Beware: Your next transfer to LifeMiles might not actually be instant

There's lots to love about the Avianca LifeMiles program. It offers excellent redemption rates and doesn't add fuel surcharges on Star Alliance flights. Even better, it's a transfer partner of most of the major point currencies (American Express Membership Rewards, Capital One, Citi ThankYou Rewards and Marriott Bonvoy) and frequently offers bonuses on transfers, such as one right now for transfers from Capital One.

The program does have some major restrictions, though. For example, LifeMiles doesn't always have access to the same award space as Star Alliance partners and awards cannot be canceled online. Plus, it imposes a small partner booking fee on all partner-operated tickets.

In this post, we'll discuss another quirk that can be problematic if you plan on transferring points to the program.

The problem

With the exception of Marriott Bonvoy, point transfers to LifeMiles are usually instant. This means that when you initiate a transfer, your miles should appear in your LifeMiles account right away (though you may need to log out and log back in before they pop up).

That still holds true. However, you might not actually be able to redeem your miles right away.

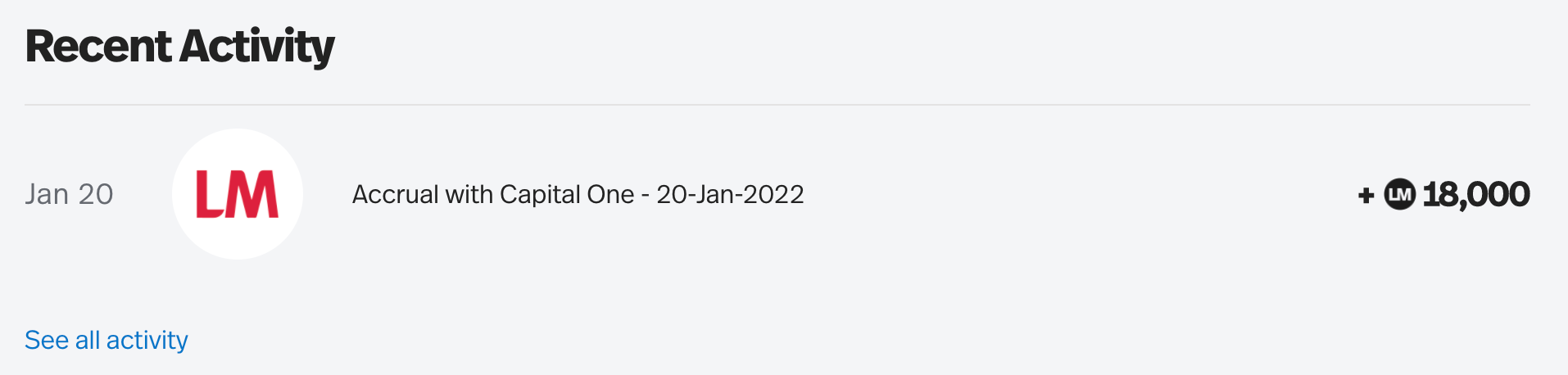

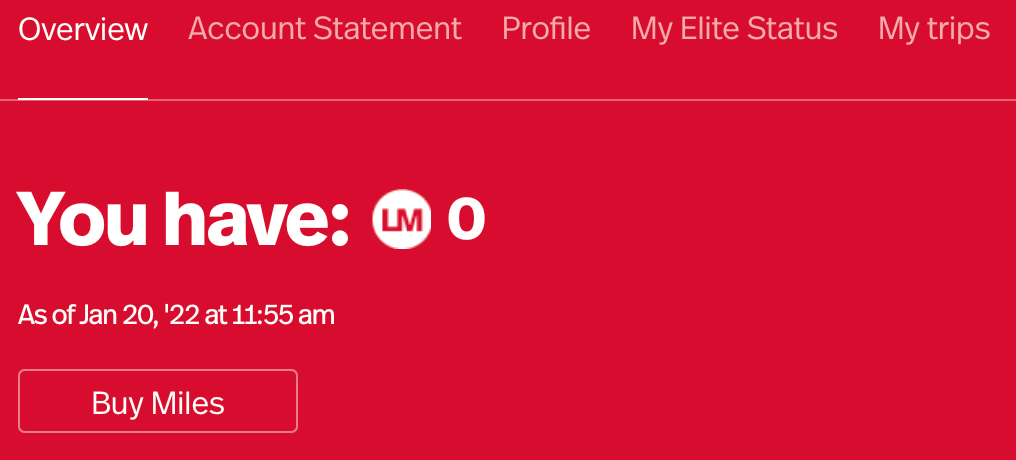

Based on multiple tests conducted by TPG staffers, transfer activity from Capital One is indeed showing up on account statements almost instantaneously. However, the mileage balance on the accounts isn't updating right away. In other words, the miles can't actually be redeemed right after you transfer.

