Airlines ask DOT to suspend flights to more US airports, small cities fare worst

U.S. airlines have jumped en mass for a slice of the $25 billion in grants available to cover staff compensation during the novel coronavirus pandemic even as the strings to taking the funds continue to be ironed out.

One of those strings is a requirement that recipients continue air service to all of the U.S. destinations on their maps. The government aid, part of the $2 trillion CARES Act coronavirus stimulus package, requires airlines fly to all of the airports deemed "reasonable and practicable" by the Department of Transportation.

The DOT has given airlines some leeway. Carriers can opt to maintain service based on either their summer or winter schedule, and they are allowed to consolidate service at one airport in large metropolitan regions where they serve multiple airports, like in the Los Angeles or New York areas.

Carriers must receive a waiver from the DOT for any other cities that they want to suspend service amid the COVID-19 crisis.

Get Coronavirus travel updates. Stay on top of industry impacts, flight cancellations, and more.

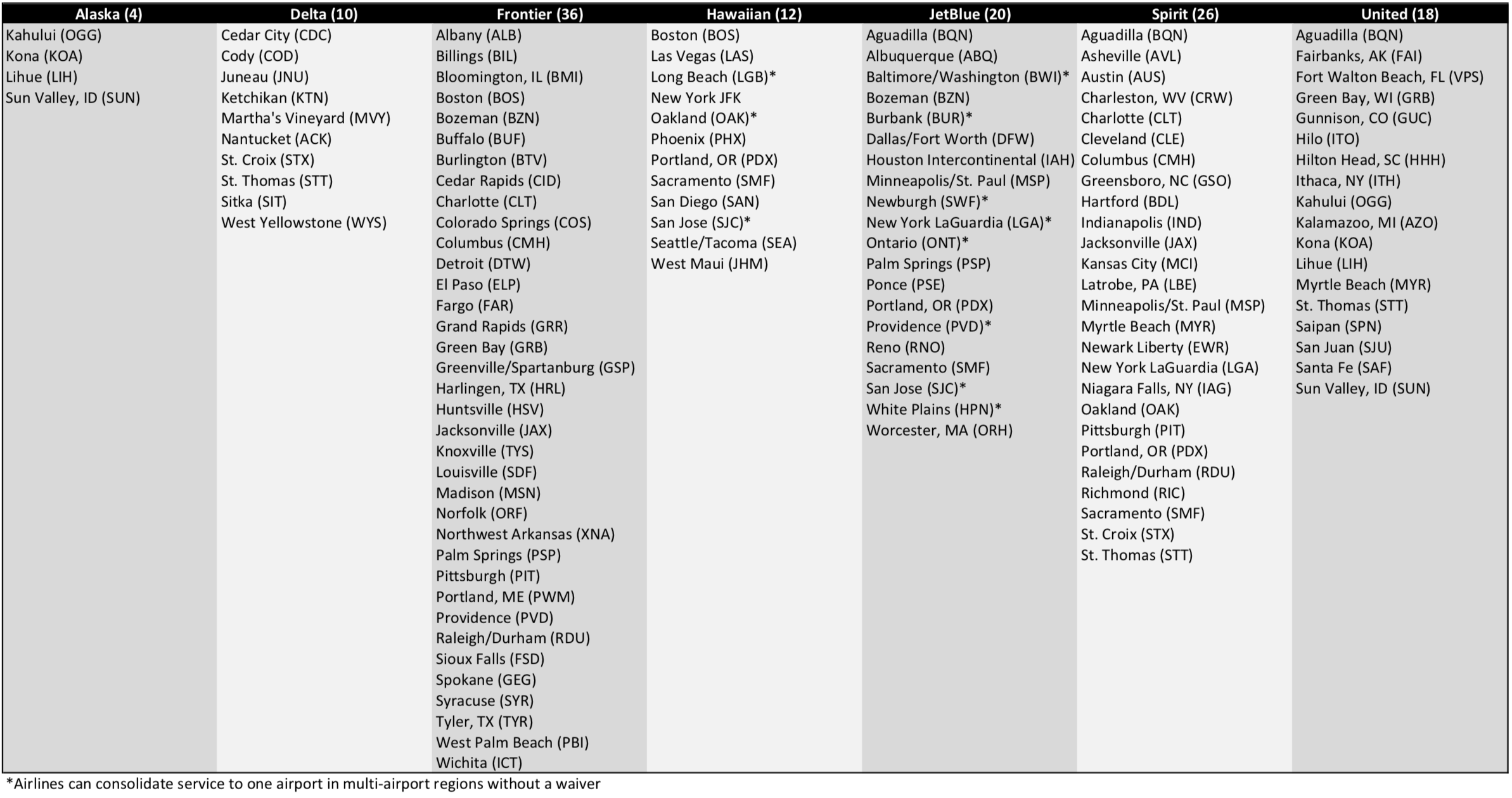

Alaska Airlines, Delta Air Lines, Frontier Airlines, Hawaiian Airlines, JetBlue Airways, Spirit Airlines and United Airlines had each sought to suspend service to airports as of midday on April 13. The rationale for these applications range from allowing seasonal flights to begin as planned in May or June, to airport closures or proximity to other airports.

