Amex Fine Hotels & Resorts Stays Are Now Bookable With Points

Update: Some offers mentioned below are no longer available. View the current offers here.

One of the many benefits available to American Express card members with a Platinum or Centurion-branded card, including the Platinum Card® from American Express and the Business Platinum Card® from American Express, is access to the American Express Fine Hotels & Resorts program (also known as Amex FHR). This program provides elite-like benefits like daily breakfast for two, guaranteed 4pm late checkout and a unique property amenity valued at around $100 at select properties worldwide.

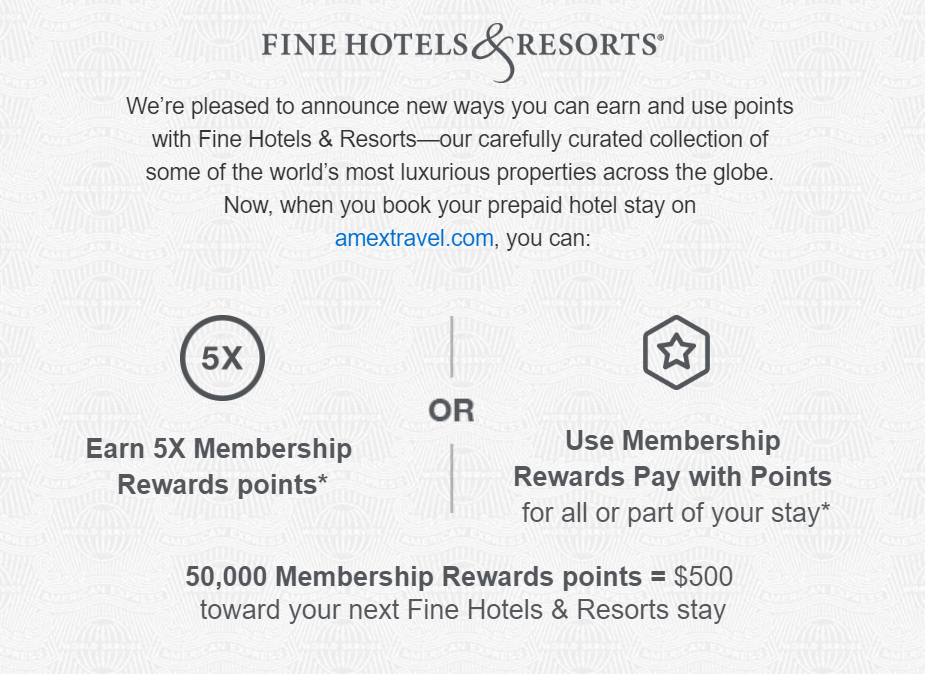

The American Express Fine Hotels & Resorts program made a splash last fall when it was announced that card members could earn 5x points on prepaid Fine Hotels & Resorts bookings. We subsequently found that many, but not all, hotel loyalty programs would still provide elite benefits and earnings on these stays. Now, Amex has began sending emails to card holders stating that they can use Membership Rewards Pay With Points to cover all or part of a Fine Hotels & Resorts stay.

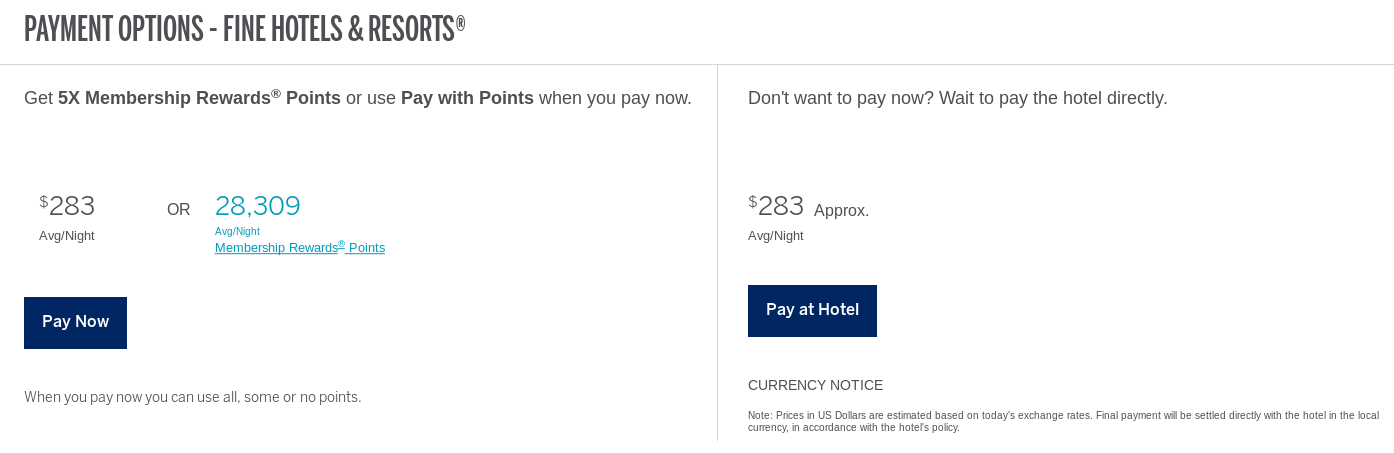

The Pay With Points option will only appear when you are logged in as a primary card member. As an authorized user on my husband's Platinum Card, I didn't see the Pay With Points option until I logged in as him. Once you log in, you'll see that the Pay With Points option only values Membership Rewards points at 1 cent each.

Redeeming your Membership Rewards points for 1 cent each generally isn't a high-value redemption, especially considering you'll be giving up the chance to earn 5x points on your stay. After all, TPG's latest valuations value Membership Rewards points at 2 cents each. But, if you have ample Membership Rewards points or don't want to worry about transferring your points to any of the Membership Rewards transfer partners, this is another option for getting value from your points. And given that you'll be enjoying free breakfast, late checkout and an on-property credit with an Amex FHR stay, you could argue that you are getting more than 1 cent per point at the end of the day.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app