Big changes coming to JFK as 60-year-old Terminal 2 closes for good

New York's busiest airport is in the midst of a major makeover, and with it comes the demolition of one of the longest-standing relics of a bygone era.

As of Jan. 15, the 60-year-old Terminal 2 at John F. Kennedy International Airport (JFK) will no longer be operational. The airport is winding down operations at the 10-gate facility starting Jan. 10, beginning with the phase-out of departing flights.

Arriving flights will no longer use Terminal 2 as of Jan. 14, the date when the facility closes for good, according to an update posted by the Port Authority of New York and New Jersey, the government agency responsible for overseeing JFK airport.

After Terminal 2 closes, it'll meet its final fate: demolition. The facility is expected to be torn down in phases shortly after the final arriving flight lands Jan. 14. There's no word yet on which flight will be the last to deplane at the facility.

While the closing may be bittersweet for some longtime travelers, the demolition will make way for an all-new JFK experience that's likely to impress anyone who has recently passed through the airport.

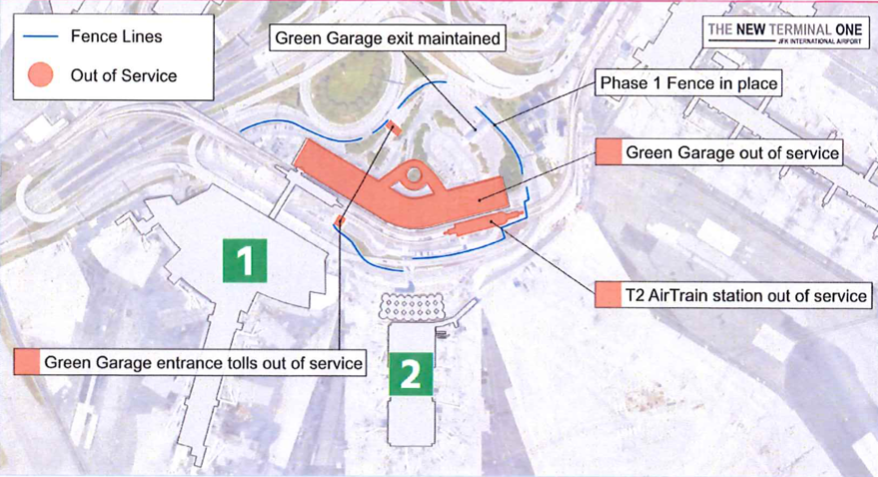

By tearing down Terminal 2, airport authorities are making way for the "New Terminal One," which replaces the existing Terminal 1 and Terminal 2 spaces. It will also include the vacant site of Terminal 3, fondly remembered as Pan Am's Worldport.

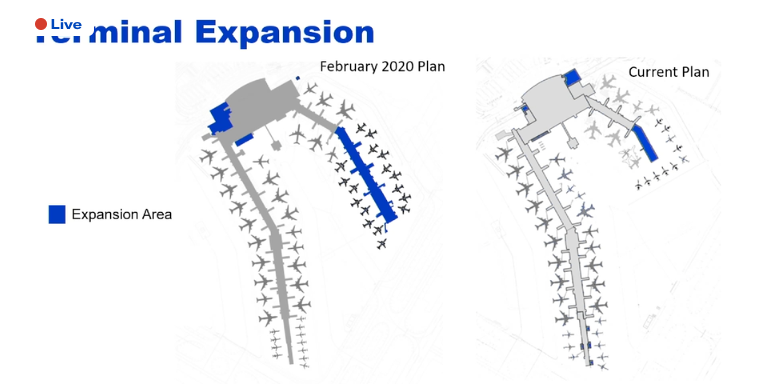

Construction on the New Terminal One began in September. The new terminal will measure a whopping 2.4 million square feet, nearly as large as LaGuardia Airport's (LGA) two new terminals combined. Construction is expected to be fully completed in 2030.

At a cost of $9.5 billion, the New Terminal One will become the flagship JFK international terminal. All but one of the new facility's 23 gates will be able to accommodate wide-body aircraft that fly long-haul missions.

The demolition of Terminal 2 and the New Terminal One are components of the major $18 billion "JFK Vision" transformation plan, which also includes an expanded Terminal 4 and Terminal 8, and new Terminal 6.

While the future is bright for JFK and the space that Terminal 2 used to occupy, it hasn't necessarily been that way in recent years. Terminal 2 first opened on Nov. 18, 1962, and it was jointly operated by three now-defunct or nonexistent airline brands: Braniff, Northwest and Northeast.

Terminal 2 has had the same number of gates (10) throughout its history, but they aren't all large enough to serve wide-body jets. The facility is now the oldest active terminal at JFK, one of the original pieces of what was called "Terminal City."

In the early 1960s, JFK (then referred to as Idlewild Airport) was growing so rapidly that airport planners decided to dedicate an individual terminal to each major airline operating there at the time. The largest carriers, such as TWA and Eastern Airlines, got their own facilities, while Braniff, Northwest and Northeast shared Terminal 2.

Fast forward many years and Delta has used Terminal 2 as an auxiliary space for its hub operations in New York, with some flights departing and arriving at this outdated facility.

Though Delta operated a Sky Club in Terminal 2, it wasn't nearly as large or as impressive as its main one in Terminal 4, the airline's primary home at JFK. To ease connections, Delta operated an airside shuttle bus between terminals 2 and 4.

