Businesses Can Now Book American Airlines Business Extra Awards, Upgrades Online

American Airlines Business Extra is a great way for businesses and employees to "double-dip" from AA flights. Travelers get the mileage earning they would otherwise get, and the business gets points that can be redeemed for free flights, flight upgrades, club membership, elite status and more.

Unlike other airline business programs, AA only requires two travelers for a business to be eligible and there's no minimum spending requirement. The earning structure is simple, and periodically there are lucrative bonuses. Businesses have at least two years to use these points before they expire.

The trouble is, the redemption process has been a pain. First, the business needs to redeem points for an upgrade or free flight certificate. Then, after searching to find eligible flights and availability, the business then needs to call in to redeem the certificate for the free flight or upgrade. And that can be a problem when a rare upgrade or award comes available when the Meeting Services Desk is closed.

The good news is that process just got a lot easier: you can redeem for free flights and upgrades right on AA's revamped "American Airlines For Business" website. However, not all flights are eligible, as we will detail below.

How To Use the New System

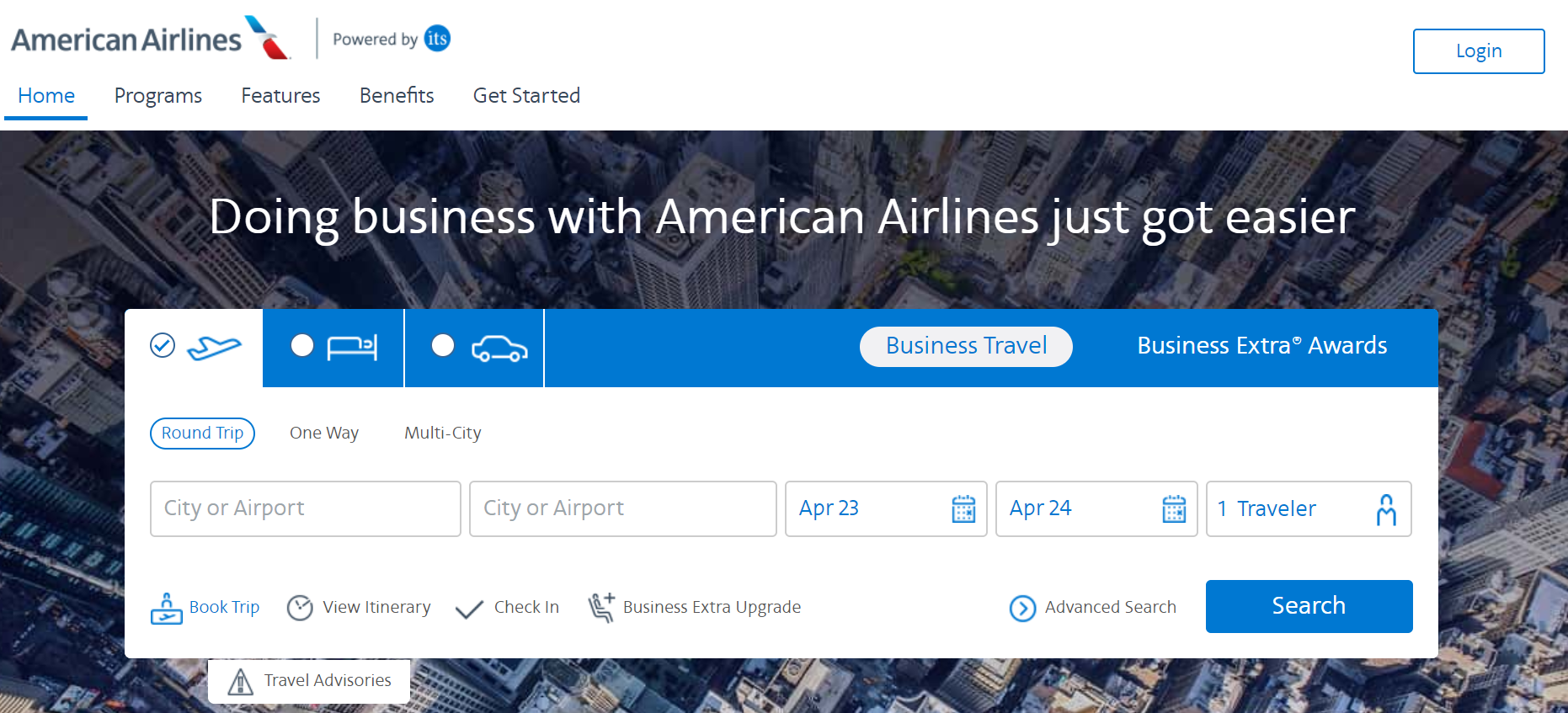

To get started, head to AA's new "American Airlines For Business" homepage: https://business.aa.com/

There, you can book cash flights directly on the homepage. But, that's nothing special, unless you're working with a business that has a negotiated rate with AA. If so, this is now your landing page to make these bookings.

