.

But after AA instituted a new spend requirement of $15,000 for 2019 that could no longer be — at least partially — mitigated with credit card spend, I knew I could no longer swing Executive Platinum status.

Sign up for the free daily TPG newsletter for more travel tips!

You see, I used to be able to take off $6,000 of the former $12,000 AA spend requirement by putting all my spending on the Barclays AAdvantage Aviator Silver Mastercard. (You can get this card only by upgrading from the Barclays Red Aviator Card.)

Last year, I put $50,000 on the card, and got $6,000 in EQD's. But this year, I only got $3,000 in EQDs after spending that same $50,000, as Barclays had cut its EQD benefit in half. (I still got 10,000 in EQMs toward status, which was nice.)

I knew I was unlikely to make EP again.

I figured if I was going to be a midlevel status, I might as well try something new. That along with AA's recent travails got me curious about checking out the competition. So this summer, I signed up for a Delta Air Lines status challenge.

Thankfully, friend and Delta expert Rene de Lambert helped me through the process. Also instrumental was the TPG guide to status matches and challenges. TPG values Delta Platinum status as worth about $3,865 so it's definitely worth the effort.

Delta has an official SkyMiles Medallion Status Challenge landing page where you can upload your proof of current status and request to begin a challenge. I knew to do it after July 1, 2019, to get status through January 31, 2021. That's a year and a half of status!

Related: What is Delta elite status worth in 2019?

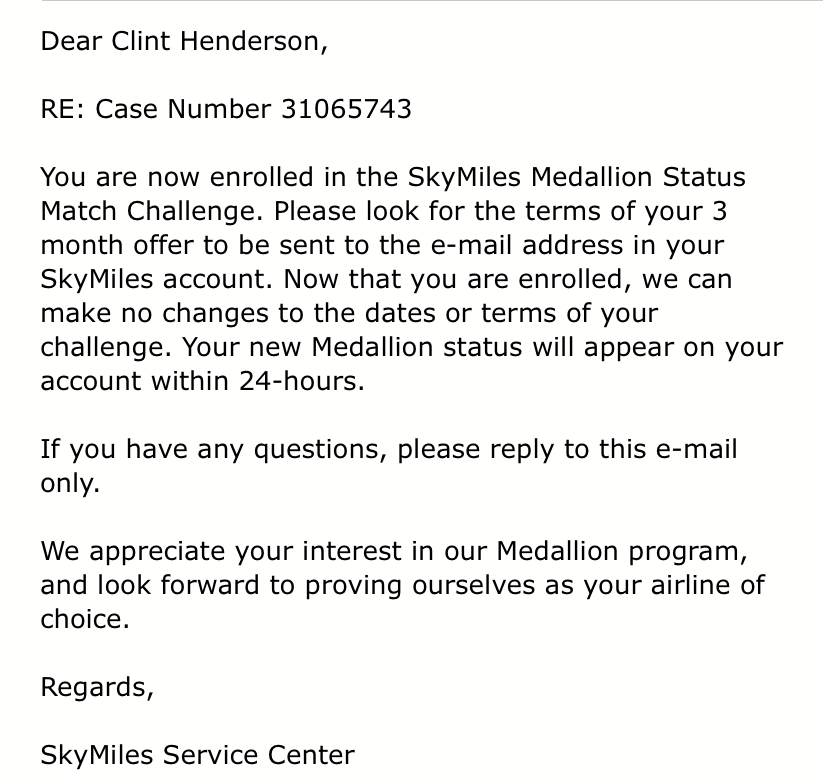

I sent them a picture of my AA card showing I held Exec Platinum status via the website, and got a confirmation that my request was received. It took 2 weeks, but I eventually got word via email that I was enrolled. I was half hoping they would offer me a challenge to Diamond, but no such luck.

That same day my new Platinum status showed up in my Delta account.

Now came the tricky part: I had to earn 18,750 MQMs in 90 days plus $2,250 dollars in MQDs. There is a way around that hefty spend requirement, but it's not easy. If you spend $25,000 on the Delta Gold or Platinum card or $30,000 on the Delta Reserve card — depending on which card you have — you can get a spend waiver for Silver, Gold or Platinum status. (To get the waiver for Delta Diamond status you'd have to put $250,000 in spend on the card!).

I knew about the workaround and had several months of payments to put on a card, so the same day I applied for the challenge I also opened the Delta Reserve® Credit Card from American Express. I used my new Reserve card to pay my bills and successfully completed the $30,000 in spending, and hit the MQD requirement.

Next, I need to fly ... a lot.

One great way to earn lots of Delta MQMs (and MQDs) is by flying partner airlines in business class. I booked an Aeromexico business class vacation from New York-JFK to Guatemala City (GUA) via Mexico City (MEX) on Expedia that included a hotel for two nights in Guatemala City for just over $1,000 dollars. I got 8,238 MQMs and $2,196 in EQDs for the journey. That one trip nearly got the challenge done in EQDs and got me well on my way to the EQM requirement.

Fortunately, I had a few more domestic trips including a roundtrip to San Francisco, and another to Butte, Montana that got me well over the top and voilà. Platinum status until 2021.

I'll report back on how flying Delta compares to American Airlines. In any case, I did end up earning Platinum Pro on AA so it should be a fun year.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app