Cruise lines now accept at-home COVID-19 test results to meet new CDC guidelines

Effective September 13, the U.S. Centers for Disease Control and Prevention (CDC) is recommending that all cruise passengers, regardless of vaccination status, provide negative test results in order to cruise.

Although a recent Florida ruling said the CDC's cruise protocols are recommendations and not mandates, cruise lines have committed to implementing them across their vessels. That means vaccinated passengers will now have to provide negative results from a PCR or antigen test no more than two days old in order to board cruises from the U.S., and those who are unvaccinated must provide PCR results no more than three days old. The rule is in effect through at least Oct. 31, 2021.

Because many pharmacies administering the tests cannot guarantee results that quickly, major cruise lines -- including Carnival, Royal Caribbean, Holland America, Celebrity, Princess and MSC -- are now allowing vaccinated passengers to submit results from self-administered at-home tests, as long as they're FDA-authorized for emergency use and overseen virtually by a telehealth professional.

[table-of-contents /]

Which at-home tests are accepted?

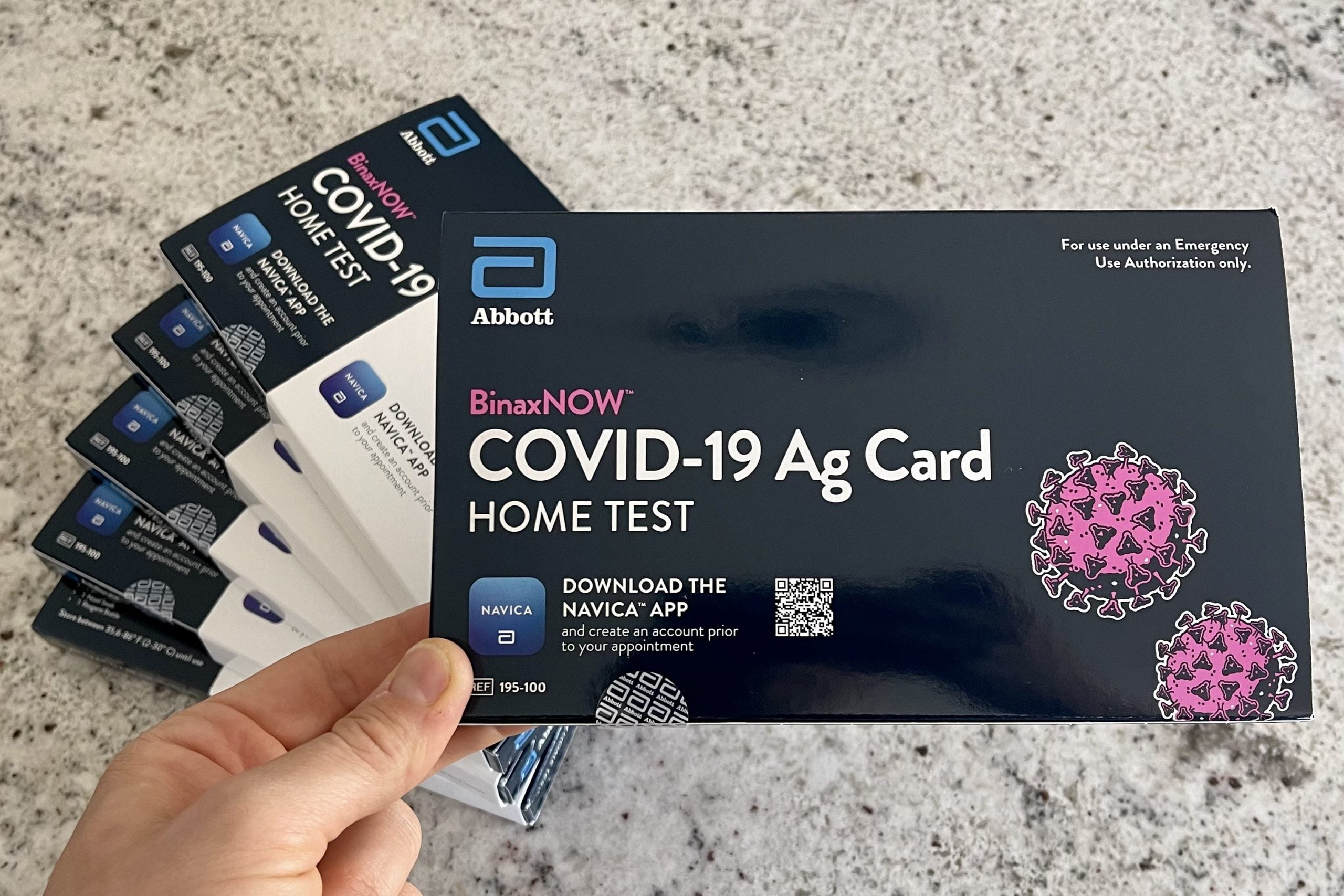

The go-to for this type of testing is the Abbott BinaxNOW COVID-19 Ag Card Home Test.