However, as far as Business Extra improvements, you can now click "Business Extra Awards" to get started booking a Business Extra free flight award. If you're not already familiar with the Business Extra free flight program and award options, this is the comprehensive guide to get you started.

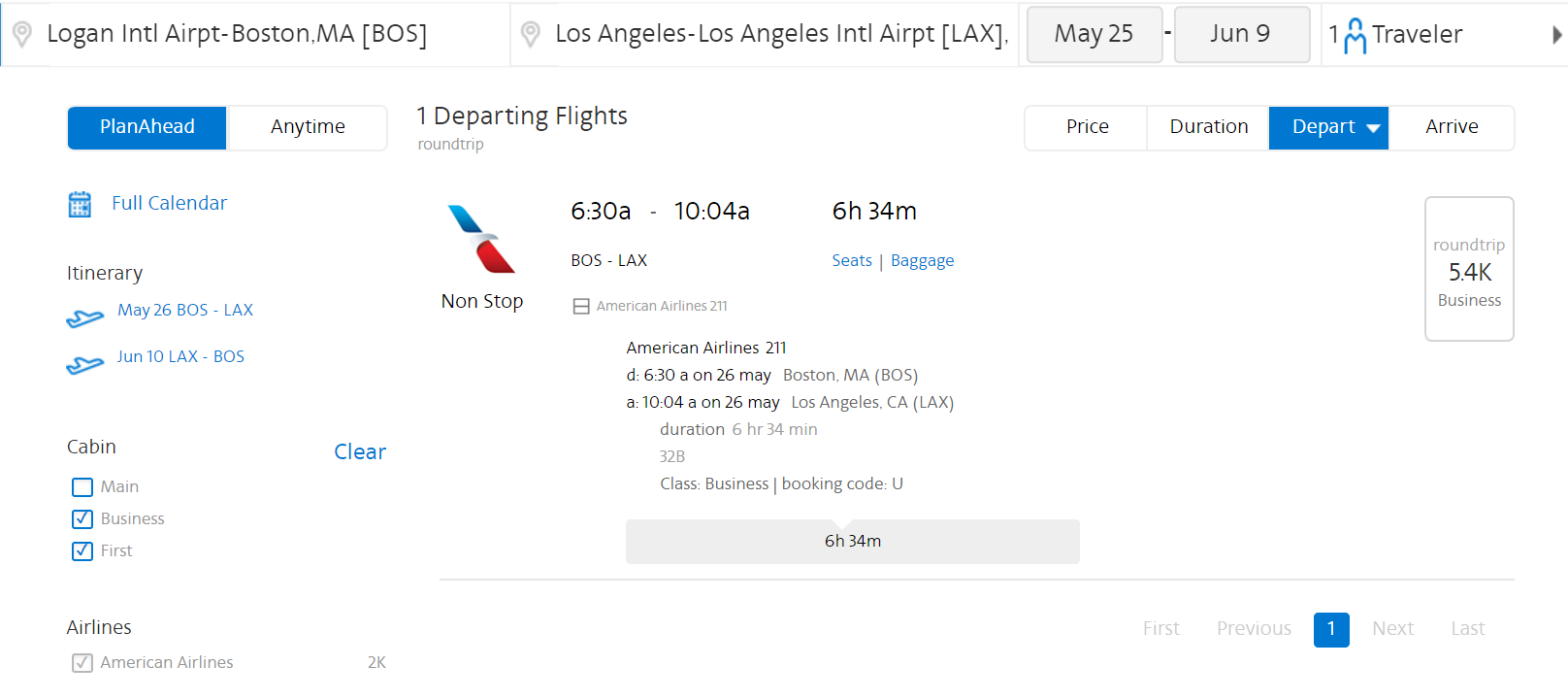

It's evident that Business Extra created an entirely new search engine specifically for Business Extra flight awards. You can use this search engine to find and book availability using Business Extra certificates. If you're looking for availability before you redeem points for a certificate, make sure to pay attention to PlanAhead (saver space) vs. Anytime results. You can use filters on the left-hand sidebar to limit to PlanAhead, nonstop and cabin options.

