Check your SkyMiles account: Delta Choice Benefits, guest passes and MQD status boosts posting now

There's good news for some Delta Air Lines customers: Many of the 2025 perks for having Delta elite status or holding various credit cards are now hitting customers' accounts. Among the things that should now be in your accounts? Delta Choice Benefits, Medallion Qualification Dollar status boosts, Delta Sky Club guest passes and a new club visit tracker.

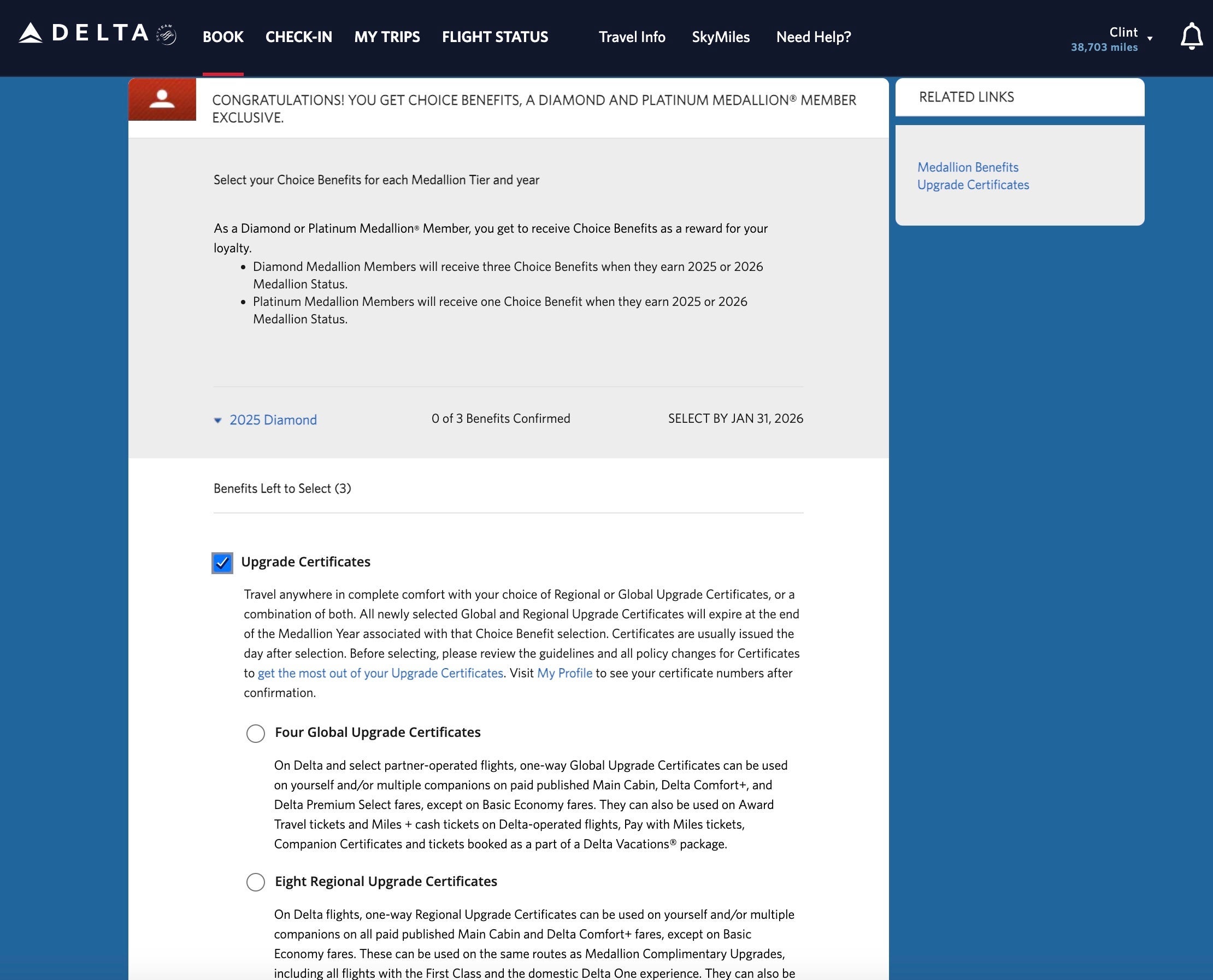

Delta Choice Benefits are now live

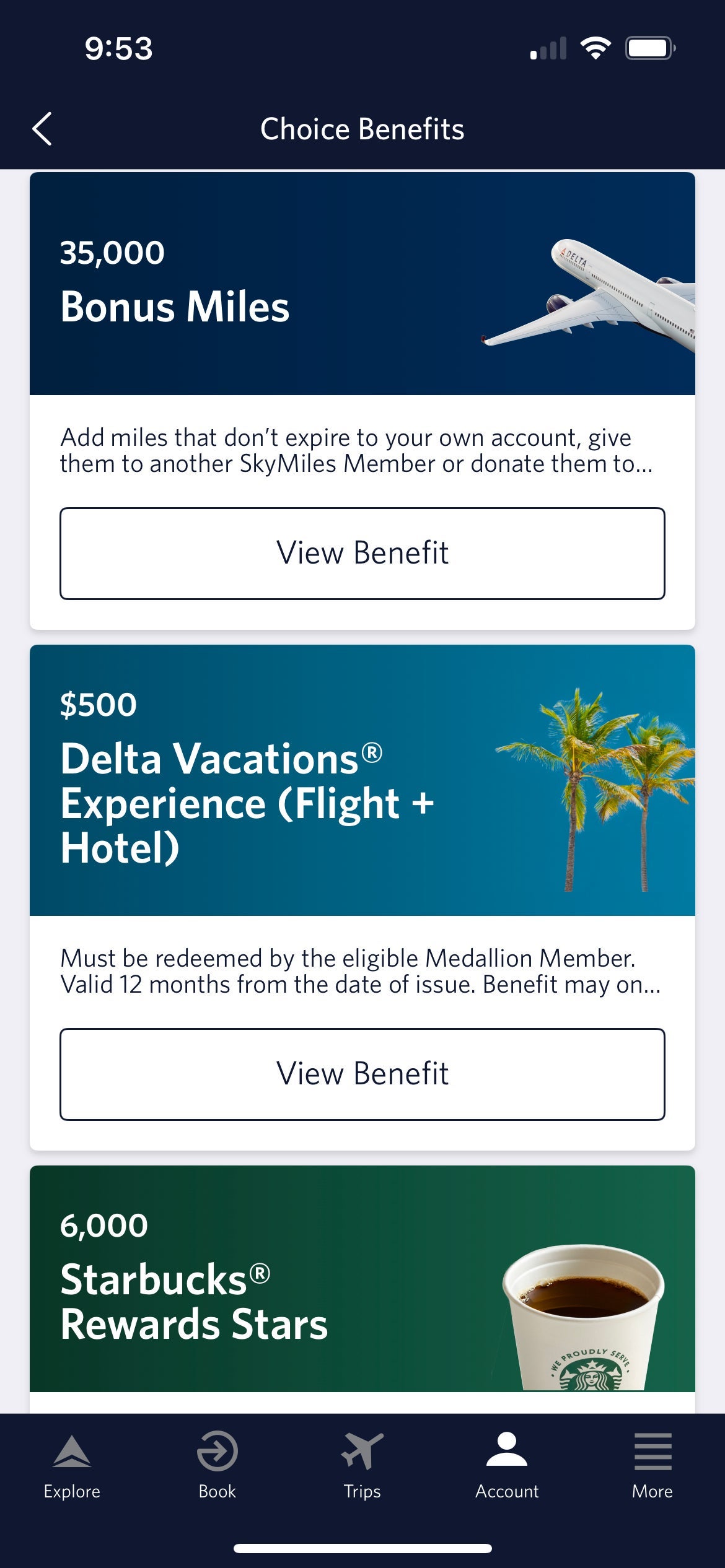

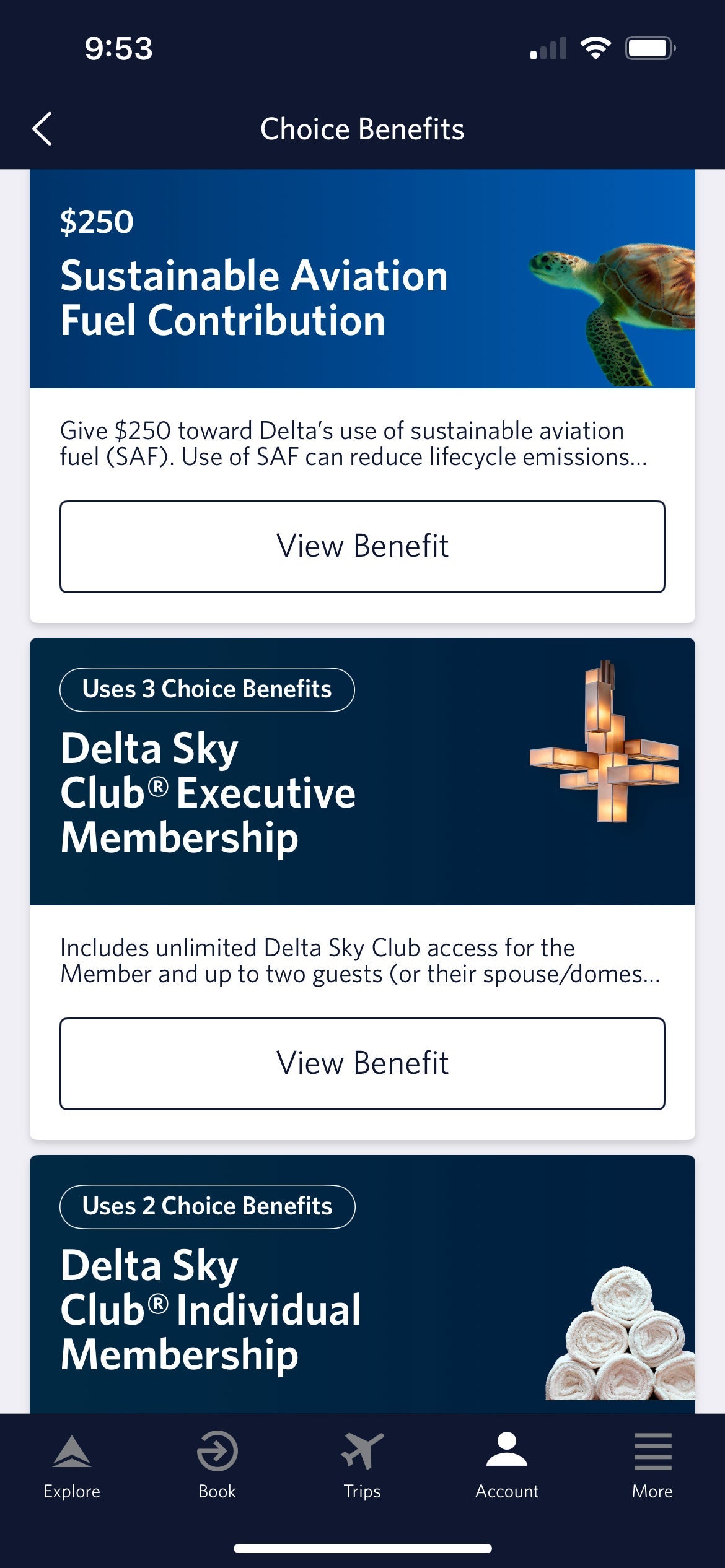

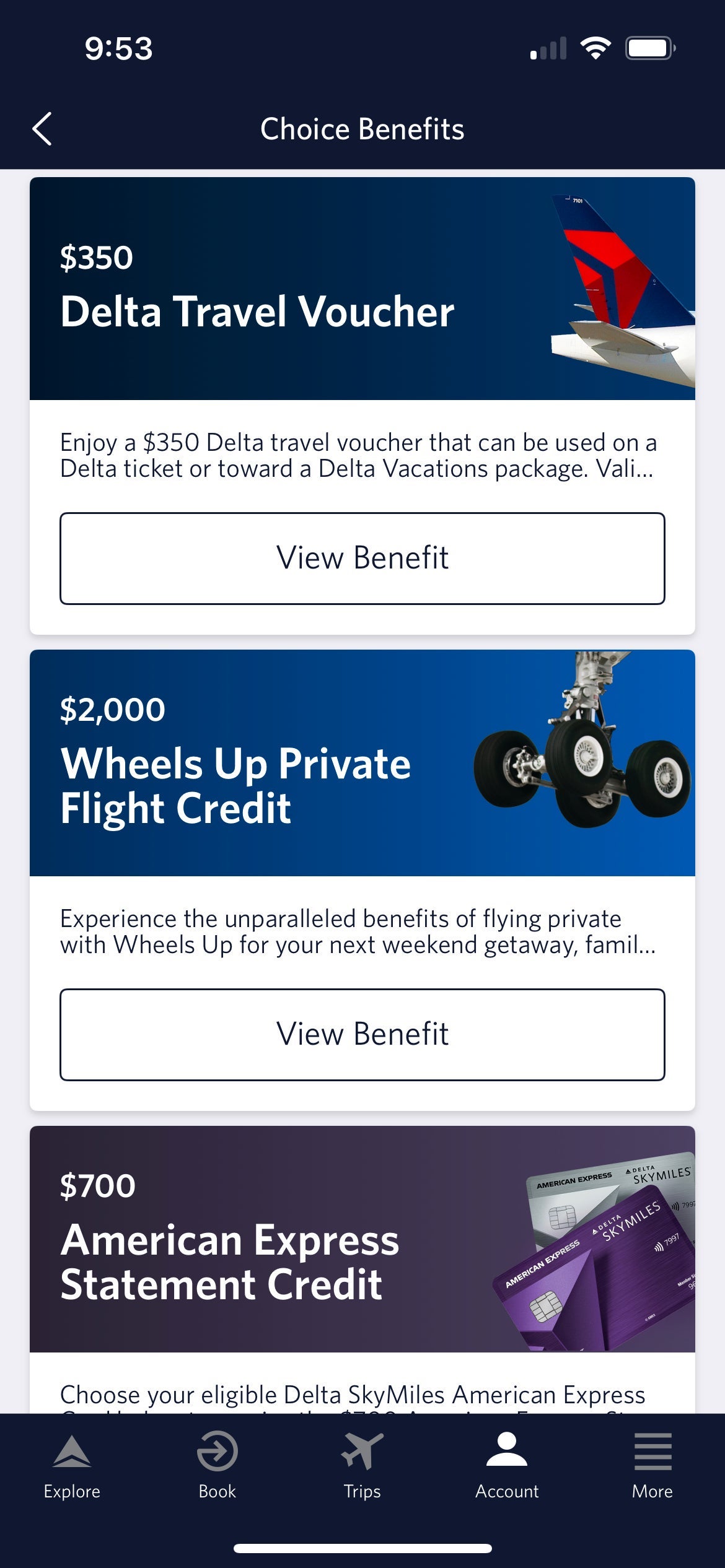

After a brief delay, your ability to choose your Delta Choice Benefits is live now. Several new choices are available, along with previous options like upgrade certificates and bonus Delta SkyMiles.

If you qualified for Platinum or Diamond Medallion status in the 2025 Medallion year (based on qualifying activity during the 2024 calendar year), you have until Jan. 31, 2026, to select your annual Delta Choice Benefits.

Delta has now also enabled you to pick those benefits within the Fly Delta app instead of having to log in on your computer.

Here's what the choices looked like on my phone.

