Another hotel devaluation: Hilton raises the price of some properties to 120,000 points per night

Editor's note: This post has been updated with a statement from Hilton.

While Hilton Honors has long employed dynamic pricing for award bookings, it has tended to stick to set point ranges for standard award nights, meaning nights where there is award availability for a standard room.

For the past few years, the highest standard award rates for some of the chain's nicest properties, including many Conrads, Waldorf Astorias and LXRs, have hovered around 95,000 points. There were some exceptions, like the Waldorf Astoria Los Cabos, where standard awards cost 120,000 points, or the Waldorf Astoria Maldives, where standard awards started at a whopping 150,000 points. But they were few and far between.

It looks like more hotels are going to start costing a lot more in terms of points now, though.

Hilton has quietly raised the cost of a handful of former 95,000-point properties to the 120,000-point level, representing a 26% increase in price. The change was first noticed by View From The Wing at various Maldives properties that previously only charged 95,000 points per night for standard awards, including the aspirational (and ever-popular) Conrad Maldives.

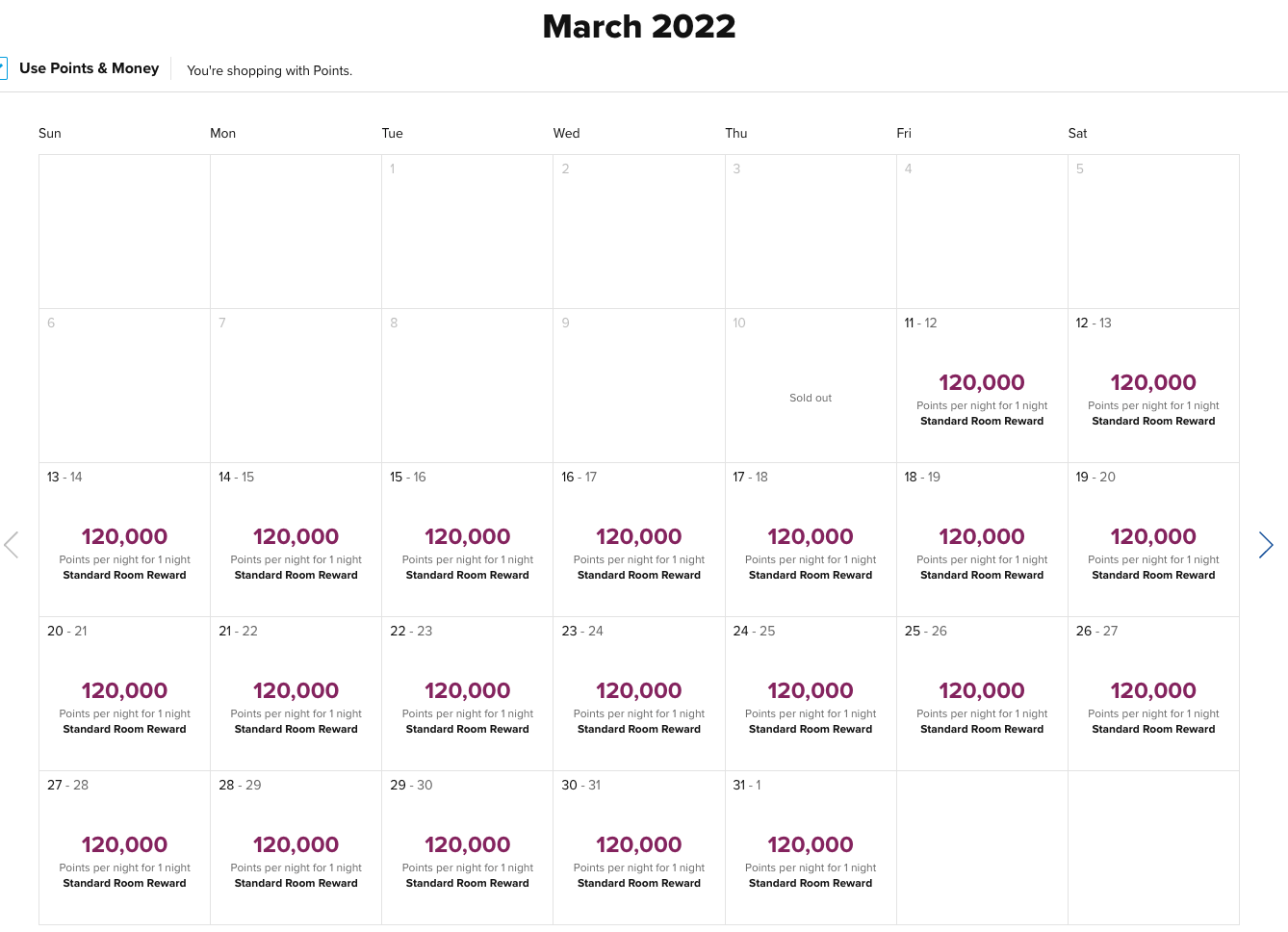

Here's a look at current award pricing at the Conrad Maldives for the month of March. As you can see, nights are going for 120,000 points apiece.

