4 great credit cards likely going away soon and why you should get them now

As someone who holds more than 20 credit cards, I keep a close eye on what's available in the cards space ... and what could be going away soon.

It's been a pretty intense year of card changes, card launches and heightened offers. There are also several cards that we think may not be around for much longer.

Some of those cards could help savvy readers stock up on points and miles without high annual fees. Here's a list of some of my favorite opportunities in the card space and offers that may be off the table sooner rather than later.

Aviator cards

The Barclays Aviator credit cards are among my favorite cards to recommend to folks looking for a good welcome bonus without a high minimum spending requirement or a high annual fee.

AAdvantage Aviator Red World Elite Mastercard

Right now, the offer on the entry-level AAdvantage® Aviator® Red World Elite Mastercard® is just 50,000 AAdvantage miles, but you get the miles after making your first purchase in the first 90 days after account opening and paying the $99 annual fee. That means the minimum spending to get 50,000 miles is literally as low as $100: $99 annual fee and a $1 charge. This, to me, is borderline free AAdvantage miles.

Keep in mind, I've seen offers as high as 70,000 miles. However, an offer that high might not come back before the card is no longer available.

The information for the AAdvantage Aviator Red World Elite Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Barclays used to have several cards under its AAdvantage Aviator portfolio. However, only one is currently available to new applicants: the AAdvantage Aviator Red.

Citi will become the exclusive issuer of AAdvantage cards starting in 2026. That means new applications for the Aviator Red could soon get pulled, potentially before the end of 2025.

AAdvantage Aviator World Elite Silver Mastercard

I hold the higher-end version of the card, the AAdvantage® Aviator® World Elite Silver Mastercard®, which comes with the same benefits as the Red card.

The information for the AAdvantage Aviator World Elite Silver Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Each year, you can earn a companion certificate ($99 fare plus taxes and fees) after you spend at least $20,000 on your card and keep it open for 45 days after your cardmember anniversary. You'll also get up to $50 in statement credits each account anniversary year for inflight Wi-Fi purchases.

The Silver card has a higher $199 annual fee, but it comes with an additional companion on its certificate, so you can bring two guests for $99 each.