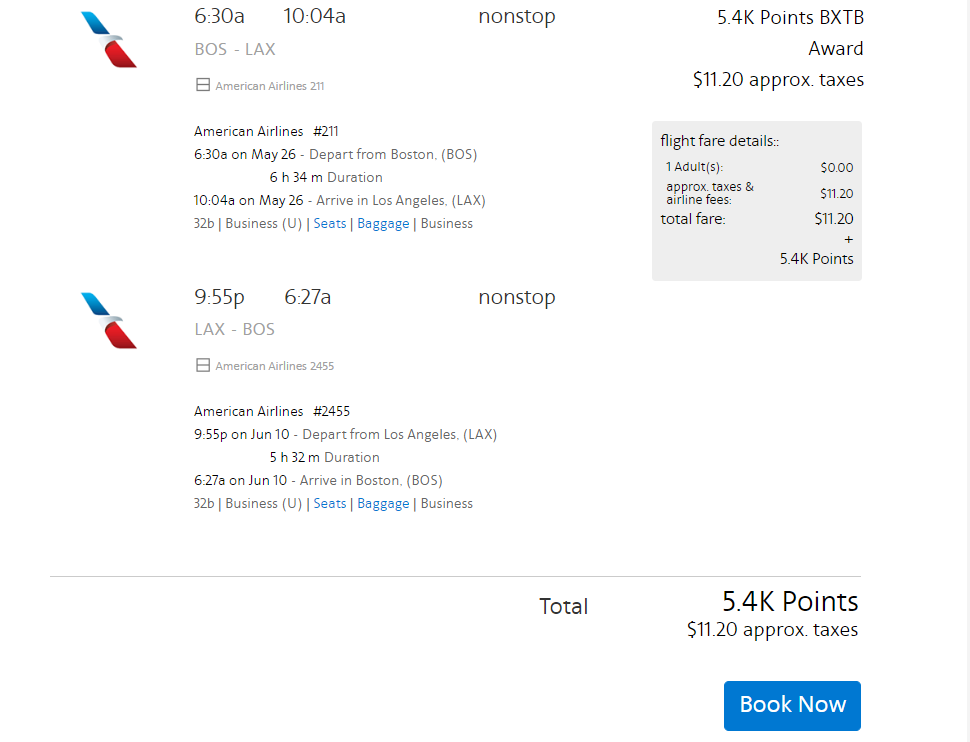

Once you have the flight result you want to redeem, the search engine will show how many Business Extra points are needed and the certificate code required for the award:

If you already have the certificate, you can click the "book now" button to do so online. But, even if you don't have a certificate, you can click "book now" to directly apply points from your account for an award flight without having to redeem those points for a certificate first.

