Why Delta and United are both fighting to serve Cape Town

Delta Air Lines and United Airlines both want to launch nonstop service to Cape Town, South Africa. But they both can't do it, so, a competition has emerged.

It's perhaps one of the most intriguing battles right now in the airline industry, and it's playing out in the normally staid legal dockets of the U.S. Department of Transportation.

Why the tug of war? It's a tale of increased demand for travel to South Africa among U.S. carriers and constrained supply due to government restrictions.

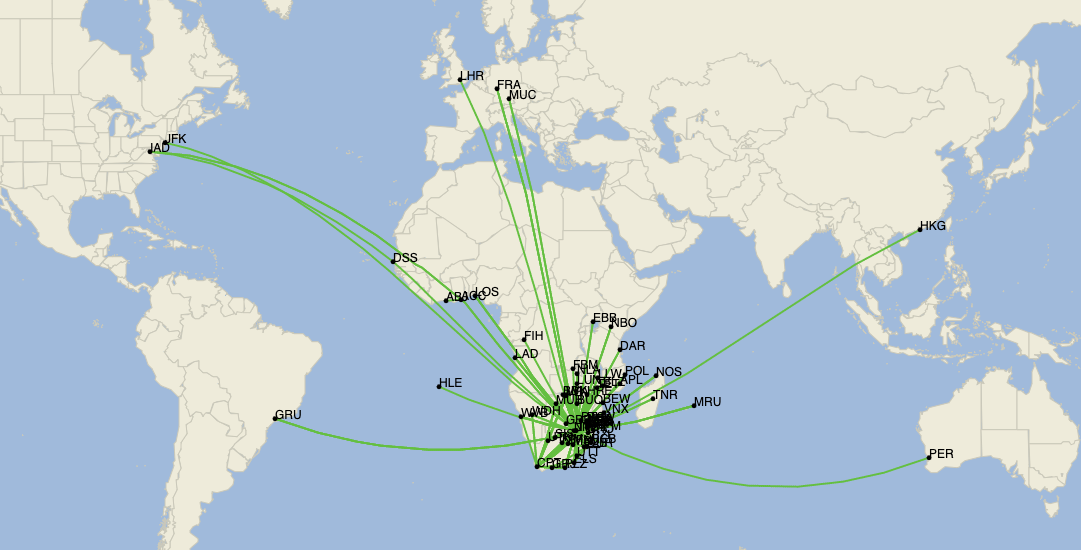

Prior to the COVID-19 pandemic, South African Airways (SAA) was a global carrier with flights from Johannesburg's OR Tambo International Airport (JNB) to New York's John F. Kennedy International Airport (JFK) and Washington Dulles International Airport (IAD). It also flew to South America, Europe, Asia and Australia.

Then, the pandemic hit, and SAA entered a 17-month administration, a form of bankruptcy. At one point, the carrier had paused all of its operations. Now, the Star Alliance member is flying again, but its flights only go as far as Kotoka International Airport (ACC) in Accra, Ghana, and Murtala Muhammed International Airport (LOS) in Lagos, Nigeria.

Appearing to sense an opportunity, Delta and United have increased their service from the U.S. to South Africa dramatically during the pandemic — and now they're not done.

For years, Delta was the only U.S. carrier to fly nonstop to South Africa, beginning service from its home base at Hartsfield-Jackson Atlanta International Airport (ATL) to JNB in June 2009. That service replaced earlier one-stop service to JNB and Cape Town International Airport (CPT) via Dakkar's old Léopold Sédar Senghor International Airport (DKR). Then, in December 2019, United began its service to CPT from Newark Liberty International Airport (EWR).

Following a yearlong pause during the initial phase of the pandemic, United returned to the market first, with a new flight from EWR to JNB. Delta then restarted ATL-JNB, and then United restarted EWR-CPT — though that's now on a temporary hiatus until next month, when it returns for good. For its part, Delta will debut a new triangle routing later this year that travels from ATL to JNB to CPT to ATL.

Now, both airlines want more — but they can't each get what they want.

