Allegiant is planning a joint-venture with a Mexican budget carrier; Here’s how it will work

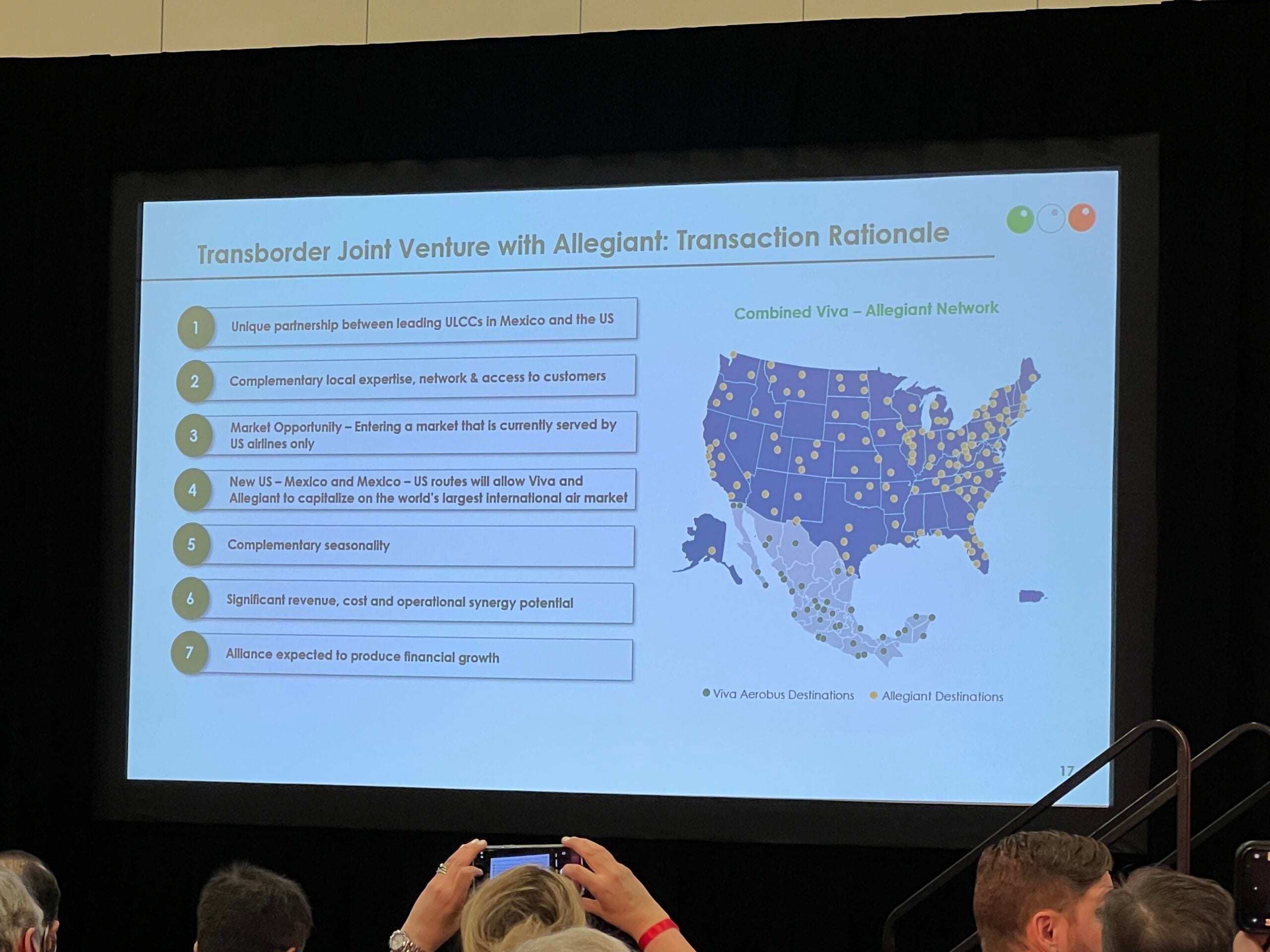

When ultra-low-cost carriers Allegiant and Viva Aerobus announced plans in December to form a joint venture, it was not quite clear what that would look like for customers.

Other joint ventures, like the one between Delta and Aeromexico, or between American and British Airways, see the airlines coordinate on overlapping routes, plan networks around multi-airline connections.

But Allegiant and Viva Aerobus, a low-cost carrier based in Mexico, have no overlapping routes.

In fact, their networks are remarkably distinct. Allegiant focuses on low-cost flights within the U.S., while Viva offers cheap flights between the U.S. and Mexico, as well as within Mexico itself.

Both airlines intend for their flights to be point-to-point, meaning no stops or connections, and the airlines have absolutely zero overlap on their route maps. That begs the question: why the joint venture?

At the annual Routes Americas conference this week in San Antonio, Viva Aerobus CEO Juan Carlos Zuazua shared a few more details of the coming joint venture (which still must be approved by each country's regulators).

"Once we get approval, we're going to be able to coordinate a lot of our network decisions and our growth decisions between Mexico and the U.S.," Zuazua told TPG after an appearance on a conference panel. "Not only from north to south, but also from south to north."

Allegiant does not currently offer service to Mexico or any other international destination. Even if it began to operate internationally, the difficult logistics of selling tickets in a foreign currency would likely mean it would focus entirely on U.S.-originating passengers at first — similar to Southwest.

Zuazua noted that unlike other joint ventures, including Delta-Aeromexico, the Allegiant-Viva tie-up would not plan for connecting passengers — both airlines would stay true to their point-to-point business models.

"We're not connecting traffic," Zuazua said. "That can be an option, but it's not a priority. Our priority is connecting [markets] on a point-to-point market basis."

Instead, the idea is expanding service and sharing profitability, he said.

"The idea is to create a new market, a market that doesn't exist," Zuazua said, thinking of hypothetical cases. "For example [San Antonio] is a big city, and you can only get service to Cancun. You can't fly to Los Cabos, etc. We could have connectivity, two flights a week, perhaps."

Still, this seems like something that Viva Aerobus could do on its own. If Allegiant doesn't offer connecting passengers from other cities, or start flying to Mexico on its own, what's the point of the partnership? If Allegiant gets to share in the U.S.-Mexico profits, what does Viva get?

In essence, distribution, according to Henry Harteveldt, an airline and travel industry analyst and founder of Atmosphere Research.

Related: Frontier, Spirit announce blockbuster merger that would create giant ultra-low-cost airline

"Allegiant has a massive customer database and Viva will benefit through the co-marketing with Allegiant," Harteveldt said. "For Allegiant, this gives them instant access to one of the most popular leisure destinations for U.S. travelers at very little risk and very little expense."

Allegiant can help sell service to Mexico, operated by Viva, without having to commit aircraft and crews to an international operation. In exchange, it can share in the profits.

"You know Allegiant will be studying the results of this very carefully. And undoubtedly, if they see that this works well, I expect we'll see Allegiant announce its own flights from the U.S. to Mexico," coordinated with Viva, Harteveldt added.

And of course, there's another benefit: this gives Allegiant another tool to compete after the Spirit-Frontier merger, which was announced more than two months after the joint venture with Viva Aerobus.

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app