The 2 reasons I don't use Marriott mobile check-in

Hotel companies around the world continue to invest heavily in upgrading their technology, including providing mobile room keys and chat features that let you connect with the property directly through the app. When people think about hotel applications, one of the most basic functions that comes to mind is mobile check-in for an upcoming stay.

I'm a Marriott Bonvoy Titanium elite member, and recently got back from a month-long trip that saw me staying 23 nights across eight different Marriott properties. Not once during this trip did I use Marriott's mobile check-in option in the app, and there are two important reasons why.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

I get upgraded without using mobile check-in

There are generally two reasons why people use mobile check-in services: convenience, and because they think it will enhance their chances of an upgrade. I don't really buy the convenience argument since at 99% of hotels you still need to stop by the front desk, show your ID and swipe your credit card to pick up a room key, but I'm finding the upgrade argument to hold less and less sway as well.

Related: Which Marriott Bonvoy credit card is right for you?

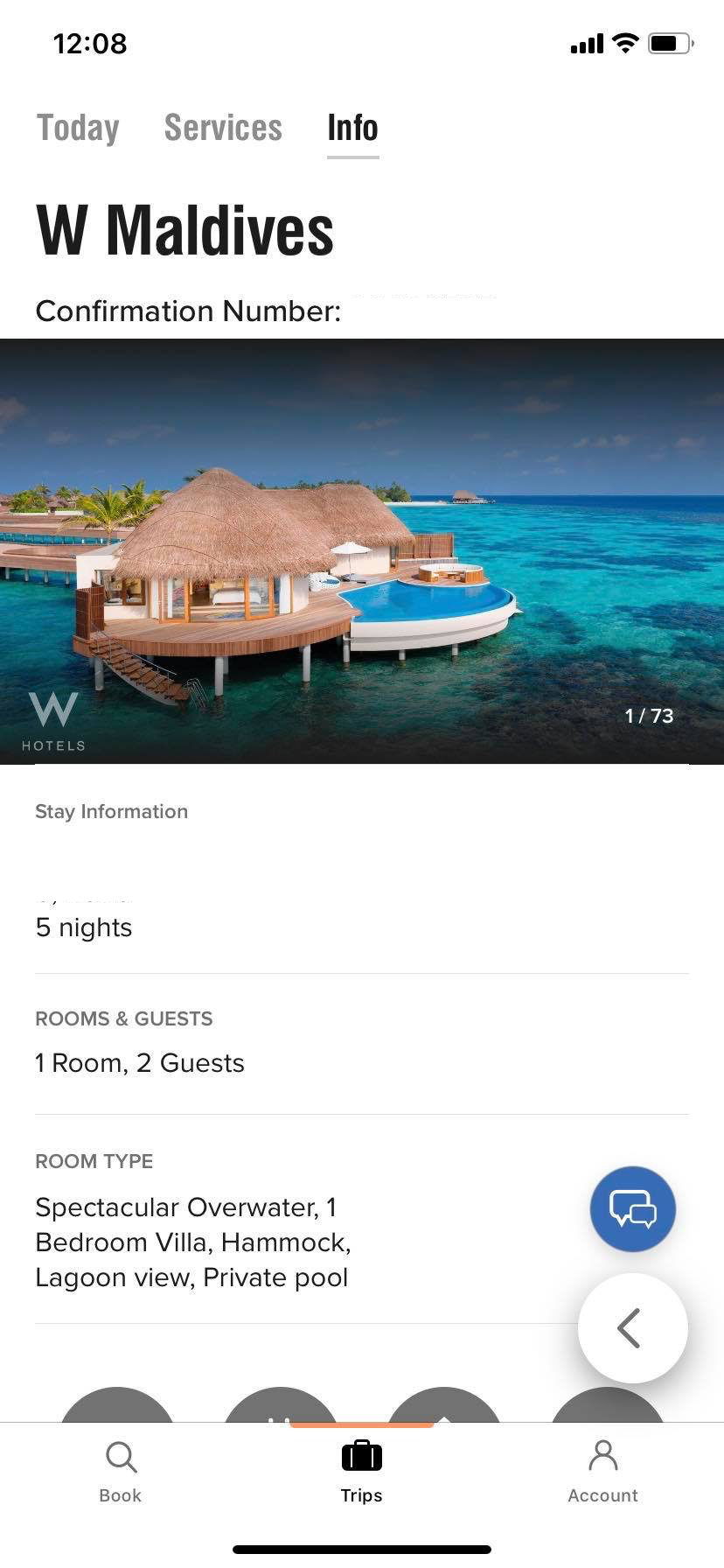

I don't know what's changed, but in the last six months or so I've noticed more and more hotels have started upgrading me two or three days before arrival, with my new room type reflected in the app. I don't know what caused this sudden change or whether I'm just getting very lucky with the specific hotels I've been staying at, but I never use mobile check-in so that doesn't explain it. For example, my upgrade to an overwater villa at the W Maldives was showing in my Marriott app the day before I arrived in Malé.

When I got to the W lounge to wait for my seaplane flight, Adam from the W team was so excited to tell me I'd been upgraded. I decided to play dumb while he gave me a strong handshake and the biggest smile I'd ever seen when he told me the good news, but I'd already known about the upgrade for nearly 24 hours.

Of course, I don't get preemptively upgraded like this at every property. More often than not, there are better rooms (including suites) available but I'll only get upgraded if I ask specifically at check-in. In that case, checking in on the app doesn't help at all as I still need to stop by the desk.

Related: Maximizing redemptions with Marriott Bonvoy

Marriott's elite benefits guarantee

You might be thinking to yourself "fine, so there's no clear benefit in mobile check-in but I'm going to keep doing it because there's no harm either." I'll admit that this second point is a bit nitpicky, but for elite members, especially those who've felt burned under the new Bonvoy program, this point is worth paying attention to.

