The Critical Points: Airlines should give passengers a rating based on behavior

Each week in his column "The Critical Points," TPG Loyalty and Engagement Editor Richard Kerr presents his opinion on a loyalty program, card product or recent news that he believes is overlooked, unsung or the result of groupthink taking mass opinion in a direction with which he doesn't agree. His goal is not necessarily to convince you to agree with his position but rather to induce critical thought for each of the topics and positions he covers.

We live in odd times. While significant advances are being made around the world in a number of fields, we still often see the worst in humanity come out. In my experience, this happens all too frequently in the airport or on an airplane. Recent years have seen sensational accounts surrounding airline customer service incidents and inadequate airline operations. These stories — and an unfortunately poor public opinion of airlines in general — has created a situation where passengers often fortify a proverbial shield around themselves before beginning a trip.

I've spent a lot of time in airports this year, and I feel like I can see people preparing for "battle" as they head to the customer service counter. Their body language stiffens and their shoulders rear back as they set their eyes on getting what they need. In general, there is nothing wrong with trying to make the flying experience as enjoyable as possible — as long as it's done with a civil (dare I say pleasant?) approach. But for many passengers, the slightest sign of a disruption or inconvenience causes a knee-jerk reaction, as they deploy every possible defense mechanism to make the airline bend to their will. Unfortunately, these behaviors often come with a "me first" attitude that breaks the bounds of courtesy and decency.

Simply put, they should not be tolerated by airlines, nor should they have to be tolerated by fellow passengers.

Due to repeated examples of passengers' inability to behave and police themselves, it's time for airlines to give passengers a rating. Like Uber and Lyft, a passenger should be held accountable for their actions and have a numerical score placed in their profile, one that can lead to increased rewards for travelers with higher scores — and could lead to consequences for those with low ones.

Rating System Basics

Here's my vision for how a rating system would work. For starters, it would operate on a simple (1-5) scale, with five being the highest and one the lowest. Unlike the ratings from popular ride-hailing platforms, this wouldn't require a per-flight score. In fact, there wouldn't be any reason to rate a passenger in the vast majority of situations — unless there was a customer service encounter (either in-person or over the phone). If a flight attendant sees a passenger going above and beyond to be pleasant and polite, they get a positive rating. If a passenger is being irate, rude or inconsiderate, they'd get a negative rating.

Everyone starts at a base-level rating (say 3) and can either go up or down. Then, at the end of the year, the passengers with scores in the highest X% would be rewarded in some way — be it a deposit of frequent flyer miles, an upgrade certificate or a free flight. The airline could even send all passengers who flew a minimum number of flights and had a 4+ rating a drink coupon or some other small token of appreciation. This would incentivize passengers to go out of their way to be polite and kind.

On the opposite end of the spectrum, passengers who are repeatedly given a one-star rating could be penalized. This might start with a warning letter but could escalate to a mileage deduction, expulsion from the loyalty program or even placement on an airline's do-not-fly list. Remind passengers that doing business with your airline is a privilege and if you repeatedly expose staff and passengers to rude behavior, you will no longer receive that privilege.

Of course, there are other factors to consider in this type of system. One of the biggest is revenue. What would an airline do with a passenger that consistently gets poor reviews but buys weekly, transatlantic, business-class tickets that cost thousands of dollars? Nevertheless, knowing that there was an incentive to behave well and a disincentive to act boorishly could go a long way toward making the skies a friendlier, more enjoyable place.

I want to stress that this proposed rating system isn't (and shouldn't) be purely a negative one. You can often see the best in humanity come out when strangers cross paths and help one another. Simple gestures like assisting with luggage, pointing folks in the right direction or swapping seats to unite traveling companions can make your heart warm. Positive ratings should be given by staff when something like this is observed.

Ensuring accountability

All that said, it's critical to hold airline staff accountable, and there are two important aspects for this safeguard. First, a flight attendant can't go off the deep-end and give the majority of passengers they encounter a one-star rating. Management should review the spread of scores staff give and recalibrate (or throw out) scores from staff who repeatedly give an overwhelming majority of negative ratings. The same would go for those staff that only give an overwhelming majority of perfect scores.