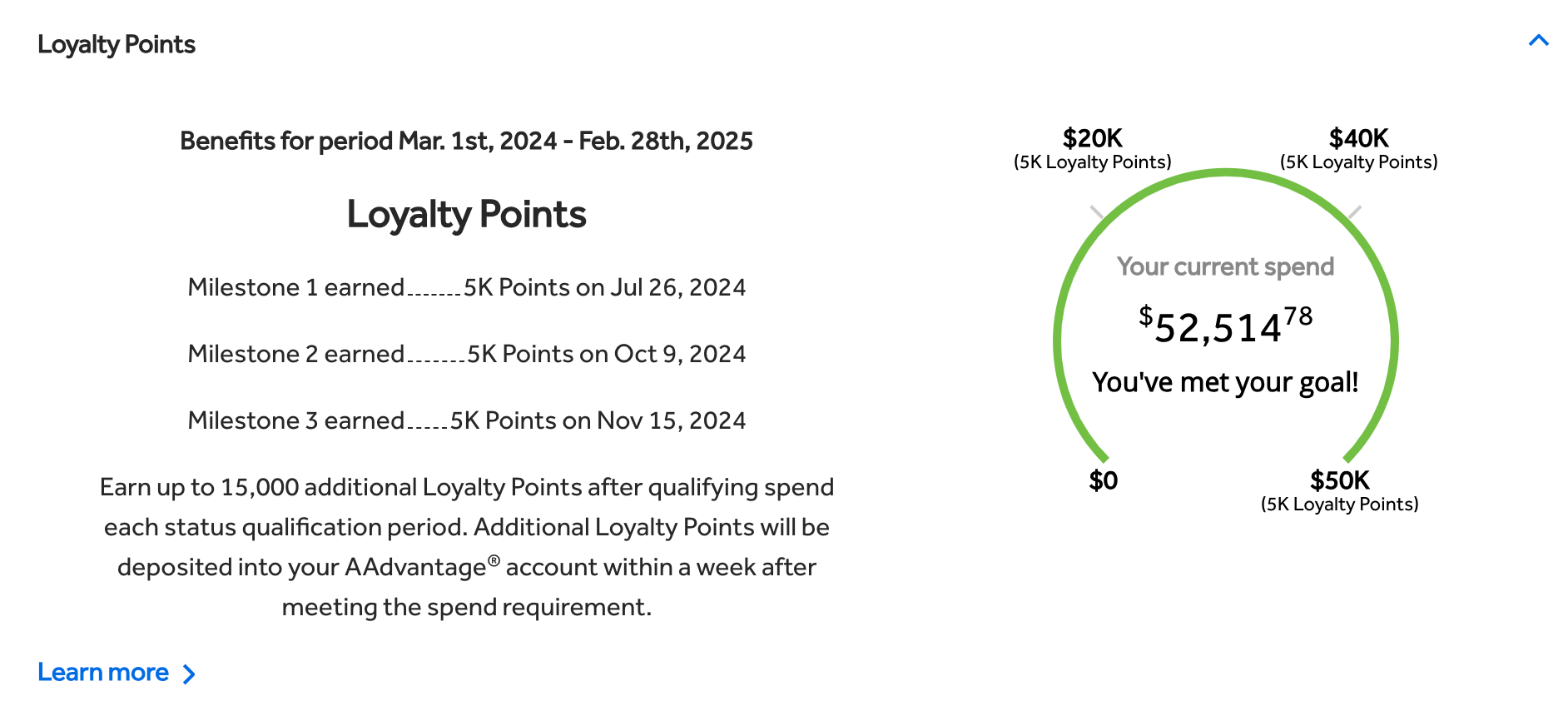

It also has my favorite feature: a shortcut to status. You can earn up to 15,000 Loyalty Points after qualifying spending each status qualification period. You get 5,000 Loyalty Points for spending $20,000, another 5,000 for spending $40,000, and another 5,000 if you hit $50,000 in spending each year on the card.

These boosts have gotten me a long way toward reearning American Airlines Executive Platinum status for the past several years.

You can't apply for the Silver card outright. You'll need to open the Red card first and then ask Barclays to upgrade to the higher-annual-fee version.

We don't know how long these cards will remain available. But I did get a letter from Barclays saying the card would retain the ability to earn AAdvantage miles and Loyalty Points through 2025 at least, so I'm good for now.

Hopefully, Citi will keep the same benefits on the card when and if it migrates from Barclays. In the meantime, I would jump on these cards while you can.

Hawaiian Airlines cards

Once it became clear that Hawaiian Airlines would be acquired by Alaska Airlines in a blockbuster merger, I guessed the Hawaiian credit cards would eventually go away, and the Hawaiian miles I earned would convert to Alaska Mileage Plan miles.

Although the Hawaiian credit cards aren't going away (just yet), the airlines recently announced a new joint loyalty program, Atmos Rewards.

You can currently transfer HawaiianMiles to Atmos Rewards at a 1:1 ratio, and HawaiianMiles will become Atmos points Oct. 1.

Related: A gamble on Alaska miles — why I applied for 2 Hawaiian Airlines cards on the same day

I applied for both the personal and business versions of the Hawaiian Airlines cards. That way, I could really maximize the welcome bonuses that may eventually go away (or, at least, evolve from their current state).

Opening these two credit cards earned me 138,000 HawaiianMiles.

I earned 70,000 HawaiianMiles after making a purchase within 90 days from account opening (no longer available) for the Hawaiian Airlines® World Elite Mastercard®. The other offer was for up to 60,000 HawaiianMiles after spending $2,000 and making a purchase with an employee card within the first 90 days from opening an account (no longer available) for the Hawaiian Airlines® World Elite Business Mastercard®.

The information for the Hawaiian Airlines World Elite Mastercard and the Hawaiian Airlines World Elite Business Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

You don't have to have a huge business for this strategy to work. If you have any type of small business — even one as small as an eBay store — you can apply for a business credit card with your name as the business and your Social Security number instead of an employer identification number.

Related: Do I need a business to get a business credit card?

Bottom line

Several of these credit cards have generous welcome bonuses that don't come with high spending requirements or annual fees.

By strategically signing up for these cards right now, you could get a chunk of miles for that next trip to Hawaii. Or to do something like I did recently and use the miles to book some extraordinary business-class flights to Asia.

Related reading:

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app