How (and why) you should regularly audit your loyalty accounts

Editor's Note

Growing up as the son of an accountant, I learned the importance of verifying credits and debits from a young age. This mindset extends to my loyalty accounts as well.

There are numerous opportunities to make the most of your travel rewards. However, this game assumes you will earn and redeem points at the expected rates set by travel providers.

Unfortunately, there are plenty of instances where entire flights or hotel stays fail to be credited to our accounts. Therefore, regularly examining and assessing our loyalty accounts' accuracy is crucial. Mistakes, more often than not, tend to work against us as customers.

Here's how and why you should conduct audits of your loyalty accounts.

How to audit your accounts

Conducting audits of your loyalty accounts can vary in difficulty depending on the level of accuracy you seek. For instance, when it comes to flights, a simple check to ensure that Premier qualifying points, Loyalty Points or Medallion Qualification Dollars align roughly with the ticket price is easier than manually verifying each lifetime flight mile.

I may go a bit overboard, but I check my major loyalty accounts nearly every day, since I spend significant time traveling. It is crucial to me that I receive proper credit for my journeys. When flying, paying extra attention to your frequent flyer accounts is essential, especially when traveling with partner airlines. TPG staffer Nick Ewen encountered difficulties getting Delta SkyMiles to accurately credit miles for a SkyTeam partner flight in the past, while I've experienced mileage mishaps by crediting Star Alliance partner flights to United MileagePlus.

In the realm of hotels, I have observed that certain brands are more dependable when accurately posting stays. Hilton Honors, for example, has never made an error in my Hilton Honors account. World of Hyatt generally posts my stays correctly, but sometimes the qualifying revenue is incorrect, resulting in fewer earned points.

On the other hand, I've had multiple issues with Marriott Bonvoy, including instances of entire stays not being posted or significant discrepancies in qualifying revenue.

TPG staffers have also experienced errors with IHG One Rewards. One had an IHG stay in Iceland credited as 316 Icelandic krona (~$2.39) instead of $316. He promptly contacted IHG through online messaging, and the issue was swiftly resolved.

Since points are typically earned based on total spending, errors in qualifying revenue can significantly impact the overall points accumulation.

As a result, I have learned to pay special attention to the less reliable loyalty programs.

