Earn Alaska elite status through 2026 by taking 1 round-trip flight

Airlines often try to tempt infrequent flyers with status matches, challenges and buy-up offers. Sometimes they even offer ways to shortcut your path to status — like this deal from Alaska Airlines and Hawaiian Airlines, where you can earn MVP status through 2026 by taking a single round-trip flight from the continental U.S. to select destinations Down Under.

Here are all the details to help you decide whether this deal is worth jumping on.

Alaska MVP elite status promotion: How it works

Airlines: Alaska Airlines, Hawaiian Airlines

Routes: Between the continental U.S. (including Alaska, excluding Hawaii) and Sydney or Auckland

Sales period: Now through Dec. 31

Travel period: Now through Dec. 31

Complete one qualifying flight as described above, and you'll earn Alaska MVP status through the end of 2026.

There are some stipulations to be aware of. For instance, award tickets and Saver fares (Alaska's version of basic economy) are not eligible for this promotion.

To qualify, all segments of your round-trip flight must be booked at the same time on alaskaair.com or hawaiianairlines.com using your Alaska Mileage Plan number. All segments must be operated by Alaska Airlines, Hawaiian Airlines, Horizon Air or SkyWest Airlines; flights operated by other codeshare partners are not eligible. Your flight must originate and end in the same city within the U.S. (excluding Hawaii).

