Chase confirms $10 Gopuff credit is gone

Chase confirmed that the $10 Gopuff credit on many of its cards expired on Dec. 31, 2023, and won't return for the new year. It's a credit I've been using religiously since the deal was announced in 2021.

Chase told TPG it was "Confirming that the Gopuff offer for eligible Chase cardmembers ended on December 31, 2023."

Gopuff is a delivery service that brings groceries and other household items right to your door — usually within 40 minutes, in my experience. The company offered Chase cardholders $10 in a monthly credit card statement credit on each of the Chase cards they registered. That meant I was getting $10 back on orders over $10 on three of my personal Chase cards.

Every month, I placed three separate orders and received the statement credit on my Chase Sapphire Preferred, my World of Hyatt Credit Card and my IHG Rewards Club Select Credit Card (no longer available to new applicants).

The information for the IHG Rewards Club Select has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: Earn up to 140,000 points with these IHG card offers

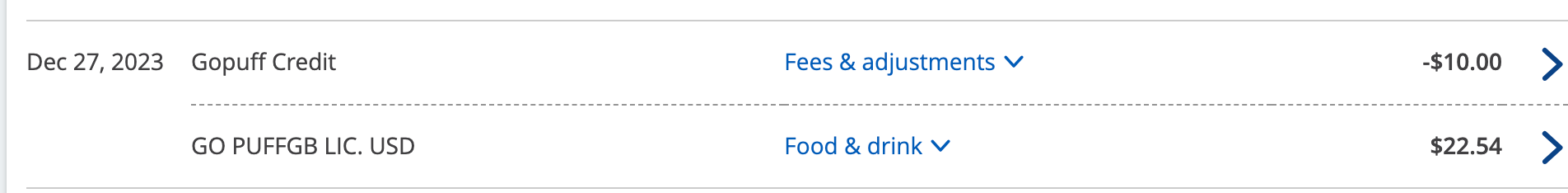

I found I was using these offers pretty regularly, and I'm disappointed to see this deal go away for 2024. Here's just one example from my Chase Sapphire card. I spent $22.54 at Gopuff and got $10 in statement credits.

It could still make sense to use Gopuff for some items, since you can get stuff delivered for a flat fee of as low as $3.95, and the site often has sales. Gopuff is in more than 1,000 markets right now.

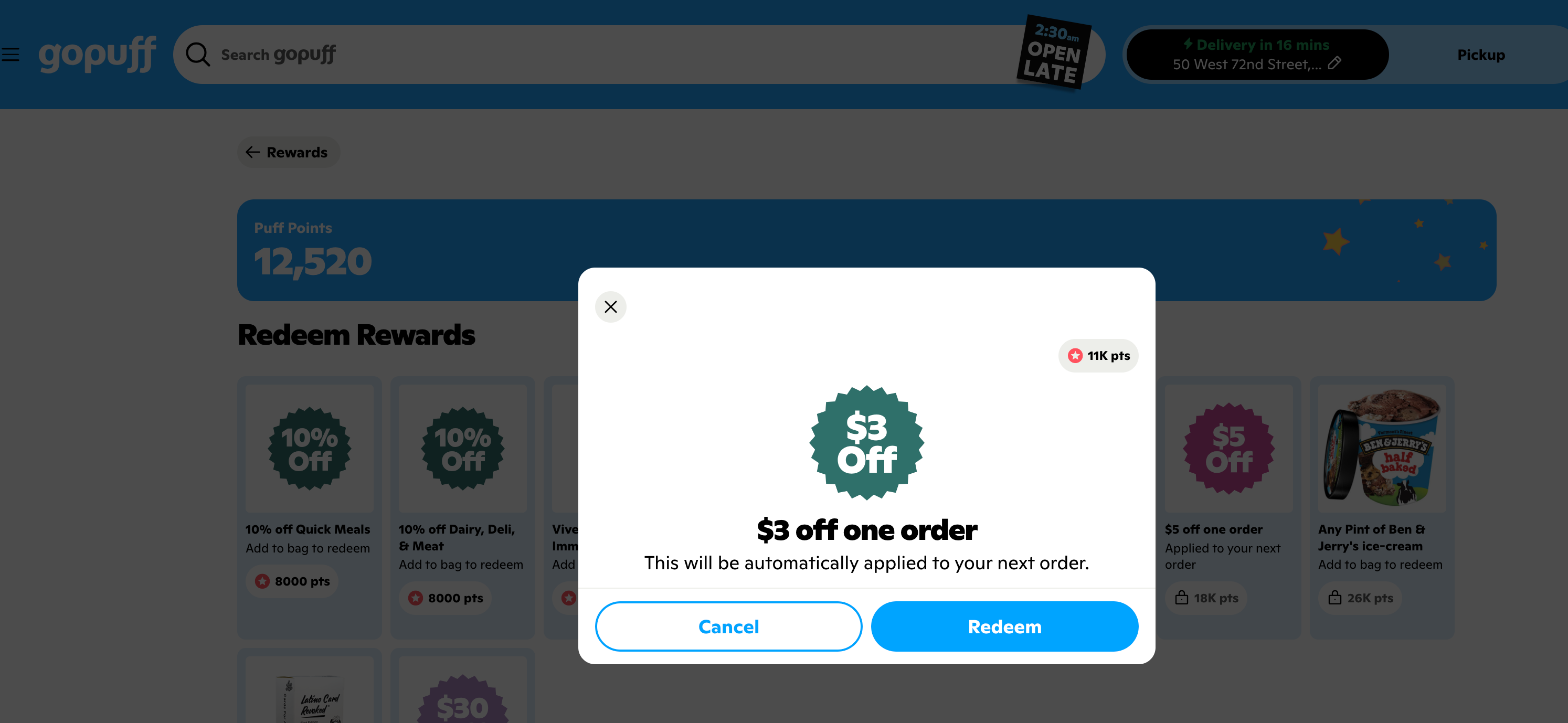

Unfortunately, it has also ditched a once-lucrative rewards program. Gopuff announced it was "... sunsetting the Puff Points program effective Jan. 31, 2024."

Related: You can now get Gopuff delivery for free to select Hyatt Place hotels

I'd been able to use my Puff Points to take set dollar amounts off future deliveries. For example, I used my last points to redeem an offer for $3 off before the promotion ends later this month.

I will not likely continue to use the service regularly without the Chase credit. In fact, I've canceled my monthly "Fam" membership that gave me free delivery, but had gone up to $7.99 recently. The company said I'd saved $138 via my service over the past few years, but without the $10 per card per month via Chase, it no longer makes much sense for me personally.

Remember there are still many ways to save money on your Chase cards. If you're unfamiliar, the program is similar to Amex Offers. You can add special cash back of other offers to your online accounts on Chase-issued debit and credit cards. Our complete guide to Chase Offers is here.

Related reading:

- Key travel tips you need to know — whether you're a first-time or frequent traveler

- Best travel credit cards

- Where to go in 2024: The 16 best places to travel

- 6 real-life strategies you can use when your flight is canceled or delayed

- 8 of the best credit cards for general travel purchases

- 13 must-have items the TPG team can't travel without

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app