Related: Here's why you should always double-check your hotel bill

Why you should audit your accounts

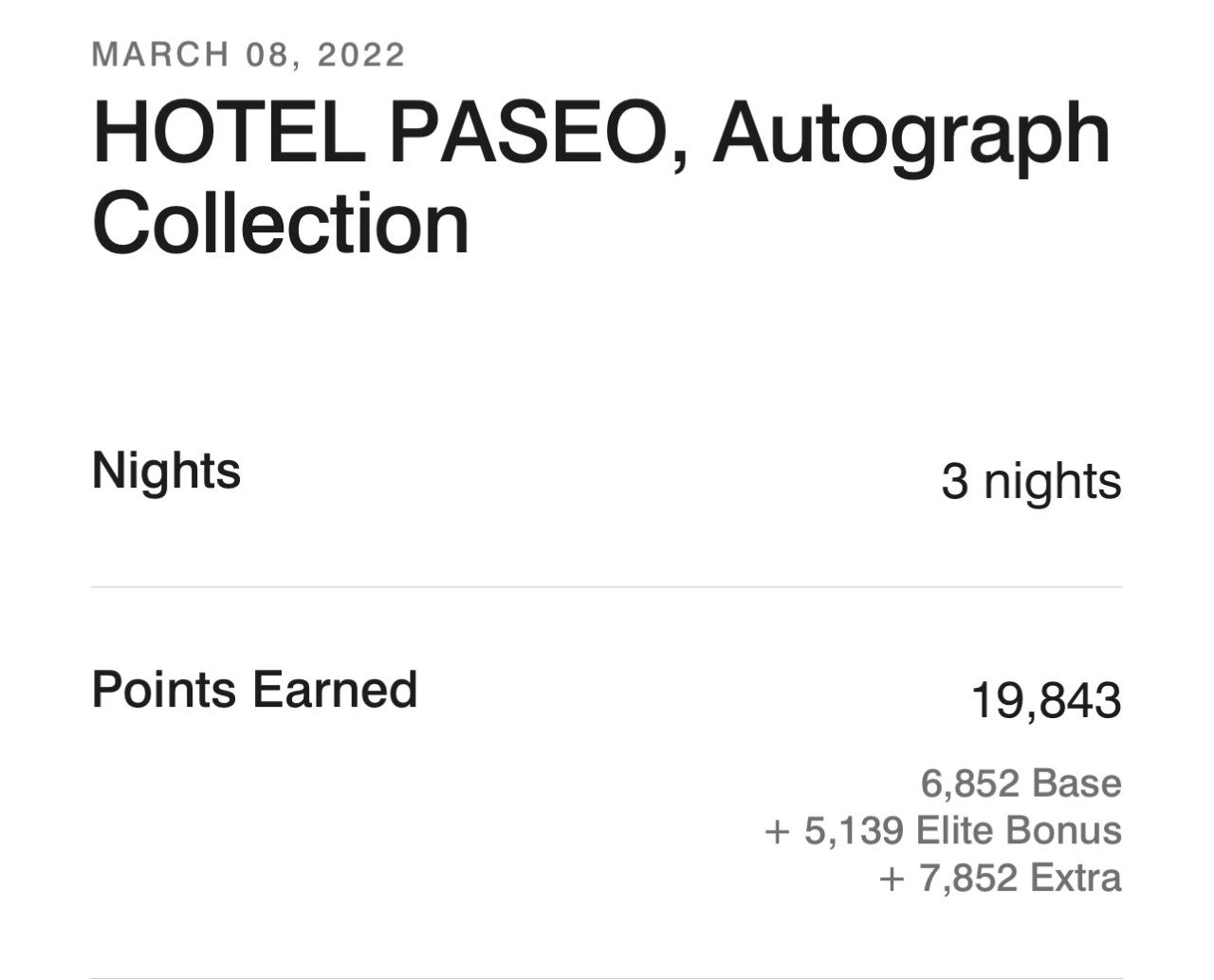

One of the most compelling examples of why you should always audit your accounts came from my 2022 stay at Hotel Paseo, Autograph Collection in Palm Desert, California.

Although I stayed in early February, the stay was never posted to my Marriott Bonvoy account. I booked the stay directly through Marriott, and it was an eligible rate to earn Marriott Bonvoy points. My Ambassador Elite membership was also linked to the reservation.

I waited a month for the stay to be posted to my account, and it never happened. This prompted me to contact Marriott Bonvoy using this form, which you can do if your stay hasn't been posted within 10 business days of your checkout date.

Fortunately, Marriott swiftly resolved this mistake, and the stay was posted the same day I submitted the form.

Almost 20,000 points and three elite qualifying nights were completely missing from my account — the points alone are worth $166.68 by our valuations. Although it was likely a system error at fault, this was decidedly not in my favor — and without an audit, it would've gone unnoticed.