Of the 126 waivers sought by the airlines, 61% would suspend service to the country's smallest airports, or those that handle roughly less than one million passengers annually, a TPG analysis finds. The applications range from Delta's request for a waiver for Cedar City (CDC), Utah — where previously planned runway work has closed the facility until July — to Spirit's request to halt flights to Latrobe (LBE), Pennsylvania, due to the airport's proximity to Pittsburgh International Airport (PIT).

Just over 22% of the waivers were for what the DOT classifies as medium-sized airports. These include Alaska's service to Kahului (OGG) on Maui, and JetBlue's flights to Albuquerque (ABQ) and Sacramento (SMF).

Related: JetBlue among first US airlines to seek waivers to suspend flights to 12 cities

Only nearly 17% of the waiver requests were for service to the country's 25 largest airports. These include JetBlue's decision to suspend flights to Baltimore/Washington (BWI) in favor of serving the Washington, D.C., area via Washington Reagan National (DCA) — a move that is technically allowed without a waiver under the DOT's rules. Another example is Hawaiian's request to suspend flights to Boston Logan (BOS) as the airline's namesake islands are essentially closed for business.

"While Hawaiian maintains lifeline air service connections to critical mainland points, serving the full breadth of Hawaiian's pre-COVID-19 network is neither reasonable nor practicable," Honolulu-based Hawaiian said in its April 19 application. "Expanded services are neither warranted by traveler demand nor welcome by the State of Hawaii."

The number of waivers includes multiple airline applications for the same airport. For example, Bozeman (BZN), Montana, is counted twice in separate requests from both Frontier and JetBlue.

Related: At least 9 US airlines have applied for CARES Act grants

Small airports hit hardest

Regardless of how many waiver requests were filed for any given airport, it comes as little surprise that the country's smallest airports are hit the hardest. The DOT has the difficult job of determining what is essential service to keep these airports — places like Charleston (CRW), West Virginia, and Ithaca (ITH), New York — connected to the national air transport system.

Does Spirit really need to connect Charleston, West Virginia, to Orlando (MCO) when there are fewer people flying daily than since the 1950s?

The Transportation Security Administration (TSA) reported screening just 90,510 people on Sunday, March 12 — just 4% of the number who passed through checkpoints across America on the same weekday a year ago.

View this post on Instagram

Air service to small communities has frequently suffered after past industry crises. A widely cited 2013 study by William Swelbar and Michael Wittman at MIT found that from 2007 to 2012, America's smaller airports lost 21.3% of their scheduled flights in the fallout from the Great Recession. This is more than twice the 8.8% of flights that the country's largest airports lost over the same period.

What Swelbar and Wittman found, though, was history repeating. Airlines culled capacity after 9/11, keeping most domestic destinations but often by serving them with 50-seat regional jets instead of mainline aircraft with more than double the number of seats, like the Boeing 737, as Continental Airlines did.

Of course, once an airline suspends service to a market there is always the question of whether they will resume flights.

Related: How will airlines rebuild their route maps after the coronavirus?

Where flight suspensions might make sense

Some waivers make sense. Take Delta and United's requests to begin planned seasonal service as scheduled in May or June, instead of within a week of receipt of CARES Act funds. The national air system gains little from flights to Martha's Vineyard (MVY) — an almost entirely summer, leisure destination — getting flights two months early in the middle of a pandemic.

The same could be said of the waiver applications for airports where the local government has asked airlines to stop flying. For example, the government in Puerto Rico has closed the Aguadilla (BQN) and Ponce (PSE) airports to restrict the spread of COVID-19, prompting JetBlue, Spirit and United all to seek waivers for some or all of these airports.

Then there are the airports that were already closed before the coronavirus landed on U.S. shores, like Cedar City. In this case, Brett Snyder in the Cranky Coronavirus Daily Update put it best: "If the DOT denies this one, then all hope is lost."

Related: JetBlue consolidating flights in New York, Los Angeles and 3 more big cities

TPG featured card

at Capital One's secure site

Terms & restrictions apply. See rates & fees.

| 5X miles | Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel |

| 2X miles | Earn unlimited 2X miles on every purchase, every day |

Pros

- Stellar welcome offer of 75,000 miles after spending $4,000 on purchases in the first three months from account opening. Plus, a $250 Capital One Travel credit to use in your first cardholder year upon account opening.

- You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories

- Rewards are versatile and can be redeemed for a statement credit or transferred to Capital One’s transfer partners

Cons

- Highest bonus-earning categories only on travel booked via Capital One Travel

- LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Receive up to a $120 credit for Global Entry or TSA PreCheck®

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enjoy a $50 experience credit and other premium benefits with every hotel and vacation rental booked from the Lifestyle Collection

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app