Spring travel chaos as EasyJet and British Airways cancel hundreds of flights

The first day of the Easter school holidays in the U.K. kicked off in chaos today as overwhelmed airlines canceled hundreds of flights.

EasyJet and British Airways were the worst hit, saying COVID-19 had torn through their workforce leaving them no choice but to ground more than 300 planes since Saturday. At the time of writing, they had canceled 62 and 90 flights respectively on Monday.

Pertinently, the coronavirus-related cancellations come weeks after both airlines made much fanfare of their decisions to ditch mask rules on their flights.

Airports, already struggling with staffing issues, were left to deal with the fallout as queues of angry travelers snaked through terminals, and in some cases into parking lots outside.

It comes as thousands of U.K. vacationers descend on airports across Britain for the first school holidays since the start of the pandemic and the lifting of travel restrictions.

Related: The Netherlands drops predeparture testing ahead of Easter travel surge

At Manchester Airport (MAN), some travelers missed their flights due to long lines, while others reportedly jumped over barriers and abandoned their luggage.

Lengthy queues were also reported at London Heathrow Airport (LHR) on top of hours-long flight delays.

EasyJet apologized for canceling 222 flights over the weekend but said it was a small proportion of its wider schedule, though we imagine this was little consolation to travelers who were affected.

"As a result of the current high rates of [COVID-19] infections across Europe, like all businesses, EasyJet is experiencing higher than usual levels of employee sickness," a spokesman said.

EasyJet said it tried to offset the problem by deploying standby crews but was forced nevertheless "to make some cancellations in advance."

"We have taken action to mitigate this through the rostering of additional standby crew this weekend, however, with the current levels of sickness we have also decided to make some cancellations in advance which were focused on consolidating flights where we have multiple frequencies so customers have more options to rebook their travel, often on the same day," it said last night.

The airline said refunds, vouchers or the opportunity to rebook alternative flights were available.

British Airways — which cut around 10,000 jobs during the pandemic — also apologized after grounding 90 flights from Heathrow on Monday, adding to the ones axed last week due to a huge IT failure.

Fifty flights were canceled in advance last week, but more got the last-minute chop last night due to COVID-19 sickness among staff.

Related: Travel is back in a big way as COVID-19 appears to be entering endemic stage; Why I'm still nervous

British Airways and EasyJet are among a handful of airlines that have dropped the requirement to wear masks on their flights.

Announcing the move less than two weeks ago, EasyJet said: "Following the removal of mandatory mask-wearing in a number of countries, we have reviewed our mask policy on board and have taken the decision that, from March 27, 2022, on flights where masks are no longer legally required at both ends of the route, we will not mandate customers and crew to wear masks on board the flight."

A week before that, British Airways trumpeted: "As an international airline, we fly to a large number of countries around the world, all of which have their own local restrictions and legal requirements ... and from Wednesday, March 16, customers will only be required to wear a face-covering on board our flights if the destination they're traveling to requires it."

In a further blow to Easter travelers, Britain's flagship airline is also pumping up its prices for some short-haul flights until Easter Monday, in an apparent bid to deter customers from booking, The Independent reported.