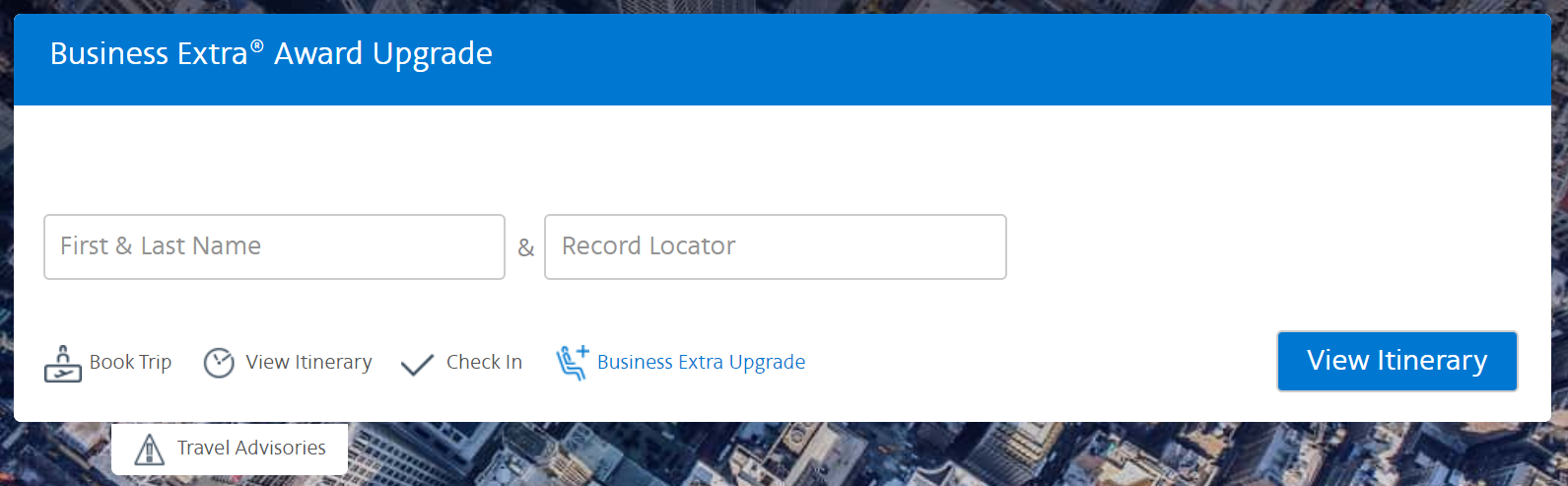

For upgrades, go back to the Business Extra homepage and click "Business Extra Upgrade" to get the award upgrade search widget:

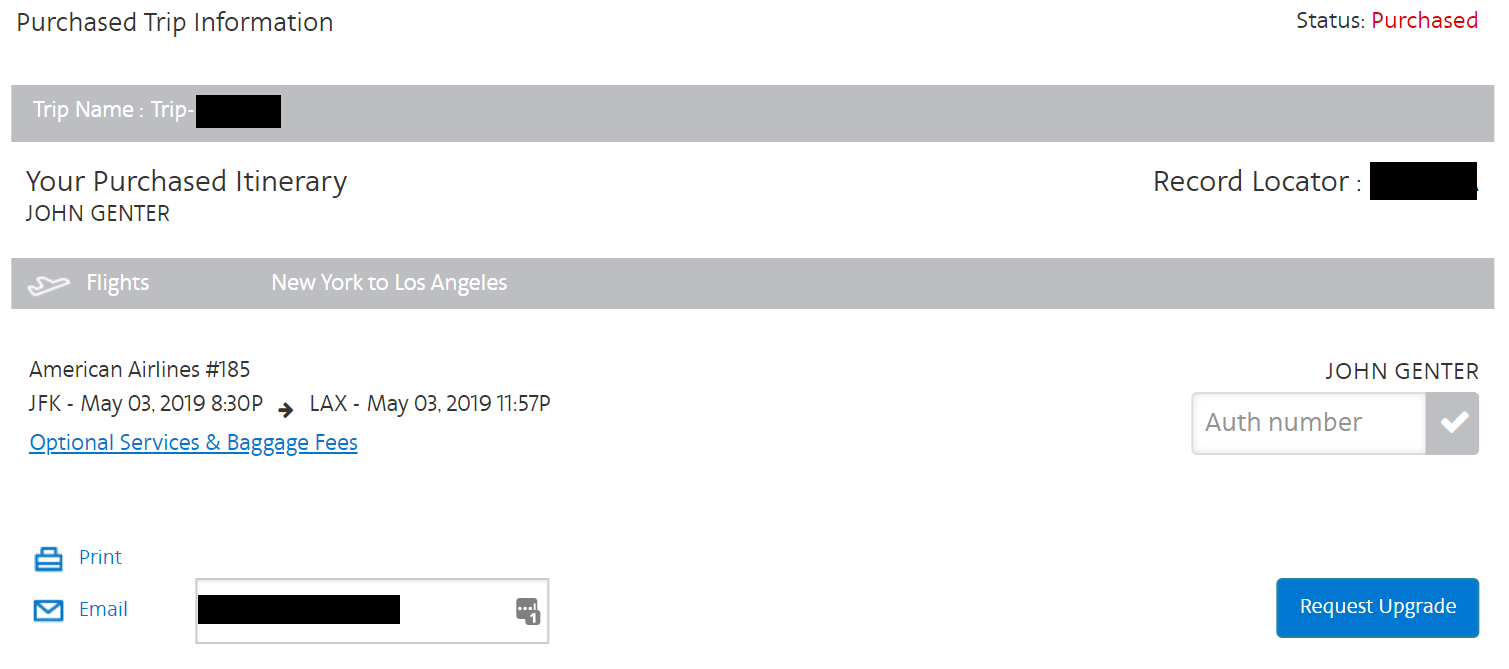

Enter the traveler's first and last name and record locator to retrieve the reservation. If there's an upgrade available, the next page will show a small "auth number" box. Enter the upgrade certificate in this box to apply the certificate to this flight:

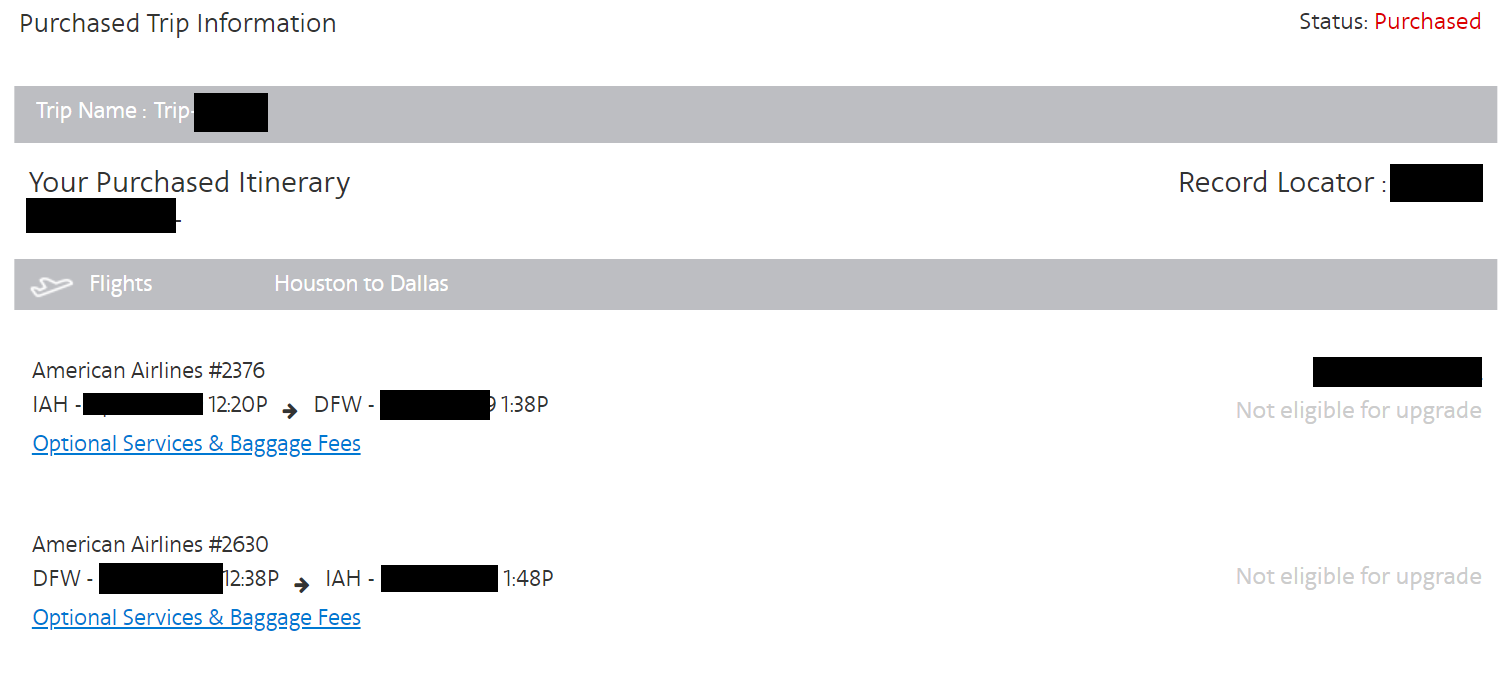

If there's no award upgrade space, you'll get a message that the flight is "not eligible for upgrade":