The U.S. and South African governments still have a traditional bilateral air service agreement that's been in place since 1996. The deal is not a so-called "open skies" agreement that has become commonplace with other countries, including the entire European Union. Open skies pacts allow for unlimited traffic between two countries, but the U.S.-South Africa air service agreement caps the number of round trips that U.S. carriers can fly between the U.S. and South Africa at 21 per week — or the equivalent of a total of three daily round-trip flights.

Right now, United operates 10 round trips per week, while Delta operates seven. That leaves four round trips remaining to be assigned.

To assign those remaining frequencies, the U.S. Department of Transportation is accepting requests from the carriers to increase service. It's essentially a competition of sorts, where both airlines need to prove to them why they're best suited to win the remaining frequencies. Delta is proposing three times weekly service from ATL to CPT, while United proposes three times weekly service from IAD to CPT. Both proposals would be year-round.

In its proposal, Delta is asking the DOT to begin the service around Nov. 17 using the Airbus A350-900. In its 79-page filing, Delta's argument is one that centers on competition and fairness. It argues that United would monopolize the market should its IAD-CPT proposal be approved and that United already holds more round-trips to begin with (10 versus seven).

"By reaching parity with United's awarded frequencies for service to/from Cape Town, Delta will ensure its ability to compete for travelers between the U.S. and Cape Town specifically and South Africa more broadly," the airline wrote in its filing.

More: 4 reasons why you should visit Cape Town, South Africa

As the Biden administration focuses on increasing competition in a number of industries, including the airline industry, this is an argument that could resonate with the regulators at DOT.

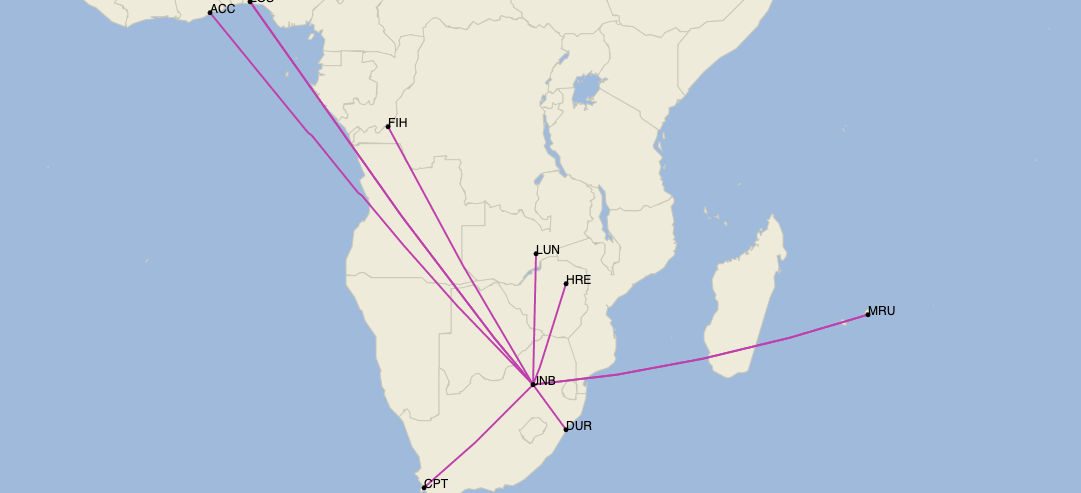

United's 177-page proposal, which would see service operated using its Boeing 787-9 Dreamliner aircraft, focuses on the fact that D.C. is currently the largest underserved market in the U.S. without direct service to Cape Town. That, United argues, would better meet demand. The airline also highlights its codeshare with South African carrier Airlink, which offers further connectivity on the Cape Town end of the route.

United's application is backed up with a bevy of letters from political leaders, business groups and airports in its filing. Perhaps most surprisingly is one from Charleston International Airport (CHS), which has thrown its support behind United's bid despite the fact that Delta offers 2.5 times the capacity between that airport and ATL this month than United does between CHS and IAD, according to Cirium schedule data.

"In total, United's Dulles gateway will connect Cape Town with 55 U.S. cities, totaling over 155,000 annual bookings, and which account for 92% of U.S. – Cape Town demand," United writes in its filing.

Whichever airline the DOT chooses, it will offer more choices to a city that many of us at TPG strongly recommend visiting. We'll likely know DOT's answer soon, as the department is moving fast on this, and will wrap up the final round of submissions by June 1.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app