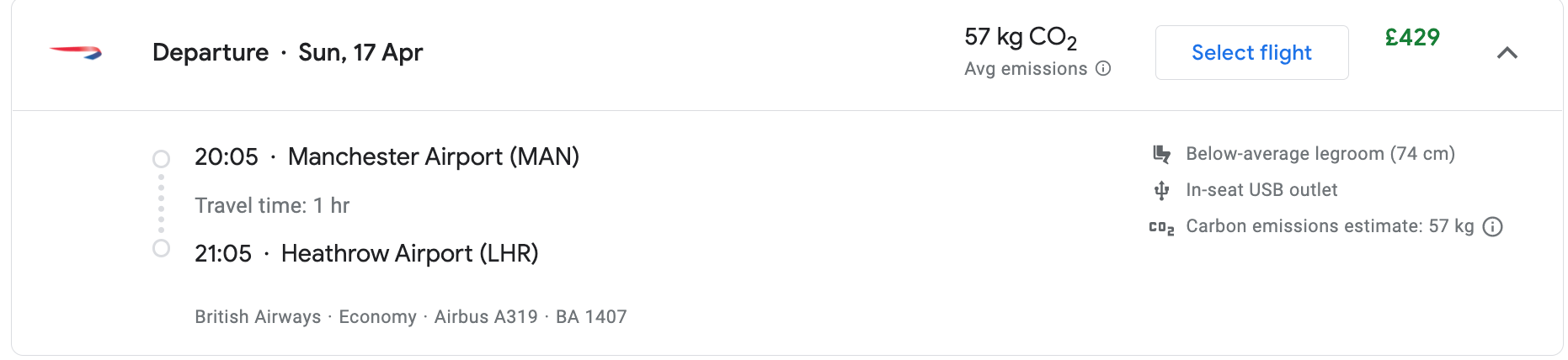

For instance, the lowest price for the 151-mile flight from Heathrow to Manchester up to and including April 17 is £415 ($544) – a rate of £2.75 (about $3.61) per mile.

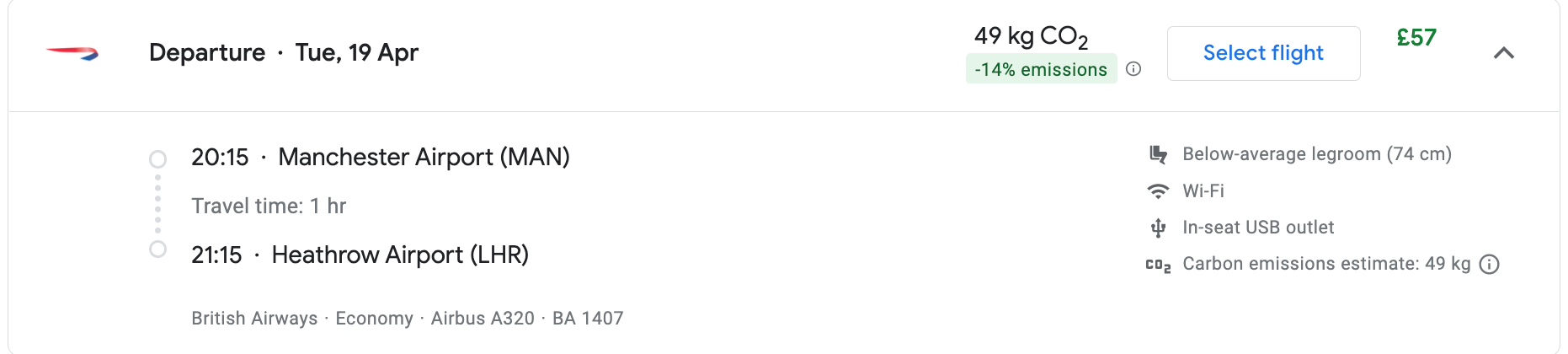

Meanwhile, a flight at a similar time that departs just two days later can be snapped up for £57 ($74.76), some £372 (or $488) cheaper and at a rate of £0.37p (or just about $0.50) per mile.

On some routes, the cost per mile is said to be even pricier than the top fares on Concorde's London to New York route.

London Stansted Airport (STN) is also bracing for spring crowds. It said it expected 1.3 million people to pass through its gates over the Easter holidays, and urged travelers to arrive early for flights.

"The lifting of international travel restrictions has been extremely good news for passengers and the whole of the aviation industry following the most challenging two years in our history," said managing director Steve Griffiths. "We know people are excited to be flying again after such a long time, so we want to provide them with the best possible experience."

"I want to reassure people that we are working hard to get back to where we need to be. While queues may be longer than people are used to at times, customers can definitely help us by arriving in good time."

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app