Capital One re-adds JetBlue as transfer partner

There's good news for travelers with Capital One miles: The program has re-added JetBlue TrueBlue as a transfer partner.

Capital One first added JetBlue to its roster of 15-plus transfer partners in 2019, but it dropped it in 2021. Now, JetBlue is back, opening up new possibilities for Capital One cardholders to redeem their hard-earned miles.

But now that you can transfer your miles to JetBlue, should you? Here's everything you need to know.

Related: Cashing in Capital One miles? How to get the maximum value when redeeming miles

How to transfer Capital One miles to JetBlue

You can now transfer Capital One miles to JetBlue TrueBlue at a 5:3 ratio. That means for every 2,000 Capital One miles you transfer, you'll get 1,200 TrueBlue points.

This ratio isn't ideal, especially considering that you can transfer miles to most of Capital One's airline and hotel partners at a better rate of 1:1.

If you need TrueBlue points, you're better off transferring American Express Membership Rewards points to JetBlue at a ratio of 250:200 (meaning 2,000 Amex points would net you 1,600 TrueBlue points). Even better, you can transfer Chase Ultimate Rewards points and Citi ThankYou Rewards points to JetBlue at a 1:1 ratio.

But if you don't have any other currencies that transfer to JetBlue or are having trouble finding ways to use your Capital One miles with the program's other partners, this is a nice option to have.

To transfer miles to JetBlue, you'll have to set up a TrueBlue loyalty account if you don't have one already. Make sure the name on your TrueBlue account exactly matches that on your Capital One account, as any mismatch can interfere with the transfer process.

We don't recommend transferring Capital One miles to TrueBlue (or any travel partner) without having an immediate plan to use them and confirming award space for the flight you want. However, if you end up with a few leftover points after a redemption, you can save them for your next one because TrueBlue points never expire.

Related: How to keep your airline, hotel and rental car points and miles from expiring

How to redeem JetBlue points

JetBlue is a U.S.-based carrier with over 100 destinations across the U.S., Latin America, the Caribbean, Canada, and Europe. You can redeem TrueBlue points for any seat on any JetBlue flight — now including Blue Basic fares.

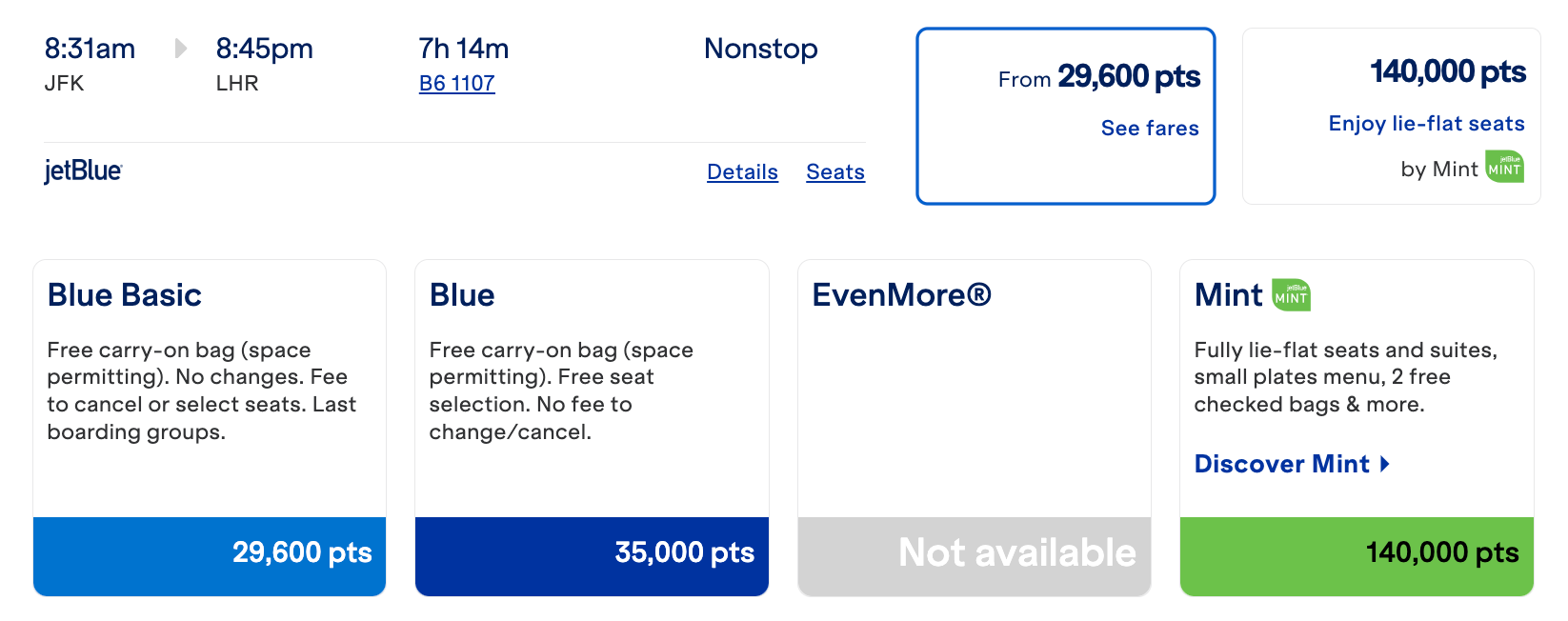

For instance, you could fly nonstop from New York to London for under 30,000 points each way in Blue Basic or in JetBlue's business-class Mint cabin for 140,000 points one-way (plus taxes and fees).