We reached out to LifeMiles' customer support team and were informed that account balances might not update until around midnight El Salvador time (1 a.m. EST). Even more frustrating, LifeMiles agents have no way to manually update the account balances sooner.

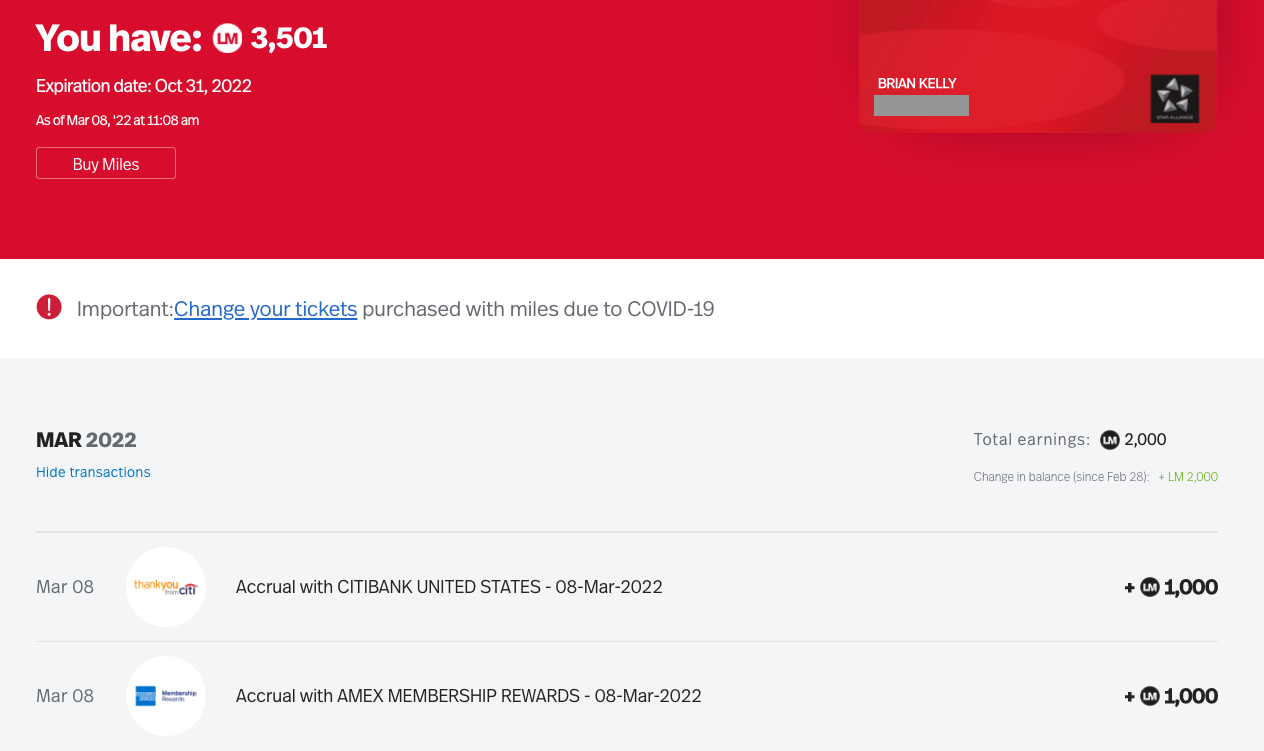

The TPG team only experienced this issue when transferring points from Capital One, and the miles did end up becoming usable by the next day. However, readers have reported similar issues when transferring points from American Express.

Related: Save on Star Alliance award flights with 20% transfer bonus to LifeMiles

The implications

Waiting an extra day or so for miles to post might not seem like a big deal, but it can have some major implications.

The biggest issue is that award availability can change while you're waiting for miles to show up in your account. LifeMiles does not let you put partner awards on hold so there's no guarantee that you'll be able to book the flight you wanted by the time your miles post. Transfers are irreversible, so in the worst-case scenario, you'll be stuck with thousands of miles you have little use for beyond your originally intended award ticket.

Related: Here's why you need a healthy stash of Avianca LifeMiles

This also makes it harder to redeem miles for last-minute awards. Same-day and next-day bookings are effectively out of the picture if you won't be able to redeem your miles right away. This can also make it more difficult to secure Lufthansa first-class awards, for instance, which are generally released closer to departure.

Bottom line

You can often get great value by transferring flexible points to Avianca LifeMiles, especially now with the 20% transfer bonus from Capital One. However, there's some risk in doing so as you might not be able to redeem your miles right away and the award you originally intended to book might no longer be available by the time they become redeemable.

Unfortunately, LifeMiles' customer service agents have no way to expedite transfers, but hopefully, this issue will be resolved soon. For the time being, transferring points from Citi ThankYou Rewards might be your safest bet for boosting your LifeMiles balance.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app