Related: Why I always charge my meals, gifts and spa treatments to my hotel room

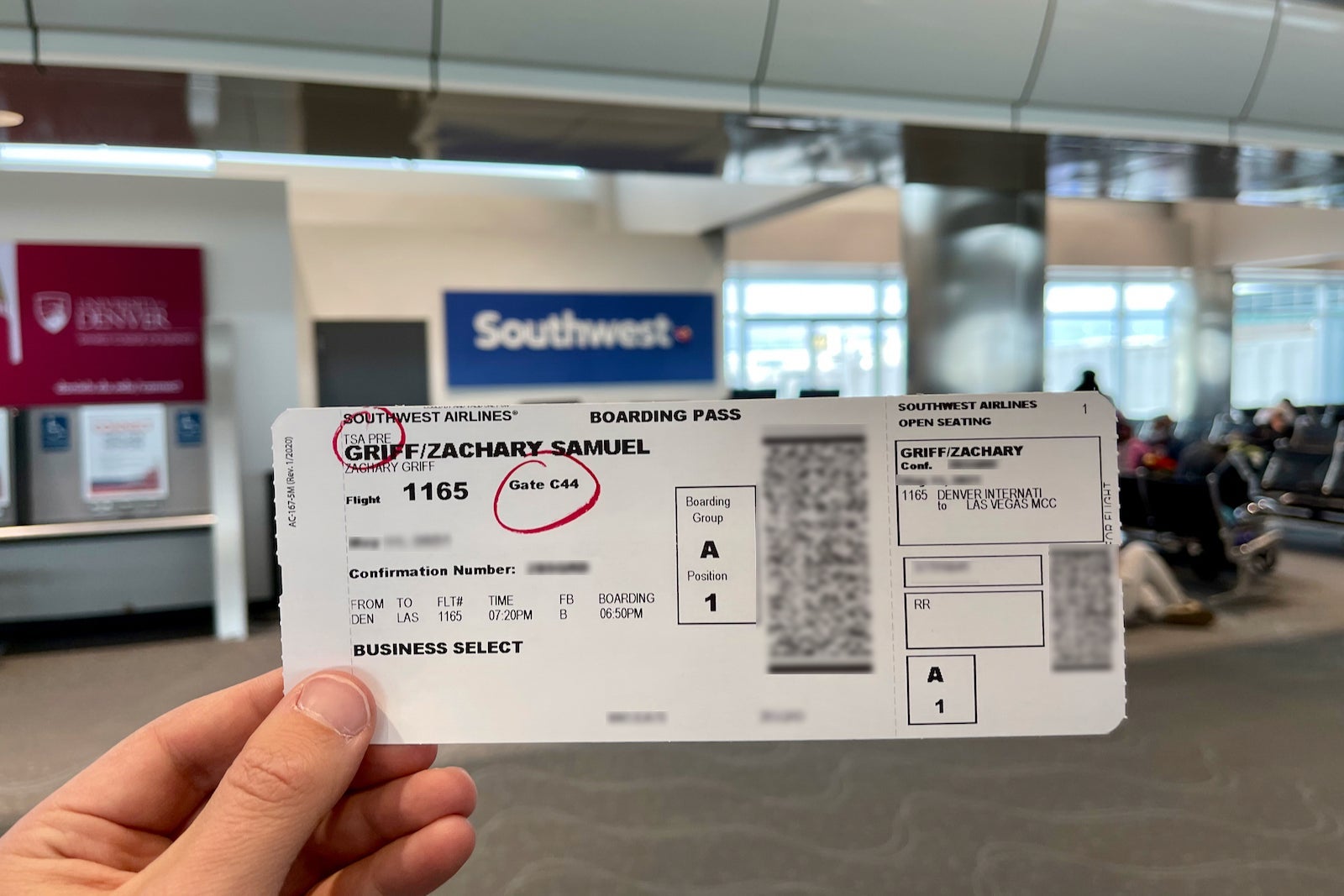

For an example from airline loyalty programs, I have a friend who has traveled to India multiple times using his MileagePlus account on Air India-issued tickets. On different trips, the miles haven't been awarded to his MileagePlus account in several cases. When this happens, you will need to submit a request for missing miles with United. But don't expect to be done there.

Although the Air India ticket numbers were provided on the ticket receipt to United, United could not locate the flights using its Star Alliance partner ticket search. As a result, an email from United made it clear that it would be unable to credit these flights without a physical boarding pass for each sector. Luckily, he had copies of the boarding passes, which were submitted, and the miles were posted.

Because of situations like this, I've learned to keep my boarding passes for partner flights until the miles post.

Bottom line

It's an unfortunate reality that mistakes happen when it comes to earning points or miles for your travel activity — regardless of the underlying cause. Failing to conduct regular audits puts you at risk of missing out on what you rightfully deserve, which can be extremely frustrating and leave you feeling deceived.

Just as you ensure that transactions on Venmo and PayPal are accurately reflected in your bank account, verifying that your travel activities are being properly recorded is equally important. If you're unsure about what you should earn, we recommend referring to our beginner's guide and consulting each travel provider you engage with.

Pay attention to detail and meticulously review your records. Keep all of your airline boarding passes until your rewards post — especially when traveling on partner carriers. And when you do come across a clear mistake, submit a request to fix it as soon as possible.

The first time you identify (and ultimately correct) an error, you'll immediately see the benefits of this practice.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app