Why I'm focusing on the American Airlines shopping portal this year

As a Delta Diamond Medallion and United Premier Gold elite, I've never been much of an American Airlines flyer — but that isn't stopping me from getting into the Loyalty Points game.

I fly American a handful of times per year, and plan to try for low- or mid-tier elite status with the airline, largely due to the ease of earning Loyalty Points, American's new elite status metric. This will help me have a mildly better experience when I fly with the carrier. Plus, I don't need to fly American frequently to earn this elite status as most base points earned with partners should be eligible to earn Loyalty Points.

I do the majority of my shopping online these days, and plan to use the American Airlines eShopping Portal for the majority of my online purchases this year. This will help me earn both AAdvantage miles and Loyalty Points, both of which are incredibly valuable to me. In the past, I've used American miles to fly everything from Cathay Pacific business class to Qatar Airways Qsuite, which have been some of my favorite experiences in the sky.

But why am I earning through the AAdvadvantage shopping portal when I could earn different airline miles, cash back or transferrable points through another portal? That's a fair question — so let's take a closer look.

[table-of-contents /]

I highly value AAdvantage miles

AAdvantage miles are worth 1.77 cents per point according to TPG's most recent valuations, putting them near the top of the list of most valuable airline miles. In fact, they beat out every domestic airline currency sans Alaska Airlines Mileage Plan, which has had its own set of devaluations over the past few months.

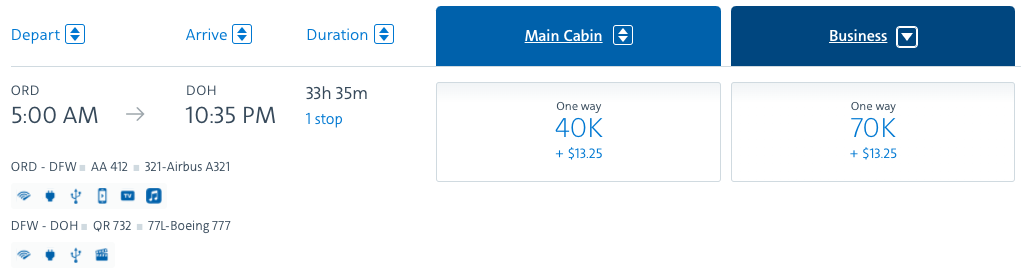

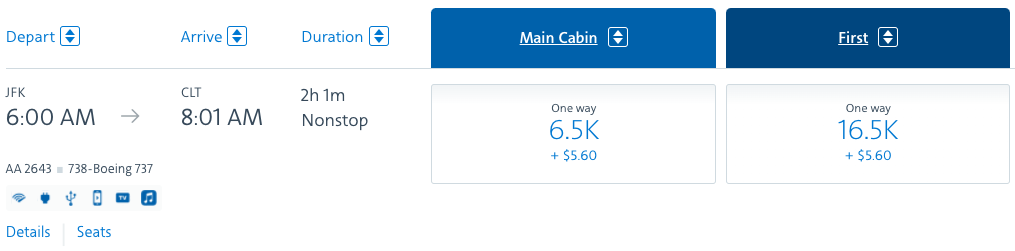

In practice, I find AAdvantage miles to be extremely valuable, too. The program has kept a standard award chart — at least for now — for partner award tickets. And award prices are reasonable. For example, I can use the program to book Qatar Airways Qsuite or Etihad business class to the Middle East for just 70,000 miles one-way with minimal taxes and fees.

Web Special awards have often helped me score cheap flights on American metal too. Routes like New York-JFK to Charlotte (CLT) frequently price as low as 6,500 miles one-way, which is an excellent deal compared to many competing programs.

As an aviation enthusiast, it also helps me to have access to a stash of miles I can redeem on Oneworld airlines. The bulk of my flying is on SkyTeam and Star Alliance carriers due to my loyalty, but having the chance to try top-notch Oneworld airlines once or twice per year is something I'm excited to do as I start to shift some of my earning focus to AAdvantage.