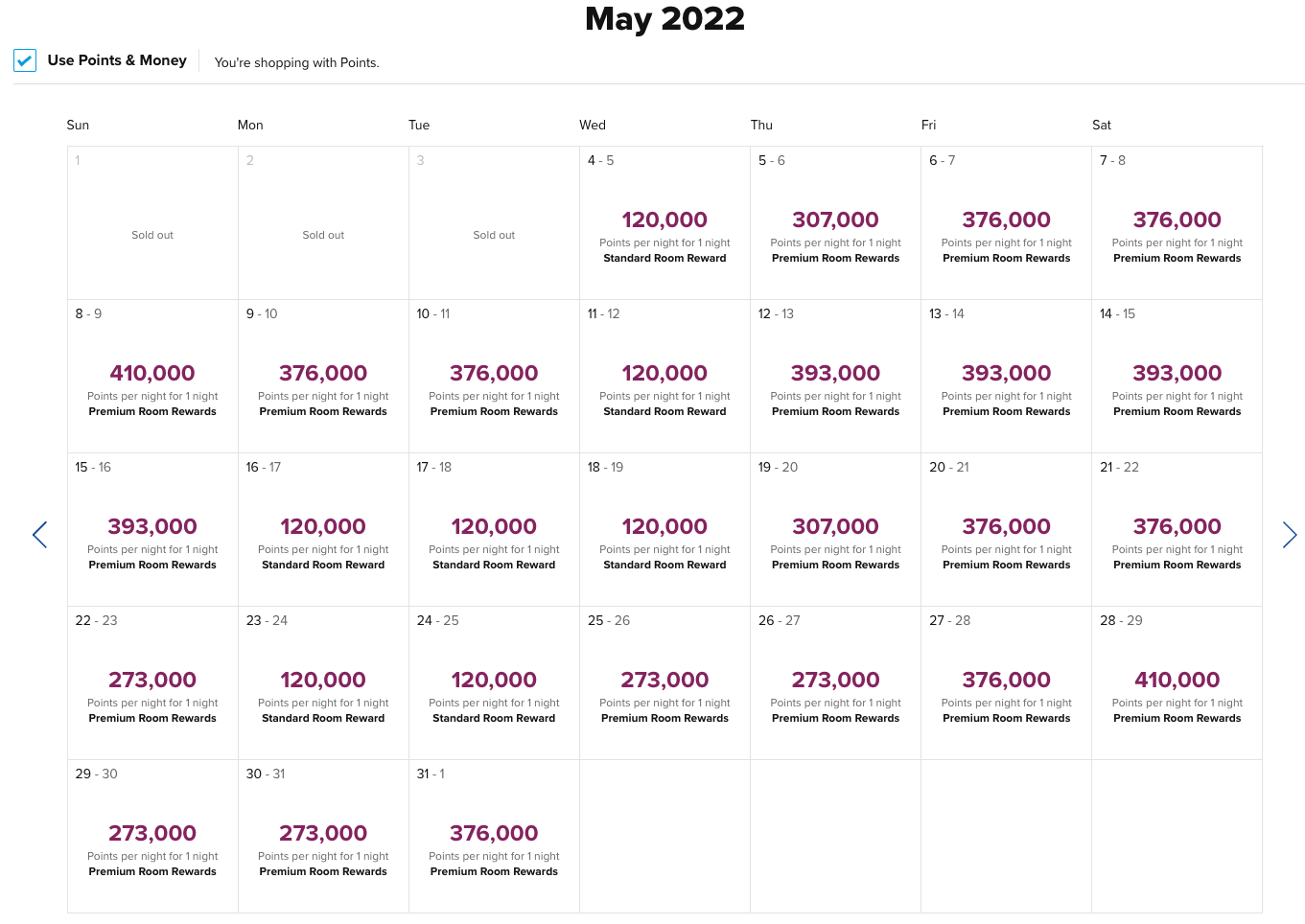

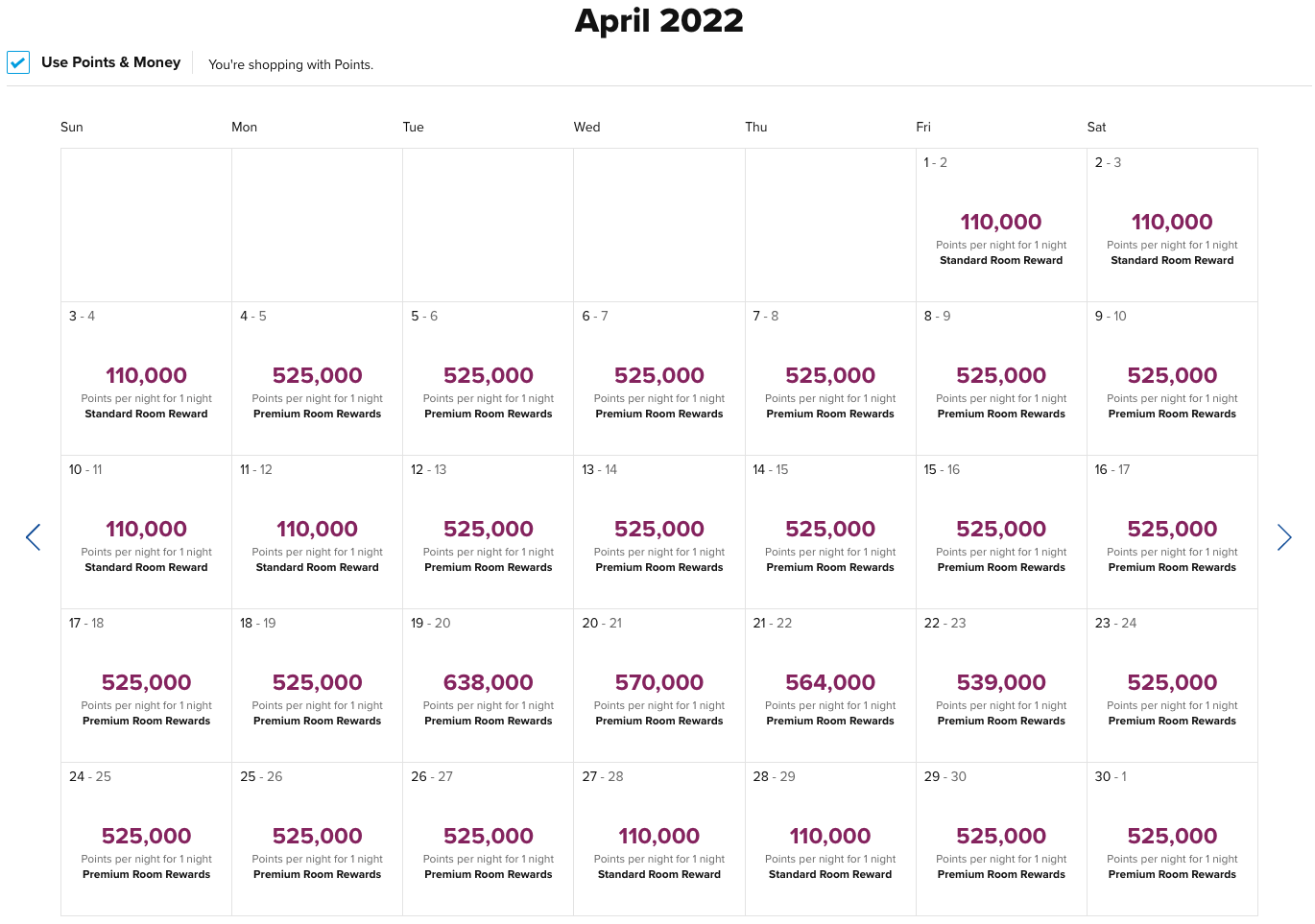

Unfortunately, the price hike goes beyond the Maldives and includes other Hilton Honors reader favorites like the Waldorf Astoria Beverly Hills, which historically charged 95,000 points per night for a standard room but now requires 120,000 points per night (with much steeper prices for higher-category rooms).

Other properties, like Maui's Grand Wailea, A Waldorf Astoria Resort, have increased from 95,000 to 110,000 points per night — a nearly 16% jump.

To state the obvious, this unannounced change is terrible news for Hilton Honors members who are hoping to redeem their hard-earned points for luxurious hotels around the world.

More and more loyalty programs have been raising award prices overnight with no advanced notice to members, but it's still a shame to see Hilton taking a page from this disappointing playbook.

When asked for comment on these pricing changes, Hilton told TPG the following:

"Since the launch of Points & Money, our team regularly monitors the performance of the program and makes necessary tweaks along the way. Recently, we conducted a series of business as usual changes in our Point pricing for a small number of hotels. As previously shared, while we won't be sending updates for each and every shift, we are fully committed to delivering the best value to our members and will carefully consider any Point adjustments for Hilton properties."

On the bright side, these price increases shouldn't affect free night certificates offered by some Hilton cobranded credit cards, as the list of excluded hotels has not been updated to reflect these properties specifically ... yet. If you're planning to use your certificates to book one of them, play it safe and book now just in case. You can always cancel your plans later.

Right now, we're unsure of just how many properties have been affected by this change but will update this article with more examples as we find them.

Feature photo of the Conrad Maldives by Ryan Patterson/The Points Guy.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app