Bilt adds Southwest Rapid Rewards as its newest transfer partner

TPG founder Brian Kelly is a Bilt advisor and investor.

The Bilt news keeps rolling in. After introducing the ability to pay rent with more credit cards and redeem Bilt Points for student loans, the Bilt Rewards program has revealed that Southwest Rapid Rewards will be its newest transfer partner.

Bilt currently partners with 18 other airline and hotel programs, including Alaska Airlines Mileage Plan, United MileagePlus and World of Hyatt.

Keep reading to find out more about Bilt's 19th transfer partner.

Related: Bilt members can now use points to pay for Lyft rides

Transferring Bilt points to Southwest

As of today, you can transfer Bilt points to Rapid Rewards at a 1:1 ratio. That means 1,000 Bilt points will give you 1,000 Rapid Rewards points that you can redeem for Southwest Airlines flights and more.

Bilt sometimes offers transfer bonuses as part of Rent Day promotions to celebrate a new transfer partner. Keep an eye out for these promotions; you may be able to score some extra Southwest Rapid Rewards points when you transfer Bilt points for the first time.

This partnership is good news for Rapid Rewards enthusiasts, as the program currently only has one credit card transfer partner: Chase Ultimate Rewards. Bilt's new partnership will give Southwest flyers another way to boost their Rapid Rewards points balance and redeem free flights — especially since the Bilt Mastercard® allows you to earn transferable Bilt points on rent payments, home purchases and more. (You must use the card at least five times each statement period to earn points.)

However, unlike most of Bilt's transfer partners, transfers to Southwest won't process instantaneously. Instead, the program uses a twice-daily batch process, with one batch of transfers in the morning and one in the evening. According to a press release, "Bilt will be working toward a real-time point transfer solution in the near future."

For now, it sounds like you should only have to wait a few hours for your points to transfer, but keep this in mind when planning your redemptions.

The information for the Bilt Mastercard has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related: How long do Bilt Rewards points take to transfer?

Should you transfer Bilt points to Southwest?

Last month, Southwest began implementing variable pricing for award tickets, meaning you can potentially get solid value from your award redemption — or not.

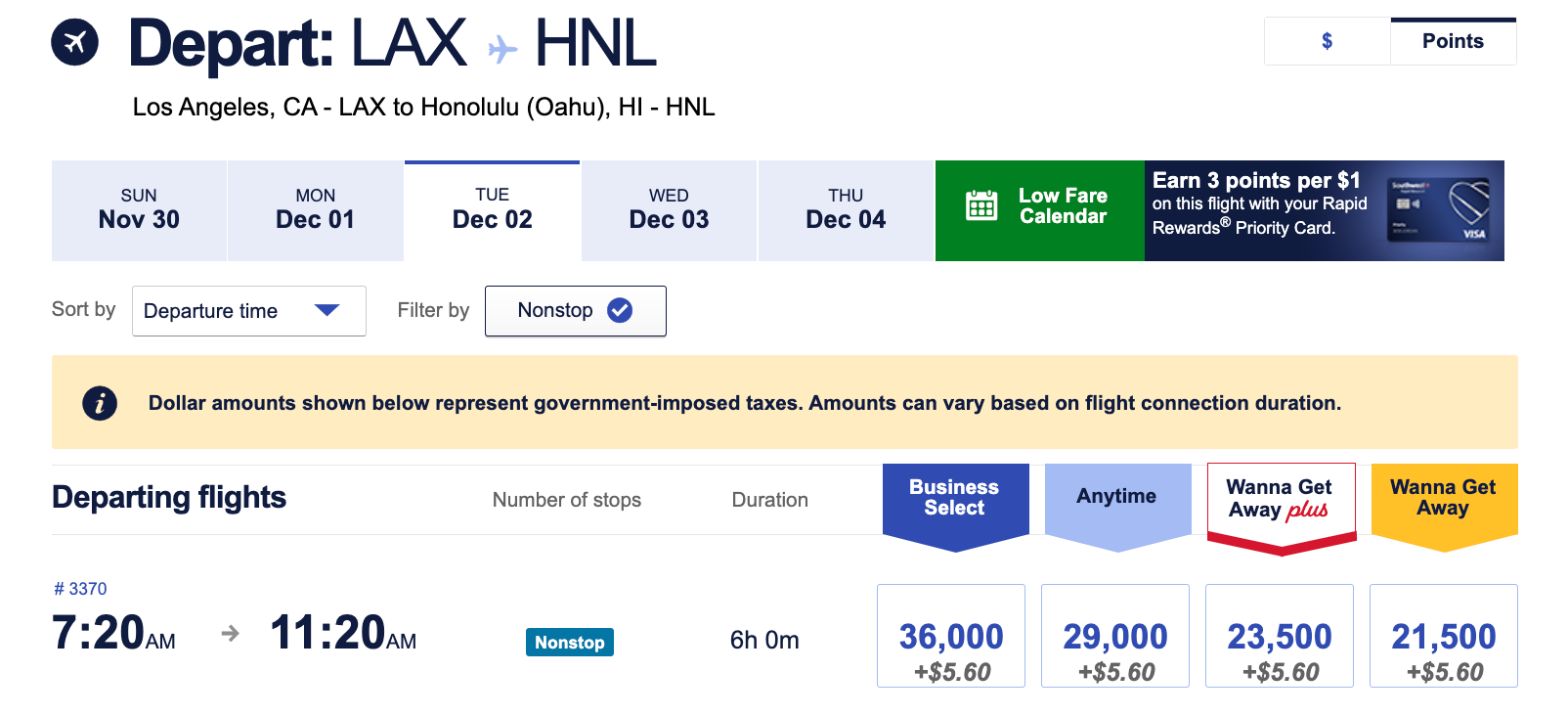

For example, many Southwest flights to Hawaii cost more points than before. This one from Los Angeles to Honolulu is priced at $249 or 21,500 points for a Wanna Get Away ticket. That comes out to roughly 1.2 cents per point, which is below TPG's April 2025 Rapid Rewards valuation of 1.4 cents per point.

On the other hand, you can get a much more attractive 1.6 cents per point by redeeming 7,000 points for this $115 flight from Los Angeles to Phoenix.

If you find a good-value redemption like this, transferring Bilt points to Southwest can make sense. If the flight you want presents a poor redemption value, you may be better off paying with cash and earning Rapid Rewards points on the purchase. Additionally, be aware that you'll now earn fewer points on Wanna Get Away and Wanna Get Away Plus fares, as the airline reduced the earning rates last month without notice.

Overall, note that you will probably lose some value if you transfer your rewards to Southwest, as TPG values Bilt points at 2.2 cents apiece, per our estimations. Therefore, you may not get outsize value by transferring your points to Southwest. But, if you want to skip paying the cash cost on your next vacation to Hawaii, transferring your points to book an award flight may make sense.

Related: Bilt's new payment platform paves way for new reward categories

Bottom line

Not all the Southwest changes are for the worse. The airline is set to debut its extra-legroom seats next month, and it plans to expand its partnership with Icelandair to allow members to earn and redeem Rapid Rewards points on Icelandair flights.

When these changes go live, Bilt members will have some exciting new ways to redeem their points via Southwest.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app