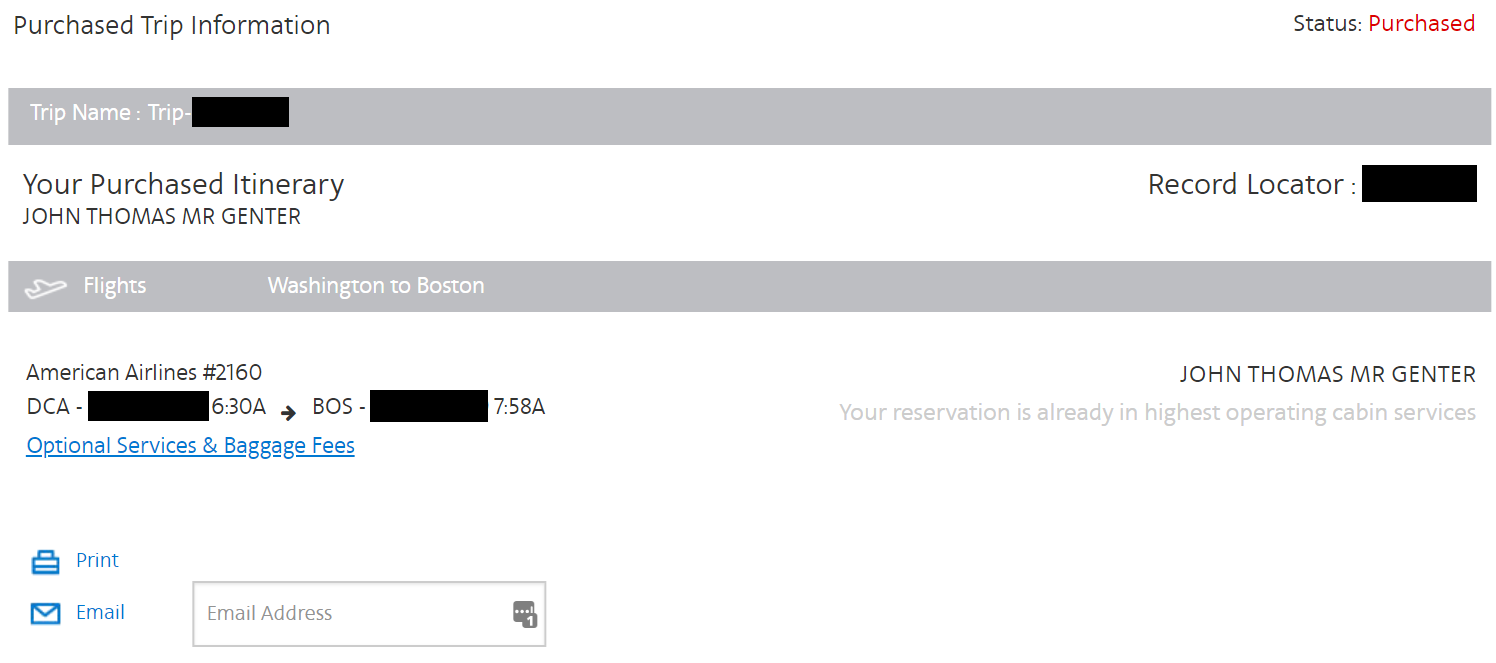

And, if you pull up a reservation where you're already booked into the front cabin, Business Extra will note it:

Limitations of the New System

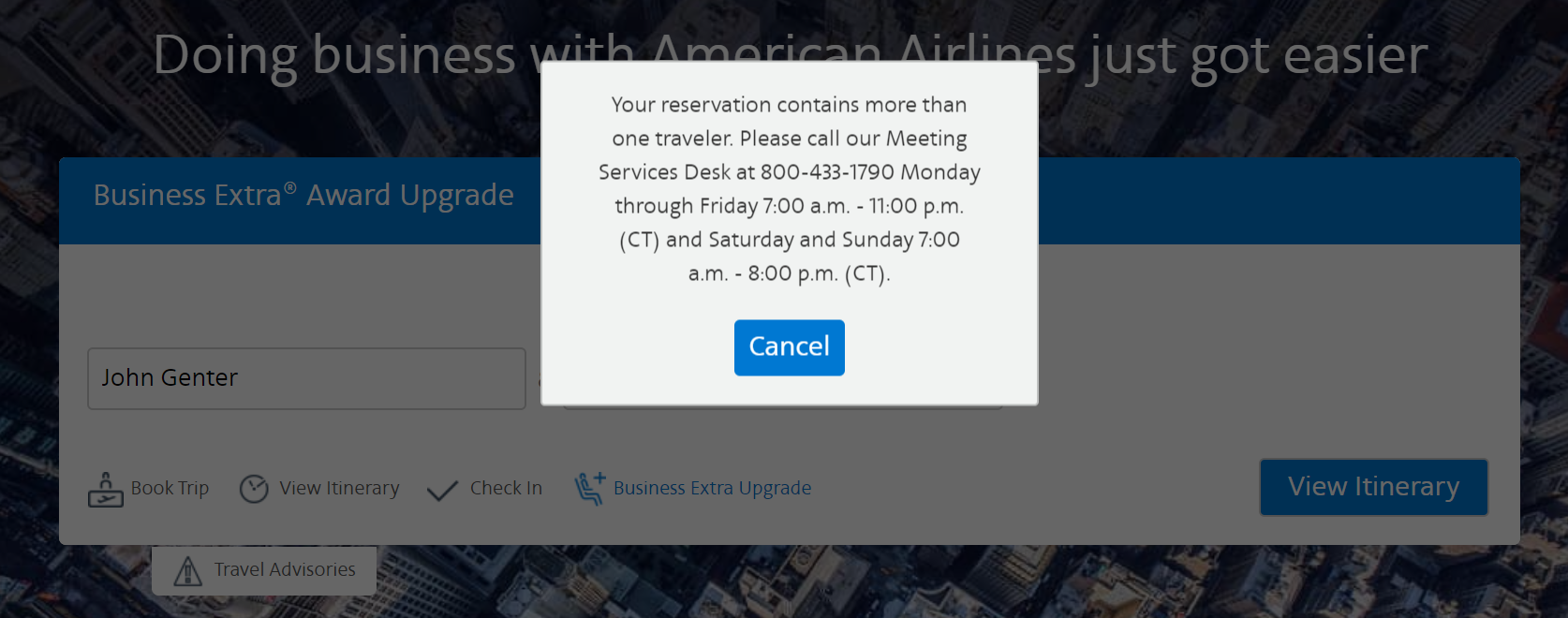

As a big fan of the Business Extra program and frequent AA flyer, I was eager to try to use this new system for myself. Unfortunately, I didn't have a single upcoming flight that qualified. One of the biggest limitations I ran into is that the new system won't let you apply an upgrade to a reservation with more than one traveler.