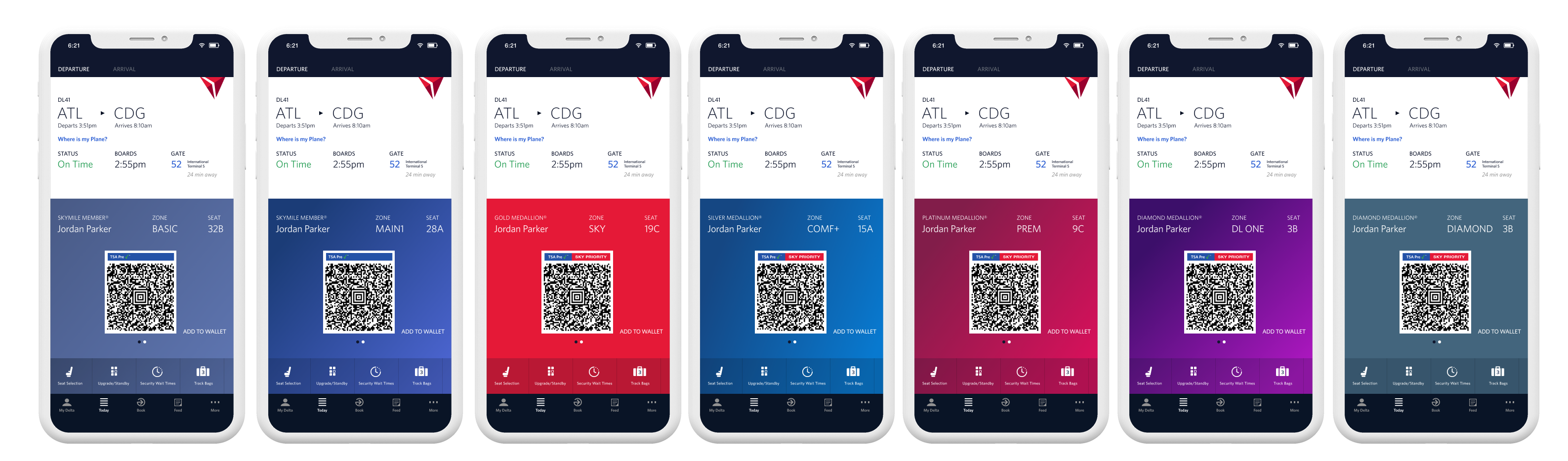

The second part of accountability would be the ability of passengers to rate flight attendants and ground staff. In the section of the app where you access your current day's itinerary and boarding pass, why not add a place for you to quickly rate the crew member(s) and gate agent(s) assigned to your flight, either positively or negatively? Just like for crew, passengers who only give overwhelmingly negative comments should be thrown out of crew's score calculation. Everyone is bound to have a bad day at work, but it should be pretty clear for management to see trends in a particular staff member's performance.

It Already (Sort of) Exists

If this seems like a pipe dream and something that would never come to fruition, think again. Delta began arming flight attendants with SkyPro handheld devices a few years ago, and these machines have a lot of nifty abilities — including annotating passengers' accounts who were particularly troublesome. Flight attendants can also reward passengers with SkyMiles for kind gestures like trading seats so family members can sit together.

They can also see your exact, up-to-date SkyMiles Medallion status and where you are supposed to be sitting, making it impossible to claim a higher tier and attempt to score perks to which you aren't entitled. Rating passengers and creating a standardized scoring system — then training customer-facing staff on that system — is just the next iteration of what is already in place with Delta.

Bottom Line

I'm tired of seeing unruly travelers in airports and on planes, so I'd love to see a passenger rating system take root. The only opposition I could see someone having to this is if they're afraid they'll receive constantly poor ratings. An airline won't take action against you for a one-off bad score, but just like with staff, it would be pretty easy for an airline to see a trend in how you handle yourself in the airport and on their flights. Most of the time in the above program, you wouldn't receive a rating at all.

I wish a rating system wasn't necessary, but I believe we've reached a point where policing adults is now necessary. I'd posit that this is partly due to shifting norms of what is (and isn't) acceptable behavior, but it's also connected to the stress and proximity to others that flying creates. Smaller seats, less space, packed flights, more rules and busy airports have all made flying a less-than-enjoyable activity for many. However, that's no excuse to behave badly.

I encourage airlines to begin to empower staff (and passengers) to rate one another in an effort to incentivize good behavior and punish bad actors.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app