No Plane Left Behind: JetBlue Has Evacuated All Aircraft From Florida

In February 2000, a brand new airline celebrated its first-ever flight, between New York's JFK and Fort Lauderdale, Florida (FLL). Since then, that start-up airline has taken off to become one of the major players in the US.

Since that small beginning in 2000, JetBlue has maintained a strong presence in Florida. It has become Fort Lauderdale airport's largest airline, now operating 140 daily flights from there. Of the airline's five crew bases, two are in Florida: Fort Lauderdale itself, and Orlando (MCO). In addition, JetBlue has maintenance hangers in four Florida airports: Fort Lauderdale, Orlando, West Palm Beach (PBI) and Tampa (TPA).

All of this means that at any one time, quite a few of JetBlue's 236 aircraft can be found in Florida. At least until now.

On Saturday evening, a JetBlue employee took to Twitter to note this incredible stat:

A JetBlue spokesperson was able to confirm to us that the airline has indeed evacuated all aircraft from Florida. However, JetBlue is (understandably) unable to say when was the last time it hasn't had an aircraft on the ground in Florida.

That's right: the last of the capped $99 JetBlue flights has departed Florida. Where did all of the planes go? We asked JetBlue just that question on Friday:

For Irma, our operating plan is to stage aircraft and crews at focus cities outside the hurricane path (mostly BOS and NYC) in order to resume service once we receive an all-clear from the area airports and our local crewmembers.

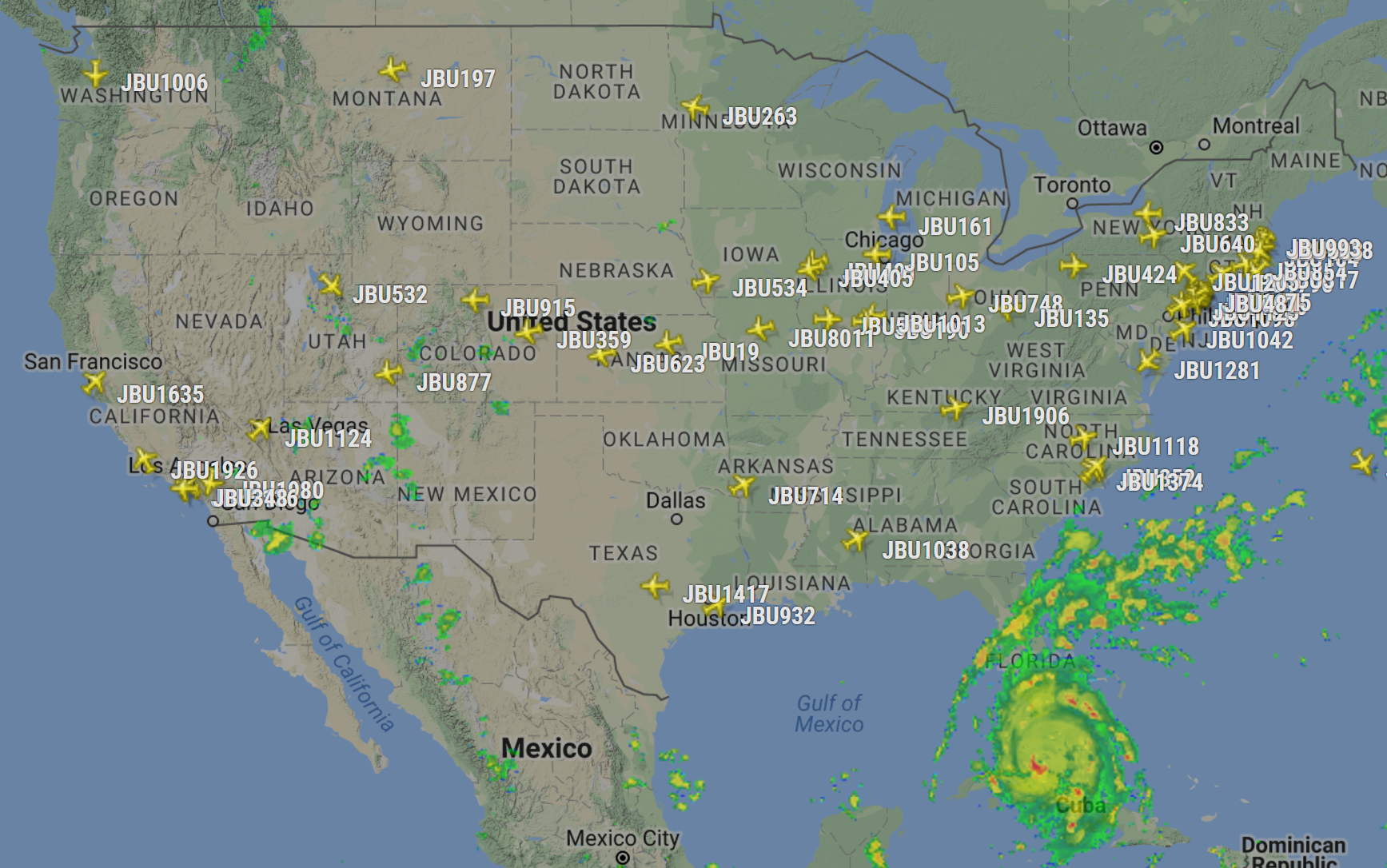

And, current JetBlue flights are giving Hurricane Irma a wide berth, as you can see in the Flightradar24 image below, showing all its airplanes airborne now. The only JetBlue plane near Florida at 8pm US Eastern time is an Airbus A320, on its way from Cancun (CUN) to New York's JFK:

Once the storm passes, hopefully the damage will be light enough for JetBlue to resume its normal Florida operations quickly.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app