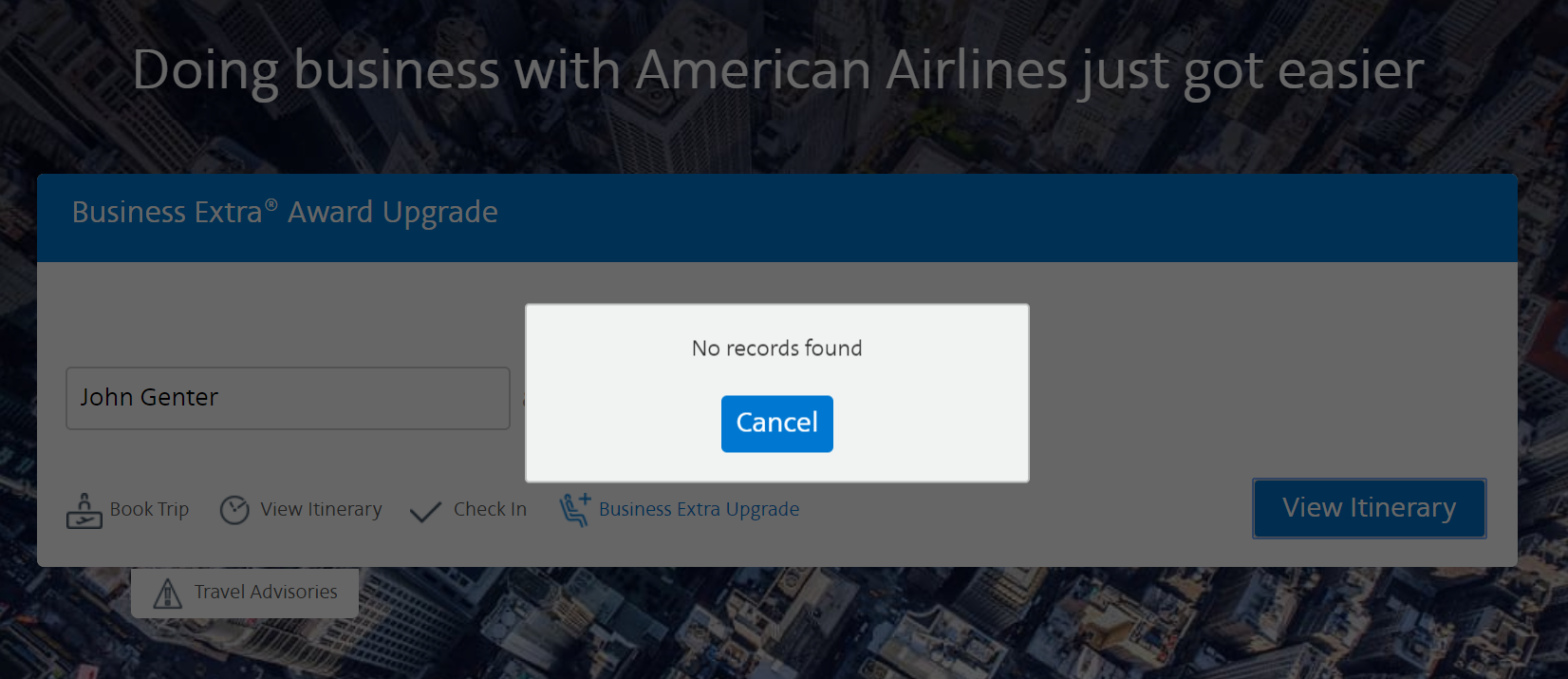

I tried holding an itinerary with available upgrade space to see if I could retrieve it through the Business Extra website. I received a message that there were "no records found." So, I ticketed this reservation. It wasn't until the reservation was ticketed that I was able to pull up the reservation through Business Extra's website. Even while the ticket was pending, I couldn't retrieve the reservation:

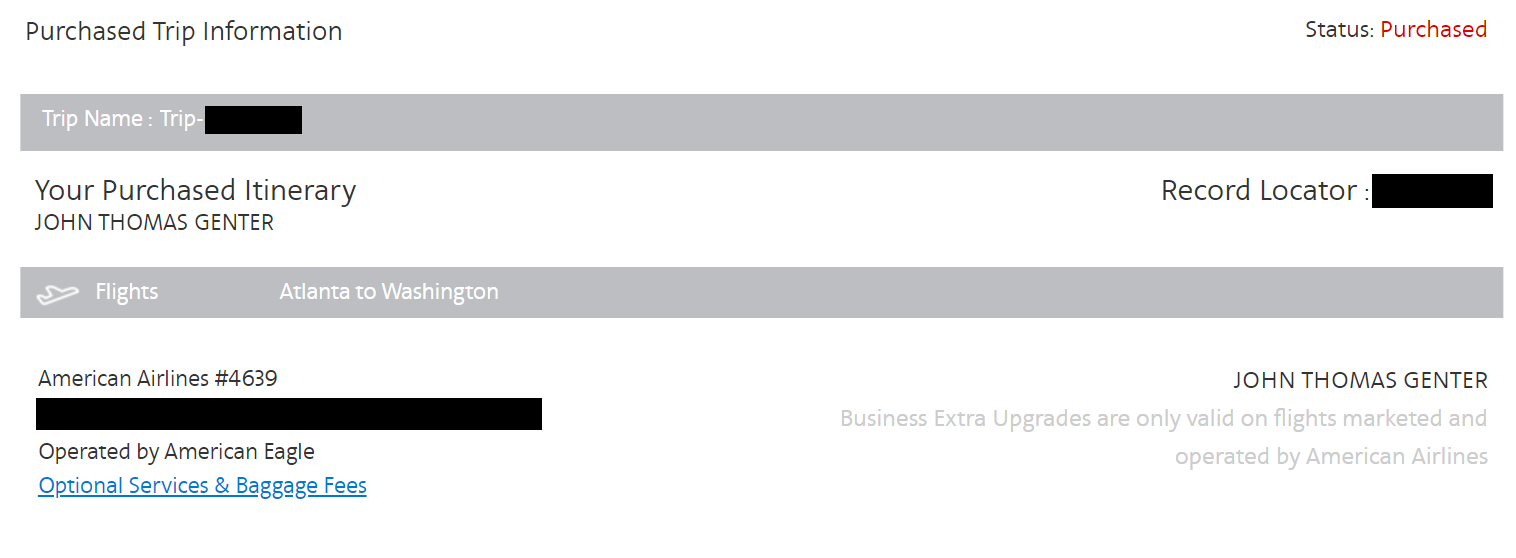

Finally, Business Extra upgrade certificates can't be applied to flights operated by American Eagle aircraft -- but these are regional jets not worth using a Business Extra certificate on anyway. Update: American Airlines reached out to note that certificates can be used for American Eagle flights and that the team is looking into why this wasn't possible in my case.

If you have an American Airlines Business Extra account, make sure to add your Business Extra account number to your AAdvantage profile. This should help you automatically get points for bookings made through AA's website -- without having to look up your number each time.

For more reading about American Airlines Business Extra, check out:

- Guide to Earning and Burning With American's Business Extra Program

- The Pros and Cons of American Airlines' Business Extra Program

- How to Use American Airlines Business Extra Points for Free Flights

- Register for Double AA Business Extra Points on South America Flights

- Why American Airlines Has a Competitive Edge for Business Travelers

- Airline Loyalty Programs for Small Businesses

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app