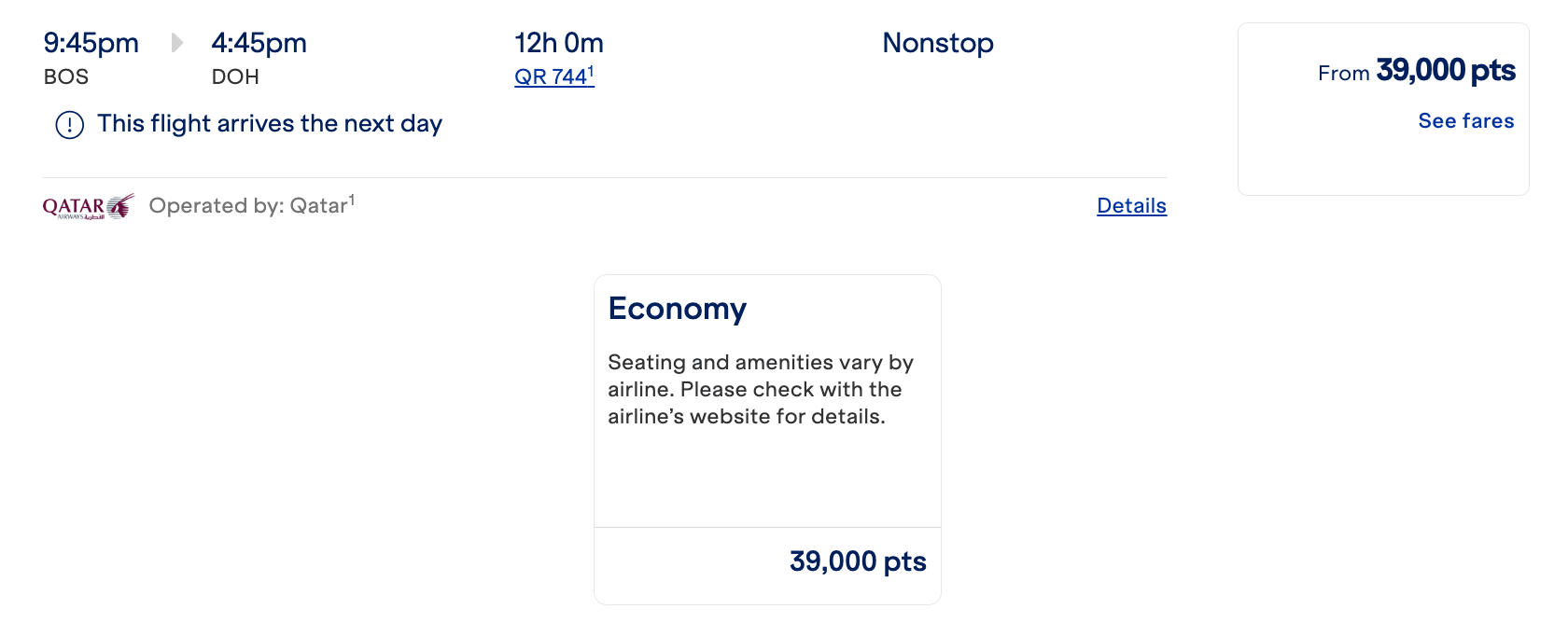

You can also redeem JetBlue points for flights operated by select JetBlue airline partners, including Etihad Airways, Hawaiian Airlines and Qatar Airways. For example, even though JetBlue doesn't fly to Qatar, you could book a trip from Boston to Doha on Qatar Airways for 39,000 TrueBlue points each way.

According to TPG's February 2025 valuations, you can expect to get around 1.35 cents per TrueBlue point. However, since JetBlue uses dynamic award pricing, the value you get for your points may vary.

Plus, if you hold the JetBlue Plus Card, the JetBlue Premier Card or the JetBlue Business Card, you'll get 10% of your points back when you redeem them for flights.

The information for the JetBlue Plus Card, the JetBlue Premier Card and the JetBlue Business Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: JetBlue's new premium credit card has launched — should you jump on board?

How to earn Capital One miles

The following cards earn miles that you can transfer to any of Capital One's 15-plus airline and hotel partners, including JetBlue.

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Spark Miles for Business

These cards let you earn Capital One miles on everyday purchases, but they also offer lucrative welcome bonuses to new members. For instance, the Venture Rewards card is offering 75,000 bonus miles after you spend $4,000 on purchases within the first three months of account opening. Plus, upon approval, you'll receive a $250 Capital One Travel credit to use during your first year.

You can also transfer rewards from some other cards to Capital One's travel partners, as long as you hold one of the above cards. For instance, while the Capital One Savor Cash Rewards Credit Card earns cash-back rewards by itself, you can transfer those rewards to one of the above travel cards and turn them into valuable Capital One miles.

Related: Why the Capital One Venture X and the Savor Cash make a dynamic duo

Bottom line

Capital One's list of travel partners has steadily grown over the years, making Capital One miles an increasingly valuable transferable points currency. The addition of JetBlue opens new redemption opportunities, primarily within North America, Latin America, the Caribbean and Europe.

However, Capital One's 5:3 transfer ratio to JetBlue will make your TrueBlue redemptions cost more miles. Look out for transfer bonuses that can help you stretch your miles further, or consider transferring to JetBlue from another program that offers a better ratio.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app