Why now's the time to consider Avianca's Subscribe-and-Save Club LifeMiles program

Editor's note: This post has been updated with the latest promotion. It was most recently published on Aug. 28, 2019.

In February 2018, Avianca LifeMiles launched a unique buy-miles program called Club LifeMiles. Through a subscribe-and-save type of promotion, members can rack up LifeMiles for as little as 1.35 cents per mile.

Between this low price and LifeMiles' sweet spots, this program allows members to score one-way United awards for as little as $101 all the way up to a first-class flight to Europe with Lufthansa (with no fuel surcharges) for $1,175 in purchased miles. The catch is that you have to subscribe for a full year to get all of the quarterly bonuses necessary to lower the per-mile cost to 1.35 cents each. For reference, that's significantly cheaper than TPG's valuation of LifeMiles at 1.7 cents per mile.

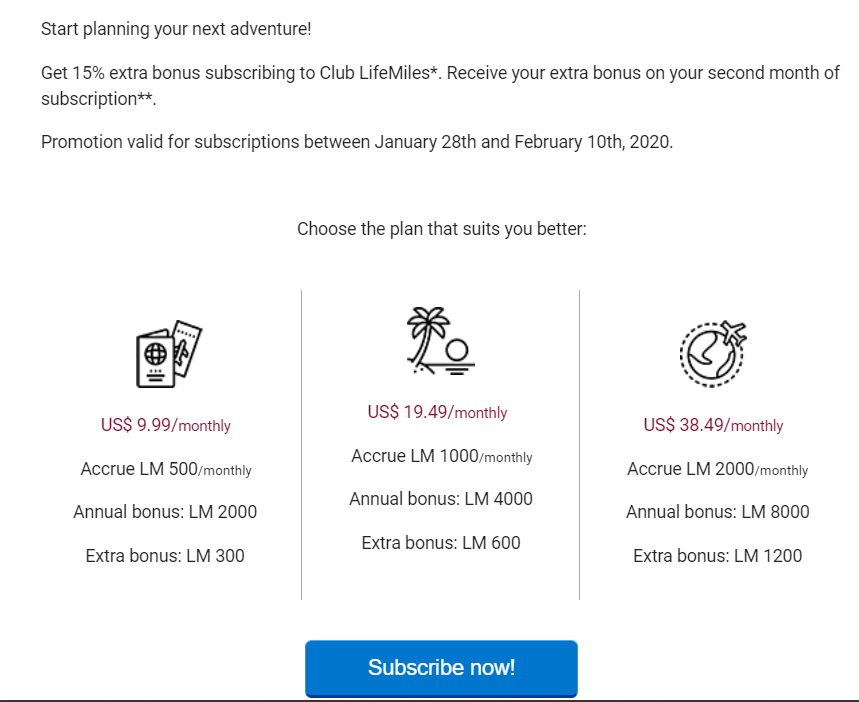

If that wasn't a good enough deal, LifeMiles is running an offer to targeted members to get another 15% mileage bonus for subscribing to Club LifeMiles. If you've been targeted by email you have a deadline of Feb. 10, 2020, to sign up.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

The details can be a bit confusing with this offer, so let's break down how it works. In addition to the standard quarterly bonus, targeted members who take advantage of this offer will get an additional bonus after the second month of subscription. This bonus is calculated as 15% of the annual bonus for that plan.

Let's say that you subscribe to the $126 per month plan to buy 7,000 miles per month. The quarterly bonuses add up to 28,000 miles for a year. And 15% of that annual bonus amount is 4,200 miles, which is the "extra bonus" paid after the second month.

After one year of subscribing to Club LifeMiles at this 7,000 per month rate, you'd collect 84,000 miles from the monthly purchases plus 28,000 from the quarterly bonuses plus 4,200 from this "extra bonus." That's a total of 116,200 LifeMiles for a total cost of $1,512. That computes to 1.3 cents per mile.

The bonuses aren't paid out linearly. The quarterly bonuses are meant to keep members subscribing for the full year. When factoring in both the quarterly bonuses and this special one-time 15% bonus, here's how the accumulated cost and accumulated miles by month add up for the 7,000 LifeMiles per month package option:

| Month | Total payments | Total miles | Cost per mile |

|---|---|---|---|

1 | $126 | 7,000 | 1.80 |

2 | $252 | 18,200 | 1.38 |

3 | $378 | 28,000 | 1.35 |

4 | $504 | 35,000 | 1.44 |

5 | $630 | 42,000 | 1.50 |

6 | $756 | 53,200 | 1.42 |

7 | $882 | 60,200 | 1.47 |

8 | $1,008 | 67,200 | 1.50 |

9 | $1,134 | 81,200 | 1.40 |

10 | $1,260 | 88,200 | 1.43 |

11 | $1,386 | 95,200 | 1.46 |

12 | $1,512 | 116,200 | 1.30 |

And for the 5,000 LifeMiles per month option:

| Month | Total payments | Total miles | Cost per mile |

|---|---|---|---|

1 | $92 | 5,000 | 1.84 |

2 | $184 | 13,000 | 1.42 |

3 | $276 | 20,000 | 1.38 |

4 | $368 | 25,000 | 1.47 |

5 | $460 | 30,000 | 1.53 |

6 | $552 | 38,000 | 1.45 |

7 | $644 | 43,000 | 1.50 |

8 | $736 | 48,000 | 1.53 |

9 | $828 | 58,000 | 1.43 |

10 | $920 | 63,000 | 1.46 |

11 | $1,012 | 68,000 | 1.49 |

12 | $1,104 | 83,000 | 1.33 |

And here's how the 3,000 miles per month subscription breaks down:

| Month | Total payments | Total miles | Cost per mile |

|---|---|---|---|

1 | $57 | 3,000 | 1.90 |

2 | $114 | 7,800 | 1.46 |

3 | $171 | 12,000 | 1.42 |

4 | $228 | 15,000 | 1.52 |

5 | $285 | 18,000 | 1.58 |

6 | $342 | 22,800 | 1.50 |

7 | $399 | 25,800 | 1.55 |

8 | $456 | 28,800 | 1.58 |

9 | $513 | 34,800 | 1.47 |

10 | $570 | 37,800 | 1.51 |

11 | $627 | 40,800 | 1.54 |

12 | $684 | 49,800 | 1.37 |

Is it a good deal? Well, TPG values LifeMiles at 1.7 cents per mile, so buying miles at 1.3 cents is a solid discount to this valuation.

However, LifeMiles aren't for everyone. You're going to need to know how to use the miles and have a high-value redemption in mind for which you're planning to use the miles. Still, you could get far more than 1.3 cents per mile in value when redeeming for premium cabins like Lufthansa First Class — plus, LifeMiles doesn't pass along fuel surcharges.

Related: Everything you need to know about Avianca LifeMiles

Also, with program devaluations prevalent, points and miles are a bad investment long-term. Subscribing to a plan that takes a full year to pay off is a bit risky. However, LifeMiles has signaled through award sales of up to 31% off that it doesn't seem to think its award chart is currently too cheap.

The other catch with LifeMiles is its spotty IT and customer support. This was bad enough that TPG couldn't recommend LifeMiles for a few years. But, Avianca has made some notable improvements to its online booking system, making it much more usable than before. While there are still periodic issues or missing award availability, it's about as good as you'll find on any other airline reservation system nowadays.

Looking for other ways to top off your LifeMiles account? There are now plenty of options. LifeMiles is a transfer partner of Citi ThankYou Points (1:1), American Express Membership Rewards (1:1) Capital One Miles (2:1.5) and Marriott points.

Featured photo by Zach Honig/The Points Guy.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app