With the closure of Terminal 2, Delta's operations will be consolidated at Terminal 4. While that may temporarily place some strain on the existing 38-gate facility, Terminal 4 will also get a major expansion, which includes additional gates for Delta's operation, along with $100 million in renovations for the existing check-in areas, as well as a modified arrivals-level curb to aid congestion.

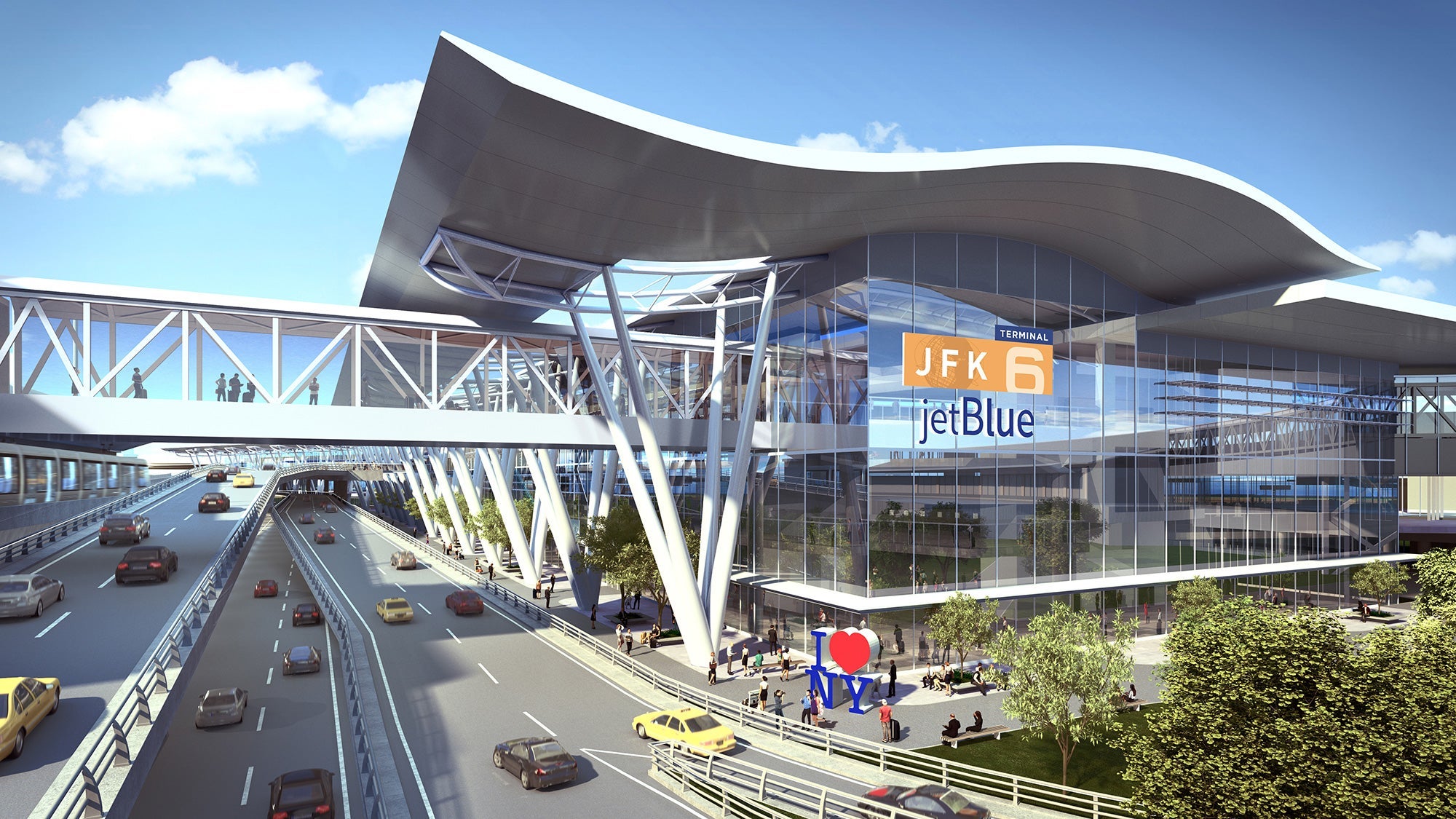

In addition to the New Terminal One and expanded Terminal 4, a brand-new Terminal 6 is in the works. In November, the Port Authority announced that this project secured the necessary funding to move forward with construction.

The new 1.2 million-square-foot Terminal 6 will be on the north side of the airport between the existing Terminal 5 and 7 facilities. It'll feature 10 gates, 9 of which will be capable of handling wide-body aircraft.

The first phase is expected to open in 2026, followed by a full completion in 2028. Groundbreaking is expected in the new few weeks.

When Terminal 6 is complete, the existing Terminal 7 will be demolished.

One part of the JFK Vision plan already opened late last year: the expanded Terminal 8. American Airlines led a $400 million modernization of its JFK home that includes new gates, three new premium lounges and an overhauled check-in area.

As part of the expansion, British Airways and Iberia moved into Terminal 8, with Japan Airlines expected to co-locate with its Oneworld alliance partners later this year.

Until all the JFK construction is complete, travelers departing from the airport should check their flight status to keep up with the latest changes to gate and terminal assignments.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app