AAdvantage miles earned through BankDirect accounts will be reported as taxable income

If you can't get enough miles for your adventures through travel rewards credit cards, there's a way that you can put your savings to work to earn American Airlines AAdvantage miles. BankDirect offers three types of mileage-earning accounts: Mileage Checking with Interest Accounts, Mileage MMAs and Mileage CDs.

Each of these accounts offers a different earning structure with the potential to earn thousands of miles each year for saving with the online bank. And, unlike other miles-earning bank accounts, these miles haven't, until now, been reported as taxable interest. Unfortunately for account holders, this no-tax treatment will end on Dec. 31, 2019.

On Dec. 2, BankDirect cardholders received an email saying that the bank will start treating miles earned as taxable starting Jan. 1, 2020.

We truly appreciate your business and thank you for banking with BankDirect. We wish to inform you that under current tax law, we are now required to report to you and the IRS the value of miles you receive from BankDirect. If you receive miles from BankDirect on or after January 1, 2020, we will issue the appropriate Form 1099 to you and the IRS in January 2021.

Since American Airline AAdvantage® miles do not have a defined cash equivalent and the value they represent is subject to various factors specific to each American Airline AAdvantage® member, the amount reported will be based on our good faith estimate of the market value. The estimated market value can be impacted by numerous factors and may materially change prior to the issuance of Form 1099 each year.

The silver lining is that it seems BankDirect will be conservative in its valuation of AAdvantage miles. While BankDirect hasn't disclosed what valuation it will use for taxing miles earned through a mileage-earning account, its sister bank has. Both BankDirect and Bask Bank are AAdvantage mileage-earning divisions of Texas Capital Bank.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter.

As MilesTalk readers caught in the Bask Bank terms and conditions (caution: PDF link), Bask Bank is disclosing to account holders that "miles are currently valued at 0.42 cents" for tax purposes. That's significantly less than TPG's valuation of 1.4 cents per mile.