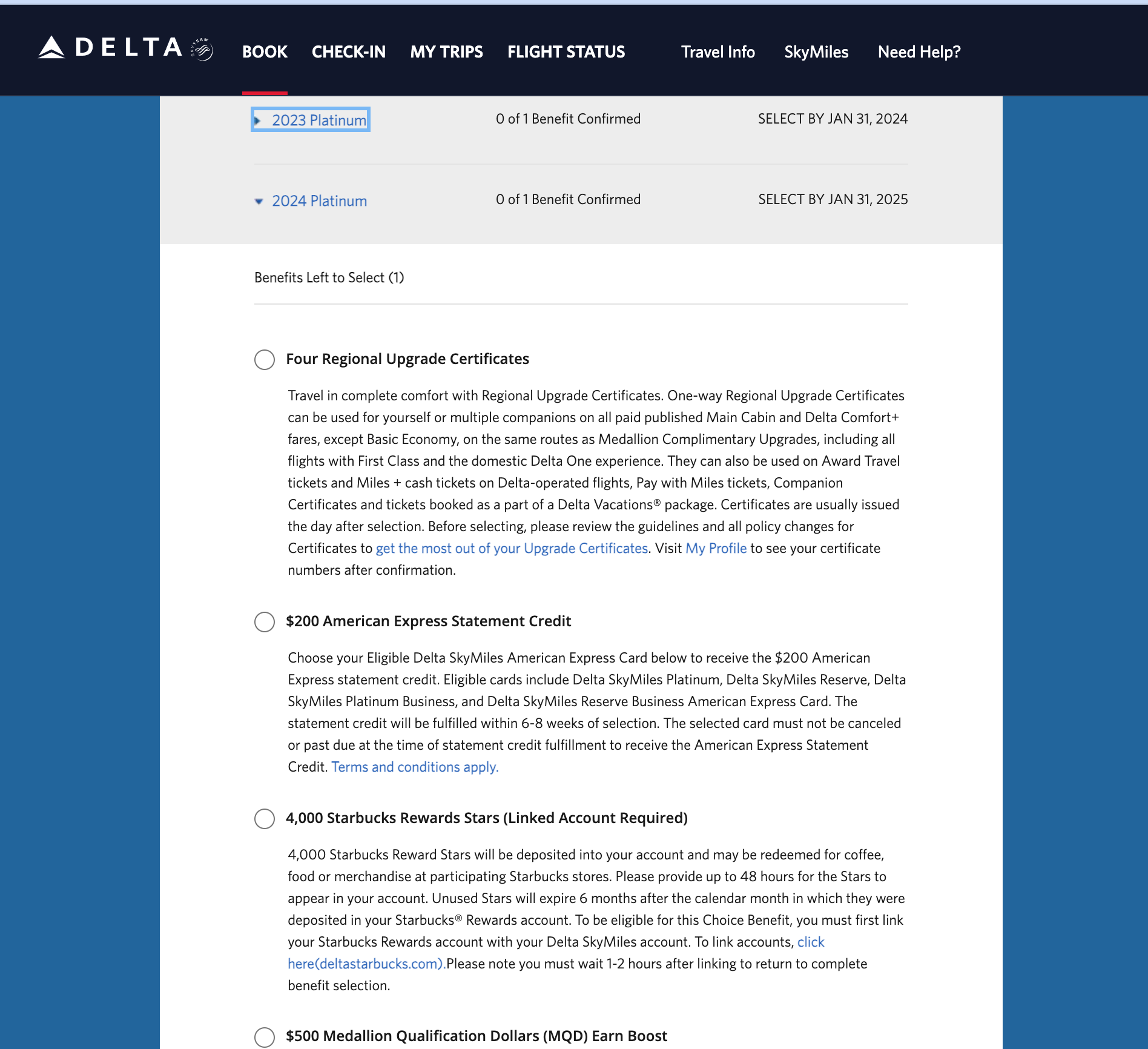

As you can see, there are quite a few valuable choices you can make, including a $700 Delta American Express statement credit, a $350 Delta travel voucher and a 2,000 MQD boost.

You can still make your selections on the website, too.

You won't have quite as many choices if you've only reached Platinum Medallion status, but there are still several great benefits, including four regional upgrade certificates and 20,000 bonus miles.

Several perks of holding the Delta SkyMiles® Reserve American Express Card (see rates and fees) or the Delta SkyMiles® Reserve Business American Express Card (see rates and fees) are also now live.