Abbott offers different types of at-home tests, but this one includes eMed Telehealth Service, which means it's proctored by a telehealth professional and meets the requirements for at-home pre-cruise testing. Abbott's other tests do not meet the requirements when self-administered at home. (Some of Abbott's other tests do meet the requirements when administered by pharmacies, where the testing is monitored in person by a health professional.)

Because this test is antigen, and antigen test results will not meet the requirements for unvaccinated passengers, this option will work for vaccinated passengers only.

Where can I get a qualifying test?

If you're interested in using an at-home test, the Abbott BinaxNOW COVID-19 Ag Card Home Test kits are available in packs of one, two, three or six, and they range in price from about $50 to $150, based on how many you order. You can find them online (allow at least five days for shipping) or at some local pharmacies, depending on where you live.

You can also make an appointment with your doctor, at a local pharmacy or with a big-box chain, such as Walgreens or CVS, all of which offer several options for both antigen and PCR testing. This is one of the best routes for unvaccinated passengers requiring PCR tests. It's rare but be warned that results can take as long as five to seven days to come back, which means you risk not having them in time for your sailing. The cost for these tests can vary, and they might or might not be covered by health insurance.

As an alternative, some cruise lines are making it easier for passengers to find testing in their areas by partnering with national labs. For example, Carnival and Carnival Corp.'s sister brands Holland America and Princess are working with Quest Diagnostics to help cruisers schedule appointments at more than 1,500 Quest locations. They include retail pharmacies, such as those at select Wal-Mart stores. Costs vary, and the test might or might not be covered by insurance. Although there are no guarantees, results are generally returned within 48 hours.

Many major airports also offer rapid testing -- both antigen and PCR -- with same-day results if you find yourself in a pinch. However, the cost is high, with some prices exceeding $200, and it's not covered by insurance.

Initially, Carnival Cruise Line said it would arrange for a mobile testing facility to conduct for-fee passenger testing at the port on embarkation day for each sailing from the U.S., but it later rescinded the offer, citing logistical issues.

Regardless of where you're tested, all test results must be computer-generated to be considered official; handwritten results won't be accepted. Results must include the following in order to meet boarding requirements: first and last name, date of birth, type of test (NAAT or antigen), date and time the sample was taken, test result as either "negative" or "not detected," and laboratory site, testing location or healthcare provider details.

Will cruise lines still offer embarkation-day testing at the pier?

Initially, some cruise lines did provide free testing at the pier for unvaccinated passengers, but that's because those passengers are small in number, given that most lines are sailing with at least 95% of the onboard population vaccinated.

With the CDC's new recommendation that all passengers be tested, regardless of whether or not they're inoculated, cruise lines are now largely putting the responsibility (and cost) of pre-cruise testing back onto passengers.

Currently, the only major cruise lines to provide mandatory testing for all passengers (not just those who are unvaccinated) at the terminal on embarkation day are Disney Cruise Line and Norwegian Cruise Line, the latter of which is sailing with 100% vaccinated passengers and crew. The day-of testing is free for passengers of both lines and vaccinated passengers sailing with either line are not required to be tested prior to embarkation day. (For Disney sailings, unvaccinated passengers will still have to be tested prior to arriving at the terminal and provide a negative result.)

Other lines -- such as Carnival, Holland America, Royal Caribbean, Celebrity and Princess -- will conduct embarkation-day mandatory testing for unvaccinated passengers only, but it's in addition to the mandatory pre-cruise testing rather than as a replacement for it. (In other words, unvaccinated passengers sailing with those lines will have to be tested prior to arriving at the terminal, show their negative test results and then undergo additional testing.) Carnival, Holland America and Princess will charge each unvaccinated passenger (even those younger than 12) a $150 fee for the cost of the testing. Royal Caribbean and Celebrity will impose a $136 charge per unvaccinated cruiser who is 12 or older; testing for unvaccinated passengers younger than 12 is free.

Bottom line

All cruisers will now have to present negative test results (PCR for unvaccinated passengers and antigen or PCR for vaccinated ones) on embarkation day before they will be allowed to board and sail. The cost is at each passenger's own expense, unless otherwise noted.

Although at-home test results are accepted, the tests must be FDA-authorized for emergency use, and they must be administered under the supervision of a telehealth professional.

Other testing options are available, but they could take longer to process, which puts passengers at risk of not having their results in time. If you have a voyage coming up soon, plan accordingly. Don't leave your testing until the last minute, and don't assume that you'll be able to receive a test at the pier on the day your cruise departs, unless you're sailing with Norwegian or Disney.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app