Related: Your ultimate guide to American Airlines AAdvantage

The American shopping portal consistently earns the most points

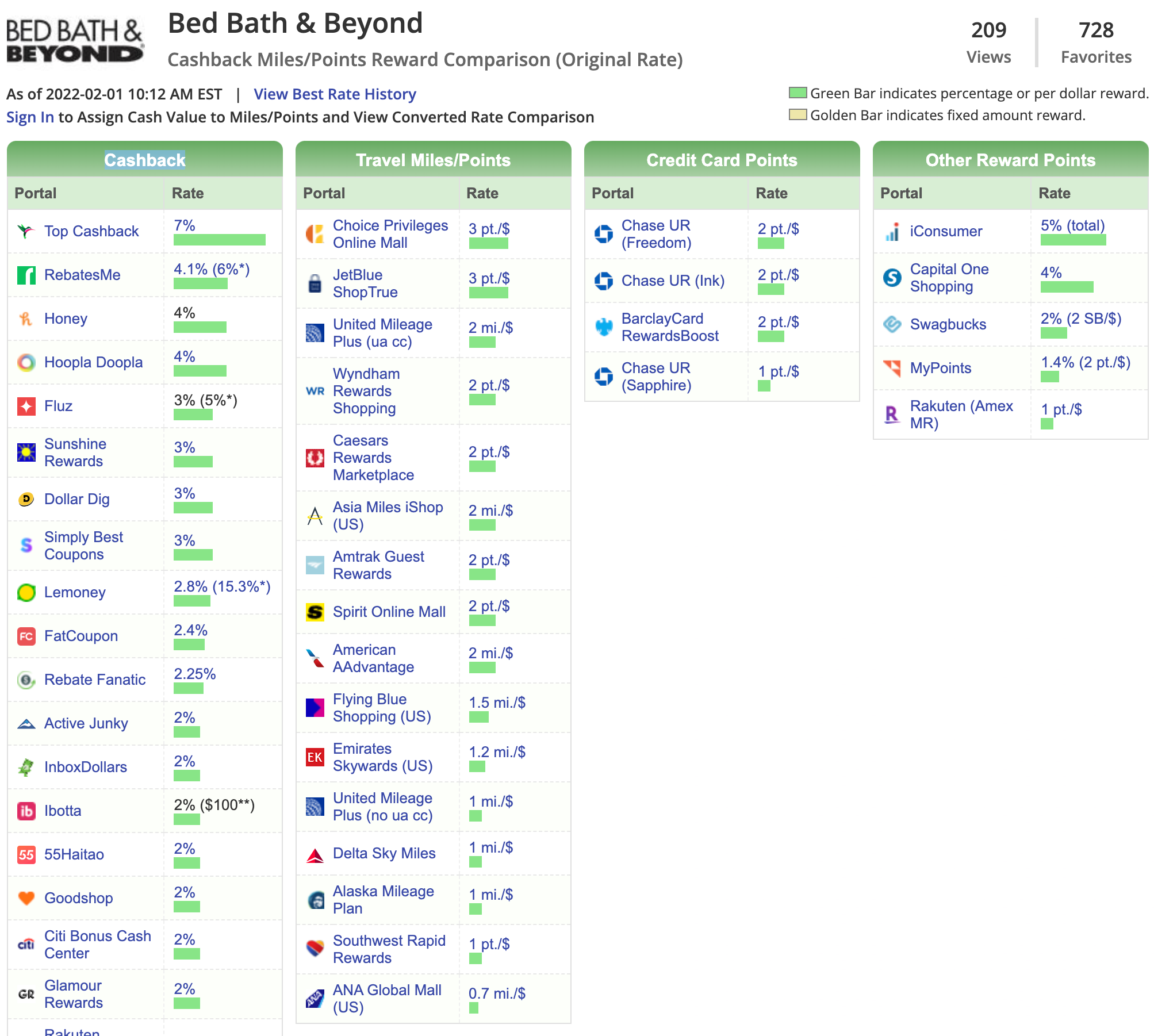

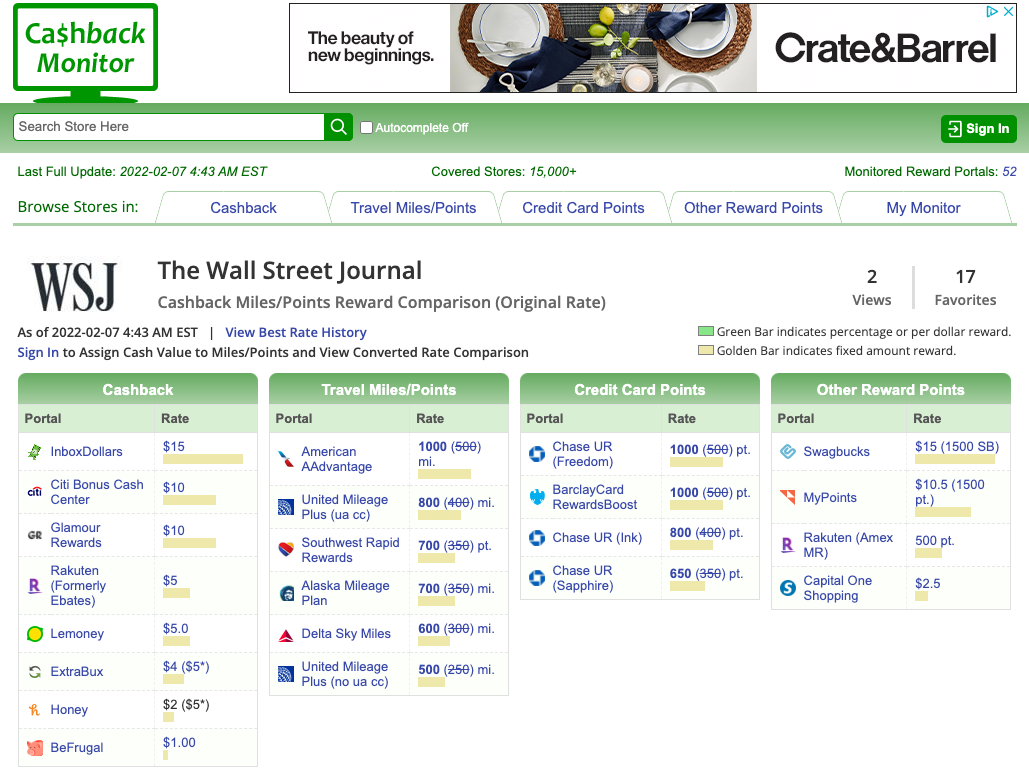

Over the past few weeks, I've noticed that the American shopping portal is consistently earning more points than other airline shopping portals, especially at the places I shop the most. For example, according to Cashback Monitor, American currently awards 2 miles per dollar at Bed Bath & Beyond, up from 1 mile per dollar with the Alaska, Delta and Southwest portals.