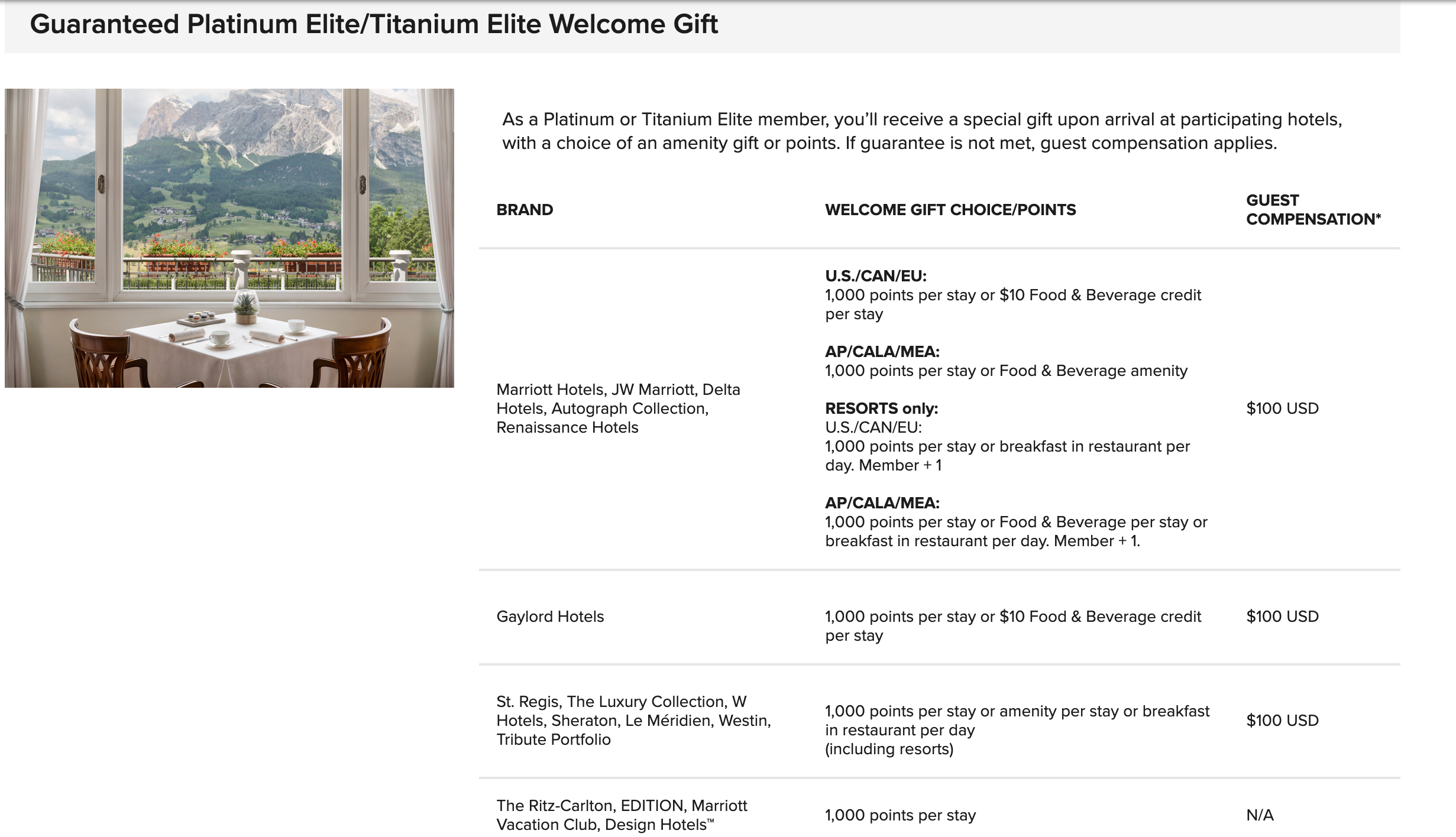

Marriott publishes an elite benefits guarantee, which clearly details the major benefits that come with different tiers of elite status, and more importantly, what compensation you're entitled to if the hotel fails to deliver on published benefits. If you're a Platinum, Titanium or Ambassador elite, you're entitled to a choice of welcome gift at most properties. The exact options vary by brand, but will usually include bonus points, free breakfast, a food and drink credit, or some local amenity.

I know exactly what gift I want to select based on the brand I'm staying at: free breakfast unless there's a club lounge or it's included already, and bonus points as my backup option. The important line here is that you'll "receive a choice of gift" when checking in. If Marriott fails to meet this guarantee, you're entitled to compensation of $100 (or the equivalent in local currency) at most luxury brands, and $25 or $50 at some extended-stay or budget properties.

So how does this relate to mobile check-in? When you check in through the app, you automatically select points as your welcome amenity, though you can change to free breakfast or any of the other options by stopping by the reception desk (again, erasing any benefit of having checked in in advance). Once you select the points, you can't then turn around and claim that Marriott didn't offer you your choice of welcome amenity: the benefit has been provided appropriately.

Related: How to get free hotel breakfast

Thankfully in all my travels I haven't yet come across a hotel that failed to offer me my choice of welcome amenity, forcing me to claim compensation under the elite benefits guarantee. Marriott properties are getting much better at uniformly recognizing elite status, and I can imagine that most properties that still drop the ball there also have other issues that would need to be addressed.

One of the reasons I've been so content to deal with all the ups and downs of Marriott Bonvoy is that Marriott has done a good job fairly compensating me every time things go wrong — absurdly long hold times, points not posting correctly, you name it. The elite benefits guarantee is another safety net, so that if Marriott doesn't deliver as advertised, you'll be compensated appropriately.

Bottom line

Mobile check-in is very easy to do, and hotel apps do a great job of sending you push notifications to encourage you to use the feature. However, when you break it down, there isn't much benefit in doing so. For starters, you'll almost always need to stop by the physical check in desk to verify your ID and pick up your key, and by using the mobile check-in you'll end up invalidating an elite benefit guarantee that you might need later.

Of course we'd all rather hotels stick to the script and do what they're supposed to do, but claiming the compensation you're entitled to when they don't helps keep them honest and reminds them to play by the rules.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app