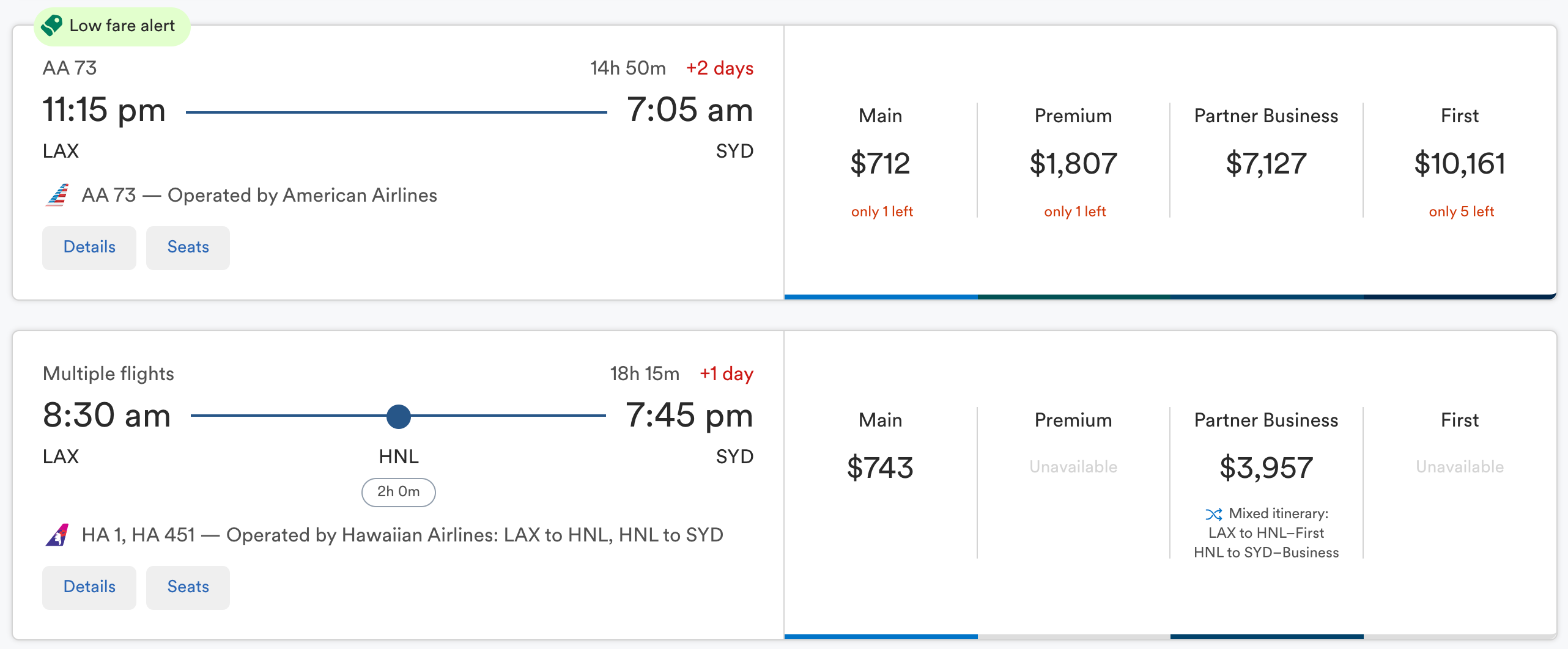

This limits your options, and you may miss out on savings if there are cheaper flights available on excluded partner airlines. For example, this Hawaiian Airlines flight from Los Angeles to Sydney would cost $743 in Main Cabin, but you could save money on the first leg of your round-trip journey by taking an ineligible flight operated by American Airlines for $712.

This promotion only applies to members who do not hold Mileage Plan elite status. If you're already an elite member, you won't be able to level up your status with this promotion.

Additionally, eligible flights for this promotion will earn elite qualifying miles as usual, but they won't earn any bonus EQMs.

What is Alaska elite status worth?

With airlines making status increasingly difficult to achieve, this deal provides a shortcut to Alaska MVP status. Instead of earning the 20,000 elite qualifying miles it normally takes to reach MVP status, all you have to do is complete one round-trip flight to Sydney or Auckland.

Your new elite status will be awarded by the 15th of the month following the month in which you complete your qualifying flight, and you will hold your new status through the end of 2026. So the sooner you head Down Under (and return home), the longer you'll hold your shiny new status.

MVP status may be the lowest elite tier of Alaska's Mileage Plan program, but it confers several valuable benefits, including:

- 25% bonus miles

- Seat upgrades

- Free checked bags

- Priority check-in, security and boarding

- Alaska lounge membership discount

MVP members also get automatic Oneworld Ruby status, which provides business-class priority check-in, preferred or prereserved seating, and priority on waitlists and on standby when you fly with other Oneworld alliance airlines.

And now that Alaska and Hawaiian offer reciprocal status matches, MVP status also gives you HawaiianMiles Pualani Gold status, which provides similar benefits when you fly Hawaiian. Plus, Gold members can access discounted award fares on Hawaiian's website.

Is Alaska's MVP elite status promotion worth it?

As you've seen, this deal is very specific in terms of which destinations you can visit and which airlines you can fly on, and flights that count toward this promotion may not be the most affordable options.

MVP status is the lowest elite tier in the Alaska Mileage Plan program, so the benefits are limited. However, earning any airline status for a single round-trip flight is nothing to sneeze at. This deal offers an easy path for infrequent flyers to reach Alaska status — and, by extension, Hawaiian status. That's two airline statuses for the price of one.

It could make sense to take advantage of this offer, as long as you think you'll fly Alaska or Hawaiian enough to reap the benefits of elite status.

If you go that route, don't forget to use the right credit card to maximize the rewards on your ticket. This could mean using an Alaska Airlines or Hawaiian Airlines cobranded credit card, or a travel card that offers bonus rewards on airfare booked directly with the airline, such as:

- The Platinum Card® from American Express

- American Express® Gold Card

- Chase Sapphire Reserve® (see rates and fees)

- Chase Sapphire Preferred® Card (see rates and fees)

- Wells Fargo Autograph Journey℠ Card (see rates and fees)

Bottom line

If you've got your eye on Alaska Airlines Mileage Plan's MVP status, this promotion offers an easy way to try it out for the next year or more. On the other hand, if you're planning a trip to Australia or New Zealand in 2025, this could be a chance to maximize the rewards on your journey even further. Just keep in mind the promo's limitations and check prices to ensure you're not missing out on significant savings.

There's no deadline to book as long as you complete your qualifying round-trip flight by Dec. 31.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app