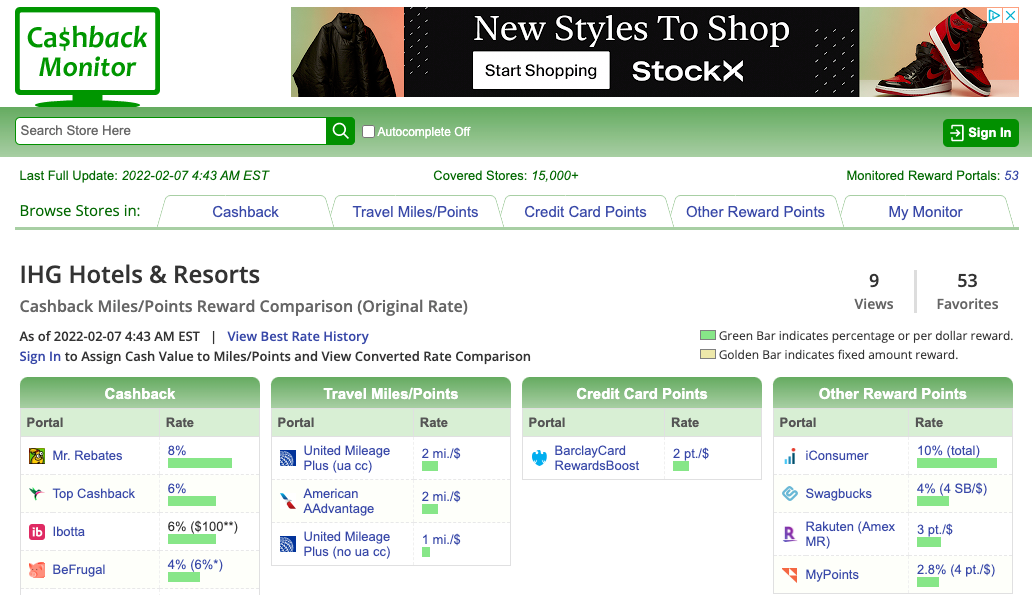

Likewise, I always use a shopping portal when I book hotels directly. For example, I recently booked an IHG stay for work and went through the American portal, earning 2 American miles per dollar in the process. This falls behind Rakuten, where I could earn 3 American Express Membership Rewards points per dollar, but helps me earn American miles, which I have significantly fewer of right now.

I also recently subscribed to the Wall Street Journal and earned 1,000 AAdvantage miles (and Loyalty Points) on my subscription. It cost just $12 for my first 12 weeks, which is an excellent deal in and of itself. Again, since TPG values AAdvantage miles at 1.77 cents per mile, I actually come out ahead with this promotion. In theory, the miles should be worth at least $17.70, and that's not including the progress toward American elite status.

All of this is to say that American consistently offers good returns on the places I shop frequently. Plus, there are a lot of great opportunities to earn Loyalty Points and AAdvantage miles quickly with limited-time promotions like Wall Street Journal and wine box subscriptions. Oftentimes, you can come out ahead with these limited-time offers.

Related: Earn even more rewards by adding this 1 small step to your online shopping routine

Diversifying my points portfolio

I highly recommend that all points and miles enthusiasts diversify their points portfolio. This way, you're protected if one program devalues its miles, which we've seen time after time during the pandemic.

Historically, the majority of my Oneworld miles have been in Alaska Airlines Mileage Plan. But given recent developments with the program losing partners, implementing dynamic pricing on American awards and adding new redemption partners with poor rates, we could be headed toward a larger devaluation. Diversifying my portfolio by adding AAdvantage miles protects me from this larger devaluation if it happens.

Plus, I already have a sizable stock of other airline miles and transferable points, but my AAdvantage balance is low. Since I value them highly, diversifying my portfolio to include more AAdvantage miles gives me more flexibility in how I redeem my points. And since only Bilt Rewards and Marriott Bonvoy points transfer to American, the American shopping portal gives me an easy way to acquire these otherwise hard-to-earn points.

Related: 4 easy strategies I use to earn over 500,000 points and miles a year

Earning low- or mid-tier elite status

I fly a lot every year. While most of my flights are on Delta and United thanks to my elite status, I do fly American, Alaska and other Oneworld carriers a handful of times per year. Gold or Platinum status would give me minor benefits to make these flights slightly more rewarding and provide a better overall experience, and it seems worth the effort given I don't need to fly on Oneworld partners extensively to earn these status tiers.

I'm hoping to earn Platinum via Loyalty Points, as this would give me Oneworld lounge access when traveling on international Oneworld flights. It would also give me Main Cabin Extra seats on American flights and a shot at an upgrade when using 500-mile certificates. This would make me more excited to fly American, other Oneworld partners and even JetBlue a handful of times per year.

That said, I still plan to fly Delta as my main carrier. I look at status as a secondary benefit of using the American portal, with the main benefit being the AAdvantage miles I learn along the way.

Related: I have top-tier status with 3 airlines — why not 4?

Bottom line

The introduction of Loyalty Points makes the American shopping portal a lot more intriguing. The program already offers a solid return on purchases, and being able to earn elite status is exciting even for the occasional American flyer. I plan to use the portal for the bulk of my online purchases this year, earning valuable miles and elite status in the progress.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app