Related: The 5 Delta SkyMiles Amex changes I'm most excited about

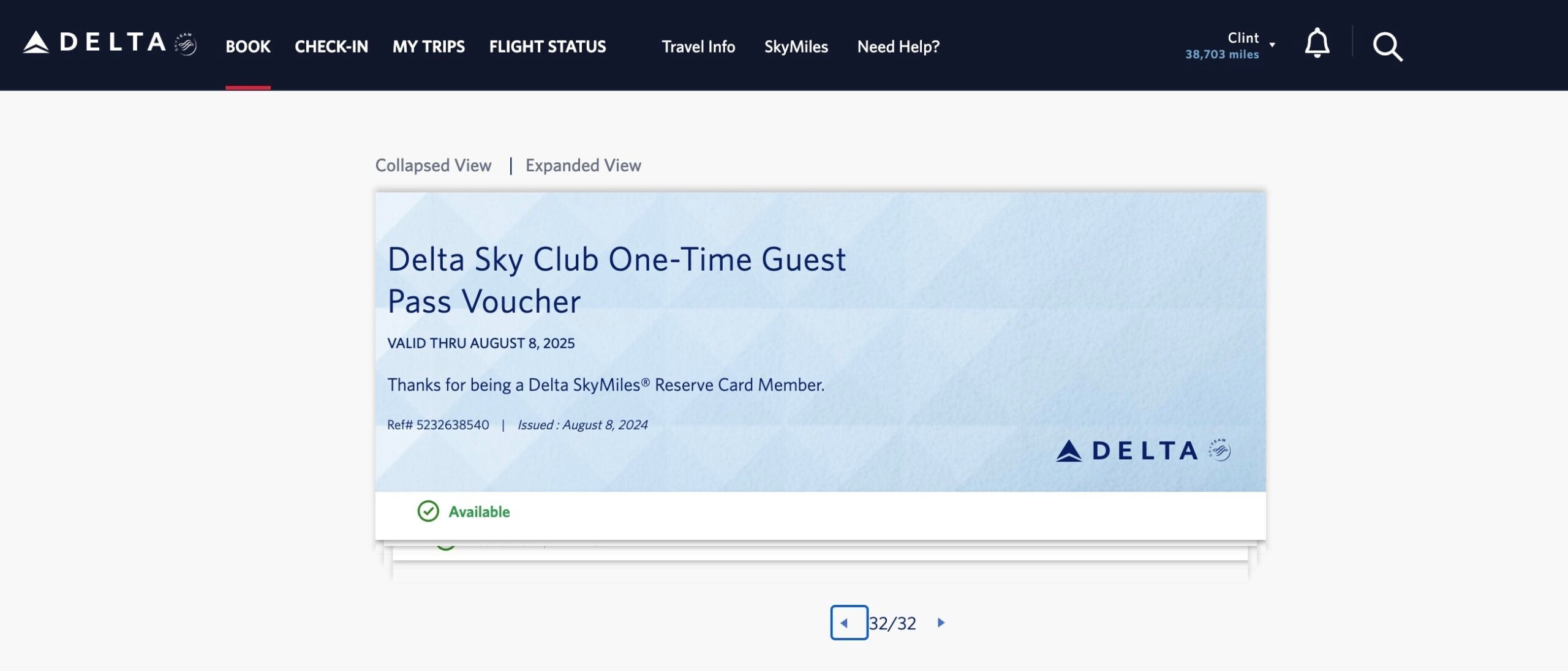

Delta Sky Club passes should now be in your account

The timing of the four Sky Club annual guest passes you get each year has changed. Cardholders usually get four passes each year when the annual fee comes due. Now, it happens Feb. 1 of each year, according to Delta:

"Delta SkyMiles® Reserve Basic Card Members will be issued four One-Time Guest Passes for complimentary access to the Delta Sky Club or usage of the Delta Sky Club 'Grab and Go' feature within 6 to 8 weeks after Account opening, and thereafter every subsequent year within 6 to 8 weeks after February 1 while the Account is open. Additional Card Members are not eligible. ... One-Time Guest Passes issued from February 1, 2025 through January 31, 2026 will expire on January 31, 2026, and One-Time Guest Passes issued in subsequent years will expire on January 31 of each calendar year thereafter."

Indeed, I now have four passes issued Feb. 1, 2025, as well as the four passes from when my Reserve card was renewed back in August.