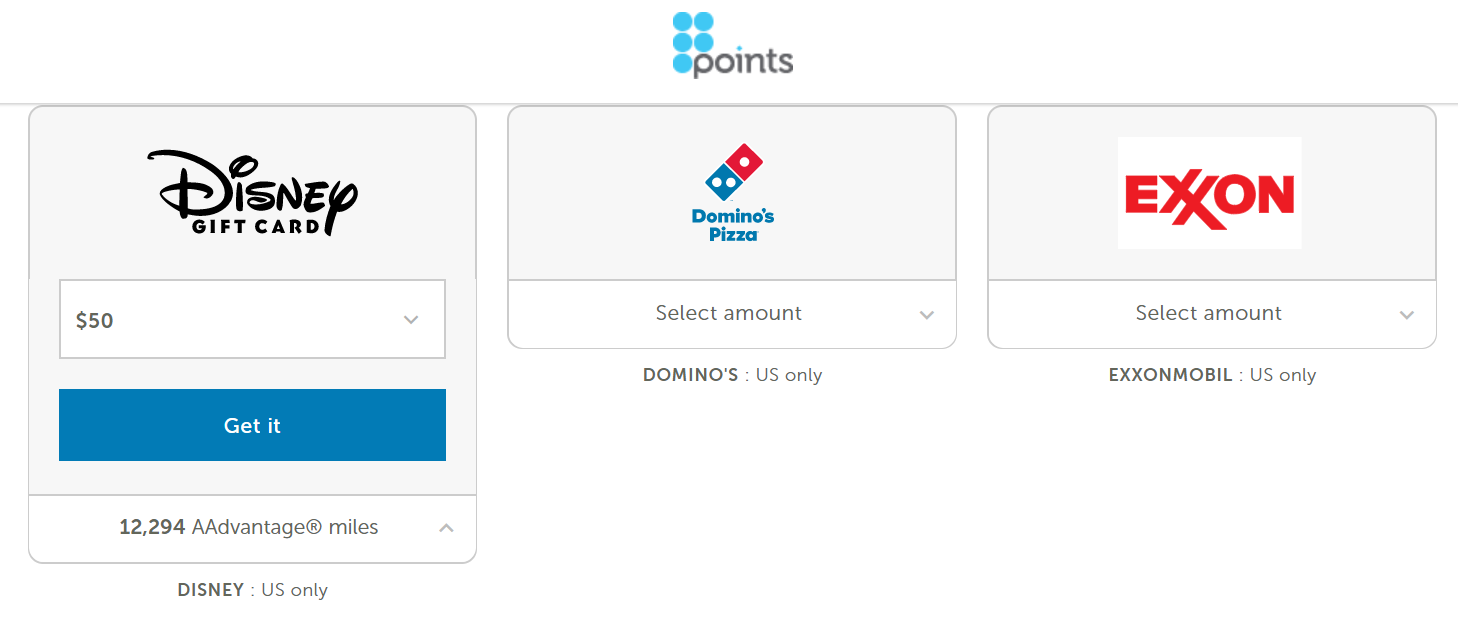

While Bask Bank doesn't elaborate on how it gets to this valuation, it's likely basing this on a cash-equivalent redemption instead of what you can get by redeeming American Airlines miles for travel. As it turns out, 0.42 cents is approximately the value that you could get for cashing out miles for a gift card through Points.com:

Some account holders may be wondering if they should still maintain savings with BankDirect after these changes. So, let's crunch some numbers.

| Amount saved in a Mileage Checking with Interest account | $10,000 | $25,000 | $50,000 | $100,000 |

|---|---|---|---|---|

Miles earned (per year) | 12,000 | 30,000 | 60,000 | 75,000 |

Value of miles at TPG valuations | $168 | $420 | $840 | $1,050 |

Account fees (per year) | $144 | $144 | $144 | $144 |

Tax at 20% marginal rate | $10 | $25 | $50 | $63 |

Tax at 30% marginal rate | $15 | $38 | $76 | $95 |

Tax at 40% marginal rate | $20 | $50 | $101 | $126 |

Saving small amounts in BankDirect hasn't made sense for a while due to the account's $12 per month service fees. Based on TPG's valuations, saving $8,500 only earns $143 worth of miles per year — meaning you don't even break even. Now that BankDirect is going to report tax on these miles, you're going to need to save even more to earn enough miles to cover the after-tax and after-fee cost.

BankDirect savings accounts earn 100 miles per month per $1,000 saved up to a balance of $50,000. Above that, the rate is dropped to just 25 miles per month per $1,000. That means there's a sweet spot at saving exactly $50,000. If you do so, you'll earn 60,000 AAdvantage miles per year — which are worth $840 at TPG valuations. After $144 in account fees, you'll now need to factor in $50 (at a 20% tax rate) to $101 (at a 40% tax rate) of taxes. The combination of the two significantly erodes the value you'll end up with after taxes and fees.

Related: Maximizing redemptions with American Airlines AAdvantage

In the past, there's been plenty of controversy around mileage-earning bank accounts. For years, Citi sent tax forms to account holders that earned AAdvantage miles as a bonus for signing up for a CitiGold bank account. The trouble is that Citi valued AAdvantage miles at 2.5 cents each — which was much more than most AAdvantage members would be able to get in value from their AA miles.

Accountholders sued Citi over this rate and alleged that Citi didn't properly disclose that it would be filing a 1099 to report income for the miles earned. In late 2017, Citi offered to pay up to $1.75 million to settle. BankDirect is surely hoping to avoid the same issues by providing advance notice before they start reporting earned AAdvantage miles as taxable.

The author is a Certified Public Accountant (CPA) in Georgia. However, this article has been prepared for informational purposes only, and is not intended to provide — and should not be relied on as — tax advice. Please consult your tax professional.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app