American Airlines making big changes to award ticket hold times

Let's start with the good news: American Airlines will continue to allow users to put award tickets on hold.

However, its policy is getting more restrictive.

As first flagged by Ben Schlappig at One Mile at a Time, American Airlines is reducing award ticket hold times to 24 hours. Previously, members of the AAdvantage program were allowed to hold award tickets for as long as five days if they were booking at least two weeks in advance. If they were booking less than two weeks out, they could hold tickets for 24 hours.

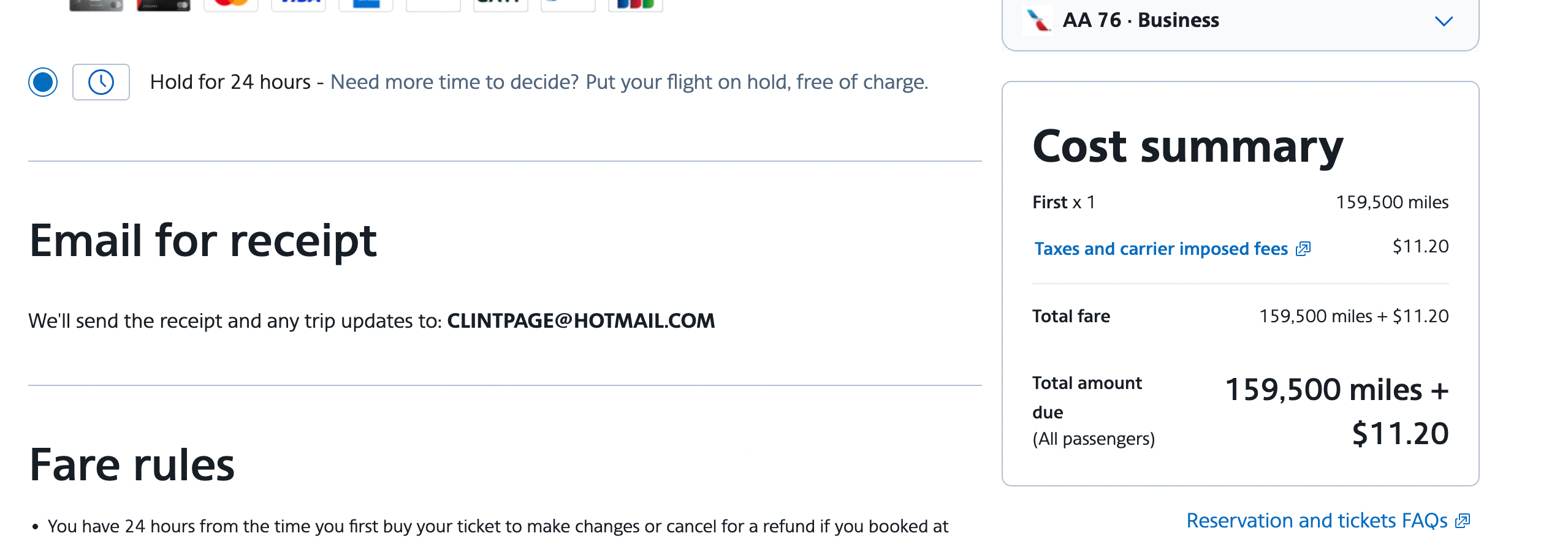

As shown in the screenshot below, you can now only hold award tickets for 24 hours, no matter how far out you are booking.

This long hold time had been a fairly generous tool on American's part: it was the only U.S. airline to allow holds that long. In fact, American is one of just a handful of airlines in the world that still allows award holds at all. I've used the tool myself several times over the years when trying to decide on a trip or waiting on approval for a time-off request.

The great thing about an award ticket hold is that it lets you reserve award space before actually booking, giving you time to firm up plans or coordinate with other people (or find awards on other airlines). It also gives you extra time to transfer points from a credit card, for example. In the case of American, it can be especially useful for booking partner awards on airlines like Japan Airlines.

We should note, American does still allow members to cancel an award ticket without any fee, and will refund both the miles and taxes and fees paid by the customer.

Still, some TPG staffers were disappointed to see the hold period for award tickets shrink.

"This was a nice benefit AAdvantage offered its members and it's frustrating when any benefit is removed from a program," TPG director of content operations Andrea M. Rotondo said. "Holding an award, instead of booking it and canceling later, meant that I didn't have to check my credit card statement to confirm that the taxes and fees paid were refunded."

But fewer and fewer airlines are allowing this, despite how customer-friendly it is. Some other airlines allow holds on award tickets, such as Lufthansa's Miles & More and Air France-KLM's Flying Blue, but they have become far less common overall.

Related: How American Airlines sucked me back into AAdvantage with Loyalty Points

In any case, the lengthy hold option was fun while it lasted, and I'm glad American will continue allowing holds even in this reduced capacity.

We reached out to American Airlines for comment and will update this story if we get more information.

Related reading:

- Best credit cards for American Airlines flyers

- American Airlines elite status: What it is and how to earn it

- Maximize your airfare: The best credit cards for booking flights

- The best credit cards to reach elite status

- American Airlines basic economy: What you need to know about bags, seats, boarding and more

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app