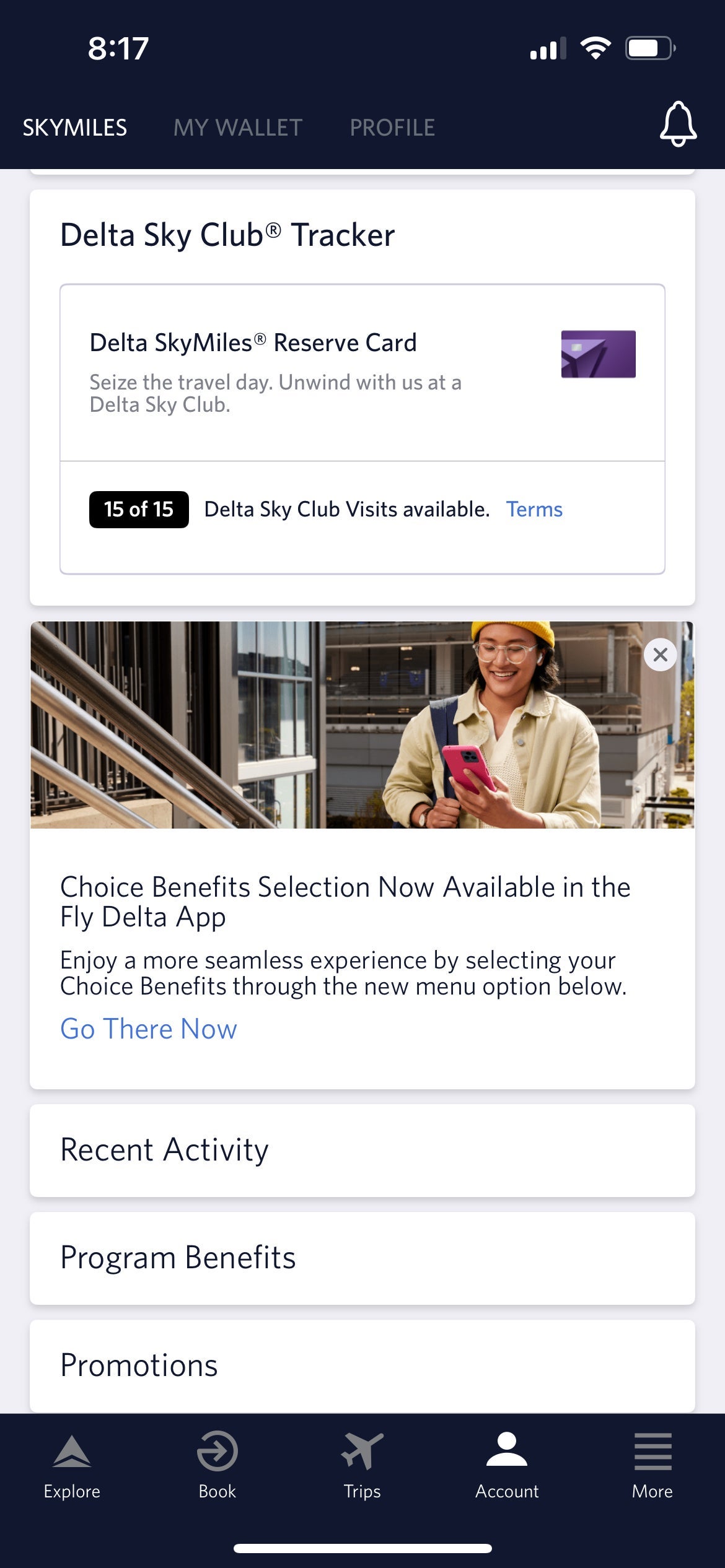

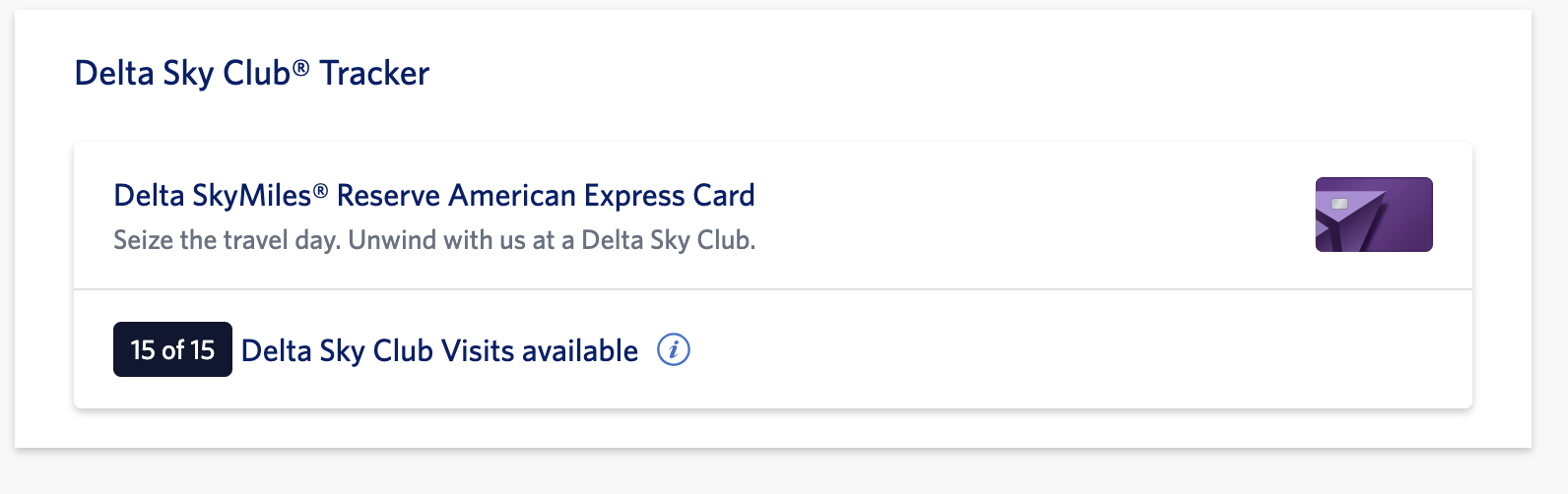

Delta Sky Club trackers are live

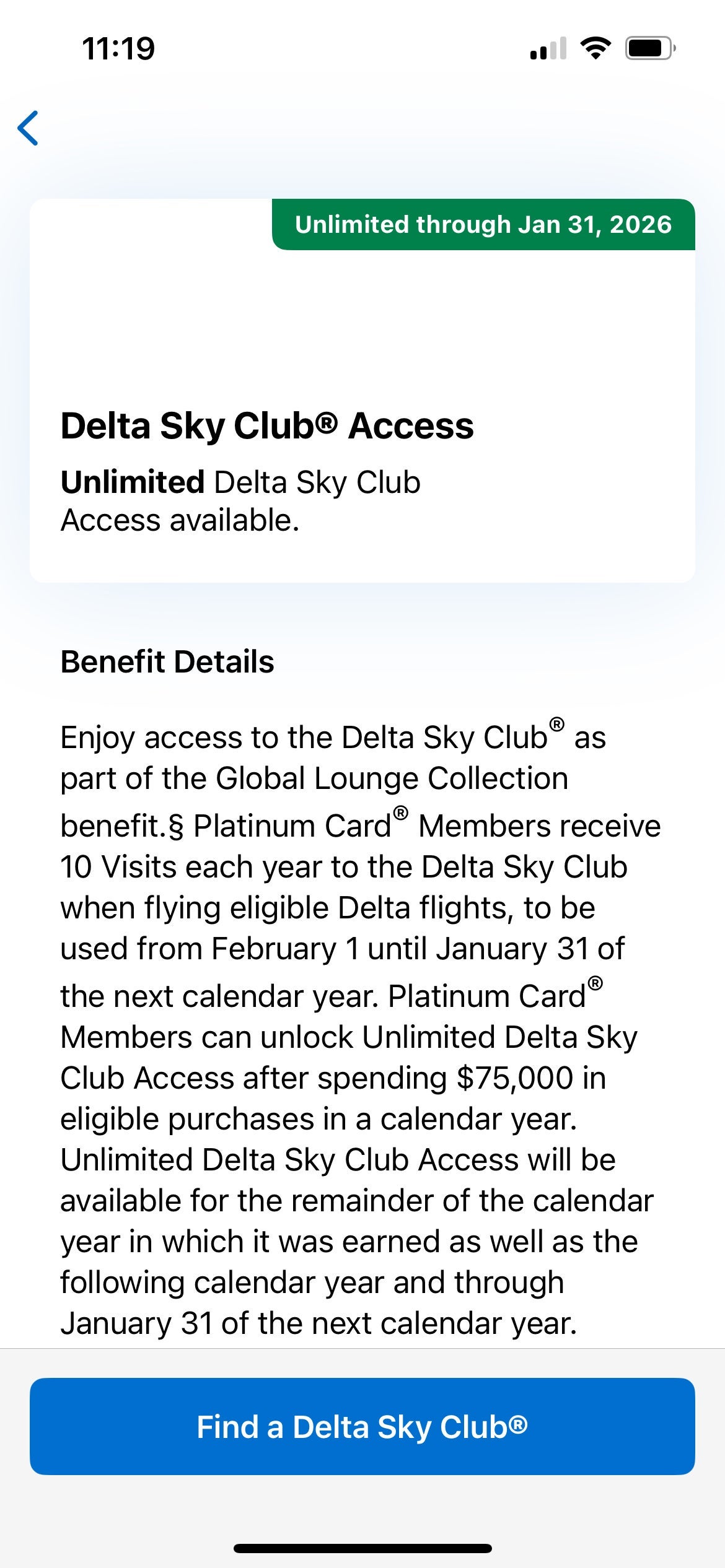

The other thing to note is that there is now a Sky Club visit tracker in the Fly Delta app and on the homepage. It will tell you how many Delta Sky Club visits you have left on your account.

Remember that you get just 15 visits from Feb. 1 until Jan. 31 of the following year. If you are a big spender, you can spend $75,000 on purchases with your eligible card in a year to get unlimited Delta Sky Club access.

Don't worry if you are supposed to have unlimited visits because you spent $75,000 on either the Delta Reserve card or The Platinum Card® from American Express; it will reportedly show up after your first visit to a Delta Sky Club in this new status year after you've checked in.

The tracker will also show you your available visits in the American Express app. You may need to click around a bit to find the tracker, but it will show up under the "Membership" and "Card benefits" sections at the very bottom.

MQD boosts are here

Some Delta cardmembers also get a status boost. Current cardmembers with one (or more) of the following cards get 2,500 MQDs at the start of each year just for being a cardmember. These stack for travelers with multiple eligible cards, including:

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

That means if you have two of these cards, for example, you'd get a 5,000 MQD head start on status for the year.

Related: Best Delta credit cards

I already got my MQD status boost. You should have yours, too, if you are a cardmember.

Bottom line

Lots of new options, including your Platinum or Diamond Medallion Choice Benefits, your annual MQD boost, new Sky Club passes and lounge visit trackers, are now available via Delta's website and app.

It takes some of the sting out of the increased status requirements and new restrictions on lounge visits.

Related reading:

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- Delta basic economy: What you need to know about bags, seats, boarding and more

For rates and fees of the Delta Reserve, click here.

For rates and fees of the Delta Reserve Business, click here.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app