Guide to using digital ID for TSA checkpoints

The Transportation Security Administration continues to roll out facial recognition technology to modernize the airport security process.

In my experience, the most helpful advancement thus far has been its digital identification system, which allows you to show a digital ID at TSA security checkpoints.

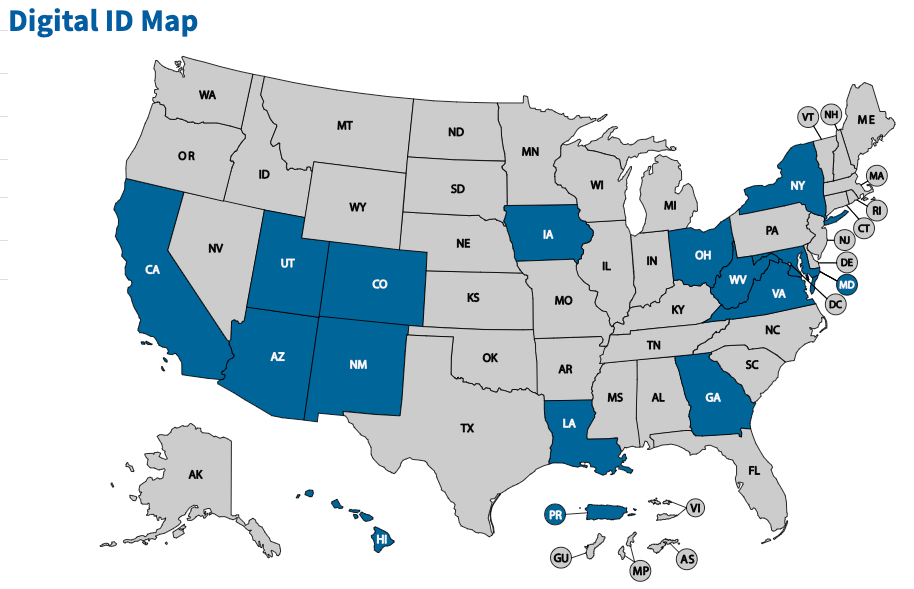

Currently, 14 states accept digital IDs in lieu of physical IDs, and more are set to start.

Here's what you need to know about using a digital ID on your next trip.

What is a digital ID?

Digital ID stems from TSA's Credential Authentication Technology, which it uses to biometrically scan travelers. Digital IDs are also used in TSA PreCheck's Touchless Identity Solution to verify travelers when they check bags and pass through TSA PreCheck on United Airlines, Delta Air Lines and American Airlines at participating airports.

Digital IDs are compatible with Apple Wallet, Google Wallet, Samsung Wallet and state-issued apps, depending on the state. Adding a digital ID to your phone should only take a few minutes.

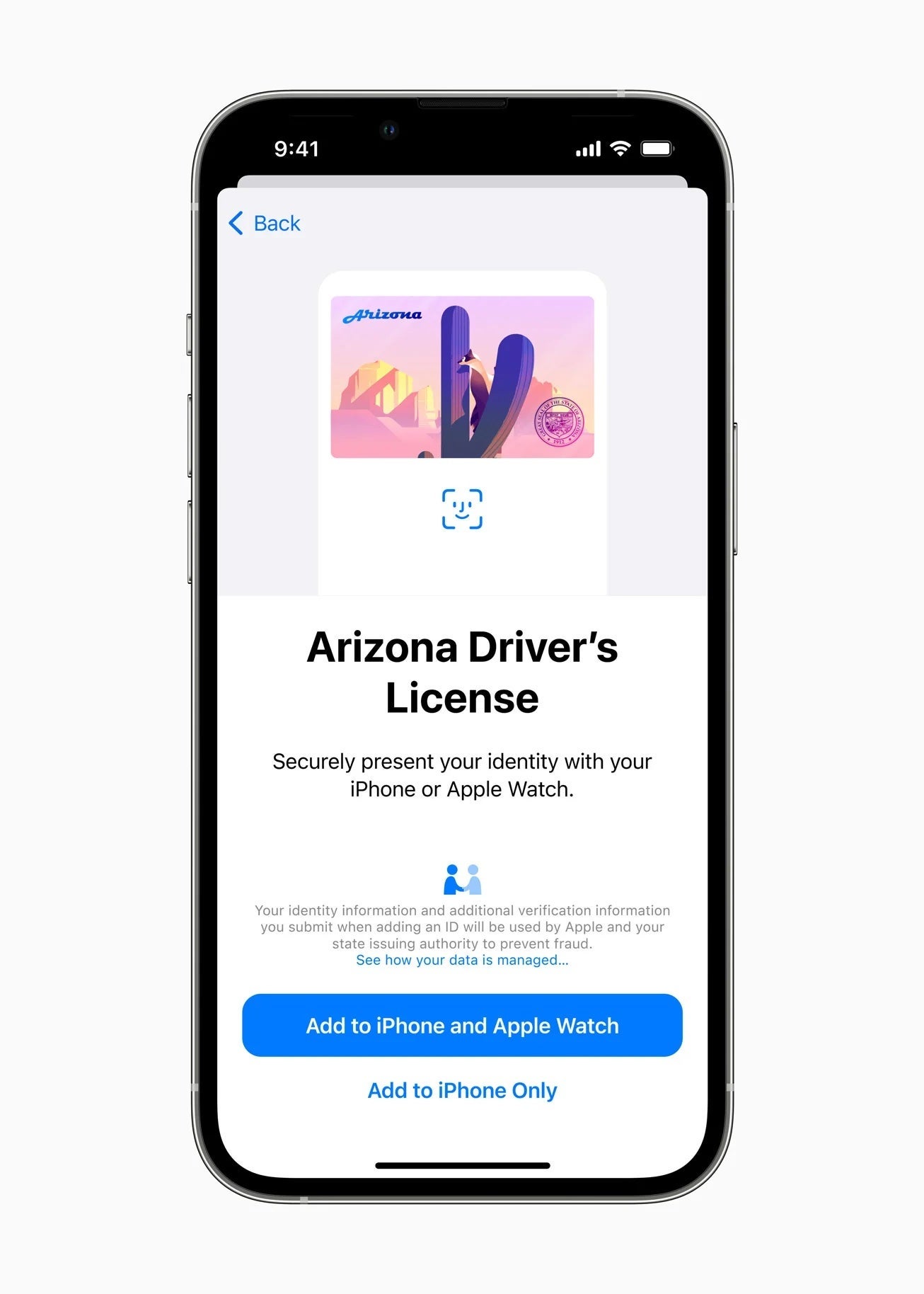

If you have an iPhone, you can do this by opening the Wallet app and tapping the "+" button in the top right corner. From there, select "Driver's License or State ID" and then follow the on-screen instructions to complete the setup and verification process.

Once your state accepts your submission, a digital ID is created and stored on your iPhone. Apple Watch users can store digital IDs on their watches for iOS 16.5 or later.

How do digital IDs work?

For passengers who opt to use the CAT-2 reader, you'll simply scan your digital ID QR code or your mobile device on the reader at the TSA checkpoint.

From there, a message on your phone will ask you to consent to sharing your information with the TSA. After you consent, the camera will take your picture and prompt you to proceed to the TSA officer.

While participation in the program is optional, TSA requires all passengers to bring their physical IDs when traveling in case a digital ID cannot be verified.

Who can use them?

As of February, travelers with digital IDs from 14 states (and Puerto Rico) can upload digital IDs to pass through TSA security. The below states are currently issuing digital IDs:

- Arizona: available on Apple Wallet, Google Wallet and Samsung Wallet

- California: available on the California DMV Wallet app, Apple Wallet and Google Wallet

- Colorado: available on Apple Wallet, Google Wallet and Samsung Wallet

- Georgia: available on Apple Wallet, Google Wallet and Samsung Wallet

- Hawaii: available on Apple Wallet

- Iowa: available on Apple Wallet, Samsung Wallet and Iowa Mobile ID app

- Louisiana: available on LA Wallet

- Maryland: available on Apple Wallet, Google Wallet and Samsung Wallet

- New Mexico: available on Apple Wallet and Google Wallet

- New York: available on the NY MiD app

- Ohio: available on Apple Wallet

- Puerto Rico: available on Apple Wallet and Google Wallet

- Utah: available on Get Mobile app

- Virginia: available on the Virginia Mobile ID app

- West Virginia: available on the WV MiD app

Where are they accepted?

Travelers with a digital ID from one of the states mentioned above and Puerto Rico can use their IDs at airports with CAT-2 technology that biometrically scans travelers' faces to pass through TSA checkpoints.

Currently, digital IDs can be used at the following airports:

- John F. Kennedy International Airport (JFK)

- LaGuardia Airport (LGA)

- New York Stewart International Airport (SWF)

- Syracuse Hancock International Airport (SYR)

- Baltimore/Washington International Thurgood Marshall Airport (BWI)

- Salisbury Regional Airport (SBY)

- Richmond International Airport (RIC)

- Roanoke-Blacksburg Regional Airport (ROA)

- Ronald Reagan Washington National Airport (DCA)

- Dulles International Airport (IAD)

- Huntington Tri-State Airport (HTS)

- West Virginia International Yeager Airport (CRW)

- Akron-Canton Airport (CAK)

- Cleveland Hopkins International Airport (CLE)

- John Glenn Columbus International Airport (CMH)

- Hartsfield-Jackson Atlanta International Airport (ATL)

- Savannah/Hilton Head International Airport (SAV)

- Des Moines International Airport (DSM)

- Eastern Iowa Airport (CID)

- Lake Charles Regional Airport (LCH)

- Louis Armstrong New Orleans International Airport (MSY)

- Shreveport Regional Airport (SHV)

- Denver International Airport (DEN)

- Albuquerque International Sunport (ABQ)

- Lea County Regional Airport (HOB)

- Salt Lake City International Airport (SLC)

- Phoenix Sky Harbor International Airport (PHX)

- Los Angeles International Airport (LAX)

- San Jose Mineta International Airport (SJC)

- San Francisco International Airport (SFO)

- Luis Muñoz Marín Airport (SJU)

Bottom line

If you are from one of the 14 states currently offering digital IDs to their residents, you can use a digital ID instead of showing your physical ID to pass through TSA checkpoints at more than 30 airports.

In addition to TSA PreCheck's Touchless Identity Solution for United, Delta and American flyers, select airports are deploying biometric technology to speed up the boarding process.

Related reading:

- Apple's TSA-approved digital ID is now live in 5 states, coming soon to many more

- TSA PreCheck travelers will no longer have to show ID or boarding pass at certain airports

- TSA to pilot self-service security screening in Las Vegas

- Are new TSA scanners slowing down the screening process for travelers?

- Delta Air Lines hopes to speed passengers through airports with biometrics starting next week

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app